Singapore Cosmetic Products Market (2025-2031) | Outlook, Analysis, Value, Forecast, Revenue, Industry, Share, Trends, Size, Growth & Companies

Market Forecast By Type (Skin Care Products, Color Cosmetics, Hair Care Products, Fragrance And Deodorants, Sun Care Products, Soaps, Bath, & Shower Products, Oral Hygiene Products, Personal Hygiene Products), By Distribution Channel (Supermarkets, Pharmacy & Drug Stores, Department Stores, Direct Selling, Specialty Stores, Beauty Salons, Internet Retailing, Others) And Competitive Landscape

| Product Code: ETC320907 | Publication Date: Aug 2022 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

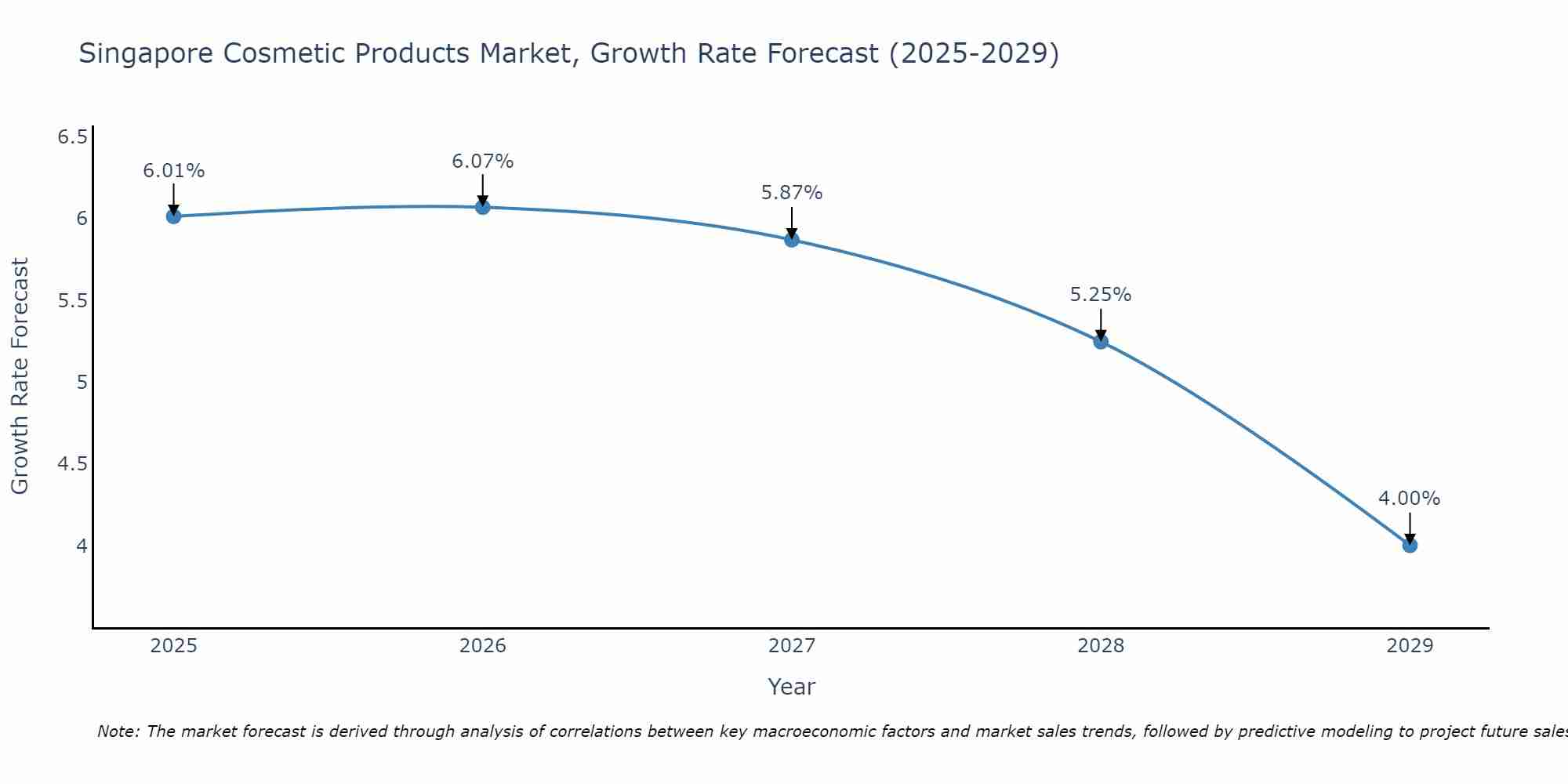

Singapore Cosmetic Products Market Size Growth Rate

The Singapore Cosmetic Products Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 6.07% in 2026, following an initial rate of 6.01%, before easing to 4.00% at the end of the period.

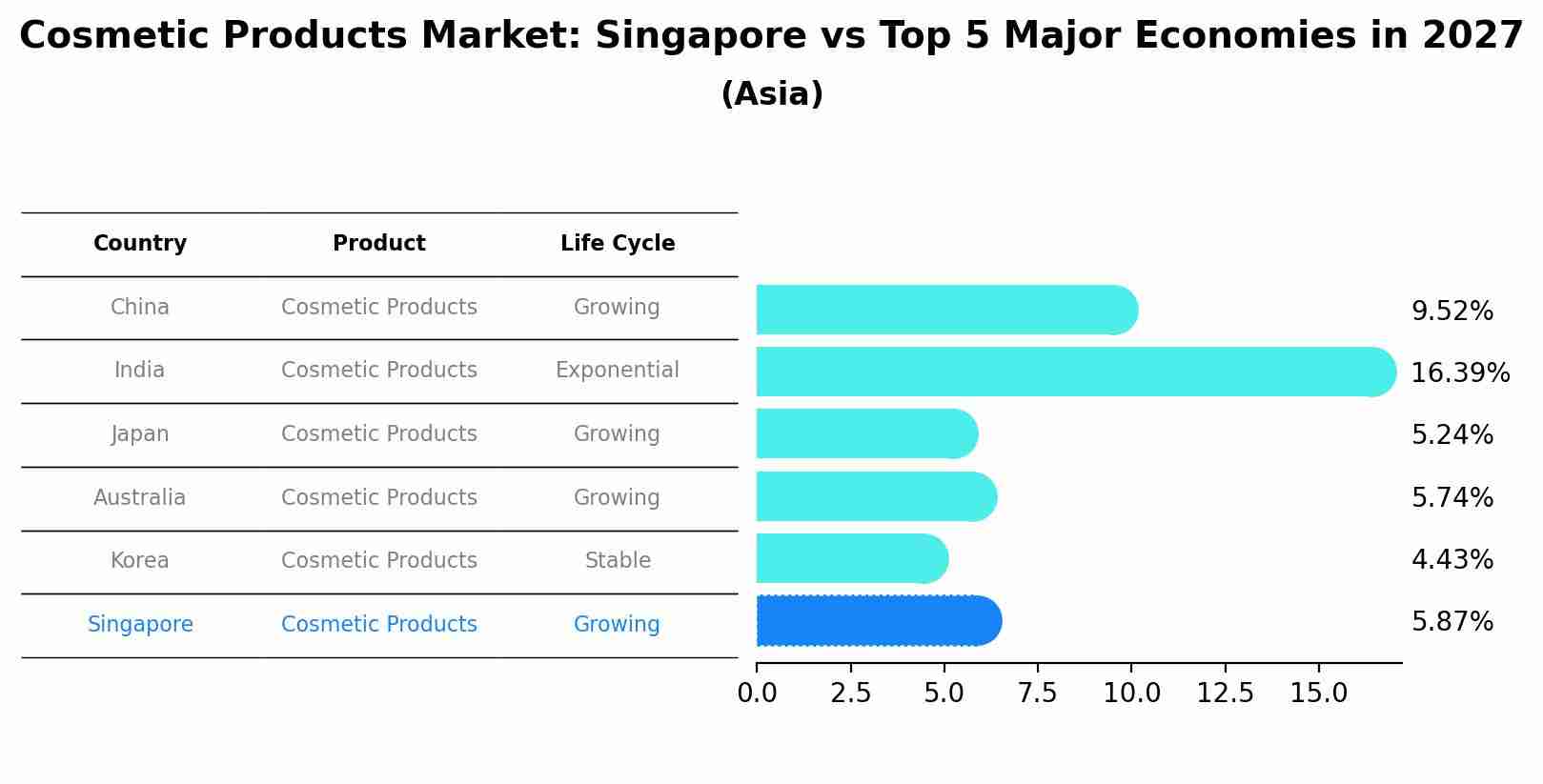

Cosmetic Products Market: Singapore vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Cosmetic Products market in Singapore is projected to expand at a growing growth rate of 5.87% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Singapore Cosmetic Products Market Size Growth Rate

As per 6Wresearch, Singapore Cosmetic Products Market Size is projected to reach USD 14.2 billion by 2031 from USD 8.1 billion, growing at a CAGR between 3.4% during the 2025 to 2031. Singapore's robust e-commerce landscape enables greater accessibility for consumers to explore a wide range of cosmetic products, further boosting market demand.

Singapore Cosmetic Products Market Highlights

| Report Name | Singapore Cosmetic Products Market |

| Forecast period | 2025-2031 |

| CAGR | 3.4% |

| Growing Sector | Premium Skincare and Sun Protection Products |

Topics Covered in the Singapore Cosmetic Products Market Report

The Singapore Cosmetic Products Market report offers a comprehensive analysis segmented by Type and Distribution Channel. It provides an unbiased and detailed examination of current market trends, high-growth areas, and key drivers, assisting stakeholders in formulating strategies aligned with present and future market dynamics.

Singapore Cosmetic Products Market Synopsis

Singapore's cosmetics market is steadily growing thanks to people who care about their looks, people who have more money to spend, and social media trends. The tropical environment of the country has made people more aware of their skin care needs, especially when it comes to sun protection and anti-aging products.

Singapore Cosmetic Products Market is estimated to grow at a CAGR of 3.4% during 2025–2031. Premium and specialised cosmetics, like anti-aging creams, serums, and sun protection formulas, are becoming more popular, which is driving this rise. People are looking for high-quality goods that address specific skin problems, which is making the market more creative and open to new ideas. Businesses that work in the cosmetics industry also have to deal with strict rules and high costs to follow them. Also, there is a growing demand for eco-friendly and sustainable goods. This forces businesses to come up with new ideas and start using greener methods, which often requires big investments.

Singapore Cosmetic Products Market Trends

Growing interest in "clean beauty," personalised skin care solutions, and using technology in product creation are some of the most important trends in the Singapore cosmetics market. Consumers are increasingly choosing goods that are made from natural ingredients, don't contain any harmful chemicals, and can be customised to fit each person's skin type and concerns.

Investment Opportunities in the Singapore Cosmetic Products Market

Investors can look for chances to make money by making environmentally friendly and new beauty items that meet the needs of people who want to look good in an ethical way. There is a niche market with a lot of potential because more and more people want vegan and halal-certified goods.

Leading Players in the Singapore Cosmetic Products Market

Prominent players in the Singapore cosmetic products market include L’Oréal S.A., The Estée Lauder Companies Inc., Shiseido Co. Ltd., Beiersdorf AG, Groupe Clarins, Unilever Plc, Kao Corp., LVMH Moët Hennessy Louis Vuitton SE, Coty Inc., and Note Cosmetics. These companies offer a wide range of products across various categories, including skincare, makeup, and fragrances.

Government Regulations

The Health Sciences Authority (HSA) controls the market for cosmetics in Singapore. It checks that the items are safe, of good quality, and properly labelled. The ASEAN Cosmetic Directive sets the rules for cosmetics in the area and must be followed by both manufacturers and importers.

Future Insights of the Singapore Cosmetic Products Market

The Singapore cosmetics market is expected to grow in the future thanks to better technology, changing customer tastes, and more people becoming aware of skin care and wellness issues. Augmented reality (AR) and virtual try-on technologies will make online shopping better by giving customers more information to help them decide what to buy.

Market Segmentation Analysis

The report provides a detailed analysis of the following market segments

Skincare Products to Dominate the Market – By Type

According to Parth, Senior Research Analyst at 6Wresearch, The Singapore cosmetics market is likely to be led by skincare products. This is because skin health is becoming more important, and people want products that help with specific problems like ageing, pigmentation, and sun protection. Because of the tropical weather, people need to use sun protection goods, which helps the skincare market even more.

Supermarkets to Dominate the Market – By Price Range

Singapore's supermarkets are very important to the cosmetics industry because they make it easy for people to get a lot of different beauty and personal care goods. Major supermarket chains like Giant, NTUC FairPrice, and Cold Storage all have areas just for cosmetics that show off a wide range of brands and prices.

Key Attractiveness of the Report

- 10 Years of Market Numbers

- Historical Data Starting from 2021 to 2024

- Base Year 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- Singapore Cosmetic Products Market Outlook

- Market Size of Singapore Cosmetic Products Market, 2024

- Forecast of Singapore Cosmetic Products Market, 2031

- Historical Data and Forecast of Singapore Cosmetic Products Revenues & Volume for the Period 2021-2031

- Singapore Cosmetic Products Market Trend Evolution

- Singapore Cosmetic Products Market Drivers and Challenges

- Singapore Cosmetic Products Price Trends

- Singapore Cosmetic Products Porter's Five Forces

- Singapore Cosmetic Products Industry Life Cycle

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Skin Care Products for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Color Cosmetics for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Hair Care Products for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Fragrance And Deodorants for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Sun Care Products for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Soaps, Bath, & Shower Products for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Oral Hygiene Products for the Period 2021-2031

- Historical Data and Forecast of Singapore Skin Care Products Cosmetic Products Market Revenues & Volume By Personal Hygiene Products for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Distribution Channel for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Supermarkets for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Pharmacy & Drug Stores for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Department Stores for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Direct Selling for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Specialty Stores for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Beauty Salons for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Internet Retailing for the Period 2021-2031

- Historical Data and Forecast of Singapore Cosmetic Products Market Revenues & Volume By Others for the Period 2021-2031

- Singapore Cosmetic Products Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Distribution Channel

- Singapore Cosmetic Products Top Companies Market Share

- Singapore Cosmetic Products Competitive Benchmarking By Technical and Operational Parameters

- Singapore Cosmetic Products Company Profiles

- Singapore Cosmetic Products Key Strategic Recommendations

Markets Covered

The report provides a detailed analysis of the following market segments

By Type

- Skin Care Products

- Color Cosmetics

- Hair Care Products

- Fragrance And Deodorants

- Sun Care Products

- Soaps

- Bath, & Shower Products

- Oral Hygiene Products

- Personal Hygiene Products

By Distribution Channel

- Supermarkets

- Pharmacy & Drug Stores

- Department Stores

- Direct Selling

- Specialty Stores

- Beauty Salons

- Internet Retailing

- Others

Singapore Cosmetic Products Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Singapore Cosmetic Products Market Overview |

| 3.1 Singapore Country Macro Economic Indicators |

| 3.2 Singapore Cosmetic Products Market Revenues & Volume, 2021 & 2031F |

| 3.3 Singapore Cosmetic Products Market - Industry Life Cycle |

| 3.4 Singapore Cosmetic Products Market - Porter's Five Forces |

| 3.5 Singapore Cosmetic Products Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.6 Singapore Cosmetic Products Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

| 4 Singapore Cosmetic Products Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Singapore Cosmetic Products Market Trends |

| 6 Singapore Cosmetic Products Market, By Types |

| 6.1 Singapore Cosmetic Products Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Singapore Cosmetic Products Market Revenues & Volume, By Type, 2021-2031F |

| 6.1.3 Singapore Cosmetic Products Market Revenues & Volume, By Skin Care Products, 2021-2031F |

| 6.1.4 Singapore Cosmetic Products Market Revenues & Volume, By Color Cosmetics, 2021-2031F |

| 6.1.5 Singapore Cosmetic Products Market Revenues & Volume, By Hair Care Products, 2021-2031F |

| 6.1.6 Singapore Cosmetic Products Market Revenues & Volume, By Fragrance And Deodorants, 2021-2031F |

| 6.1.7 Singapore Cosmetic Products Market Revenues & Volume, By Sun Care Products, 2021-2031F |

| 6.1.8 Singapore Cosmetic Products Market Revenues & Volume, By Soaps, Bath, & Shower Products, 2021-2031F |

| 6.1.9 Singapore Cosmetic Products Market Revenues & Volume, By Personal Hygiene Products, 2021-2031F |

| 6.1.10 Singapore Cosmetic Products Market Revenues & Volume, By Personal Hygiene Products, 2021-2031F |

| 6.2 Singapore Cosmetic Products Market, By Distribution Channel |

| 6.2.1 Overview and Analysis |

| 6.2.2 Singapore Cosmetic Products Market Revenues & Volume, By Supermarkets, 2021-2031F |

| 6.2.3 Singapore Cosmetic Products Market Revenues & Volume, By Pharmacy & Drug Stores, 2021-2031F |

| 6.2.4 Singapore Cosmetic Products Market Revenues & Volume, By Department Stores, 2021-2031F |

| 6.2.5 Singapore Cosmetic Products Market Revenues & Volume, By Direct Selling, 2021-2031F |

| 6.2.6 Singapore Cosmetic Products Market Revenues & Volume, By Specialty Stores, 2021-2031F |

| 6.2.7 Singapore Cosmetic Products Market Revenues & Volume, By Beauty Salons, 2021-2031F |

| 6.2.8 Singapore Cosmetic Products Market Revenues & Volume, By Others, 2021-2031F |

| 6.2.9 Singapore Cosmetic Products Market Revenues & Volume, By Others, 2021-2031F |

| 7 Singapore Cosmetic Products Market Import-Export Trade Statistics |

| 7.1 Singapore Cosmetic Products Market Export to Major Countries |

| 7.2 Singapore Cosmetic Products Market Imports from Major Countries |

| 8 Singapore Cosmetic Products Market Key Performance Indicators |

| 9 Singapore Cosmetic Products Market - Opportunity Assessment |

| 9.1 Singapore Cosmetic Products Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Singapore Cosmetic Products Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

| 10 Singapore Cosmetic Products Market - Competitive Landscape |

| 10.1 Singapore Cosmetic Products Market Revenue Share, By Companies, 2024 |

| 10.2 Singapore Cosmetic Products Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero