Thailand Busbar Market (2024-2030) | Companies, Revenue, Industry, Analysis, Forecast, Trends, Growth, Size, Share & Value

Market Forecast By Conductor (Copper, Aluminium), By Power Rating (Low Power (Below 125A), Medium Power (125A – 800A), High Power (Above 800A)), By End User (Residential, Commercial, Utilities (Power Generation & Transmission), Industrial (Metal & Mining, Oil & Gas, Chemical & Petrochemical), Manufacturing (Automotive, Textile, Food Processing, Electronic))And Competitive Landscape

| Product Code: ETC4525766 | Publication Date: Jul 2023 | Updated Date: Jan 2024 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 73 | No. of Figures: 22 | No. of Tables: 4 |

Thailand Busbar Market Synopsis

Before the pandemic, the Thailand Busbar market experienced substantial growth, driven by rising demand from the manufacturing, industrial, and power sectors. For instance, in 2019, Thailand's manufacturing output reached US$ 139.39 billion with developments such as, Toyota completing its HEV battery production plant in Chachoengsao province, Fuji Electric finishing its 3rd factory project in Thailand among others contributing in a significant manner. However, the COVID-19 pandemic caused a temporary slowdown in 2020 due to supply chain disruptions and reduced demand caused by lockdowns. Furthermore, market recovery began in 2021 with the easing of restrictions, resulting in the manufacturing sector's output reaching US$ 137.40 billion in 2021, up from US$ 127.89 billion in 2020 which had a positive impact on the busbar market.

According to 6wresearch, Thailand Busbar market size is projected to grow at a CAGR of 5.4% during 2024-2030F. The busbar market in Thailand is experiencing significant growth, primarily fueled by the government's substantial investment of US$ 9.6 billion in the development and expansion of the transmission system. Additionally, Thailand is expected to attract investments totalling approximately US$ 5.5 billion in the data center industry, with the data center capacity anticipated to reach 500 MW by 2028, up from 157 MW in 2023. Furthermore, as per the Thailand Board of Investment (BOI), applications for investment promotion in the first half of 2023 increased by 70% year on year in value, reaching US$ 10.3 billion. Global companies continue to find Thailand as a potential manufacturing base in targeted industries, such as electronics, food processing, automotive etc.

The investments would lead to the construction of new manufacturing and industrial facilities, resulting in a higher demand for power distribution systems, control panels, switchgear, and other electrical systems. This, in turn, would further increase the demand for busbars in Thailand in the upcoming years owing to their extensive use in power distribution and other electrical systems.

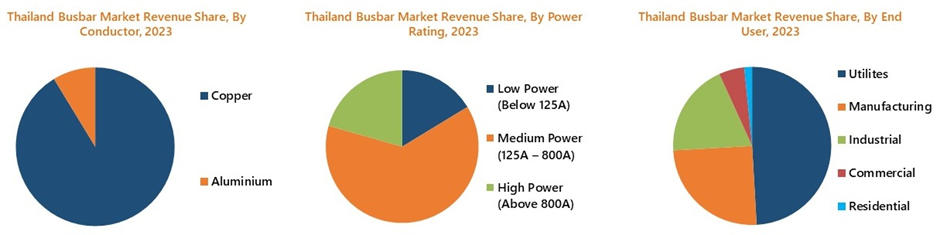

Market Segmentation by Conductor

Copper is anticipated to experience the highest growth within the forecasted time frame due to its superior electrical conductivity, enabling the efficient flow of electrical current with minimal resistance. This characteristic renders copper especially advantageous for applications in the utilities, industrial, and manufacturing sectors.

Market Segmentation by Power Rating

Medium power has occupied a major share, primarily driven by increased consumption in industrial, utilities, and commercial sector projects such as the completion of Murata Manufacturing Co. and Sanhua Industry (Thailand) Co. factories in 2023. Furthermore, the increased investment by government in transmission project which is expected to significantly boost the segment's growth.

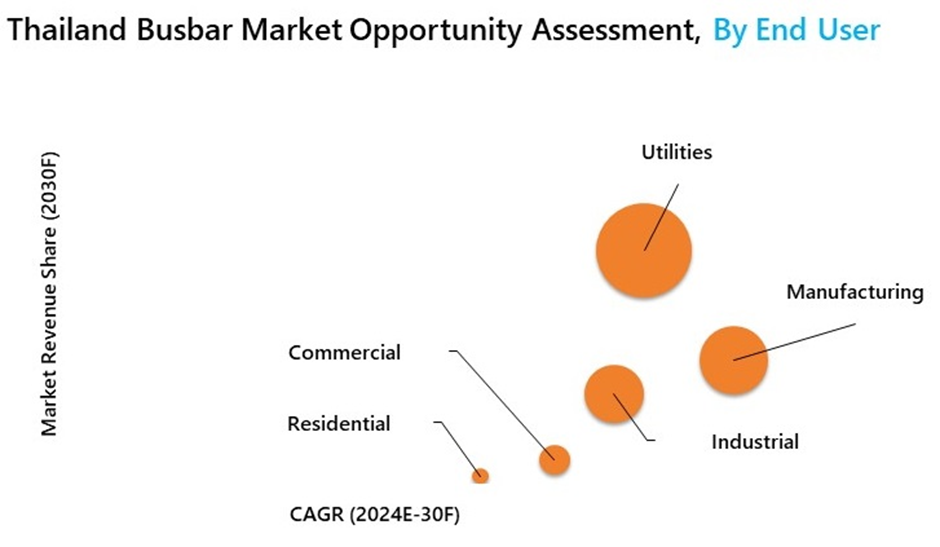

Market Segmentation by End User

Utilities, sector accounts for a major revenue share in the Thailand Busbar market owing to the prominent requirement of bus bars in power transmission and distribution projects. The advancement in Thailand smart grid projects in Thai provinces such as Mae Hong Son, Lampang, and others. The development is expected to significantly boost the segment's growth in years to come.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Thailand Busbar Market Overview

- Thailand Busbar Market Outlook

- Thailand Busbar Market Forecast

- Historical Data and Forecast of Thailand Busbar Market Revenues, for the Period 2020-2030F

- Historical Data and Forecast of Thailand Busbar Market Revenues, By Conductor, for the Period 2020-2030F

- Historical Data and Forecast of Thailand Busbar Market Revenues, By Power Rating, for the Period 2020-2030F

- Historical Data and Forecast of Thailand Busbar Market Revenues, By End User, for the Period 2020-2030F

- Industry Life Cycle

- Thailand Busbar Market – Porter’s Five Forces

- Market Drivers and Restraint

- Market Trends

- Market Opportunity Assessment

- Company Revenue Ranking

- Market Competitive Benchmarking

- Company Profiles

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Conductor

- Copper

- Aluminium

By Power Rating

- Low Power (Below 125A)

- Medium Power (125A – 800A)

- High Power (Above 800A)

By End User

- Residential

- Commercial

- Utilities (Power Generation & Transmission)

- Industrial (Metal & Mining, Oil & Gas, Chemical & Petrochemical)

- Manufacturing (Automotive, Textile, Food Processing, Electronic)

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Thailand Busbar Market Overview |

| 3.1 Thailand Busbar Market Revenues (2020-2030F) |

| 3.2 Thailand Busbar Market Industry Life Cycle |

| 3.3 Thailand Busbar Market Porter's Five Forces |

| 4. Thailand Busbar Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Thailand Busbar Market Trends |

| 6. Thailand Busbar Market Overview, By Product Types |

| 6.1 Thailand Busbar Market Revenue Share & Revenues, By Conductor, (2020-2030F) |

| 6.1.1 Thailand Busbar Market Revenues, By Copper, 2020-2030F |

| 6.1.2 Thailand Busbar Market Revenues, By Aluminium, 2020-2030F |

| 7. Thailand Busbar Market Overview, By Material Types |

| 7.1 Thailand Busbar Market Revenue Share & Revenues, By Power Rating, (2020-2030F) |

| 7.1.1 Thailand Busbar Market Revenues, By Low Power, 2020-2030F |

| 7.1.2 Thailand Busbar Market Revenues, By Medium Power, 2020-2030F |

| 7.1.3 Thailand Busbar Market Revenues, By High Power, 2020-2030F |

| 8. Thailand Busbar Market Overview, By Applications |

| 8.1 Thailand Busbar Market Revenue Share & Revenues, By End User, (2020-2030F) |

| 8.1.1 Thailand Busbar Market Revenues, By Utilities (2020-2030F) |

| 8.1.2 Thailand Busbar Market Revenues, By Manufacturing (2020-2030F) |

| 8.1.3 Thailand Busbar Market Revenues, By Industrial (2020-2030F) |

| 8.1.4 Thailand Busbar Market Revenues, By Commercial (2020-2030F) |

| 8.1.5 Thailand Busbar Market Revenues, By Residential (2020-2030F) |

| 9. Thailand Busbar Market Key Performance Indicators |

| 10. Thailand Busbar Market Opportunity Assessment |

| 10.1 Thailand Busbar Market Opportunity Assessment, By Conductor (2030F) |

| 10.2 Thailand Busbar Market Opportunity Assessment, By Power Rating (2030F) |

| 10.3 Thailand Busbar Market Opportunity Assessment, By End User (2030F) |

| 11. Thailand Busbar Market Competitive Landscape |

| 11.1 Thailand Busbar Market Revenue Ranking, By Companies (2023) |

| 11.2 Thailand Busbar Market Competitive Benchmarking, By Technical Parameters |

| 11.3 Thailand Busbar Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1 Oriental Copper Co., Ltd. |

| 12.2 Yueqing Yirui Electric Appliance Co., Ltd. |

| 12.3 Rittal Ltd. |

| 12.4 MSS India Pvt. Ltd. |

| 12.5 EAE ELEKTRİK A.Ş. |

| 12.6 ABB Electrification (Thailand) Co., Ltd |

| 12.7 Siemens Energy Ltd. Thailand |

| 12.8 Schneider Electric Thailand Ltd. |

| 12.9 Eaton Industries (Thailand) Ltd. |

| 12.10 Acme Insulation Co. Ltd. |

| 12.11 Interplex Holdings Pte. Ltd. |

| 12.10 United Copper Co.,Ltd |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Thailand Busbar Market Revenues, 2020-2030F ($ Million) |

| 2. Thailand Data Center Capacity (In MW), 2023 & 2028F |

| 3. Thailand Internet Penetration (In Percent), (2018-2022) |

| 4. Thailand Copper & Aluminium Prices Per Metric Ton, (In US$), June 2020 – November 2023` |

| 5. Thailand Busbar Market Revenue Share, By Conductor, 2023 and 2030F |

| 6. Thailand Busbar Market Revenue Share, By Power Rating, 2023 and 2030F |

| 7. Thailand Busbar Market Revenues, By End User, 2020-2030F ($ Million) |

| 8. Manufacturing Production Index (MPI), Q1 2022 – Q1 2023 |

| 9. Automotive Production (In Thousand Units), 2020 – 2030F |

| 10. Transmission Length (In Circuit Km), 2021 & 2027F |

| 11. Thailand Substations Capacity (In MVA), 2021 & 2027F |

| 12. Thailand Busbar Market Opportunity Assessment, By Conductor, 2030F |

| 13. Thailand Busbar Market Opportunity Assessment, By Power Rating, 2030F |

| 14. Thailand Busbar Market Opportunity Assessment, By End User, 2030F |

| 15. Thailand Busbar Market Revenue Ranking, By Companies, 2023 |

| 16. Thailand PPP Value of Projects For The Period 2020-2027, ($ Million ) |

| 17. Thailand Development Projects, 2024-2025 |

| 18. SEPO PPP Strategic Plan 2020-2027 |

| 19. Thailand new electricity generation capacity, MW, 2037 |

| 20. Thailand Electricity generation outlook, 2019-2037, in MW |

| 21. Thailand’s EV Production Target, (Million units) |

| 22. Thailand’s EV Use Target, (Million units) |

| List of Tables |

| 1. Approved Transmission System Development and Expansion Projects in Thailand |

| 2. Thailand Busbar Market Revenues, By Conductor, 2020-2030F ($ Million) |

| 3. Thailand Busbar Market Revenues, By Power Rating, 2020-2030F ($ Million) |

| 4. Thailand Busbar Market Revenues, By End User, 2020-2030F ($ Million) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero