South Africa Ethanol Market (2025-2031) | Size, Growth, Outlook, Value, Industry, Analysis, Share, Revenue, Trends, Forecast, Segmentation

MarketForecastBy Purity (Denatured, Non-Denatured), By Sources (Sugar & Molasses Based, Grained Based, Second Generation) By Application (Industrial Solvent, Fuel & Fuel Additives, Beverages, Disinfectant, Personal Care, Others) And Competitive Landscape

| Product Code: ETC003157 | Publication Date: Jul 2020 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

South Africa Ethanol Market | Country-Wise Share and Competition Analysis

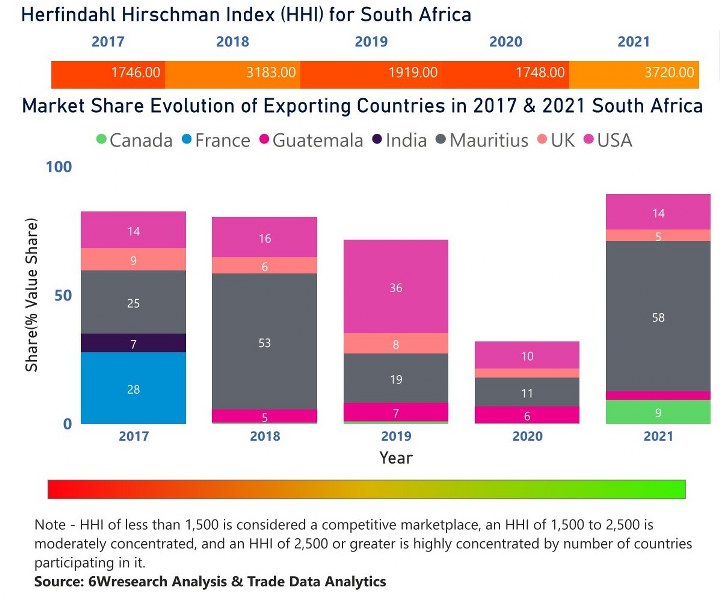

In the year 2021, Mauritius was the largest exporter in terms of value, followed by the USA. It has registered a growth of 350.74% over the previous year. While the USA registered a growth of 13.93% as compared to the previous year. In the year 2017, France was the largest exporter followed by Mauritius. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, South Africa has a Herfindahl index of 1746 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 3720 which signifies high concentration in the market.

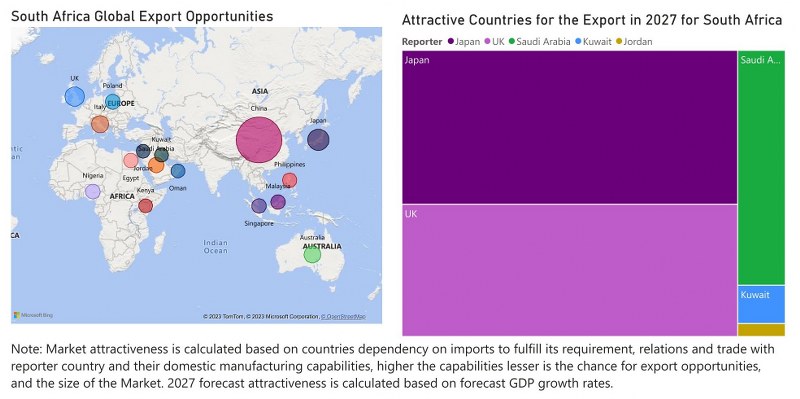

South Africa Ethanol Market - Export Market Opportunities

Topics Covered in the South Africa Ethanol Market Report

The South Africa Ethanol Market report thoroughly covers the market by Purity, Source, and Application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

South Africa Ethanol Market Synopsis

The South Africa Ethanol Market has experienced growth in the past years. The market is also expected to grow steadily in the coming years. This growth is driven by demand for biofuels, depletion of fossil fuels reserves, rising concerns over climate change, policies by the government, and focus on greenhouse gas emissions.

According to 6Wresearch, the South Africa Ethanol Market size is expected to grow at a significant CAGR of 5.5% during 2025-2031. One of the major drivers for the South Africa ethanol market is the increasing demand for biofuels. With rising concerns over climate change and depleting fossil fuel reserves, there has increased use of biofuels, including ethanol, as a cleaner and more sustainable option. Moreover, the South African government has implemented policies and initiatives to promote the use of renewable energy sources, including ethanol. Additionally, the growing focus on reducing greenhouse gas emissions has also played a key role in driving the demand for ethanol.

One of the major challenges is the high cost of production. Producing ethanol requires large amounts of water, land, and energy, making it an expensive process. Another challenge is the limited availability of feedstock for ethanol production. Furthermore, there are concerns about the impact of using crops for biofuel production on food security and land use.

South Africa Ethanol Industry: Leading Players

Some of the key players operating in the South African ethanol market include Sasol, Tongaat Hulett, Illovo Sugar, Grainvest Group, Gencor Ltd., Omnia Holdings Ltd., Ethanol SA (Pty) Ltd., BioTherm Energy (Pty) Ltd., Tsheleka Renewable Energy Resources Pty Ltd., Biogas Investments Africa (Pty) Ltd., and African Clean Energy Solutions (Pty) Ltd. Each of these players brings their unique expertise, resources, and technologies to the market, making it a dynamic and competitive industry

South Africa Ethanol Market: Government Regulations

One major initiative is the mandatory blending requirement for all petrol sold in South Africa. Another important initiative is the establishment of the Ethanol Producers Program (EPP) by the Department of Energy. This program aims to incentivize the production and use of ethanol by providing grants, tax breaks, and other support for local producers. Additionally, South Africa has implemented a biofuels subsidy scheme which provides additional financial support to blending facilities that use locally-produced ethanol. Furthermore, the government has invested in research and development for new technologies and methods for producing ethanol from non-food sources such as sugarcane bagasse, wood chips, and waste products.

Future Insights of the Market

The demand for ethanol in South Africa is expected to continue growing due to its benefits as an alternative fuel source. The country's commitment to reducing greenhouse gas emissions and promoting sustainable energy sources is expected to drive market growth. Additionally, the increasing demand for cleaner and more affordable fuel options, especially in the transportation sector, is likely to support the market expansion. With advancements in technology and production processes, it is also expected that ethanol production in South Africa will become more efficient and cost-effective.

Market Segmentation by Purity

According to Ravi Bhandari, Research Head, 6Wresearch, the non-denatured segment is projected to grow significantly in the South Africa ethanol market. This can be attributed to the increasing demand for high-purity ethanol in various industries such as pharmaceuticals, cosmetics, and food & beverages.

Market Segmentation by Source

In terms of source, the second-generation source segment is also expected to witness considerable growth in the coming years due to the use of agricultural residues and municipal waste as feedstock for ethanol production.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- South Africa Ethanol Market Overview

- South Africa Ethanol Market Outlook

- South Africa Ethanol Market Forecast

- Historical Data of South Africa Ethanol Market Revenues and Volumes, for the Period 2021-2031

- Market Size & Forecast of South Africa Ethanol Market Revenues and Volumes, until 2031.

- Historical Data of South Africa Ethanol Market Revenues and Volumes, by purity, for the Period 2021-2031

- Market Size & Forecast of South Africa Ethanol Market Revenues and Volumes, by purity, until 2031.

- Historical Data of South Africa Ethanol Market Revenues and Volumes, by Source, for the Period 2021-2031

- Market Size & Forecast of South Africa Ethanol Market Revenues and Volumes, by source, until 2031.

- Historical Data of South Africa Ethanol Market Revenues and Volumes, by application, for the Period 2021-2031

- Market Size & Forecast of South Africa Ethanol Market Revenues and Volumes, by application, until 2031.

- Market Drivers and Restraints

- South Africa Ethanol Market Price Trends

- South Africa Ethanol Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- South Africa Ethanol Market Share, By Players

- South Africa Ethanol Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The report provides a detailed analysis of the following market segments:

By Purity

- Denatured

- Non-Denatured

By Source

- Sugar & molasses Based

- Second Generation

- Grain Based

By Application

- Fuel & Fuel Additives

- Disinfectant

- Industrial Solvents

- Personal Care

- Beverages

- Others

South Africa Ethanol MarkET(2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. South Africa Ethanol Market Overview |

| 3.1 South Africa Ethanol Market Revenues and Volume, 2021-2031F |

| 3.2 South Africa Ethanol Market Revenue Share, By Purity, 2021&2031F |

| 3.3 South Africa Ethanol Market Revenue Share, By Source, 2021&2031F |

| 3.4 South Africa Ethanol Market Revenue Share, By Application, 2021&2031F |

| 3.5 South Africa Ethanol Market - Industry Life Cycle |

| 3.6 South Africa Ethanol Market - Porter’s Five Forces |

| 4. South Africa Ethanol Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. South Africa Ethanol Market Trends |

| 6. South Africa Ethanol Market Overview, by Source |

| 6.1 South Africa Sugar & Molasses Based Ethanol Market Revenues and Volume, 2021-2031F |

| 6.2 South Africa Grained Based Ethanol Market Revenues and Volume, 2021-2031F |

| 6.3 South Africa Second Generation Ethanol Market Revenues and Volume, 2021-2031F |

| 7. South Africa Ethanol Market Overview, by Purity |

| 7.1 South Africa Ethanol Market Revenue and Volumes, By Denatured, 2021-2031F |

| 7.2 South Africa Ethanol Market Revenue and Volumes, By Non-Denatured, 2021-2031F |

| 8. South Africa Ethanol Market Overview, by Application |

| 8.1 South Africa Ethanol Market Revenue and Volumes, By Industrial Solvent, 2021-2031F |

| 8.2 South Africa Ethanol Market Revenue and Volumes, By Fuel & Fuel Additives, 2021-2031F |

| 8.3 South Africa Ethanol Market Revenue and Volumes, By Beverages, 2021-2031F |

| 8.4 South Africa Ethanol Market Revenue and Volumes, By Disinfectant, 2021-2031F |

| 8.5 South Africa Ethanol Market Revenue and Volumes, By Personal Care, 2021-2031F |

| 8.6 South Africa Ethanol Market Revenue and Volumes, By Others, 2021-2031F |

| 9. South Africa Ethanol Market Key Performance Indicators |

| 10. South Africa Ethanol Market Opportunity Assessment |

| 10.1 South Africa Ethanol Market Opportunity Assessment, By Purity, 2031F |

| 10.2 South Africa Ethanol Market Opportunity Assessment, By Source, 2031F |

| 10.3 South Africa Ethanol Market Opportunity Assessment, By Application, 2031F |

| 11. South Africa Ethanol Market Competitive Landscape |

| 11.1 South Africa Ethanol Market By Companies, 2024 |

| 11.2 South Africa Ethanol Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2026-2032) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero