Singapore Diesel Genset Market (2025-2031) | Companies, Trends, Analysis, Growth, Size, Value, Industry, Share, Outlook, Forecast & Revenue

Market Forecast By KVA Rating (5 KVA-75 KVA, 75.1 KVA-375 KVA, 375.1 KVA-750 KVA, 750.1 KVA-1000 KVA And Above 1000 KVA), By Applications (Residential, Commercial, Industrial, Transportation & Public Infrastructure), By Regions (Eastern, Northern, Western And Southern) And Competitive Landscape

| Product Code: ETC090026 | Publication Date: Dec 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 67 | No. of Figures: 12 | No. of Tables: 9 |

Topics Covered in Singapore Diesel Genset Market Report

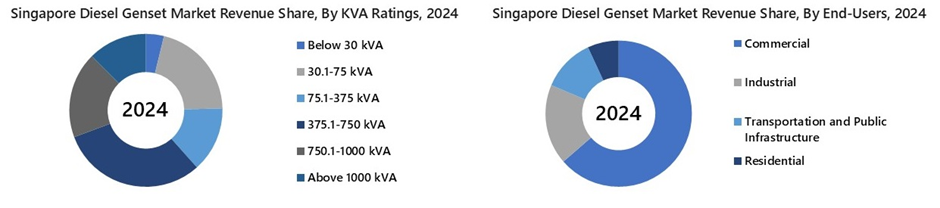

Singapore Diesel Genset Market Report thoroughly covers the market by KVA Ratings, end-users and region. The Singapore Diesel Genset Market Outlook report provides an unbiased and detailed analysis of the ongoing Singapore Diesel Genset Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Singapore Diesel Genset Market Synopsis

Singapore diesel genset market experienced growth in 2024, driven by surging demand from commercial, and construction sectors. The country has emerged as a regional tech powerhouse, hosting global software and service firms and operating data centres with a combined capacity. As these facilities require continuous and secure power, diesel gensets have become essential for both critical backup and temporary power during construction phases. The strong momentum in Singapore’s construction sector, reflected in total demand reaching high in 2024, further fueled genset sales, especially with the development of large-scale projects such as Changi Terminal 5, new MRT lines, and mixed-use commercial towers.

In parallel, the rapid addition of office spaces, amplified genset demand to ensure uninterrupted operations across emerging business hubs. The scale of individual projects, such as the Immigration & Checkpoints Authority Building, highlights the growing reliance on dependable power systems. Moreover, commercial hotspots such as the Central Business District, where developments such as IOI Central Boulevard Towers and Keppel South Central are underway, continue to anchor consistent genset deployment across emerging business hubs.

According to 6Wresearch, the Singapore Diesel Genset Market is projected to grow at a CAGR of 3.6% from 2025-2031F. The growth is supported by a combination of government investment, tech infrastructure expansion, and large-scale real estate development. Under the National AI Strategy 2.0, the government has committed through 2029 to accelerate AI capabilities, creating demand for data centres and AI labs reliant on stable backup power. AWS’s infrastructure investment in Singapore through 2028 is also expected to boost genset demand, particularly during the construction and commissioning stages of new cloud computing facilities.

The office construction pipeline remains strong, reflecting the consistent need for dependable onsite power. The hospitality and retail sectors are also expanding rapidly, with new retail space planned by 2028 and landmark developments such as the waterfront project at Resorts World Sentosa underway. As construction scales up under initiatives such as the Greater Southern Waterfront, the dual need for temporary and post-completion backup power would keep diesel gensets integral to Singapore’s growth. Coupled with the rising competition for premium commercial real estate, the market is expected to witness notable growth in the coming years.

Market Segmentation By KVA Ratings

375.1–750 kVA segment is expected to retain its dominant share in 2031 and is projected to grow rapidly during 2025-2031, owing to its adaptability for both temporary and continuous power needs in logistics centers and infrastructure expansions. Growth in medium-sized commercial towers and smart city upgrades further fuels the need for gensets in this power band, sustaining its market leadership in revenue terms.

Market Segmentation By End-Users

The commercial segment is expected to retain its dominant share in 2031 and is projected to grow rapidly during 2025-2031, driven by a growing pipeline of retail complexes, hospitality chains, and co-working hubs requiring uninterrupted power. Diesel gensets would continue to be favored for their reliability, long service life, and fast startup time during outages and, therefore, would remain critical for operational continuity in commercial hubs.

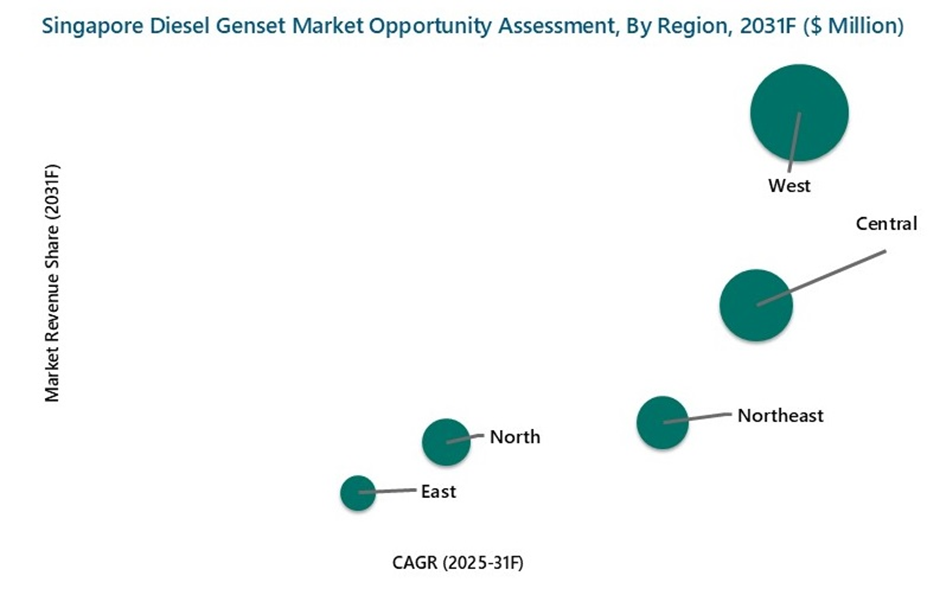

Market Segmentation By Region

West region is expected to retain its dominant share in 2031 and is projected to grow rapidly during 2025-2031, owing to its strategic focus on industrial transformation and smart port logistics. The rapid pace of public-private development partnerships and smart logistics infrastructure and integration of energy-efficient systems and transport modernization efforts in areas such as Tuas Mega Port would further accelerate genset adoption.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Singapore Diesel Genset Market Overview

- Singapore Diesel Genset Market Outlook

- Singapore Diesel Genset Market Forecast

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues and Volumes, By KVA Ratings for the Period 2021-2031F

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues, By End-Users for the Period 2021-2031F

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues, By Region for the Period 2021-2031F

- Porter’s Five Force Analysis

- Singapore Diesel Genset Market Drivers and Restraints

- Singapore Diesel Genset Market Trends and Evolution

- Market Opportunity Assessment, By KVA Ratings

- Market Opportunity Assessment, By End-Users

- Market Opportunity Assessment, By Region

- Singapore Diesel Genset Market Revenue Ranking, By Top 3 Companies

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By KVA Ratings

- Below 30 KVA

- 30.1-75 kVA

- 75.1-375 kVA

- 375.1-750 kVA

- 750.1-1000 kVA

- Above 1000 Kva

By End-Users

- Residential

- Commercial

- Industrial

- Transportation and Public Infrastructure

By Region

- North

- Northeast

- Central

- West

- East

Singapore Diesel Genset Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Singapore Diesel Genset Market Overview |

| 3.1. Singapore Diesel Genset Market Revenues and Volumes, 2021-2031F |

| 3.2. Singapore Diesel Genset Market Industry Life Cycle |

| 3.3. Singapore Diesel Genset Market Porter's Five Forces |

| 4. Singapore Diesel Genset Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Growth in construction and infrastructure development projects in Singapore leading to increased demand for diesel gensets. |

| 4.2.2 Rising frequency of power outages and blackouts in the region driving the need for backup power solutions like diesel gensets. |

| 4.2.3 Increasing adoption of diesel gensets in various industries such as healthcare, manufacturing, and data centers for reliable power supply. |

| 4.3. Market Restraints |

| 4.3.1 Stringent environmental regulations and increasing emphasis on sustainable energy sources may hinder the growth of the diesel genset market. |

| 4.3.2 High initial investment costs associated with diesel gensets could deter potential buyers. |

| 4.3.3 Availability of alternative power generation solutions like natural gas gensets and renewable energy sources may pose a threat to the diesel genset market. |

| 5. Singapore Diesel Genset Market Trends |

| 6. Singapore Diesel Genset Market Overview, By KVA Ratings |

| 6.1. Singapore Diesel Genset Market Revenue Share, By KVA Ratings, 2024 & 2031F |

| 6.1.1. Singapore Diesel Genset Market Revenues, By Below 30 kVA, 2021–2031F |

| 6.1.2. Singapore Diesel Genset Market Revenues, By 30.1–75 kVA, 2021–2031F |

| 6.1.3. Singapore Diesel Genset Market Revenues, By 75.1–375 kVA, 2021–2031F |

| 6.1.4. Singapore Diesel Genset Market Revenues, By 375.1–750 kVA, 2021–2031F |

| 6.1.5. Singapore Diesel Genset Market Revenues, By 750.1–1000 kVA, 2021–2031F |

| 6.1.6. Singapore Diesel Genset Market Revenues, By Above 1000 kVA, 2021–2031F |

| 6.2. Singapore Diesel Genset Market Volume Share, By KVA Ratings, 2024 & 2031F |

| 6.2.1. Singapore Diesel Genset Market Volumes, By Below 30 kVA, 2021–2031F |

| 6.2.2. Singapore Diesel Genset Market Volumes, By 30.1–75 kVA, 2021–2031F |

| 6.2.3. Singapore Diesel Genset Market Volumes, By 75.1–375 kVA, 2021–2031F |

| 6.2.4. Singapore Diesel Genset Market Volumes, By 375.1–750 kVA, 2021–2031F |

| 6.2.5. Singapore Diesel Genset Market Volumes, By 750.1–1000 kVA, 2021–2031F |

| 6.2.6. Singapore Diesel Genset Market Volumes, By Above 1000 kVA, 2021–2031F |

| 7. Singapore Diesel Genset Market Overview, By End-Users |

| 7.1. Singapore Diesel Genset Market Revenue Share, By End-Users, 2024 & 2031F |

| 7.1.1. Singapore Diesel Genset Market Revenues, By Residential, 2021–2031F |

| 7.1.2. Singapore Diesel Genset Market Revenues, By Commercial, 2021–2031F |

| 7.1.3. Singapore Diesel Genset Market Revenues, By Industrial, 2021–2031F |

| 7.1.4. Singapore Diesel Genset Market Revenues, By Transportation and Public Infrastructure, 2021–2031F |

| 8. Singapore Diesel Genset Market Overview, By Region |

| 8.1. Singapore Diesel Genset Market Revenue Share, By Region, 2024 & 2031F |

| 8.1.1. Singapore Diesel Genset Market Revenues, By North, 2021-2031F |

| 8.1.2. Singapore Diesel Genset Market Revenues, By Northeast, 2021-2031F |

| 8.1.3. Singapore Diesel Genset Market Revenues, By Central, 2021-2031F |

| 8.1.4. Singapore Diesel Genset Market Revenues, By West, 2021-2031F |

| 8.1.5. Singapore Diesel Genset Market Revenues, By East, 2021-2031F |

| 9. Singapore Diesel Genset Market Key Performance Indicator |

| 10. Singapore Diesel Genset Market Opportunity Assessment |

| 10.1. Singapore Diesel Genset Market Opportunity Assessment, By KVA Ratings, 2031F |

| 10.2. Singapore Diesel Genset Market Opportunity Assessment, By End-Users, 2031F |

| 10.3. Singapore Diesel Genset Market Opportunity Assessment, By Region, 2031F |

| 11. Singapore Diesel Genset Market Competitive Landscape |

| 11.1. Singapore Diesel Genset Market Revenue Ranking, By Top 3 Companies, 2024 |

| 11.2. Singapore Diesel Genset Market Competitive Benchmarking, By Technical Parameters |

| 11.3. Singapore Diesel Genset Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1. Cummins Inc. |

| 12.2. Caterpillar Inc. |

| 12.3. Mitsubishi Heavy Industries Engine System Asia |

| 12.4. Atlas Copco |

| 12.5. Yanmar Holdings Co., Ltd. |

| 12.6. Denyo United Machinery Pte Ltd. |

| 12.7. MTU Onsite Energy |

| 12.8. Wärtsilä Corporation |

| 12.9. China Yuchai International Ltd. |

| 12.10. Kawasaki Heavy Industries |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Singapore Diesel Genset Market Revenues and Volumes, 2021-2031F (US$ Million, Units) |

| 2. Singapore Number of Private Residential Units Supply in Pipeline, 2025 - 2028F Onwards |

| 3. Singapore Diesel Genset Market Revenue Share, By KVA Ratings, 2024 & 2031F |

| 4. Singapore Diesel Genset Market Volume Share, By KVA Ratings, 2024 & 2031F |

| 5. Singapore Diesel Genset Market Revenue Share, By End-Users, 2024 & 2031F |

| 6. Singapore Diesel Genset Market Revenue Share, By Region, 2024 & 2031F |

| 7. Singapore Number of Hotel Rooms Supply in Pipeline, 2025- 2029F Onwards |

| 8. Singapore Retail Spaces Supply in Pipeline, 2025-2029F Onwards, (in 1000 sqm Gross) |

| 9. Singapore Office Supply by Area, 2024- 2029F (in 1000 sq ft) |

| 10. Singapore Diesel Genset Market Opportunity Assessment, By KVA Ratings, 2031F ($ Million) |

| 11. Singapore Diesel Genset Market Opportunity Assessment, By End-Users, 2031F ($ Million) |

| 12. Singapore Diesel Genset Market Opportunity Assessment, By Region, 2031F ($ Million) |

| List of Tables |

| 1. Singapore ICT Ecosystem Developments Initiatives/Investments |

| 2. Singapore Under Construction Data Centres, As of Feb 2024 |

| 3. Singapore Major Construction Projects, 2025E-2030F |

| 4. Singapore Diesel Genset Market Revenues, By KVA Ratings, 2021-2031F, ($ Million) |

| 5. Singapore Diesel Genset Market Volumes, By KVA Ratings, 2021-2031F, (Units) |

| 6. Singapore Diesel Genset Market Revenues, By End-Users, 2021-2031F, ($ Million) |

| 7. Singapore Diesel Genset Market Revenues, By Region, 2021-2031F, ($ Million) |

| 8. Singapore Major Commercial Projects |

| 9. Singapore Major Office Supply Project, 2024-2027F |

Market Forecast By KVA (5 - 75 KVA, 75.1 - 375 KVA, 375.1 - 750 KVA, 750.1 - 1000 KVA, Above 1000 KVA), By Application (Residential, Commercial , Industrial, Transportation & Public Infrastructure) And Competitive Landscape

| Product Code: ETC090026 | Publication Date: Aug 2021 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

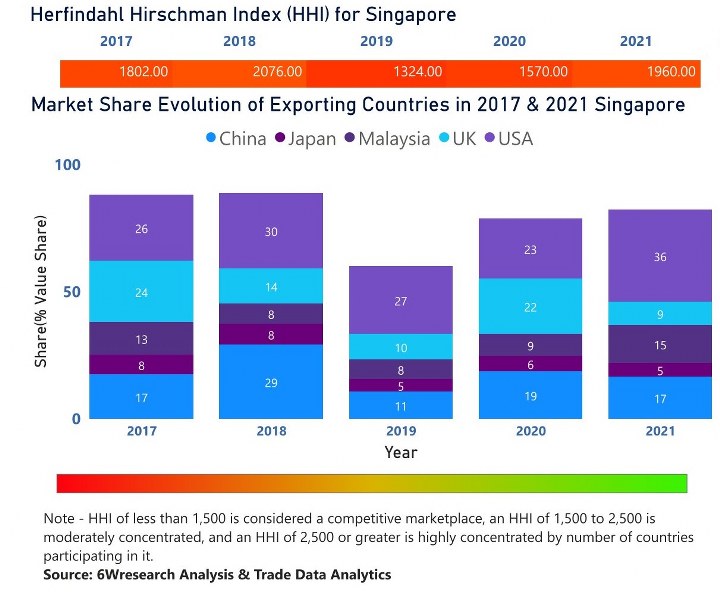

Singapore Diesel Genset Market | Country-Wise Share and Competition Analysis

In the year 2021, USA was the largest exporter in terms of value, followed by China. It has registered a growth of 52.8% over the previous year. While China registered a decline of -12.15% as compare to the previous year. In the year 2017 USA was the largest exporter followed by UK. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Singapore has the Herfindahl index of 1802 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 1960 which signifies moderately concentrated in the market.

Singapore Diesel Genset Market - Export Market Opportunities

Singapore Diesel Genset Market - Export Market Opportunities

Singapore Diesel Genset (Generator) Market Synopsis

Singapore Diesel Genset (Generator) Market is projected to grow over the coming year. Singapore Diesel Genset (Generator) Market report is a part of our periodical regional publication Asia Pacific Diesel Genset (Generator) Market outlook report. 6W tracks diesel genset market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Diesel Genset (Generator) Market outlook report annually.

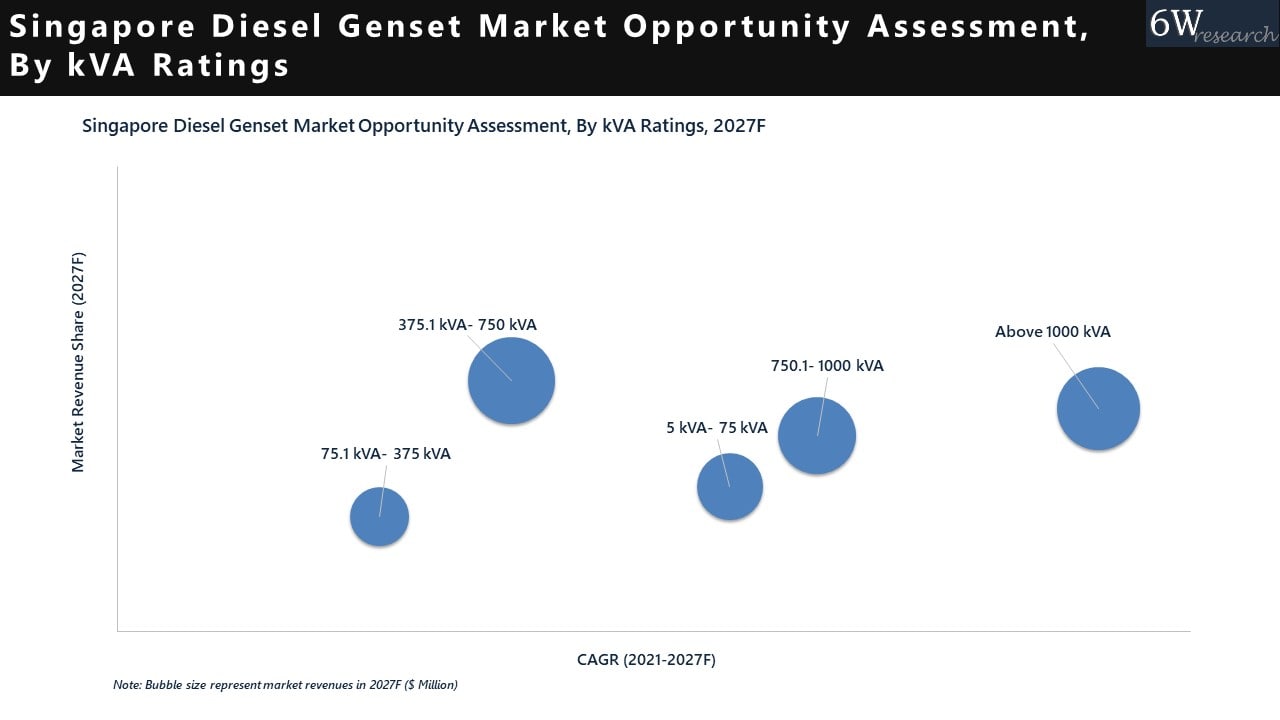

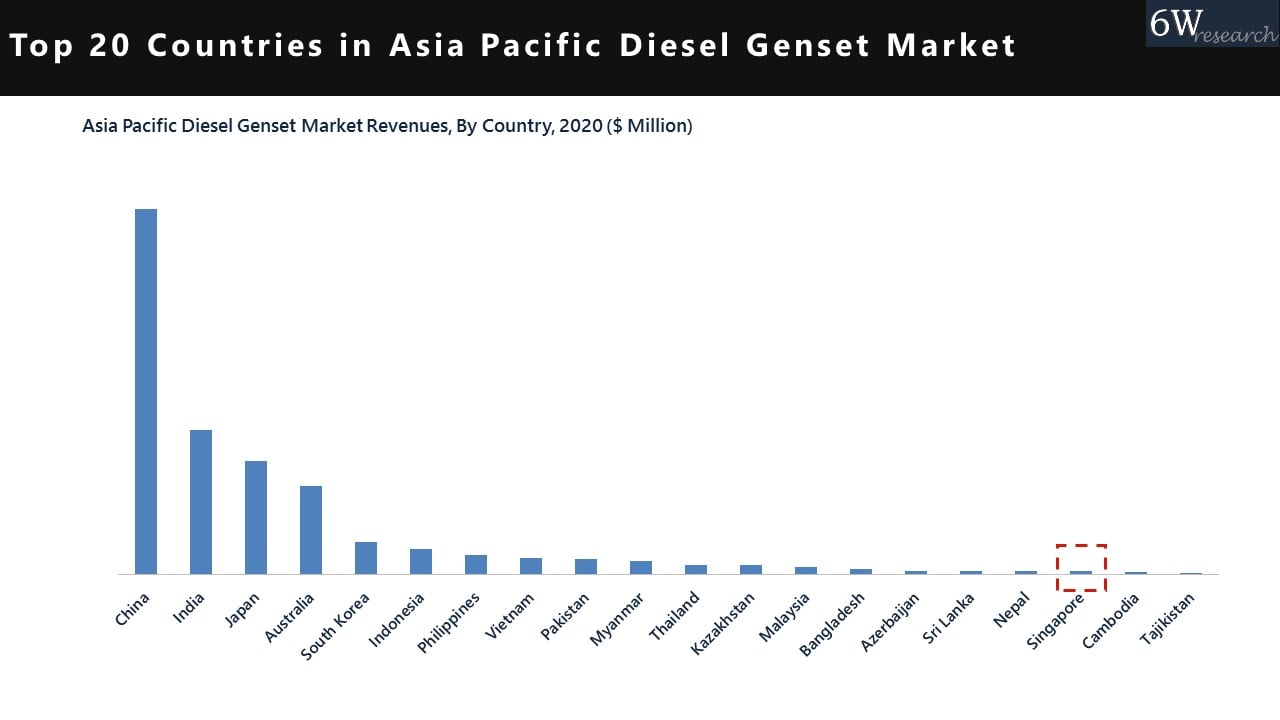

Singapore Diesel Genset Market decline by -10.2% in 2017- 2020 and is expected to grow at a CAGR of 2.6% during 2021- 2027. Singapore occupies 18th position in terms of the market size in the APAC Diesel Genset Market.

In terms of market by kVA ratings, 375.1KVA-750KVA dominates the market and is expected to remain in a dominant position in the coming years. However, the Above 1000KVA rating is expected to have the fastest growth rate among all ratings.

In terms of application, Commercial dominates the market and is expected to remain in a dominant position in the coming years with the fastest growth rate among all applications.

Singapore Diesel Genset Market report comprehensively covers the market by kVA ratings, applications, and regions. The Singapore Diesel Genset Market outlook report provides an unbiased analysis of the ongoing Singapore Diesel Genset Market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

- Singapore Diesel Genset Market Outlook

- Market Size of Singapore Diesel Genset Market, 2020

- Forecast of Singapore Diesel Genset Market, 2027

- Historical Data and Forecast of Singapore Diesel Genset Revenues & Volume for the Period 2018 - 2027

- Singapore Diesel Genset Market Trend Evolution

- Singapore Diesel Genset Market Drivers and Challenges

- Singapore Diesel Genset Price Trends

- Singapore Diesel Genset Porter's Five Forces

- Singapore Diesel Genset Industry Life Cycle

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues & Volume By KVA for the Period 2018 - 2027

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues & Volume By 5 - 75 KVA for the Period 2018 - 2027

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues & Volume By 75.1 - 375 KVA for the Period 2018 - 2027

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues & Volume By 375.1 - 750 KVA for the Period 2018 - 2027

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues & Volume By 750.1 - 1000 KVA for the Period 2018 - 2027

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues & Volume By Above 1000 KVA for the Period 2018 - 2027

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues & Volume By Application for the Period 2018 - 2027

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues & Volume By Residential for the Period 2018 - 2027

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues & Volume By Commercial for the Period 2018 - 2027

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues & Volume By Industrial for the Period 2018 - 2027

- Historical Data and Forecast of Singapore Diesel Genset Market Revenues & Volume By Transportation & Public Infrastructure for the Period 2018 - 2027

- Singapore Diesel Genset Import Export Trade Statistics

- Market Opportunity Assessment By KVA

- Market Opportunity Assessment By Application

- Singapore Diesel Genset Top Companies Market Share

- Singapore Diesel Genset Competitive Benchmarking By Technical and Operational Parameters

- Singapore Diesel Genset Company Profiles

- Singapore Diesel Genset Key Strategic Recommendations

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero