Saudi Arabia Vehicle Rental Market (2020-2026) | Revenue, Forecast, Companies, Analysis, Value, Size, Share, Industry, Trends, COVID-19 IMPACT, Outlook & Growth

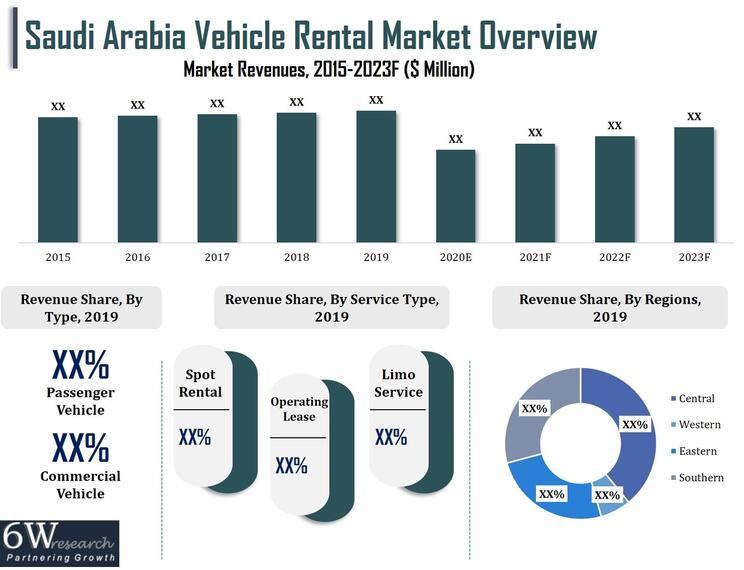

Market Forecast By Type (Passenger Vehicle, Commercial Vehicle), By Service Type (Spot Rental, Limo Service, Operating Lease), By Booking Type (Online, Offline), By Regions (Central, Southern, Eastern, Western) and competitive landscape

| Product Code: ETC004409 | Publication Date: Sep 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 200 | No. of Figures: 56 | No. of Tables: 22 |

Saudi Arabia Vehicle Rental Market report thoroughly covers the market by type, service type, booking type, and region. The Saudi Arabia vehicle rental market report provides an unbiased and detailed analysis of the Saudi Arabia vehicle rental market trends, opportunities high growth areas, market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Saudi Arabia Vehicle Rental Market Synopsis

Saudi Arabia Vehicle Rental Market is expected to witness growth, primarily backed by the rapidly growing investments in the tourism sector, robust development of the logistics sector, as well as the rising preference of corporate players towards leasing cars. Furthermore, the government’s initiatives for the diversification of the economy away from oil, led by Saudi’s Vision 2030, would lead to the establishment of several new commercial entities in the country, thereby propelling the demand for transportation services over the coming years. This, in turn, would also augment the revenues of the vehicle rental market in Saudi Arabia.

The outburst of coronavirus has adversely impacted the country’s Diesel Generator market in 2020 as the government imposed nationwide lockdown has led to the closure of all economical foundational work in the country and has led to a massive disruption in the overall market competitive landscape.

According to 6Wresearch, Saudi Arabia Vehicle Rental Market size is projected to grow at CAGR of 7.5% during 2020-2026. Saudi Arabia vehicle rental market is estimated to register sound revenues in the upcoming six years backed by the rising logistics industry in the country. Increased eCommerce platforms have boosted the logistic industry coupled with a rise in the need for vehicles on rent in order to transport goods to the warehouse which is expected to accelerate the vehicle rental deployment in the country in the forthcoming years. Moreover, increased urbanization is estimated to generate high sales revenue in the market owing to the increased vehicle on rent during traveling for a few days. Is expected to proliferate the demand for the vehicle rental and would leave a positive impact on the market and is estimated to secure optimistic growth of Saudi Arabia vehicle rental market in the upcoming six years.

Market Analysis by Type

By type, the passenger vehicle segment dominated the market revenue share in 2019 and is expected to witness significant growth, on account of the surge in investments in the tourism sector. The rapidly growing internet penetration in the kingdom along with the growing inclination of customers, especially young users, to make travel bookings through online and mobile platforms, would bolster the market for online vehicle rental bookings during the forecast period. The airport and seaport expansion projects in the kingdom to strengthen the logistics industry would further drive the demand for commercial rental vehicles over the coming years. The coronavirus pandemic and oil price crash is expected to significantly impact the vehicle rental market in 2020 on account of reduced mobility, temporary suspension of tourism and commercial activities, as well as reduced spending capacity of people. However, the resumption of tourism and commercial activities, combined with an increase in potential consumer base on account of the anticipated reduction in sales of new cars due to the imposition of 15% VAT from July 2020 and the projected shift of users of public transport to other means for commuting due to hygiene concerns, would help the vehicle rental market to gradually recover in the kingdom over the coming years.

Market Analysis by Booking Type

The online booking type is rapidly gaining popularity, on account of increasing internet penetration in the country and has secured a massive chunk in the overall market revenues in 2019, coupled with the improved access to new services and promotional offers provided by vehicle rental companies to users through online apps and portals. Furthermore, the coronavirus pandemic is expected to further augment the demand for online bookings, on account of the increasing inclination of customers to minimize social and physical contact

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Vehicle Rental Market Overview

- Saudi Arabia Vehicle Rental Market Outlook

- Saudi Arabia Vehicle Rental Market Size

- Historical Data of Saudi Arabia Vehicle Rental Market Revenues for the Period 2015-2019.

- Saudi Arabia Vehicle Rental Market Forecast until 2023F.

- Historical Data of Saudi Arabia Vehicle Rental Market Revenues, By Type for the Period 2015-2019.

- Saudi Arabia Vehicle Rental Market Forecast, By Type until 2023F.

- Historical Data of Saudi Arabia Vehicle Rental Market Revenues, By Service Type for the Period 2015-2019.

- Saudi Arabia Vehicle Rental Market Forecast, By Service Type until 2023F.

- Historical Data of Saudi Arabia Vehicle Rental Market Revenues, By Booking Type for the Period 2015-2019.

- Saudi Arabia Vehicle Rental Market Forecast, By Booking Type until 2023F.

- Historical Data of Saudi Arabia Vehicle Rental Market Revenues, By Regions for the Period 2015-2019.

- Saudi Arabia Vehicle Rental Market Forecast, By Regions until 2023F.

- Market Drivers and Restraints.

- Saudi Arabia Vehicle Rental Market Trends

- Saudi Arabia Vehicle Rental Market Industry Life Cycle

- Porter’s Five Force Analysis

- Saudi Arabia Vehicle Rental Market Opportunity Assessment

- Saudi Arabia Vehicle Rental Market Revenue Share, By Company

- Saudi Arabia Vehicle Rental Market Revenue Share, By Regions

- Saudi Arabia Vehicle Rental Market Overview on Competitive Benchmarking

- Company Profiles.

- Key Strategic Recommendations.

Market Scope and Segmentation

The report provides a detailed analysis of the following Market segments:

- By Type:

- Passenger Vehicle

- Commercial Vehicle

- By Service Type:

- Spot Rental

- Limo Service

- Operating Lease

- By Booking Type:

- Online

- Offline

- By Regions:

- Central

- Southern

- Eastern

- Western

Other Key Reports Available:

- Ethiopia Vehicle Rental Market (2017-2027F)

- Kenya Vehicle Rental Market (2017-2027F)

- Nigeria Vehicle Rental Market (2017-2027F)

Saudi Arabia Vehicle Rental Market: FAQs

|

TABLE OF CONTENTS |

|

1. Executive Summary |

|

2. Introduction |

|

2.1 Report Description |

|

2.2 Key Highlights of The Report |

|

2.3 Market Scope & Segmentation |

|

2.4 Research Methodology |

|

2.5 Assumptions |

|

3. Saudi Arabia Vehicle Rental Market Overview |

|

3.1 Saudi Arabia Vehicle Rental Market Revenues, 2015-2023F |

|

3.2 Saudi Arabia Vehicle Rental Market Revenue Share, By Type, 2019 & 2023F |

|

3.3 Saudi Arabia Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

3.4 Saudi Arabia Vehicle Rental Market Revenue Share, By Booking Type, 2019 & 2023F |

|

3.5 Saudi Arabia Vehicle Rental Market Revenue Share, By Regions, 2019 & 2023F |

|

3.6 Saudi Arabia Vehicle Rental Market Industry Life Cycle, 2019 |

|

3.7 Saudi Arabia Vehicle Rental Market Porter’s Five Forces, 2019 |

|

4. Saudi Arabia Vehicle Rental Market Dynamics |

|

4.1 Impact Analysis |

|

4.2 Market Drivers |

|

4.3 Market Restraints |

|

5. Saudi Arabia Vehicle Rental Market Trends |

|

6. Saudi Arabia Vehicle Rental Market: TAM Analysis |

|

7. Saudi Arabia Vehicle Rental Market Overview, By Passenger Vehicle |

|

7.1 Saudi Arabia Passenger Vehicle Rental Market Revenues, 2015-2023F |

|

7.2 Saudi Arabia Passenger Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

7.3 Saudi Arabia Spot Passenger Vehicle Rental Market Overview |

|

7.3.1 Saudi Arabia Spot Passenger Vehicle Rental Market Revenues, 2015-2023F |

|

7.3.2 Saudi Arabia Spot Passenger Vehicle Rental Market Revenue Share, By Verticals, 2019 & 2023F |

|

7.3.2.1 Saudi Arabia Spot Passenger Vehicle Rental Market Revenues, By Leisure Vertical, 2015-2023F |

|

7.3.2.2 Saudi Arabia Spot Passenger Vehicle Rental Market Revenues, By Tourism Vertical, 2015-2023F |

|

7.3.2.3 Saudi Arabia Spot Passenger Vehicle Rental Market Revenues, By Business Vertical, 2015-2023F |

|

7.4 Saudi Arabia Operating Lease Passenger Vehicle Rental Market Overview |

|

7.4.1 Saudi Arabia Operating Lease Passenger Vehicle Rental Market Revenues, 2015-2023F |

|

7.4.2 Saudi Arabia Operating Lease Passenger Vehicle Rental Market Revenue Share, By Verticals, 2019 & 2023F |

|

7.4.2.1 Saudi Arabia Operating Lease Passenger Vehicle Rental Market Revenues, By Leisure Vertical, 2015-2023F |

|

7.4.2.2 Saudi Arabia Operating Lease Passenger Vehicle Rental Market Revenues, By Tourism Vertical, 2015-2023F |

|

7.4.2.3 Saudi Arabia Operating Lease Passenger Vehicle Rental Market Revenues, By Business Vertical, 2015-2023F |

|

7.5 Saudi Arabia Limo Passenger Vehicle Rental Market Overview |

|

7.5.1 Saudi Arabia Limo Passenger Vehicle Rental Market Revenues, 2015-2023F |

|

7.5.2 Saudi Arabia Limo Passenger Vehicle Rental Market Revenue Share, By Verticals, 2019 & 2023F |

|

7.5.2.1 Saudi Arabia Limo Passenger Vehicle Rental Market Revenues, By Leisure Vertical, 2015-2023F |

|

7.5.2.2 Saudi Arabia Limo Passenger Vehicle Rental Market Revenues, By Tourism Vertical, 2015-2023F |

|

7.5.2.3 Saudi Arabia Limo Passenger Vehicle Rental Market Revenues, By Business Vertical, 2015-2023F |

|

8. Saudi Arabia Vehicle Rental Market Overview, By Commercial Vehicle |

|

8.1 Saudi Arabia Commercial Vehicle Rental Market Revenues, 2015-2023F |

|

8.2 Saudi Arabia Commercial Vehicle Rental Market Revenues Share, By Type, 2019 & 2023F |

|

8.3 Saudi Arabia Bus Rental Market Overview |

|

8.3.1 Saudi Arabia Bus Rental Market Revenues, 2015-2023F |

|

8.3.2 Saudi Arabia Bus Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

8.3.2.1 Saudi Arabia Bus Rental Market Revenues, By Spot Rental, 2015-2023F |

|

8.3.2.2 Saudi Arabia Bus Rental Market Revenues, By Operating Lease, 2015-2023F |

|

8.4 Saudi Arabia Truck Rental Market Overview |

|

8.4.1 Saudi Arabia Truck Rental Market Revenues, 2015-2023F |

|

8.4.2 Saudi Arabia Truck Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

8.4.2.1 Saudi Arabia Truck Rental Market Revenues, By Spot Rental, 2015-2023F |

|

8.4.2.2 Saudi Arabia Truck Rental Market Revenues, By Operating Lease, 2015-2023F |

|

8.5 Saudi Arabia Other Commercial Vehicle Rental Market Overview |

|

8.5.1 Saudi Arabia Other Commercial Vehicle Rental Market Revenues, 2015-2023F |

|

8.5.2 Saudi Arabia Other Commercial Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

8.5.2.1 Saudi Arabia Other Commercial Vehicle Rental Market Revenues, By Spot Rental, 2015-2023F |

|

8.5.2.2 Saudi Arabia Other Commercial Vehicle Rental Market Revenues, By Operating Lease, 2015-2023F |

|

9. Saudi Arabia Vehicle Rental Market Overview, By Service Type |

|

9.1 Saudi Arabia Spot Rental Market Overview |

|

9.1.1 Saudi Arabia Vehicle Rental Market Revenues, By Spot Rental, 2015-2023F |

|

9.1.2 Saudi Arabia Spot Rental Market Revenue Share, By Sectors, 2019 & 2023F |

|

9.1.3 Saudi Arabia Spot Rental Market Revenues, By Sectors, 2015-2023F |

|

9.2 Saudi Arabia Operating Lease Market Overview |

|

9.2.1 Saudi Arabia Vehicle Rental Market Revenues, By Operating Lease, 2015-2023F |

|

9.2.2 Saudi Arabia Operating Lease Market Revenue Share, By Sectors, 2019 & 2023F |

|

9.2.3 Saudi Arabia Operating Lease Market Revenues, By Sectors, 2015-2023F |

|

9.3 Saudi Arabia Vehicle Rental Market Revenues, By Limo Service, 2015-2023F |

|

9.3.1 Saudi Arabia Vehicle Rental Market Revenues, By Limo Service, 2015-2023F |

|

9.3.2 Saudi Arabia Limo Service Market Revenue Share, By Sectors, 2019 & 2023F |

|

9.3.3 Saudi Arabia Limo Service Market Revenues, By Sectors, 2015-2023F |

|

10. Saudi Arabia Vehicle Rental Market Overview, By Booking Type |

|

10.1 Saudi Arabia Vehicle Rental Market Revenues, By Online Booking Type, 2015-2023F |

|

10.2 Saudi Arabia Vehicle Rental Market Revenues, By Offline Booking Type, 2015-2023F |

|

11. Saudi Arabia Vehicle Rental Market Overview, By Regions |

|

11.1 Saudi Arabia Central Region Vehicle Rental Market Overview |

|

11.1.1 Saudi Arabia Central Region Vehicle Rental Market Revenues, 2015-2023F |

|

11.1.2 Saudi Arabia Central Region Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

11.1.2.1 Saudi Arabia Central Region Vehicle Rental Market Revenues, By Spot Rental, 2015-2023F |

|

11.1.2.2 Saudi Arabia Central Region Vehicle Rental Market Revenues, By Operating Lease, 2015-2023F |

|

11.1.2.3 Saudi Arabia Central Region Vehicle Rental Market Revenues, By Limo Service, 2015-2023F |

|

11.2 Saudi Arabia Southern Region Vehicle Rental Market Overview |

|

11.2.1 Saudi Arabia Southern Region Vehicle Rental Market Revenues, 2015-2023F |

|

11.2.2 Saudi Arabia Southern Region Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

11.2.2.1 Saudi Arabia Southern Region Vehicle Rental Market Revenues, By Spot Rental, 2015-2023F |

|

11.2.2.2 Saudi Arabia Southern Region Vehicle Rental Market Revenues, By Operating Lease, 2015-2023F |

|

11.2.2.3 Saudi Arabia Southern Region Vehicle Rental Market Revenues, By Limo Service, 2015-2023F |

|

11.3 Saudi Arabia Eastern Region Vehicle Rental Market Overview |

|

11.3.1 Saudi Arabia Eastern Region Vehicle Rental Market Revenues, 2015-2023F |

|

11.3.2 Saudi Arabia Eastern Region Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

11.3.2.1 Saudi Arabia Eastern Region Vehicle Rental Market Revenues, By Spot Rental, 2015-2023F |

|

11.3.2.2 Saudi Arabia Eastern Region Vehicle Rental Market Revenues, By Operating Lease, 2015-2023F |

|

11.3.2.3 Saudi Arabia Eastern Region Vehicle Rental Market Revenues, By Limo Service, 2015-2023F |

|

11.4 Saudi Arabia Western Region Vehicle Rental Market Overview |

|

11.4.1 Saudi Arabia Western Region Vehicle Rental Market Revenues, 2015-2023F |

|

11.4.2 Saudi Arabia Western Region Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

11.4.2.1 Saudi Arabia Western Region Vehicle Rental Market Revenues, By Spot Rental, 2015-2023F |

|

11.4.2.2 Saudi Arabia Western Region Vehicle Rental Market Revenues, By Operating Lease, 2015-2023F |

|

11.4.2.3 Saudi Arabia Western Region Vehicle Rental Market Revenues, By Limo Service, 2015-2023F |

|

12. Saudi Arabia Vehicle Rental Market Overview, By Fleet Size |

|

12.1 Saudi Arabia Regional Vehicle Rental Fleet Share, By Service Type |

|

12.2 Saudi Arabia Regional Vehicle Rental Fleet Size, By Service Type |

|

13. Saudi Arabia Vehicle Rental Market Key Performance Indicators |

|

13.1 Saudi Arabia Logistics Sector Overview |

|

13.2 Saudi Arabia Tourism and Hospitality Sector Overview |

|

13.1 Saudi Arabia Commercial Sector Overview |

|

14. Saudi Arabia Government Regulations In-Vehicle Rental Market |

|

15. Saudi Arabia Vehicle Rental Market Opportunity Assessment |

|

15.1 Saudi Arabia Vehicle Rental Market Opportunity Assessment, By Type |

|

15.2 Saudi Arabia Vehicle Rental Market Opportunity Assessment, By Service Type |

|

15.3 Saudi Arabia Vehicle Rental Market Opportunity Assessment, By Booking Type |

|

15.4 Saudi Arabia Vehicle Rental Market Opportunity Assessment, By Regions |

|

16. Saudi Arabia Vehicle Rental Market Competitive Landscape |

|

16.1 Saudi Arabia Vehicle Rental Market Competitive Benchmarking, By Service Type |

|

16.2 Saudi Arabia Vehicle Rental Market Competitive Benchmarking, By Ownership Type |

|

16.3 Saudi Arabia Vehicle Rental Market Competitive Benchmarking, By Insurance Type |

|

16.4 Saudi Arabia Vehicle Rental Market Revenue Share, By Operating Parameters |

|

16.5 Saudi Arabia Vehicle Rental Market Revenue Share, By Brands, 2019 |

|

17. List Of Key Players In-Vehicle Rental Business |

|

18. Company Profiles |

|

18.1 Theeb Rent a Car |

|

18.2 Hanco (Al Tala’s International Transportation Co. Limited) |

|

18.3 Best Rent a Car |

|

18.4 Seera Group |

|

18.5 Arabian Hala Company (Avis Car Rental) |

|

18.6 Al-Jazira Equipment Company (Sixt) |

|

18.7 Al Jomaih Auto Rental (Ajar) (Enterprise Rent a Car) |

|

18.8 Al Wasilah Rent a Car Co Ltd (The Hertz Corporation) |

|

18.9 United International Transportation Company (Budget Rent a Car) |

|

18.10 Samara-Sixt KSA |

|

18.11 Al Wefaq Rent a Car |

|

19. Key Strategic Recommendations |

|

20. Disclaimer |

|

LIST OF FIGURES |

|

1. Saudi Arabia Vehicle Rental Market Revenues, 2015 - 2023F ($ Million) |

|

2 . Saudi Arabia Vehicle Rental Market Revenue Share, By Type, 2019 & 2023F |

|

3. Saudi Arabia Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

4. Saudi Arabia Vehicle Rental Market Revenue Share, By Booking Type, 2019 & 2023F |

|

5. Saudi Arabia Vehicle Rental Market Revenue Share, By Regions, 2019 & 2023F |

|

6. Saudi Arabia Vehicle Rental Market - Industry Life Cycle, 2019 |

|

7. Saudi Arabia Expected Evolution of Entertainment Spending as % of Total Household Spending, 2013-2030* |

|

8. Saudi Arabia Office Supply Space, 2019-2022F (Sq.mt. GLA) |

|

9. Saudi Arabia Mobility Trends, By Place/Destination, as on 23 August 2020 (Compared to baseline value)* |

|

10. Saudi Arabia Passenger Vehicle Rental Market Revenues, 2015 - 2023F ($ Million) |

|

11. Saudi Arabia Passenger Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F1 |

|

12. Saudi Arabia Spot Passenger Vehicle Rental Market Revenues, 2015 - 2023F ($ Million) |

|

13. Saudi Arabia Spot Passenger Vehicle Rental Market Revenue Share, By Verticals, 2019 & 2023F |

|

14. Saudi Operating Lease Passenger Vehicle Rental Market Revenues, 2015 - 2023F ($ Million) |

|

15. Saudi Arabia Operating Lease Passenger Vehicle Rental Market Revenue Share, By Verticals, 2019 & 2023F |

|

16. Saudi Arabia Limo Passenger Vehicle Rental Market Revenues, 2015 - 2023F ($ Million |

|

17. Saudi Arabia Limo Passenger Vehicle Rental Market Revenue Share, By Verticals, 2019 & 2023F |

|

18. Saudi Arabia Commercial Vehicle Rental Market Revenues, 2015 - 2023F ($ Million) |

|

19. Saudi Arabia Commercial Vehicle Rental Market Revenue Share, By Type, 2019 & 2023F |

|

20. Saudi Arabia Bus Rental Market Revenues, 2015 - 2023F ($ Million) |

|

21. Saudi Arabia Bus Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

22. Saudi Arabia Truck Rental Market Revenues, 2015 - 2023F ($Million) |

|

23. Saudi Arabia Truck Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

24. Saudi Arabia Other Commercial Vehicles Rental Market Revenues, 2015 - 2023F ($ Million) |

|

25. Saudi Arabia Other Commercial Rental Vehicles Market Revenue Share, By Service Type 2019 & 2023F |

|

26. Saudi Arabia Vehicle Rental Market Revenues, By Spot Rental, 2015-2023F ($ Million) |

|

27. Saudi Arabia Spot Rental Market Revenue Share, By Sectors, 2019 & 2023F |

|

28. Saudi Arabia Vehicle Rental Market Revenues, By Operating Lease, 2015-2023F ($ Million) |

|

29. Saudi Arabia Operating Lease Market Revenue Share, By Sectors, 2019 & 2023F |

|

30. Saudi Arabia Vehicle Rental Market Revenues, By Limo Service, 2015-2023F ($ Million) |

|

31. Saudi Arabia Limo Services Market Revenue Share, By Sectors, 2019 & 2023F |

|

32. Saudi Arabia Online Vehicle Rental Market Revenues, 2015-2023F ($ Million) |

|

33. Saudi Arabia Offline Vehicle Rental Market Revenues, 2015-2023F ($ Million) |

|

34. Saudi Arabia Central Region Vehicle Rental Market Revenues, 2015-2023F ($ Million) |

|

35. Saudi Arabia Central Region Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

36. Saudi Arabia Southern Region Vehicle Rental Market Revenues, 2015-2023F ($ Million) |

|

37. Saudi Arabia Southern Region Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

38. Saudi Arabia Eastern Region Vehicle Rental Market Revenues, 2015-2023F ($ Million) |

|

39. Saudi Arabia Eastern Region Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

40. Saudi Arabia Western Region Vehicle Rental Market Revenues, 2015-2023F ($ Million) |

|

41. Saudi Arabia Western Region Vehicle Rental Market Revenue Share, By Service Type, 2019 & 2023F |

|

42. Saudi Arabia Hotel Supply (No of Branded Hotel Keys), Q2 2019-FY22 |

|

43. Saudi Arabia Occupancy Rate Change in Hotel Supply (YTD 2018-YTD 2020) |

|

44. Saudi Arabia Nation-Wise Pilgrims Arrival, 2019 |

|

45. Number of Arriving Vehicles to Makkah al-Mukarramah Carrying Pilgrims by Type of Vehicle, 2018-2019 |

|

46. Saudi Arabia Vehicle Rental Market Opportunity Assessment, By Type, 2023F |

|

47. Saudi Arabia Vehicle Rental Market Opportunity Assessment, By Service Type, 2023F |

|

48. Saudi Arabia Vehicle Rental Market Opportunity Assessment, By Booking Type, 2023F |

|

49. Saudi Arabia Vehicle Rental Market Opportunity Assessment, By Regions, 2023F |

|

50. Saudi Arabia Vehicle Rental Market Competitive Benchmarking, By Operating Parameters |

|

51. Saudi Arabia Vehicle Rental Market Revenue Share, By Brands, 2019 |

|

52. Riyadh Warehouses & Logistics Demand Projections, 2020E– 2030F (M sqm) |

|

53. Jeddah Warehouses & Logistics Demand Projections, 2020E-2030F (M sqm) |

|

54. Dammam & Al Khobar Warehouses & Logistics Demand Projections, 2020E– 2030F (M sqm) |

|

55. Riyadh Warehouse & Logistics Leasable Area, By Major Districts, Q1 2020 |

|

56. Jeddah Warehouse & Logistics Leasable Area, By Major Districts, Q1 2020 |

|

LIST OF TABLES |

|

1. Saudi Araba Foreign Pilgrims, By Means of Transport (Number of Pilgrims) |

|

2. Saudi Arabia Upcoming Gigaprojects |

|

3. Saudi Arabia Upcoming Tourism, Recreation and Entertainment Projects |

|

4. Saudi Arabia Upcoming Projects |

|

5. Saudi Arabia Spot Passenger Vehicle Rental Market Revenues, By Verticals, 2015 - 2023F ($ Million) |

|

6. Saudi Arabia Operating Lease Passenger Vehicle Rental Market Revenues, By Verticals, 2015 - 2023F ($ Million) |

|

7. Saudi Arabia Limo Passenger Vehicle Rental Market Revenues, By Verticals, 2015 - 2023F ($ Million) |

|

8. Saudi Arabia Bus Rental Market Revenues, By Service Type, 2015 - 2023F ($ Million) |

|

9. Saudi Arabia Truck Rental Market Revenues, By Service Type, 2015 - 2023F ($ Million) |

|

10. Saudi Arabia Other Commercial Vehicles Rental Market Revenues, By Service Type, 2015 - 2023F ($ Million) |

|

11. Saudi Arabia Spot Rental Market Revenues, By Sectors, 2015 - 2023F ($ Million) |

|

12. Saudi Arabia Operating Lease Market Revenues, By Sectors, 2015 - 2023F ($ Million) |

|

13. Saudi Arabia Limo Services Market Revenues, By Sectors, 2015 - 2023F ($ Million) |

|

14. Saudi Arabia Central Region Vehicle Rental Market Revenues, By Service Type, 2015 - 2023F ($ Million) |

|

15. Saudi Arabia Southern Region Vehicle Rental Market Revenues, By Service Type, 2015 - 2023F ($ Million) |

|

16. Saudi Arabia Eastern Region Vehicle Rental Market Revenues, By Service Type, 2015 - 2023F ($ Million) |

|

17. Saudi Arabia Western Region Vehicle Rental Market Revenues, By Service Type, 2015 - 2023F ($ Million) |

|

18. Saudi Arabia Logistics Sector Improvement Initiatives |

|

19. List of Major Airport Projects in Saudi Arabia |

|

20. Saudi Arabia Total Number of Foreign Employees, By Region, 2019 |

|

21. Saudi Arabia Vehicle Rental Companies (1000-2000 Fleet Size) |

|

22. Saudi Arabia Limo Service Companies, Eastern Province |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- South Korea Space Power Electronics Market (2025-2031) | Companies, Trends, Revenue, Outlook, Forecast, Industry, Value, Size, Analysis, Growth & Share

- Voluntary Carbon Credit Market (2025-2031) | Companies, Outlook, Share, Forecast, Revenue, Value, Industry, COVID-19 IMPACT, Growth, Size, Analysis & Trends

- Water Purifier Market (2025-2031) | Value, Share, Size, Growth, Industry, Outlook, Analysis, Forecast, Trends, Companies & Revenue

- UAV Market (2025-2031) | Size, Forecast, Value, Revenue, Trend, Growth, Analysis & Outlook

- Smart Speaker Market (2025-2031) | Size, Trends, Share, Outlook, Revenue, Forecast, Analysis, Value, Segmentation & Industry

- Microgrid Market (2025-2031) | Value, Share, Growth, Outlook, Industry, Companies, Trends, Revenue, Forecast, Analysis & Size

- Mobile Credential Reader Market (2025-2031) | Analysis, Industry, Size, Share, Revenue, Forecast, Trends, Growth, Value & Outlook

- North America Planting Equipment Market (2024-2030) | Outlook, Size, Growth, Companies, Revenue, Share, Analysis, Forecast, Industry, Value & Trends

- Light Fidelity (Li-Fi) Market (2025-2031) | Share, Revenue, Trends, Size, Industry, Forecast, Companies, Growth, Outlook, Analysis & Value

- UAE Ready Mix Concrete Market (2025-2031) | Industry, Segmentation, Share, Analysis, Forecast, Companies, Outlook, Competitive Landscape, Trends, Value, Growth, Size & Revenue

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines