South Africa Stationery Market (2023-2029) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation, Outlook & COVID-19 IMPACT

Market Forecast By Type (Paper Products, Writing Instruments, Office Stationery, Art & Craft Stationery), By Sales Channel (Online, Offline),By Applications (Educational, Commercial, Others), And Competitive Landscape

| Product Code: ETC002756 | Publication Date: Feb 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 66 | No. of Figures: 16 | No. of Tables: 5 |

South Africa Stationery Market Synopsis

South Africa Stationery Market grew significantly before 2020 owing to the rising enrolment of students in schools along with the increasing number of offices and banks in the country. The market witnessed a decline in revenues in 2020 due to the outbreak of COVID-19 pandemic, which led to the closure of educational institutions, and over 1.1 million students have dropped out of school, which has resulted in a decline in demand for stationary products. Additionally, the distribution of 50,000 laptops to higher education students funded by the National Students Financial Aid Scheme (NSFAS) in 2021 further limited the market for stationery items like pens, pencils, and notebooks. However, the market started to recover gradually with the reopening of schools and the implementation of government initiatives. The Department of Basic Education, for instance, provided resources such as textbooks, workbooks, and other learning materials to help students who were struggling with the curriculum.

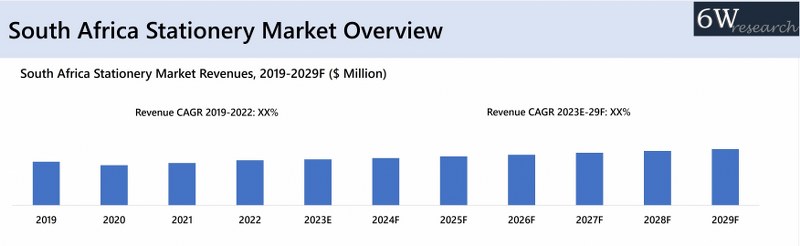

According to 6Wresearch, South Africa Stationery Market size is projected to grow at a CAGR of 3.4% during 2023-2029. South Africa stationery market is further expected to growth in the coming owing to rising number of enrolments in school which is projected to reach 13.4 million by 2030 which is an increase from 12.2 million in 2021. Also, government initiative such as The Action Plan to 2024: Towards the Realisation of Schooling 2030- Plan for Basic Education aims to improve the countries education sector couple with rising government spending on basic education and higher education, is expected to contribute to the South Africa Stationery Market Growth in the coming years.

According to 6Wresearch, South Africa Stationery Market size is projected to grow at a CAGR of 3.4% during 2023-2029. South Africa stationery market is further expected to growth in the coming owing to rising number of enrolments in school which is projected to reach 13.4 million by 2030 which is an increase from 12.2 million in 2021. Also, government initiative such as The Action Plan to 2024: Towards the Realisation of Schooling 2030- Plan for Basic Education aims to improve the countries education sector couple with rising government spending on basic education and higher education, is expected to contribute to the South Africa Stationery Market Growth in the coming years.

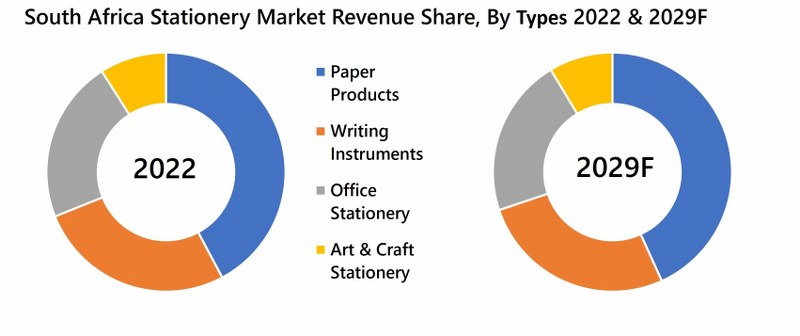

![South Africa Stationery Market Revenue Share]() Market by Type

Market by Type

Paper products garnered the major revenue share in South Africa stationery market as paper is a versatile material that can be used for a wide range of stationery products, such as notebooks, writing pads, envelopes, and greeting cards. Additionally, with growing number of student enrolment the demand for paper products such as notebook, registers, notepads etc is expected to surge in future.

Market by Sales Channel

Offline channel dominates the Stationery Market in South Africa as it is the traditional of purchasing stationery products by consumer due to an ease of availability of retail stores in every locality. Additionally, the country has a large geographic area and many remote areas, which can make it difficult and expensive to deliver products quickly and reliably, thus physical stores are more convenient for many customers, which is contributing to the segment growth.

Market by Application

Education sector dominate the South Africa Stationery Industry and the trend is expected to continue in the coming years owing to the rising government spending on basic education and higher educations which would boost the number of enrolments. Additionally, by FY2026, the government spending on higher education would reach around $8.5 billion which is expected to increase the number school enrolments, thus expected to augment the segment growth in the coming years.

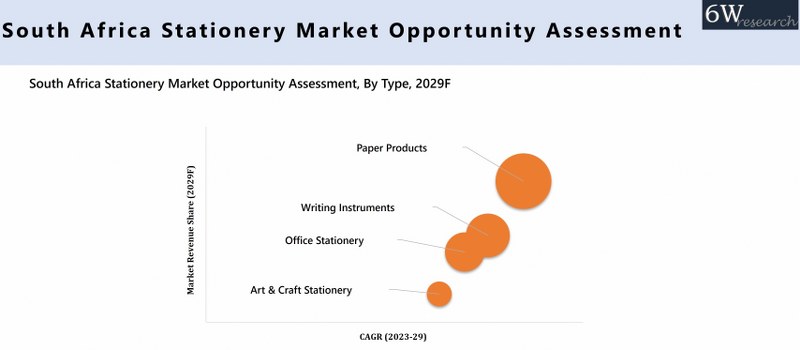

![South Africa Stationery Market Opportunity Assessment]() Key Attractiveness of the Report

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- South Africa Stationery MarketOverview

- South Africa Stationery MarketOutlook

- South Africa Stationery MarketForecast

- Historical Data and Forecast ofSouth Africa Stationery MarketRevenues, for the Period 2019-2029F

- Historical Data and Forecast ofSouth Africa Stationery MarketRevenues, By Types, for the Period 2019-2029F

- Historical Data and Forecast ofSouth Africa Stationery MarketRevenues, By Sales Channel, for the Period 2019-2029F

- Historical Data and Forecast ofSouth Africa Stationery MarketRevenues, By Application, for the Period 2019-2029F

- South Africa Stationery MarketRevenue Share, By Market Players

- COVID-19 Impact onSouth Africa Stationery Market

- South Africa Stationery MarketDrivers and Restraints

- South Africa Stationery MarketTrends

- South Africa Stationery Porters Five Forces

- South Africa Stationery Opportunity Assessment, By Types, 2029F

- South Africa Stationery Opportunity Assessment, By Sales Channel, 2029F

- South Africa Stationery Opportunity Assessment, Application, 2029F

- Market Player’s Revenue Ranking

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Type

- Paper Products

- Writing Instruments

- Office Stationery

- Art & Craft Stationery

By Sales Channel

- Online

- Offline

By Applications

- Educational

- Commercial

- Others

South Africa Stationery Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. South Africa Stationery Market Overview |

| 3.1. South Africa Stationery Market Revenues (2019-2029F) |

| 3.2. South Africa Stationery- Industry Life Cycle |

| 3.3. South Africa Stationery- Porter’s Five Forces |

| 4. South Africa Stationery Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing focus on education and literacy in South Africa |

| 4.2.2 Growing demand for personalized and customized stationery products |

| 4.2.3 Rise in the number of small businesses and startups requiring stationery supplies |

| 4.3. Market Restraints |

| 4.3.1 Competition from online and e-commerce platforms |

| 4.3.2 Fluctuating raw material prices affecting production costs |

| 5. South Africa Stationery Market Trends & Evolution |

| 6. South Africa Stationery Market Overview, By Types |

| 6.1. South Africa Stationery Market Revenue Share and Revenues, By Types (2022 & 2029F) |

| 6.1.1 South Africa Stationery Market Revenues, By Paper Products (2019-2029F) |

| 6.1.2 South Africa Stationery Market Revenues, By Office Stationery (2019-2029F) |

| 6.1.3 South Africa Stationery Market Revenues, By Art & Craft Stationery (2019-2029F) |

| 6.1.4 South Africa Stationery Market Revenues, By Writing Instruments (2019-2029F) |

| 6.1.4.1 South Africa Stationery Market Revenue Share & Revenues, By Pencil (2019-2029F) |

| 6.1.4.2 South Africa Stationery Market Revenue Share & Revenues, By Pens (2019-2029F) |

| 6.1.4.2.1 South Africa Stationery Market Revenue Share & Revenues, By Ball Point Pen (2019-2029F) |

| 6.1.4.2.2 South Africa Stationery Market Revenue Share & Revenues, By Gel Pen (2019-2029F) |

| 6.1.4.2.3 South Africa Stationery Market Revenue Share & Revenues, By Roller Pen (2019-2029F) |

| 6.1.4.2.4 South Africa Stationery Market Revenue Share & Revenues, By Fountain Pens (2019-2029F) |

| 6.1.4.2.5 South Africa Stationery Market Revenue Share & Revenues, By Other Pens (2019-2029F) |

| 7. South Africa Stationery Market Overview, By Sales Channel |

| 7.1. South Africa Stationery Market Revenue Share and Revenues, By Sales Channel (2022 & 2029F) |

| 7.1.1 South Africa Stationery Market Revenues, By Online (2019-2029F) |

| 7.1.2 South Africa Stationery Market Revenues, By Offline (2019-2029F) |

| 7.1.2.1 South Africa Stationery Market Revenue Share & Revenues, By Specialized Stores (2019-2029F) |

| 7.1.2.2 South Africa Stationery Market Revenue Share & Revenues, By Supermarket & Hypermarket (2019-2029F) |

| 7.1.2.3 South Africa Stationery Market Revenue Share & Revenues, By Convenient Stores (2019-2029F) |

| 7.1.2.4 South Africa Stationery Market Revenue Share & Revenues, By Others (2019-2029F) |

| 8. South Africa Stationery Market Overview, By Application |

| 8.1. South Africa Stationery Market Revenue Share and Revenues, By Application (2022 & 2029F) |

| 8.1.1 South Africa Stationery Market Revenues, By Educational (2019-2029F) |

| 8.1.2 South Africa Stationery Market Revenues, By Commercial (2019-2029F) |

| 8.1.3 South Africa Stationery Market Revenues, By Others (2019-2029F) |

| 9. South Africa Stationery Market Key Performance Indicators |

| 10. South Africa Stationery Market Opportunity Assessment |

| 10.1 South Africa Stationery Market Opportunity Assessment, By Type (2029F) |

| 10.2 South Africa Stationery Market Opportunity Assessment, By Sales Channel (2029F) |

| 10.3 South Africa Stationery Market Opportunity Assessment, By Application (2028F) |

| 11. South Africa Stationery Market Competitive Landscape |

| 11.1 South Africa Stationery Market Revenue Ranking, By Companies (2022) |

| 11.2 South Africa Stationery Market Competitive Benchmarking, By Technical Parameter |

| 11.3 South Africa Stationery Market Competitive Benchmarking, By Operating Parameter |

| 12. South Africa Stationery Market – Company Profile |

| 12.1 Staedtler Mars GmbH & Co. KG |

| 12.2 BIC Corporation |

| 12.3 Mitsubishi Pencil CO., LTD |

| 12.4 Hamelin Group |

| 12.5 Faber-Castell |

| 12.6 ACCO Brands Corporation |

| 12.7 Pilot Corporation |

| 12.8 Pentel Co., Ltd |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. South Africa Stationery Market Revenues, 2019-2029F ($ Million) |

| 2. South Africa Spending on Basic Education, 2023-2026F (Billion) |

| 3. South Africa Number of Higher Education Enrolments, 2022-2030F (Millions) |

| 4. South Africa Spending on Higher Education, 2023-2026F ($ Billions) |

| 5. South Africa Number of School Enrolments 2021-2030F (Millions) |

| 6. South Africa Stationery Market Revenue Share, By Types 2022 & 2029F |

| 7. South Africa Stationery Market Revenue Share, By Writing Instruments Types 2022 & 2029F |

| 8. South Africa Stationery Market Revenue Share, By Pens 2022 & 2029F |

| 9. South Africa Stationery Market Revenue Share, By Sales Channel 2022 & 2029F |

| 10. South Africa Stationery Market Revenue Share, By Offline Sales Channel, 2022 & 2029F |

| 11. South Africa Stationery Market Revenue Share, By Application 2022 & 2029F |

| 12. South Africa Education per cent of GDP spending on Education, 2015- 2020 |

| 13. South Africa Number of Schools, 2021-2022 (Units) |

| 14. South Africa Unemployment Rate, 2021 & 2030F, (%) |

| 15. South Africa Total Employees of business services, 2020-2022 (Thousand) |

| 16. South Africa Stationery Market Revenue Ranking, By Companies, 2022 |

| List of Tables |

| 1: South Africa Stationery Market Revenues, By Types 2019-2029F ($ Million) |

| 2: South Africa Stationery Market Revenues, By Writing Instruments Types,2019-2029F ($ Million) |

| 3: South Africa Stationery Market Revenues, By Writing Instruments, Pens 2019-2029F ($ Million) |

| 4: South Africa Stationery Market Revenues, By Sales Channel 2019-2029F ($ Million) |

| 5: South Africa Stationery Market Revenues, By Offline Sales Channel, 2019-2029F ($ Million) |

| 6: South Africa Stationery Market Revenues, By Application 2019-2029F ($ Million) |

| 7: South Africa Government expenditure per student, 2017- 2021, ($) |

Market Forecast By Product (Paper, Writing Instrument, Office Stationery, Others), By Application (Education, Office, Others) And Competitive Landscape

| Product Code: ETC002756 | Publication Date: Feb 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Latest 2023 Development of the South Africa Stationery Market

South Africa Stationery Market has seen a number of recent developments in recent years. For instance, there is a growing demand for eco-friendly and sustainable stationery products, and companies are responding by introducing products made from recycled materials or biodegradable materials. Improved technology and digitalization have led to a shift in the way people work, and the stationery market had to adapt according to the changing requirements of consumers. Many companies are now offering digital products and services which include online collaboration tools and cloud-based storage solutions.

The growing education sector in South Africa, with increasing enrolments in schools and universities, drives demand for the stationery industry in South Africa. The e-commerce market in South Africa is growing rapidly, and stationery companies are taking advantage of this trend by offering online sales channels for their products. Moreover, companies are investing in product design and development to differentiate themselves from their competitors and to meet the changing needs of consumers. In addition, technological advancements have resulted in an increased demand for electronic stationery products, such as scanners and ink cartridges.

South Africa Stationery Market Synopsis

South Africa Stationery Market is expected to grow on account of the increasing adult literacy rate, increasing disposable income, healthy economic growth, and changing consumer preference. Moreover, the government of South Africa is putting great effort into improving and developing the current education system in the country.

According to 6wresearch, the South Africa Stationery Market size is expected to grow during 2020-2026. In product, the paper segment is dominating a major role in the stationery market revenue share in South Africa on account of the rising demand for various paper products such as notebooks, sheets, books, and others in various applications and also due to demand for quality packaging.

During the first quarter of 2020, the Stationery Market in South Africa is expected to witness a decline in economic growth owing to the coronavirus pandemic which has a worse impact on worldwide business. However, during the second half of 2020-2026, the Stationery Market in South Africa is anticipated to recover with healthy growth in the economy. In terms of application, the office segment is leading the stationery market revenue share in South Africa owing to the growing urban population and increasing demand for stationery products in the corporate sector. Further, the education segment is expected to hold a large revenue share in the stationery market over the upcoming years in South Africa on account of the rising number of new educational institutions and Universities.

The South Africa Stationery Market report thoroughly covers the South Africa Stationery Market by product and application. The South Africa Stationery Market outlook report provides an unbiased and detailed analysis of the ongoing South Africa Stationery Market trends, opportunities/high growth areas, market drivers, and South Africa Stationery Market share by companies, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

Key Highlights of the Report:

- South Africa Stationery Market Overview

- South Africa Stationery Market Outlook

- South Africa Stationery Market Forecast

- Historical Data of South Africa Stationery Market Revenues and Volumes, for the Period 2016-2019.

- Market Size & Forecast of South Africa Stationery Market Revenues and Volumes, until 2026.

- Historical Data of South Africa Stationery Market Revenues and Volumes, by Product, for the Period 2016-2019.

- Market Size & Forecast of South Africa Stationery Market Revenues and Volumes, by product, until 2026.

- Historical Data of South Africa Stationery Market Revenues and Volumes, by application, for the Period 2016-2019.

- Market Size & Forecast of South Africa Stationery Market Revenues and Volumes, by application, until 2026.

- Market Drivers and Restraints

- South Africa Stationery Market Price Trends

- South Africa Stationery Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- South Africa Stationery Market Share, By Players

- South Africa Stationery Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The South Africa Stationery Market report provides a detailed analysis of the following market segments:

By Product:

- Paper

- Writing Instrument

- Office Stationery

- Others

By Applications:

- Education

- Office

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero