Syria Digital Banking Market (2025-2031) | Companies, Segmentation, Competitive Landscape, Trends, Size & Revenue, Growth, Share, Industry, Outlook, Value, Analysis, Forecast

Market Forecast By Services (Non-Transactional Activities, Transactional), By Deployment Type (On-Premises, On Cloud), By Technology (Internet Banking, Digital Payments, Mobile Banking), By End-User (Retail & E-commerce, BFSI, Government & Public Sector, Healthcare, Others (Media & Entertainment, Education, SMEs etc.)) And Competitive Landscape

| Product Code: ETC9596433 | Publication Date: Sep 2024 | Updated Date: Oct 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

Syria Digital Banking Market Size, Growth Rate, and Competitive Analysis

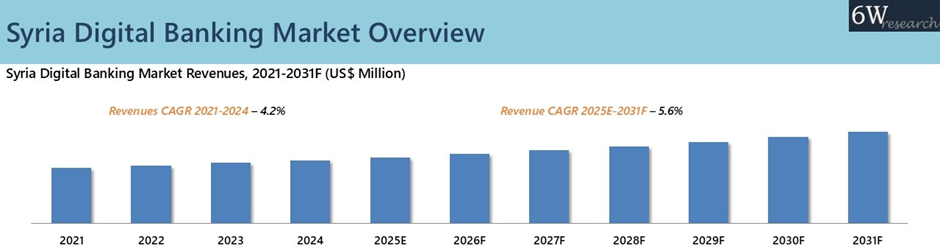

Syria Digital Banking Market was valued at around USD 56.1 million in 2024, growing at a CAGR of 4.2%. The market is projected to reach around USD 81.7 million by 2031, expanding at a CAGR of 5.6% during 2025-2031.

Here is the list of top companies in the Syria Digital Banking Market

- Banque Bemo Saudi Fransi (BBSF)- This company held the top position in Syria’s digital banking landscape in 2024. Its leadership stems from simplified account opening and integration with SEP billers and POS services.

- AlBaraka Bank Syria- The bank’s strength lies in its robust mobile application with biometric login, bill payments, and intra-bank transfers, supported by regional backing from Al Baraka Group.

- Arab Bank Syria- Ranked third, underpinned by its international brand recognition, a wide branch network across major governorates, and reliable digital channels.

Topics Covered in Syria Digital Banking Market Report

Syria Digital Banking Market Report thoroughly covers the market by services, deployment type, technology and industries. Syria Digital Banking Market Outlook report provides an unbiased and detailed analysis of the ongoing Syria Digital Banking Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Syria Digital Banking Market Synopsis

Syria Digital Banking sector is experiencing significant growth, driven by government reforms, increasing internet penetration, and rising demand for mobile-first financial services. Adoption surged in 2024 as consumers increasingly shifted to digital channels for bill payments, remittances, and daily transactions, reflecting a growing preference for convenience and efficiency. The Central Bank of Syria has further supported this momentum through regulatory measures, including e-payment frameworks and discussions around a digital Syrian pound (CBDC), signaling a clear commitment to financial modernization.

The introduction of the Syrian Electronic Payment (SEP) platform, which connects banks, utilities, and government agencies, has streamlined digital transactions for essential services, reducing cash dependence and promoting broader financial inclusion. This infrastructure, combined with regulatory support, has laid the foundation for sustained growth in digital banking.

According to 6Wresearch, Syria Digital Banking Market is projected to grow at a CAGR of 5.6% from 2025 to 2031, driven by the expansion of the banking and retail sectors. The rise of organized retail, with hundreds of shopping malls across the country, coupled with the growth of e-commerce platforms like Hudhud, creates opportunities for digital payment solutions, mobile wallets, and merchant services, further integrating digital banking into everyday commerce. Regulatory reforms, which increased foreign ownership limits and raised capital requirements for private banks, have also modernized the sector, encouraging regional and international partnerships. Together, these factors position digital banking as a key enabler of Syria’s economic transformation.

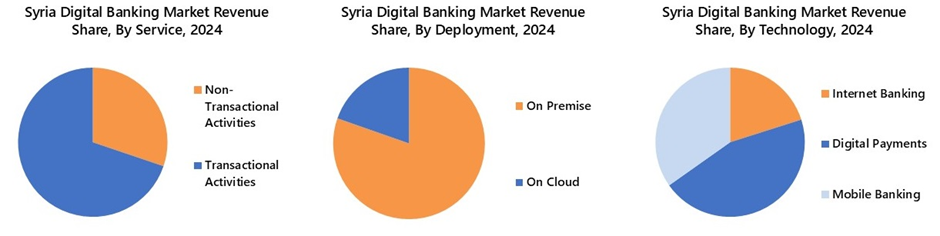

Market Segmentation By Services

Non-transactional digital banking services are projected to witness the strongest growth in Syria Digital Banking market as they offer low-risk opportunities for users to engage with digital platforms and gradually integrate into the formal financial system. Additionally, increasing internet penetration, rising smartphone adoption, and the expansion of regional fintech partnerships will enhance the accessibility of these services to a wider population. Moreover, non-transactional offerings typically generate higher margins for banks compared to basic payment services, allowing institutions to diversify revenue streams while strengthening customer loyalty.

Market Segmentation By Deployment

On-cloud digital banking deployment is anticipated to experience the fastest growth in Syria Digital Banking market in the coming years, driven by several key factors. Cloud solutions provide enhanced scalability and flexibility, allowing banks to rapidly introduce new digital products and services without the substantial upfront investment required for on-premises infrastructure. As internet penetration and mobile connectivity continue to improve, cloud-based platforms become increasingly practical and reliable, enabling banks to serve a broader population efficiently. Furthermore, regional and international partnerships are expected to deliver secure, compliant cloud solutions tailored to Syria, mitigating concerns around data sovereignty and cybersecurity risks.

Market Segmentation By Technology

Mobile banking is projected to experience the highest growth in Syria, reaching a broad population through smartphones, with over millions of mobile connections recorded in early 2025. It offers users convenient, round-the-clock access to banking services such as transactions, balance inquiries, bill payments, and money transfers making it especially vital in a country with limited physical banking infrastructure.

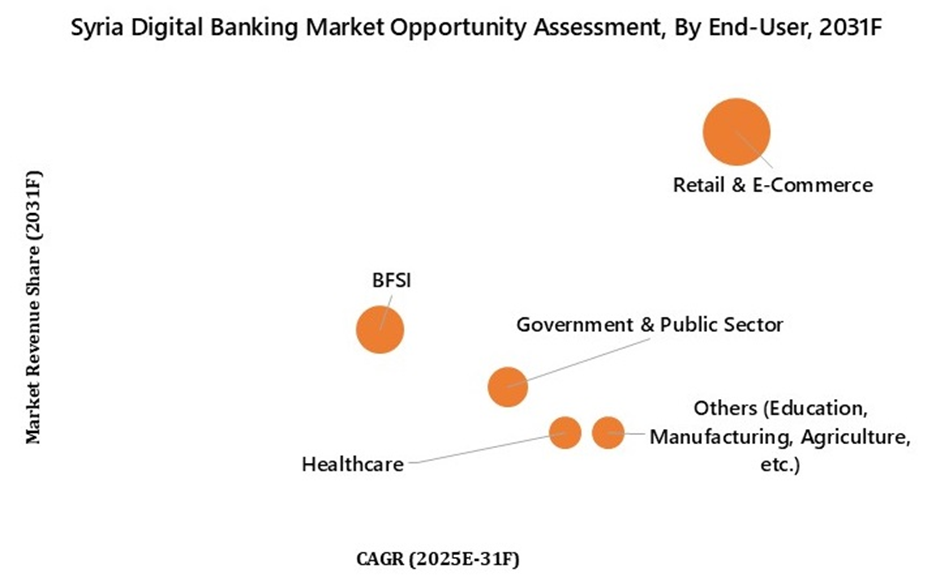

Market Segmentation By End-User

Retail and e-commerce are poised to lead growth in Syria Digital Banking market, driven by increasing demand for convenient, cashless payment solutions among both consumers and merchants. With expanding internet penetration and smartphone adoption, a growing number of individuals are participating in online shopping, mobile top-ups, and everyday digital transactions. Additionally, e-commerce platforms and retailers are progressively integrating digital wallets and mobile payment solutions, offering seamless payment experiences that promote repeated usage.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data: Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Syria Digital Banking Market Overview

- Syria Digital Banking Market Outlook

- Syria Digital Banking Market Forecast

- Historical Data and Forecast of Syria Digital Banking Market Revenues for the Period 2021-2031F

- Historical Data and Forecast of Syria Digital Banking Market Revenues, By Services, for the Period 2021-2031F

- Historical Data and Forecast of Syria Digital Banking Market Revenues, By Deployment, for the Period 2021-2031F

- Historical Data and Forecast of Syria Digital Banking Market Revenues, By Technology, for the Period 2021-2031F

- Historical Data and Forecast of Syria Digital Banking Market Revenues, By Industry, for the Period 2021-2031F

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Drivers and Restraints

- Market Trends and Evolution

- Market Opportunity Assessment

- Syria Digital Banking Market Revenue Ranking, By Top 3 Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Services

- Non- Transactional Activities

- Transactional Activities

By Deployment

- On Premise

- On Cloud

By Technology

- Internet Banking

- Digital Payments

- Mobile Banking

By End-User

- Retail & E-commerce

- BFSI

- Government & Public Sector

- Healthcare

- Others (Media & Entertainment, Education, SMEs etc.)

Syria Digital Banking Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Syria Digital Banking Market Overview |

| 3.1. Syria Macroeconomic Indicators |

| 3.2. Syria Digital Banking Market Revenues, 2021-2031F |

| 3.3. Syria Digital Banking Market Industry Life Cycle |

| 3.4. Syria Digital Banking Market Porter's Five Forces |

| 3.5. Syria Digital Banking Market Value Chain Analysis |

| 4. Syria Digital Banking Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Driver |

| 4.3. Market Restraint |

| 5. Syria Digital Banking Market Trends and Evolution |

| 6. Syria Digital Banking Market Overview, By Service |

| 6.1. Syria Digital Banking Market Revenue Share, By Service, 2024 & 2031F |

| 6.1.1. Syria Digital Banking Market Revenues, By Non-Transactional Activities, 2021-2031F |

| 6.1.2. Syria Digital Banking Market Revenues, By Transactional Activities, 2021-2031F |

| 7. Syria Digital Banking Market Overview, By Deployment |

| 7.1. Syria Digital Banking Market Revenue Share, By Deployment, 2024 & 2031F |

| 7.1.1. Syria Digital Banking Market Revenues, By On-Premise, 2021-2031F |

| 7.1.2. Syria Digital Banking Market Revenues, By On-Cloud, 2021-2031F |

| 8. Syria Digital Banking Market Overview, By Technology |

| 8.1. Syria Digital Banking Market Revenue Share, By Technology, 2024 & 2031F |

| 8.1.1. Syria Digital Banking Market Revenues, By Internet Banking, 2021-2031F |

| 8.1.2. Syria Digital Banking Market Revenues, By Digital Banking, 2021-2031F |

| 8.1.3. Syria Digital Banking Market Revenues, By Mobile Banking, 2021-2031F |

| 9. Syria Digital Banking Market Overview, By End-User |

| 9.1. Syria Digital Banking Market Revenue Share, By End-User, 2024 & 2031F |

| 9.1.1. Syria Digital Banking Market Revenues, By Retail & E-commerce, 2021-2031F |

| 9.1.2. Syria Digital Banking Market Revenues, By BFSI, 2021-2031F |

| 9.1.3. Syria Digital Banking Market Revenues, By Government & Public Sector , 2021-2031F |

| 9.1.4. Syria Digital Banking Market Revenues, By Healthcare, 2021-2031F |

| 9.1.5. Syria Digital Banking Market Revenues, By Others, 2021-2031F |

| 10. Syria Digital Banking Market Key Performance Indicator |

| 11. Syria Digital Banking Market Opportunity Assessment |

| 11.1. Syria Digital Banking Market Opportunity Assessment, By Service, 2031F |

| 11.2. Syria Digital Banking Market Opportunity Assessment, By Deployment, 2031F |

| 11.3. Syria Digital Banking Market Opportunity Assessment, By Technology, 2031F |

| 11.4. Syria Digital Banking Market Opportunity Assessment, By End-User, 2031F |

| 12. Syria Digital Banking Market Competitive Landscape |

| 12.1. Syria Digital Banking Market Revenue Ranking, By Top Companies, 2024 |

| 12.2. Syria Digital Banking Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1 Al Baraka Bank Syria |

| 13.2 Arab Bank Syria |

| 13.3 Bank of Syria & Overseas (BSO) |

| 13.4 Banque Bemo Saudi Fransi (BBSF) |

| 13.5 Cham Bank (Islamic) |

| 13.6 Commercial Bank of Syria (CBS) |

| 13.7 Qatar National Bank (QNB) Syria |

| 13.8 Bank Al Sharq S.A.S |

| 13.9 Syria International Islamic Bank |

| 13.10 Syria Gulf Bank |

| 14. Key Strategic Recommendation |

| 15. Disclaimer |

| List of Figures |

| 1. Syria GDP, 2018-2023 (US$ Billion) |

| 2. Syria GDP Per Capita 2020-23 (US$) |

| 3. Syria Digital Banking Market Revenues, 2021-2031F (US$ Million) |

| 4. Syria Region Wise Internet Outage Score November 2024-January 2025 (Thousand) |

| 5. Syria Digital Banking Market Revenue Share, By Service, 2024 & 2031F |

| 6. Syria Digital Banking Market Revenue Share, By Deployment, 2024 & 2031F |

| 7. Syria Digital Banking Market Revenue Share, By Technology, 2024 & 2031F |

| 8. Syria Digital Banking Market Revenue Share, By End-User, 2024 & 2031F |

| 9. Syrian Arab Republic Total Online Stores by Industry, 2025 |

| 10. Syria YOY Growth of Internet Users, 2021-2025E (in Million) |

| 11. Syria YOY Growth of Cellular Mobile Connections, Jan 2023–Jan 2025 (in Million) |

| 12. Syria Assets Managed By Top Banks, 2024, (Million USD) |

| 13. Syria Profits Generated By Top Banks, 2024, (Million USD) |

| 14. Syria Digital Banking Market Opportunity Assessment, By Services, 2031F |

| 15. Syria Digital Banking Market Opportunity Assessment, By Deployment, 2031F |

| 16. Syria Digital Banking Market Opportunity Assessment, By Technology, 2031F |

| 17. Syria Digital Banking Market Opportunity Assessment, By End-User, 2031F |

| 18. Syria Digital Banking Market Revenue Ranking, By Companies, CY2024 |

| 19. Syria Urban Areas 2025 |

| 20. Syria Population Aged 15-24, 2020-2050F (Million) |

| List of Table |

| 1. Syria Digital Banking & Payment Related Initiatives |

| 2. Syria Internet Outages 2025 |

| 3. Syria Digital Banking Market Revenues, By Service, 2021-2031F (US$ Million) |

| 4. Syria Digital Banking Market Revenues, By Deployment, 2021-2031F (US$ Million) |

| 5. Syria Digital Banking Market Revenues, By Technology, 2021-2031F (US$ Million) |

| 6. Syria Digital Banking Market Revenues, By End-User, 2021-2031F (US$ Million) |

| 7. Syria Number of Shopping Malls Locations By Each State/Territory, 2025 |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2026-2032) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero