Slovakia Television Market (2025-2031) | Size, Revenue, Value, Industry, Growth, Analysis, Companies, Forecast, Trends, Share & Outlook2

Market Forecast By Resolution (LCD TVs, OLED TVs), By Types (2D TVs, 3D TVs) And Competitive Landscape

| Product Code: ETC036640 | Publication Date: Jun 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

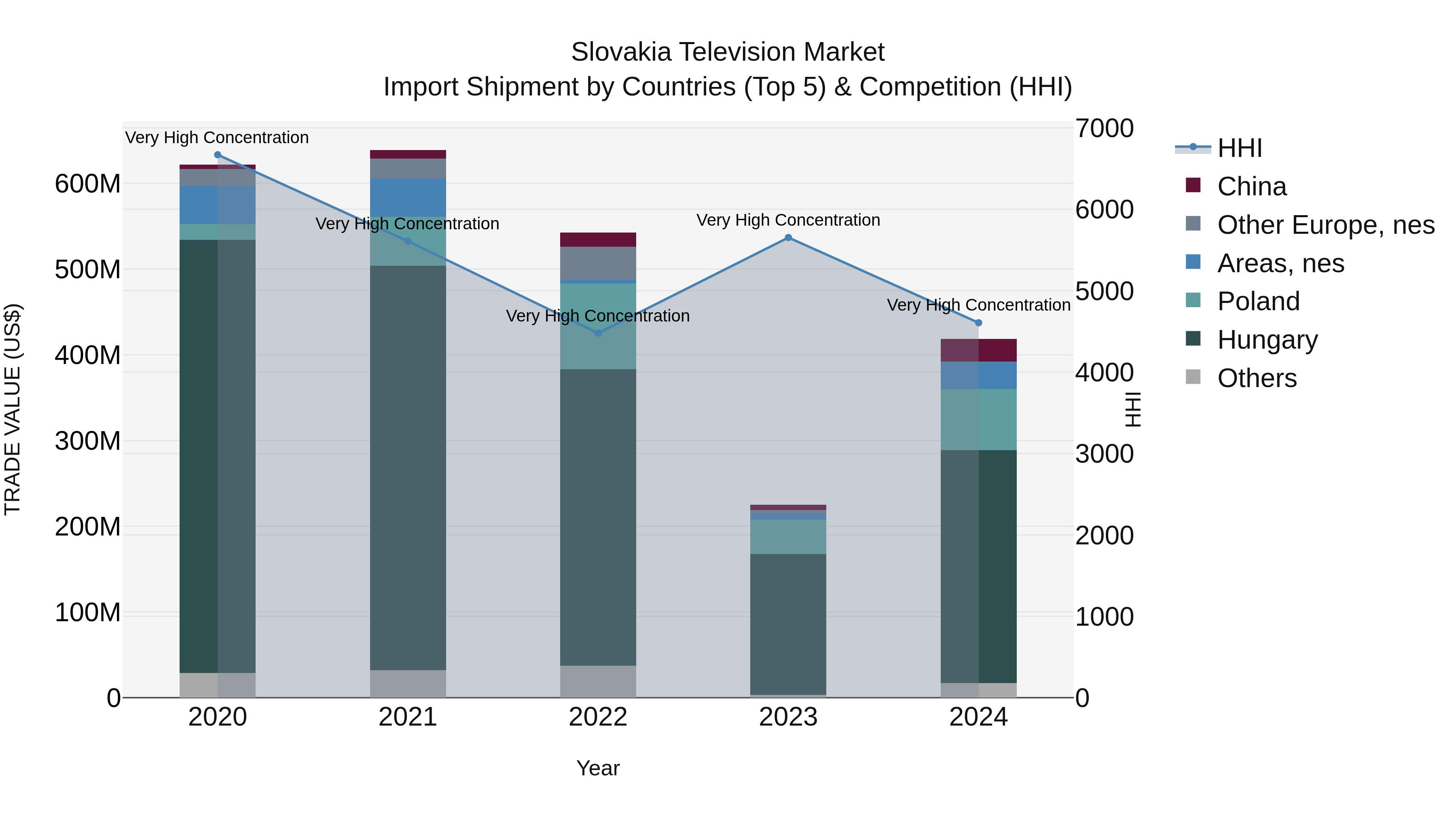

Slovakia Television Market Top 5 Importing Countries and Market Competition (HHI) Analysis

Slovakia`s television import Market Top 5 Importing Countries and Market Competition (HHI) Analysis in 2024 saw significant contributions from neighboring countries such as Hungary and Poland, along with key players like China and Czechia. Despite a high concentration level indicated by the Herfindahl-Hirschman Index (HHI), the Market Top 5 Importing Countries and Market Competition (HHI) Analysis experienced a decline in CAGR from 2020-2024. However, there was a notable spike in growth from 2023-2024, showcasing potential opportunities for further expansion and competition in the industry.

Slovakia Television Market Highlights

| Report Name | Slovakia Television market report |

| Forecast period | 2025-2031 |

| Forecast size | USD 420 Million – USD 550 Million |

| CAGR | 7.8% |

| Growing Sector | Electronics |

Topics Covered in the Slovakia Television Market Report

The Slovakia Television market report thoroughly covers the market by resolution and by type. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Slovakia Television Market Size & Analysis

In 2025, the Slovakia Television market is valued at approximately $ 420 million, with a projected compound annual growth rate (CAGR) of 7.8% over the next five years. Additionally, by 2031, the market is expected to reach around $ 550 million. The electronics sector holds significant position in the overall market.

Slovakia Television Market Synopsis

The Slovakia television market is characterized by steady growth, driven by rising consumer demand for advanced technologies such as smart TVs, 4K UHD, and OLED models. The market benefits from increasing disposable incomes, widespread internet penetration, and a growing preference for on-demand and streaming services, which has influenced consumer choices toward feature-rich televisions. Local and international brands compete vigorously, offering a variety of models at competitive prices.

According to 6Wresearch, Slovakia Television market size is projected to grow at a CAGR of 7.8% during 2025-2031. The growth of the Slovakia television market is driven by increasing consumer demand for advanced technologies like smart TVs, OLED, and 4K UHD displays, fueled by the rising penetration of streaming services and digital entertainment platforms. The country's expanding broadband infrastructure and higher disposable incomes enable greater adoption of feature-rich televisions. Additionally, growing interest in gaming and immersive experiences has spurred demand for TVs with high refresh rates and HDR capabilities.

Moreover, government initiatives to transition to digital broadcasting and the popularity of online retail platforms have further supported the market’s expansion, making it a dynamic sector in Slovakia's consumer electronics landscape. However, the Slovakia Television industry faces challenges such as fluctuating import taxes, competition from affordable international brands, and evolving consumer preferences for multi-functional devices, including smartphones and tablets, pose hurdles to market expansion.

Slovakia Television Market Trends

- Growing Adoption of Smart TVs - Increasing demand for internet-connected televisions that support streaming services like Netflix and YouTube.

- Rising Popularity of 4K and 8K Displays - Enhanced picture quality and immersive viewing experiences drive adoption.

- Shift Toward OLED and QLED Technology - Consumers prefer superior color accuracy, contrast, and thinner screen designs.

- Integration of Voice Assistants - Televisions with built-in Alexa, Google Assistant, or proprietary AI assistants are gaining traction.

- Increased Focus on Energy Efficiency - Manufacturers emphasize energy-efficient models to appeal to environmentally conscious buyers.

- Gaming-Centric Televisions - High refresh rates, low latency, and support for advanced gaming technologies like VRR are key selling points.

Investment Opportunities in the Slovakia Television Market

- Smart TV Market Expansion - High demand for internet-enabled TVs offers opportunities for manufacturers and tech integration firms.

- OLED and QLED Technology - Investments in advanced display manufacturing and supply chains to capitalize on growing consumer preference.

- Streaming Service Partnerships - Collaboration with OTT platforms for exclusive integration and pre-installed apps on televisions.

- Gaming-Friendly TVs - Development of TVs with gaming-specific features like high refresh rates and VRR to tap into the gaming industry.

- Localized Content Offerings - Investment in region-specific content delivery to cater to local consumer preferences.

- Energy-Efficient Models - Innovations in energy-saving technology for eco-conscious markets.

- Compact TV Segment - Targeting demand for smaller, affordable televisions for secondary or specialized use cases.

Key Players in the Slovakia Television Market

The Slovakia Television Market features a mix of global and regional players driving innovation and competition. Key companies include Samsung Electronics, renowned for its leadership in smart TVs and OLED/QLED technology; LG Electronics, offering cutting-edge OLED displays and AI-powered TVs; Sony Corporation, known for its high-quality displays and gaming-friendly models; and Philips, which focuses on energy-efficient and affordable models. Regional firms and distributors also contribute to the market, emphasizing localized features and competitive pricing. Additionally, some of these players hold majority of the Slovakia Television market share. Moreover, these companies invest in technology, partnerships with streaming platforms, and diverse product ranges to capture consumer demand.

Government Regulations in the Slovakia Television Market

Government regulations in the Slovakia Television Market primarily focus on ensuring compliance with European Union standards, particularly regarding energy efficiency and environmental sustainability. Televisions sold in Slovakia must adhere to the EU’s Ecodesign Directive, which mandates energy consumption limits and promotes energy-efficient designs. Additionally, regulations under the Waste Electrical and Electronic Equipment (WEEE) Directive require manufacturers to manage and finance the recycling of obsolete TVs. Broadcasting standards are aligned with the Digital Video Broadcasting (DVB-T2) framework, facilitating high-quality digital content delivery. Further, these initiatives have further boosted the Slovakia Television market revenues. Furthermore, these regulations aim to foster sustainability, promote consumer safety, and ensure compatibility with advanced broadcasting technologies.

Future Insights of the Slovakia Television Market

The Slovakia Television Market is poised for steady growth, driven by advancements in display technologies such as OLED and QLED, rising consumer preference for smart TVs with integrated streaming capabilities, and increasing internet penetration enabling seamless content consumption. The adoption of 8K resolution and enhanced connectivity features like voice assistants and IoT integration is expected to gain traction. Sustainability initiatives and government regulations will encourage manufacturers to focus on eco-friendly designs and energy-efficient products. As consumers continue upgrading to premium models, particularly in urban areas, the market is set to benefit from evolving preferences and supportive technological infrastructure.

OLED TVs Category to Dominate the Market - By Resolution

According to Ravi Bhandari, Research Head, 6Wresearch, the OLED TVs category in Slovakia is experiencing robust growth, driven by consumer demand for superior picture quality, vibrant colors, and deeper contrasts. The shift towards premium home entertainment systems, coupled with rising disposable incomes, has fueled the adoption of OLED TVs, particularly among urban and tech-savvy households. Key manufacturers are introducing innovative models with enhanced features such as 4K and 8K resolutions, ultra-slim designs, and advanced sound technologies, further boosting appeal. The category's growth is also supported by falling production costs and competitive pricing strategies, making OLED technology more accessible to a broader audience.

3D TVs to Dominate the Market – By Type

The 3D TVs category in Slovakia has seen declining growth in recent years, largely due to shifting consumer preferences towards other advanced technologies such as OLED and smart TVs. While 3D technology initially gained attention for its immersive viewing experience, the need for specialized glasses and limited 3D content availability hindered its widespread adoption. However, niche demand persists among enthusiasts and gamers who value the unique experience. Manufacturers focusing on 3D TVs are now exploring integration with other features like 4K resolution and smart connectivity to rejuvenate interest, although the market remains a small segment of the broader television industry.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year - 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Slovakia Television Market Overview

- Slovakia Television Market Outlook

- Market Size of Slovakia Television Market, 2024

- Forecast of Slovakia Television Market, 2031

- Historical Data and Forecast of Slovakia Television Revenues & Volume for the Period 2021-2031

- Slovakia Television Market - Trend Evolution

- Slovakia Television Market - Drivers and Challenges

- Slovakia Television Market - Price Trends

- Slovakia Television Market - Porter's Five Forces

- Slovakia Television Industry Life Cycle

- Historical Data and Forecast of Slovakia Television Market Revenues & Volume, By Resolution for the Period 2021-2031

- Historical Data and Forecast of Slovakia Television Market Revenues & Volume, By LCD TVs for the Period 2021-2031

- Historical Data and Forecast of Slovakia Television Market Revenues & Volume, By OLED TVs for the Period 2021-2031

- Historical Data and Forecast of Slovakia Television Market Revenues & Volume, By Types for the Period 2021-2031

- Historical Data and Forecast of Slovakia Television Market Revenues & Volume, By 2D TVs for the Period 2021-2031

- Historical Data and Forecast of Slovakia Television Market Revenues & Volume, By 3D TVs for the Period 2021-2031

- Slovakia Television Market - Import Export Trade Statistics

- Market Opportunity Assessment, By Resolution

- Market Opportunity Assessment, By Types

- Slovakia Television Market - Top Companies Market Share

- Slovakia Television Market - Competitive Benchmarking, By Technical and Operational Parameters

- Slovakia Television Market - Company Profiles

- Slovakia Television Market - Key Strategic Recommendations

Markets Covered

The Slovakia Television market report provides a detailed analysis of the following market segments -

By Resolution

- LCD TVs

- OLED TVs

By Type

- 2D TVs

- 3D TVs

Slovakia Television Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Slovakia Television Market Overview |

| 3.1 Slovakia Country Macro Economic Indicators |

| 3.2 Slovakia Television Market Revenues & Volume, 2021 & 2031F |

| 3.3 Slovakia Television Market - Industry Life Cycle |

| 3.4 Slovakia Television Market - Porter's Five Forces |

| 3.5 Slovakia Television Market Revenues & Volume Share, By Resolution, 2021 & 2031F |

| 3.6 Slovakia Television Market Revenues & Volume Share, By Types, 2021 & 2031F |

| 4 Slovakia Television Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Slovakia Television Market Trends |

| 6 Slovakia Television Market, By Types |

| 6.1 Slovakia Television Market, By Resolution |

| 6.1.1 Overview and Analysis |

| 6.1.2 Slovakia Television Market Revenues & Volume, By Resolution, 2021 - 2031F |

| 6.1.3 Slovakia Television Market Revenues & Volume, By LCD TVs, 2021 - 2031F |

| 6.1.4 Slovakia Television Market Revenues & Volume, By OLED TVs, 2021 - 2031F |

| 6.2 Slovakia Television Market, By Types |

| 6.2.1 Overview and Analysis |

| 6.2.2 Slovakia Television Market Revenues & Volume, By 2D TVs, 2021 - 2031F |

| 6.2.3 Slovakia Television Market Revenues & Volume, By 3D TVs, 2021 - 2031F |

| 7 Slovakia Television Market Import-Export Trade Statistics |

| 7.1 Slovakia Television Market Export to Major Countries |

| 7.2 Slovakia Television Market Imports from Major Countries |

| 8 Slovakia Television Market Key Performance Indicators |

| 9 Slovakia Television Market - Opportunity Assessment |

| 9.1 Slovakia Television Market Opportunity Assessment, By Resolution, 2021 & 2031F |

| 9.2 Slovakia Television Market Opportunity Assessment, By Types, 2021 & 2031F |

| 10 Slovakia Television Market - Competitive Landscape |

| 10.1 Slovakia Television Market Revenue Share, By Companies, 2024 |

| 10.2 Slovakia Television Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero