Singapore Centrifugal pumps Market (2024-2030) | Share, Forecast, Trends, Outlook, Value, Size, Companies, Industry, Analysis, Revenue & Growth

| Product Code: ETC026027 | Publication Date: Jul 2023 | Updated Date: May 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

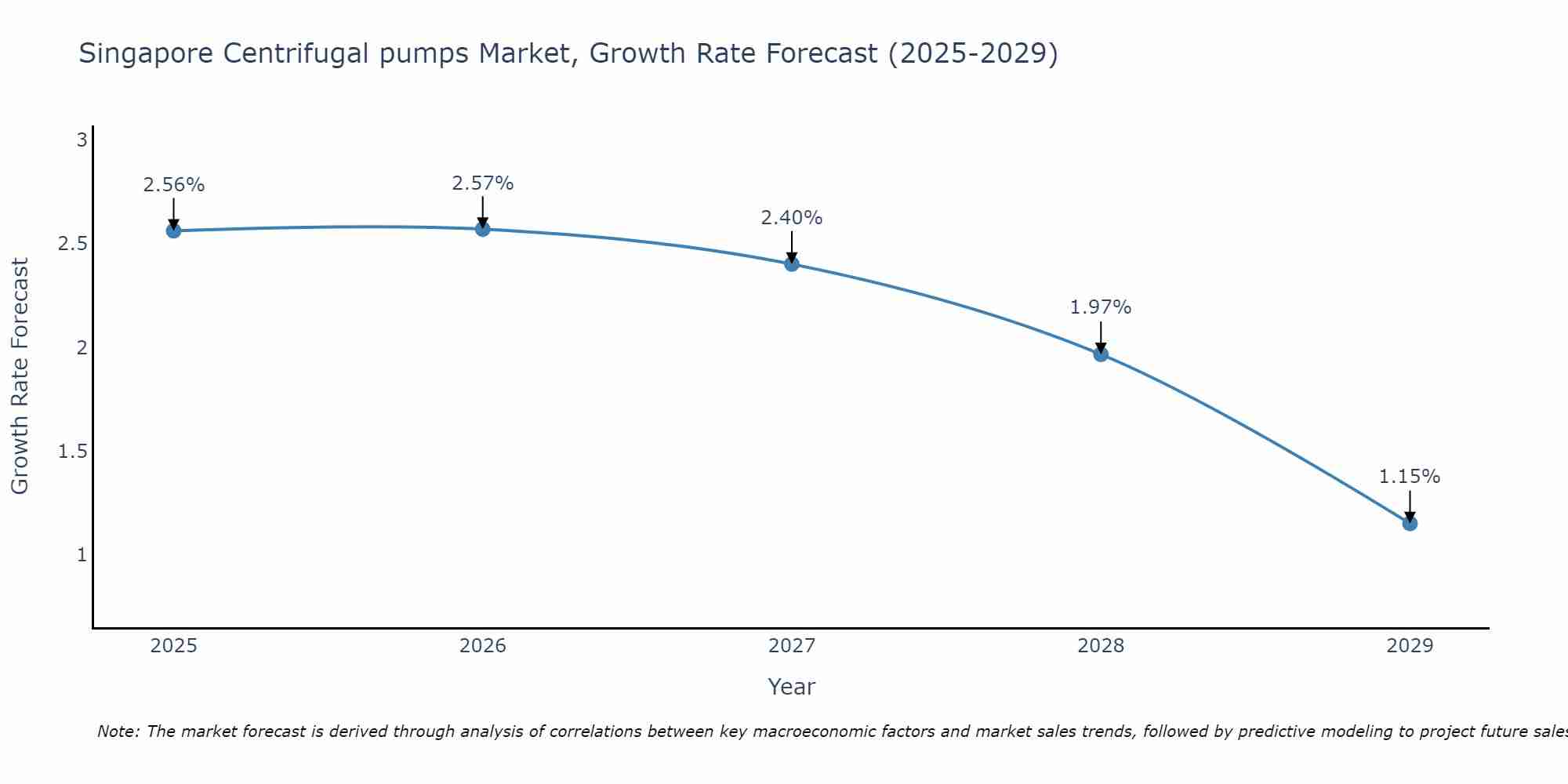

Singapore Centrifugal pumps Market Size Growth Rate

The Singapore Centrifugal pumps Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 2.56% in 2025, climbs to a high of 2.57% in 2026, and moderates to 1.15% by 2029.

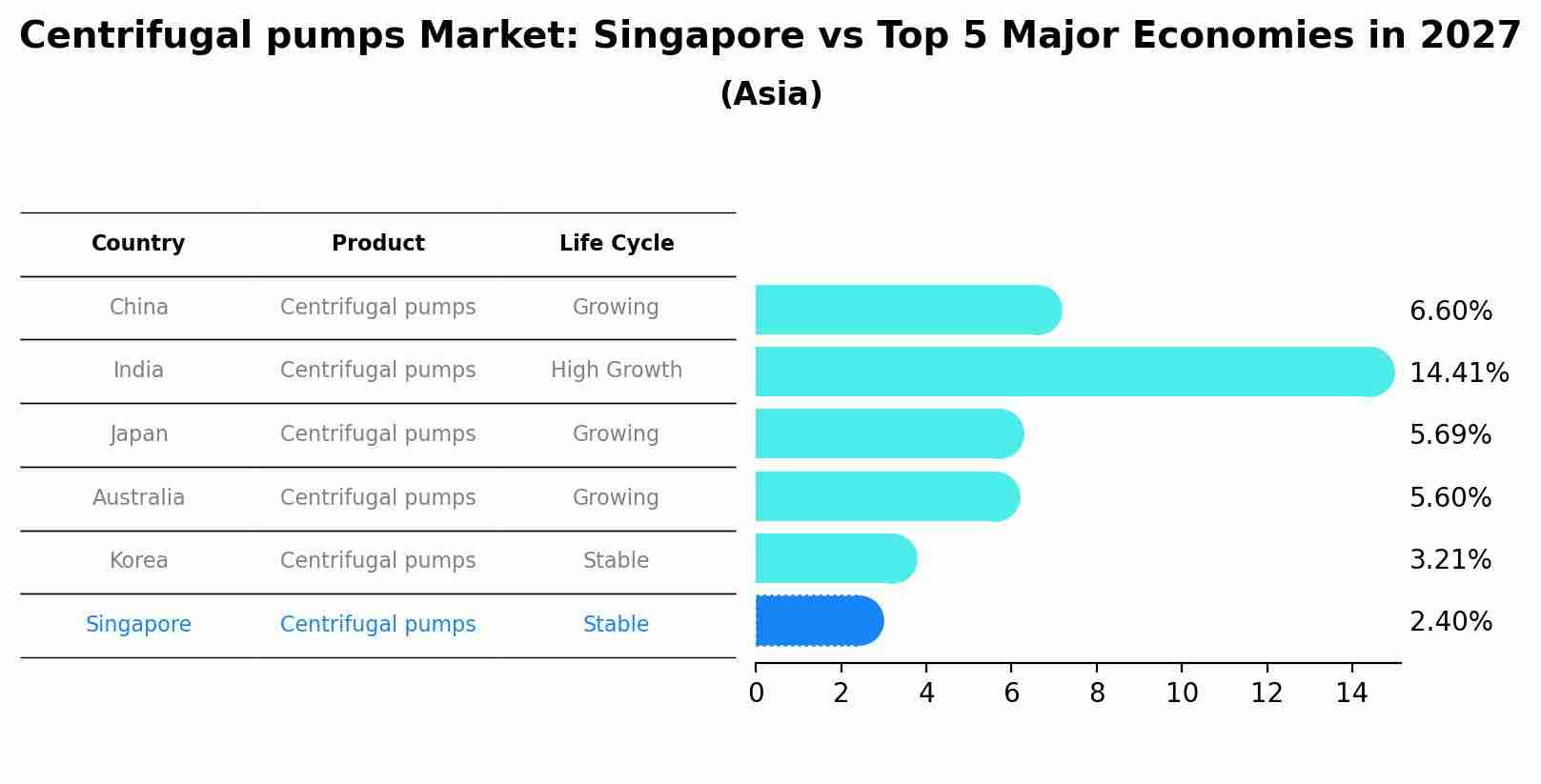

Centrifugal pumps Market: Singapore vs Top 5 Major Economies in 2027 (Asia)

By 2027, the Centrifugal pumps market in Singapore is anticipated to reach a growth rate of 2.40%, as part of an increasingly competitive Asia region, where China remains at the forefront, supported by India, Japan, Australia and South Korea, driving innovations and market adoption across sectors.

Singapore Centrifugal pumps Market Synopsis

Singapore is one of the most competitive markets for centrifugal pumps. With expanding industrial activities and rapid urbanization, demand for these pumps has been increasing in Singapore over the past few years. The growth of the market is driven by factors such as increasing government investments in infrastructure projects, heating, ventilation and air conditioning systems (HVAC) and rising water treatment applications across residential and commercial buildings. To meet the growing needs of water supply & distribution systems, wastewater management among others, centrifugal pumps have become an indispensable part of many industries including food & beverage processing plants, power plants and oil & gas refineries.

Market Drivers

Increasing Government Investments In Infrastructure Projects: Singapore government has been investing heavily in infrastructure projects to improve its transportation network which include construction of roads & bridges within cities as well as between countries. This increased spending on infrastructure will help boost demand for centrifugal pump substantially over the next few years.Rising HVAC Systems Demand In Residential And Commercial Buildings: Growing population with high disposable incomes are driving up building construction activities resulting in an increase in demand for air handling units (AHU). Furthermore, energy efficiency regulations imposed by government is expected to further push up the need for efficient cooling solutions leading to increased installation of HVAC systems which would also drive up demand for centrifugal pumps over long term period.

Market challenges

High Cost Of Installation And Low Operating Efficiency : Centrifugal pumps come at a relatively higher cost when compared against other pumping solutions available in market like reciprocating or rotary pump ETC Moreover their operating efficiency can be quite low due to various factors related material selection from wear resistance point view or cavitation effects associated with fluid itself making them less attractive option compare to other types of available options.

Key players

Grundfos ; KSB ; Xylem Inc; Sulzer Ltd ; Ebara Pumps; Wilo ; ITT Bornemann GmbH ; Flowserve Corporation; Franklin are the major players.

Covid-19 Impact

Due to pandemic situation, there was significant slowdown observed across all sectors including manufacturing sector during 2020 where lot many production facilities were shut down temporarily leading to dip sales figures recorded by manufacturers.However lately we have seen recovery happening slowly mainly driven consumer confidence returning back coupled with easing lockdown restrictions imposed globally although it still remains uncertain what kind off trajectory this market may take going forward.

Key Highlights of the Report:

- Singapore Centrifugal pumps Market Outlook

- Market Size of Singapore Centrifugal pumps Market, 2023

- Forecast of Singapore Centrifugal pumps Market, 2030

- Historical Data and Forecast of Singapore Centrifugal pumps Revenues & Volume for the Period 2020-2030

- Singapore Centrifugal pumps Market Trend Evolution

- Singapore Centrifugal pumps Market Drivers and Challenges

- Singapore Centrifugal pumps Price Trends

- Singapore Centrifugal pumps Porter's Five Forces

- Singapore Centrifugal pumps Industry Life Cycle

- Historical Data and Forecast of Singapore Centrifugal pumps Market Revenues & Volume By Pump Type for the Period 2020-2030

- Historical Data and Forecast of Singapore Centrifugal pumps Market Revenues & Volume By Overhung Impeller for the Period 2020-2030

- Historical Data and Forecast of Singapore Centrifugal pumps Market Revenues & Volume By Vertically Suspended for the Period 2020-2030

- Historical Data and Forecast of Singapore Centrifugal pumps Market Revenues & Volume By Between Bearing for the Period 2020-2030

- Historical Data and Forecast of Singapore Centrifugal pumps Market Revenues & Volume By Stage for the Period 2020-2030

- Historical Data and Forecast of Singapore Centrifugal pumps Market Revenues & Volume By Single Stage for the Period 2020-2030

- Historical Data and Forecast of Singapore Centrifugal pumps Market Revenues & Volume By Multistage for the Period 2020-2030

- Historical Data and Forecast of Singapore Centrifugal pumps Market Revenues & Volume By End User for the Period 2020-2030

- Historical Data and Forecast of Singapore Centrifugal pumps Market Revenues & Volume By Industrial for the Period 2020-2030

- Historical Data and Forecast of Singapore Centrifugal pumps Market Revenues & Volume By Commercial and Residential for the Period 2020-2030

- Singapore Centrifugal pumps Import Export Trade Statistics

- Market Opportunity Assessment By Pump Type

- Market Opportunity Assessment By Stage

- Market Opportunity Assessment By End User

- Singapore Centrifugal pumps Top Companies Market Share

- Singapore Centrifugal pumps Competitive Benchmarking By Technical and Operational Parameters

- Singapore Centrifugal pumps Company Profiles

- Singapore Centrifugal pumps Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Singapore Centrifugal pumps Market Overview |

3.1 Singapore Country Macro Economic Indicators |

3.2 Singapore Centrifugal pumps Market Revenues & Volume, 2020 & 2030F |

3.3 Singapore Centrifugal pumps Market - Industry Life Cycle |

3.4 Singapore Centrifugal pumps Market - Porter's Five Forces |

3.5 Singapore Centrifugal pumps Market Revenues & Volume Share, By Pump Type, 2020 & 2030F |

3.6 Singapore Centrifugal pumps Market Revenues & Volume Share, By Stage, 2020 & 2030F |

3.7 Singapore Centrifugal pumps Market Revenues & Volume Share, By End User, 2020 & 2030F |

4 Singapore Centrifugal pumps Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Singapore Centrifugal pumps Market Trends |

6 Singapore Centrifugal pumps Market, By Types |

6.1 Singapore Centrifugal pumps Market, By Pump Type |

6.1.1 Overview and Analysis |

6.1.2 Singapore Centrifugal pumps Market Revenues & Volume, By Pump Type, 2020-2030F |

6.1.3 Singapore Centrifugal pumps Market Revenues & Volume, By Overhung Impeller, 2020-2030F |

6.1.4 Singapore Centrifugal pumps Market Revenues & Volume, By Vertically Suspended, 2020-2030F |

6.1.5 Singapore Centrifugal pumps Market Revenues & Volume, By Between Bearing, 2020-2030F |

6.2 Singapore Centrifugal pumps Market, By Stage |

6.2.1 Overview and Analysis |

6.2.2 Singapore Centrifugal pumps Market Revenues & Volume, By Single Stage, 2020-2030F |

6.2.3 Singapore Centrifugal pumps Market Revenues & Volume, By Multistage, 2020-2030F |

6.3 Singapore Centrifugal pumps Market, By End User |

6.3.1 Overview and Analysis |

6.3.2 Singapore Centrifugal pumps Market Revenues & Volume, By Industrial, 2020-2030F |

6.3.3 Singapore Centrifugal pumps Market Revenues & Volume, By Commercial and Residential, 2020-2030F |

7 Singapore Centrifugal pumps Market Import-Export Trade Statistics |

7.1 Singapore Centrifugal pumps Market Export to Major Countries |

7.2 Singapore Centrifugal pumps Market Imports from Major Countries |

8 Singapore Centrifugal pumps Market Key Performance Indicators |

9 Singapore Centrifugal pumps Market - Opportunity Assessment |

9.1 Singapore Centrifugal pumps Market Opportunity Assessment, By Pump Type, 2020 & 2030F |

9.2 Singapore Centrifugal pumps Market Opportunity Assessment, By Stage, 2020 & 2030F |

9.3 Singapore Centrifugal pumps Market Opportunity Assessment, By End User, 2020 & 2030F |

10 Singapore Centrifugal pumps Market - Competitive Landscape |

10.1 Singapore Centrifugal pumps Market Revenue Share, By Companies, 2023 |

10.2 Singapore Centrifugal pumps Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero