Thailand Air Filters Market (2025-2031) Outlook | Industry, Trends, Growth, Value, Share, Size, Analysis, Revenue, Companies & Forecast

| Product Code: ETC282145 | Publication Date: Aug 2022 | Updated Date: Feb 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

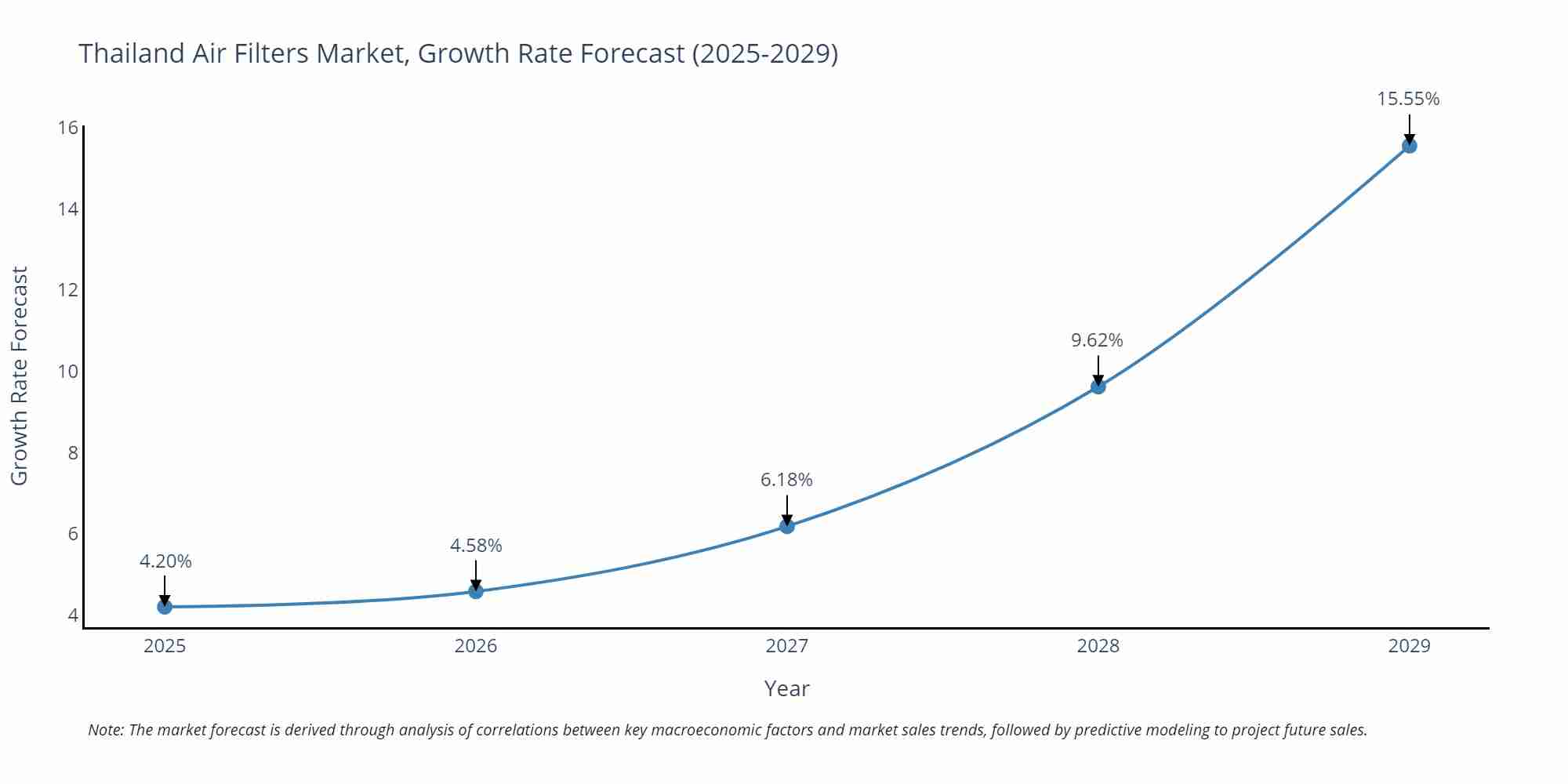

Thailand Air Filters Market Size Growth Rate

The Thailand Air Filters Market is likely to experience consistent growth rate gains over the period 2025 to 2029. Commencing at 4.20% in 2025, growth builds up to 15.55% by 2029.

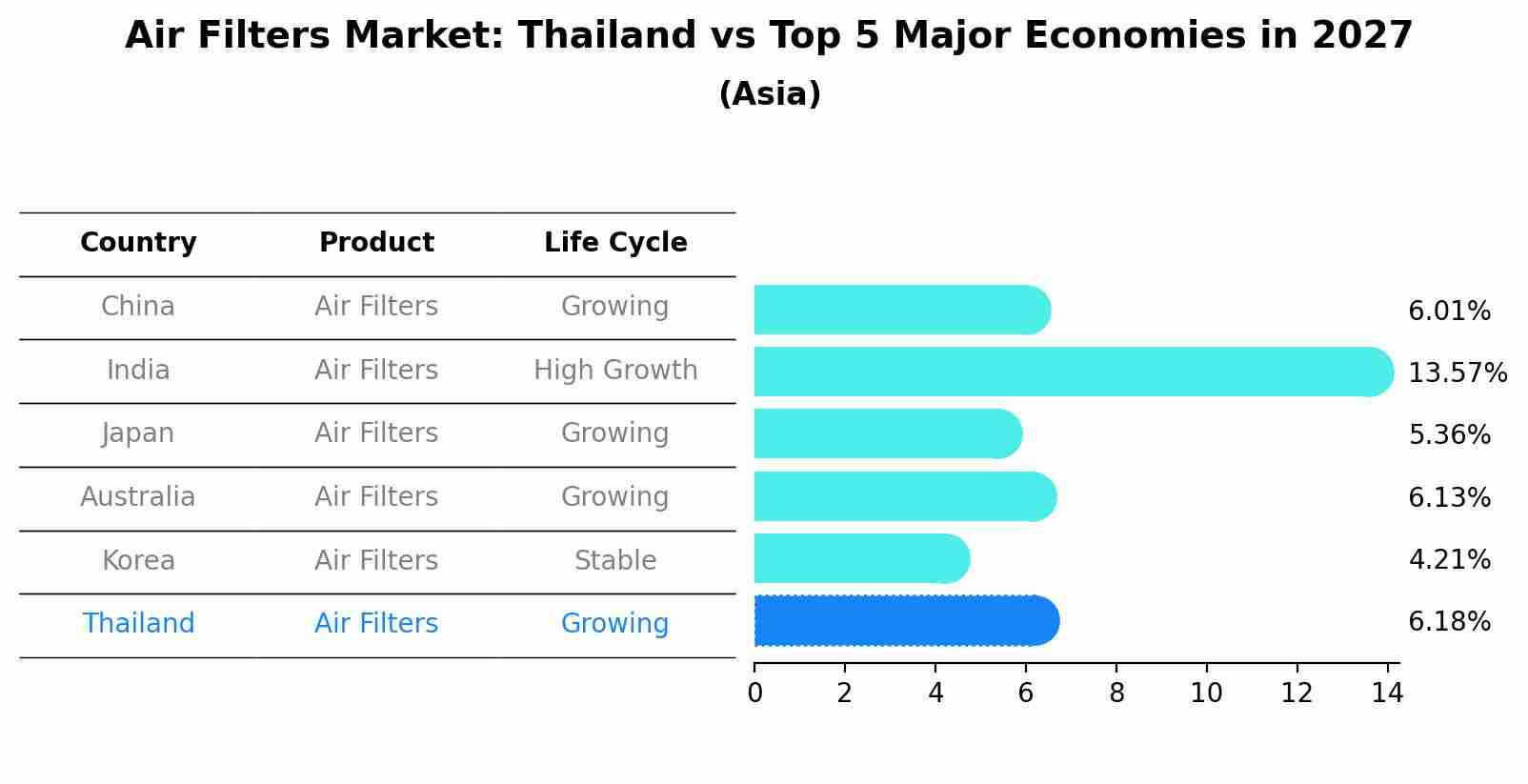

Air Filters Market: Thailand vs Top 5 Major Economies in 2027 (Asia)

Thailand's Air Filters market is anticipated to experience a growing growth rate of 6.18% by 2027, reflecting trends observed in the largest economy China, followed by India, Japan, Australia and South Korea.

Thailand Air Filters Market Synopsis

Thailand`s Air Filters Market is growing in response to increasing awareness of air quality issues. As industrialization and urbanization continue, concerns about air pollution and its impact on health have grown. This has led to a rising demand for air filtration systems across various sectors, including automotive, manufacturing, and healthcare. Local and international companies are competing to provide advanced air filter technologies to improve indoor and outdoor air quality in Thailand.

Drivers of the Market

The Thailand Air Filters market is witnessing increased demand driven by concerns about air quality and health. The awareness of air pollution`s adverse effects has led to a surge in demand for air filtration solutions in residential, commercial, and industrial settings. The industrial sector, including manufacturing and power generation, is adopting air filtration systems to comply with environmental regulations and improve workplace conditions. Moreover, the growing construction sector and urbanization are contributing to increased indoor air quality concerns, further boosting the market for air filters. Government initiatives to combat pollution also play a significant role in market expansion.

Challenges of the Market

In the Thailand Air Filters market, challenges emerge from the need to address air quality concerns and changing regulations. The demand for clean air and the reduction of indoor and outdoor air pollution have led to stricter standards for air filtration. Manufacturers must continually innovate to meet these requirements. Additionally, competition from international air filter manufacturers can pose challenges for local companies. Maintaining the performance of air filters in various industrial and commercial applications is an ongoing challenge, requiring research and development efforts.

COVID-19 Impact on the Market

The COVID-19 pandemic underscored the importance of air quality and filtration systems. As awareness about the virus`s transmission through aerosols grew, there was a heightened demand for air filters in various sectors, including healthcare, commercial buildings, and residential units. This increased demand led to a boost in the Thailand Air Filters market, with a focus on advanced filtration technologies.

Key Players in the Market

The Thailand air filters market is dominated by companies like Camfil (Thailand) Ltd. and Donaldson (Thailand) Co., Ltd. These players specialize in manufacturing a wide range of air filtration solutions for industrial, commercial, and residential applications. Their products are designed to improve air quality, reduce energy consumption, and ensure compliance with environmental regulations. Through ongoing research and development, they continue to deliver innovative air filtration technologies that address the evolving needs of Thailand`s diverse industries.

Key Highlights of the Report:

- Thailand Air Filters Market Outlook

- Market Size of Thailand Air Filters Market, 2024

- Forecast of Thailand Air Filters Market, 2031

- Historical Data and Forecast of Thailand Air Filters Revenues & Volume for the Period 2021-2031

- Thailand Air Filters Market Trend Evolution

- Thailand Air Filters Market Drivers and Challenges

- Thailand Air Filters Price Trends

- Thailand Air Filters Porter's Five Forces

- Thailand Air Filters Industry Life Cycle

- Historical Data and Forecast of Thailand Air Filters Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Filters Market Revenues & Volume By Cartridge Filters for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Filters Market Revenues & Volume By Dust Collector for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Filters Market Revenues & Volume By HEPA Filters for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Filters Market Revenues & Volume By Baghouse Filters for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Filters Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Filters Market Revenues & Volume By End-User for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Filters Market Revenues & Volume By Residential for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Filters Market Revenues & Volume By Commercial for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Filters Market Revenues & Volume By Industrial for the Period 2021-2031

- Thailand Air Filters Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By End-User

- Thailand Air Filters Top Companies Market Share

- Thailand Air Filters Competitive Benchmarking By Technical and Operational Parameters

- Thailand Air Filters Company Profiles

- Thailand Air Filters Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Thailand Air Filters Market Overview |

3.1 Thailand Country Macro Economic Indicators |

3.2 Thailand Air Filters Market Revenues & Volume, 2021 & 2031F |

3.3 Thailand Air Filters Market - Industry Life Cycle |

3.4 Thailand Air Filters Market - Porter's Five Forces |

3.5 Thailand Air Filters Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 Thailand Air Filters Market Revenues & Volume Share, By End-User, 2021 & 2031F |

4 Thailand Air Filters Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Thailand Air Filters Market Trends |

6 Thailand Air Filters Market, By Types |

6.1 Thailand Air Filters Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Thailand Air Filters Market Revenues & Volume, By Type, 2021-2031F |

6.1.3 Thailand Air Filters Market Revenues & Volume, By Cartridge Filters, 2021-2031F |

6.1.4 Thailand Air Filters Market Revenues & Volume, By Dust Collector, 2021-2031F |

6.1.5 Thailand Air Filters Market Revenues & Volume, By HEPA Filters, 2021-2031F |

6.1.6 Thailand Air Filters Market Revenues & Volume, By Baghouse Filters, 2021-2031F |

6.1.7 Thailand Air Filters Market Revenues & Volume, By Others, 2021-2031F |

6.2 Thailand Air Filters Market, By End-User |

6.2.1 Overview and Analysis |

6.2.2 Thailand Air Filters Market Revenues & Volume, By Residential, 2021-2031F |

6.2.3 Thailand Air Filters Market Revenues & Volume, By Commercial, 2021-2031F |

6.2.4 Thailand Air Filters Market Revenues & Volume, By Industrial, 2021-2031F |

7 Thailand Air Filters Market Import-Export Trade Statistics |

7.1 Thailand Air Filters Market Export to Major Countries |

7.2 Thailand Air Filters Market Imports from Major Countries |

8 Thailand Air Filters Market Key Performance Indicators |

9 Thailand Air Filters Market - Opportunity Assessment |

9.1 Thailand Air Filters Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 Thailand Air Filters Market Opportunity Assessment, By End-User, 2021 & 2031F |

10 Thailand Air Filters Market - Competitive Landscape |

10.1 Thailand Air Filters Market Revenue Share, By Companies, 2024 |

10.2 Thailand Air Filters Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero