South Africa Uninterruptible Power Supply (UPS) Market Outlook (2021-2027) | Share, Forecast, Industry, Growth, Companies, Value, Revenue, Analysis, Trends, COVID-19 IMPACT & Size

Market Forecast By KVA Rating (Up to 1.1 KVA, 1.1 KVA - 5 KVA, 5.1 KVA - 20 KVA, 20.1 KVA - 50 KVA, 50.1 KVA - 200 KVA And Above 200 KVA), By Phases (1-Phase, 3-Phase), By Applications (Commercial (Government Buildings And Offices, Healthcare, Hospitality, BFSI, Data Centre’s & Others (Retail, Education Institutes, Transportation Infrastructure Etc.), Industrial, Residential) And Competitive Landscape

| Product Code: ETC150200 | Publication Date: Dec 2021 | Updated Date: Aug 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

South Africa Uninterruptible Power Supply (UPS) Market | Country-Wise Share and Competition Analysis

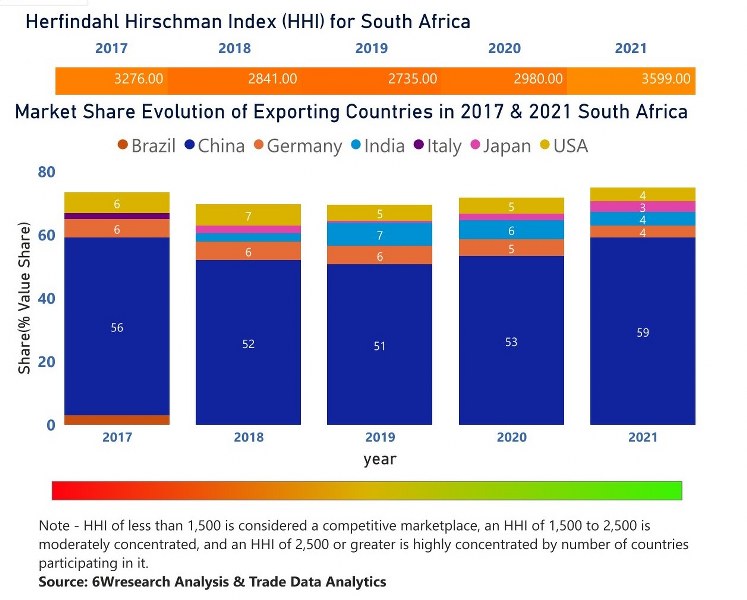

In the year 2021, China was the largest exporter in terms of value, followed by the USA. It has registered a growth of 33.39% over the previous year. While the USA registered a growth of 2.7% as compare to the previous year. In the year 2017, China was the largest exporter followed by the USA. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, South Africa has a Herfindahl index of 3276 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 3599 which signifies high concentration in the market.

South Africa Uninterruptible Power Supply (UPS) Market - Export Market Opportunities![South Africa Uninterruptible Power Supply (UPS) Market - Export Market Opportunities]() Topics Covered in the South Africa Uninterruptible Power Supply (UPS) Market

Topics Covered in the South Africa Uninterruptible Power Supply (UPS) Market

South Africa Uninterruptible Power Supply (UPS) Market report thoroughly covers the market by phases, by KVA ratings, and by applications. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

South Africa Uninterruptible Power Supply (UPS) Market is projected to grow over the coming years. South Africa Uninterruptible Power Supply (UPS) Market report is a part of our periodical regional publication Africa Uninterruptible Power Supply (UPS) Market outlook report. 6W tracks Uninterruptible Power Supply (UPS) Market for over 60 countries with individual country-wise market opportunity assessment and publishes the report titled Global Uninterruptible Power Supply (UPS) Market outlook report annually.

Latest (2023) Development of the South Africa Uninterruptible Power Supply Market

South Africa Uninterruptible Power Supply Market is expected to grow over the forecast period. With growing concerns about climate change and a desire to reduce reliance on fossil fuels, there is an increased demand for UPS solutions that integrate renewable energy sources such as solar or wind power. UPS systems with advanced energy storage capabilities like lithium-ion batteries have gained popularity due to their higher efficiency, longer lifespan, and reduced maintenance requirements. The UPS market has seen a rise in smart UPS systems that integrate with the Internet of Things (IoT) technology. These systems offer enhanced monitoring, remote management, and predictive maintenance features. As the demand for data centers increases, there could have been a corresponding surge in the adoption of UPS systems to safeguard critical IT infrastructure against power disruptions. The UPS market has witnessed the emergence of UPSaaS, where companies offer UPS solutions as a subscription-based service, reducing upfront costs for businesses.

South Africa Uninterruptible Power Supply (UPS) Market Synopsis

South Africa Uninterruptible Power Supply (UPS) Market is likely to project substantial growth during the forthcoming period on account of increasing power outages. The increasing number of data centers and the healthcare sector is driving the demand for reliable and uninterrupted power supply in order to avoid the disruption of work during power failure which further beholds the South Africa Uninterruptible Power Supply (UPS) Market Market Growth. Additionally, the strengthening of the IT sector backed by growing digitalization is adding to the South Africa UPS Market Share.

According to 6Wresearch, the South Africa Uninterruptible Power Supply (UPS) Market is expected to grow during the forecast period 2021-2027. The upsurge in the commercial and industrial sectors backed by the rising need for continuous power supply beholds the growth of the market. Also, increasing penetration towards the safety of household electric appliances is contributing to the South Africa UPS Market Revenue. The outbreak of COVID-19 has negatively impacted the growth of almost every industry. The global health emergency backed by a nationwide lockdown disrupted the supply chain of UPS further beholds the decline in the growth of the UPS Market in South Africa.

COVID-19 Impression on the South Africa Uninterruptible Power Supply (UPS) Market

During the COVID-19 pandemic, the South Africa Uninterruptible Power Supply (UPS) Market which is also a major part of the Africa Uninterruptible Power Supply (UPS) Market faced challenges due to disruptions in supply chains, reduced economic activity, and the uncertain business environment. Businesses and industries such as data centers, healthcare facilities, and critical infrastructure are heavily reliant on continuous power supply and they maintained their demand for UPS systems which in turn further proliferates the market growth even during the crisis. However, other sectors may have experienced a decline in demand due to financial constraints and reduced investments in this industry.

Leading players in the South Africa Uninterruptible Power Supply (UPS) Market

Some of the leading players in the South Africa Uninterruptible Power Supply (UPS) Market are;

- Schneider Electric

- Eaton Corporation

- ABB Ltd.

- Socomec

- Huawei Technologies Co., Ltd.

- Riello UPS

- Borri Power Holdings Ltd.

- Legrand SA

Future of the South Africa Uninterruptible Power Supply (UPS) Market

The future of the South Africa Uninterruptible Power Supply (UPS) Market will depend on various factors such as infrastructure development and advancements in UPS technology. As businesses continue to digitalize and rely more heavily on electronic systems, the demand for reliable power supply solutions like UPS is expected to grow in the future years. Additionally, the increasing awareness of the importance of data protection, especially in finance, healthcare, and telecommunications sectors will likely drive the adoption of UPS systems. Moreover, the growth of renewable energy sources influences UPS technology development, pushing for more energy-efficient solutions.

Market Analysis by Applications

According to Parth, Senior Research Analyst, 6Wresearch, the commercial sector accounted for the utmost share and is expected to lead the market during the forthcoming period as well on account of the rising healthcare sector.

Key attractiveness of the report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020.

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- South Africa Uninterruptible Power Supply (UPS) Market Overview

- South Africa Uninterruptible Power Supply (UPS) Market Outlook

- South Africa Uninterruptible Power Supply (UPS) Market Forecast

- Historical Data of South Africa Uninterruptible Power Supply (UPS) Market Revenues & Volume for the Period 2017-2020

- South Africa Uninterruptible Power Supply (UPS) Market Size and South Africa Uninterruptible Power Supply (UPS) Market Forecast of Revenues & Volume, Until 2027

- Historical Data of South Africa Uninterruptible Power Supply (UPS) Market Revenues & Volume, By Rating, for the Period 2017-2020

- Market Size & Forecast of South Africa Uninterruptible Power Supply (UPS) Market Revenues & Volume, By Rating, Until 2027

- Historical Data of South Africa Uninterruptible Power Supply (UPS) Market Revenues & Volume, By Phases, for the Period 2017-2020

- Market Size & Forecast of South Africa Uninterruptible Power Supply (UPS) Market Revenues & Volume, By Phases, Until 2027

- Historical Data of South Africa Uninterruptible Power Supply (UPS) Market Revenues & Volume, By Applications, for the Period 2017-2020

- Market Size & Forecast of South Africa Uninterruptible Power Supply (UPS) Market Revenues & Volume, By Applications, Until 2027

- Market Drivers and Restraints

- South Africa Uninterruptible Power Supply (UPS) Market Price Trends

- South Africa Uninterruptible Power Supply (UPS) Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- South Africa Uninterruptible Power Supply (UPS) Market Share, By Players

- South Africa Uninterruptible Power Supply (UPS) Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By KVA Rating

- Up To 1.1 KVA

- 1.1 KVA - 5 KVA

- 5.1 KVA - 20 KVA

- 20.1 KVA - 50 KVA

- 50.1 KVA - 200 KVA

- And Above 200 KVA

By Phases

- 1-Phase

- 3-Phase

By Applications

- Commercial

- Government Buildings And Offices

- Healthcare

- Hospitality

- BFSI

- Data Centre’s

- Others (Retail, Education Institutes, Transportation Infrastructure Etc.)

- Industrial

- Residential

South Africa Uninterruptible Power Supply (UPS) Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. South Africa Uninterruptible Power Supply (UPS) Market Overview |

| 3.1. South Africa Uninterruptible Power Supply (UPS) Market Revenues & Volume, 2017-2027F |

| 3.2. South Africa Uninterruptible Power Supply (UPS) Market - Industry Life Cycle |

| 3.3. South Africa Uninterruptible Power Supply (UPS) Market - Porter’s Five Forces Model |

| 3.4. South Africa Uninterruptible Power Supply (UPS) Market Revenue & Volume Share, By kVA Rating, 2020 & 2027F |

| 3.5. South Africa Uninterruptible Power Supply (UPS) Market Revenue & Volume Share, By Phases, 2020 & 2027F |

| 3.6. South Africa Uninterruptible Power Supply (UPS) Market Revenue Share, By Applications, 2020 & 2027F |

| 4. South Africa Uninterruptible Power Supply (UPS) Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. South Africa Uninterruptible Power Supply (UPS) Market Trends |

| 6. South Africa Uninterruptible Power Supply (UPS) Market Overview, By kVA Rating |

| 6.1. South Africa Below 1.1 kVA Uninterruptible Power Supply (UPS) Market Revenues & Volume, 2017-2027F |

| 6.2. South Africa 1.1 – 5 kVA Uninterruptible Power Supply (UPS) Market Revenues & Volume, 2017-2027F |

| 6.3. South Africa 5.1 – 20 kVA Uninterruptible Power Supply (UPS) Market Revenues & Volume, 2017-2027F |

| 6.4. South Africa 20.1 – 50 kVA Uninterruptible Power Supply (UPS) Market Revenues & Volume, 2017-2027F |

| 6.5. South Africa 50.1 – 200 kVA Uninterruptible Power Supply (UPS) Market Revenues & Volume, 2017-2027F |

| 6.6. South Africa Above 200 kVA Uninterruptible Power Supply (UPS) Market Revenues & Volume,2017-2027F |

| 7. South Africa Uninterruptible Power Supply (UPS) Market Overview, By Phases |

| 7.1. South Africa 1-Phase Uninterruptible Power Supply (UPS) Market Revenues & Volume, 2017-2027F |

| 7.2. South Africa 3-Phase Uninterruptible Power Supply (UPS) Market Revenues & Volume, 2017-2027F |

| 8. South Africa Uninterruptible Power Supply (UPS) Market Overview, By Applications |

| 8.1. South Africa Residential Uninterruptible Power Supply (UPS) Market Revenues, 2017-2027F |

| 8.2. South Africa Commercial Uninterruptible Power Supply (UPS) Market Revenues, 2017-2027F |

| 8.3. South Africa Industrial Uninterruptible Power Supply (UPS) Market Revenues, 2017-2027F |

| 9. South Africa Uninterruptable Power Supply (UPS) Market - Key Performance Indicators |

| 9.1. South Africa Residential Sector Outlook |

| 9.2. South Africa Commercial Sector Outlook |

| 9.3. South Africa Industrial Sector Outlook |

| 10. South Africa Uninterruptable Power Supply (UPS) Market - Opportunity Assessment |

| 10.1. South Africa UPS Market Opportunity Assessment, By kVA Rating, 2027F |

| 10.2. South Africa UPS Market Opportunity Assessment, By Phases, 2027F |

| 10.3. South Africa UPS Market Opportunity Assessment, By Applications, 2027F |

| 11. South Africa Uninterruptable Power Supply (UPS) Market Competitive Landscape |

| 11.1. South Africa Uninterruptible Power Supply (UPS) Market Competitive Benchmarking, By KVA Ratings |

| 11.2. South Africa Uninterruptible Power Supply (UPS) Market Revenue & Volume Share, By Company, 2020 |

| 12. Company Profiles |

| 13 Recommendations |

| 14 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Germany Genset Rental Market (2025-2031) | Analysis, Share, Industry, Growth, Revenue, Companies, Trends, Outlook, Forecast, Value & Size

- Ethiopia Genset Rental Market (2025-2031) | Trends, Analysis, Companies, Revenue, Size, Forecast, Value, Outlook, Growth, Industry & Share

- Kenya Genset Rental Market (2025-2031) | Growth, Revenue, Value, Share, Trends, Forecast, Outlook, Companies, Industry, Size & Analysis

- South Africa 800kW and Above Gas Engine for Generators Market (2025-2031) | Size, Share, Value, Industry, Companies, Trends, Analysis, Outlook, Revenue, Growth & Forecast

- South Africa Emergency and Exit Lighting Systems Market (2025-2031) | Trend, Size, Share, Growth, Revenue, Analysis & Outlook

- Turkey Emergency and Exit Lighting Systems Market (2025-2031) | Size, Share, Growth, Forecast, Revenue, industry, Analysis & Outlook

- Thailand Electric Vehicle Charging Infrastructure Market (2025-2031) | Share, industry, Growth, Revenue, Forecast, Outlook & Outlook

- United Kingdom Genset Rental Market (2025-2031) | Revenue, Companies, Forecast, Trends, Value, Size, Growth, Share, Outlook, Analysis & Industry

- South Africa Genset Rental Market (2025-2031) | Trends, Outlook, Companies, Growth, Revenue, Industry, Size, Forecast, Value, Analysis & Share

- Latin America Plastics Processing Machinery Market (2025-2031) | Industry, Segmentation, Share, Analysis, Forecast, Companies, Outlook, Competitive Landscape, Trends, Value, Growth, Size & Revenue

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines