Thailand Diesel Genset (Generator) Market (2021-2027) | Growth, Industry, Share, Segmentation, Trends, Analysis, Revenue, Size, Value, Outlook & COVID-19 IMPACT

Market Forecast By KVA (5 - 75 KVA, 75.1 - 375 KVA, 375.1 - 750 KVA, 750.1 - 1000 KVA, Above 1000 KVA), By Application (Residential, Commercial, Industrial, Transportation & Public Infrastructure) And Competitive Landscape

| Product Code: ETC090024 | Publication Date: Aug 2021 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Thailand Diesel Genset Market | Country-Wise Share and Competition Analysis

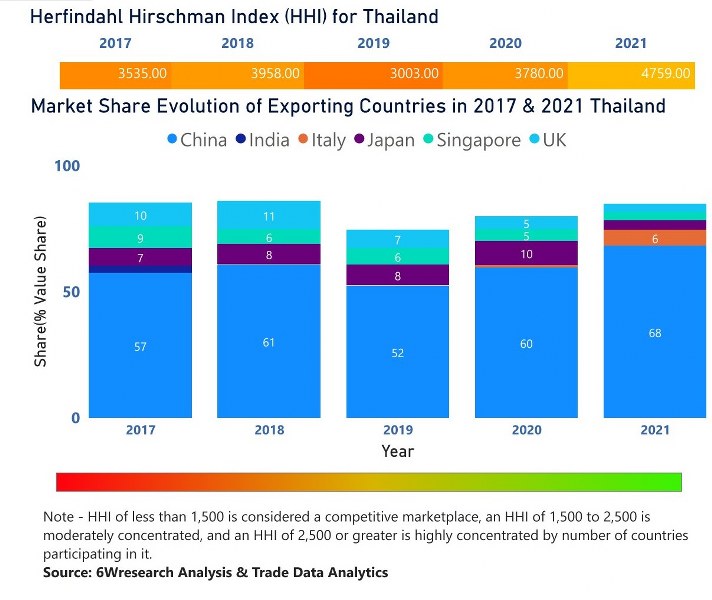

In the year 2021, China was the largest exporter in terms of value, followed by Italy. It has registered a decline of -0.39% over the previous year. While Italy registered a growth of 498.37% as compared to the previous year. In the year 2017, China was the largest exporter followed by the UK. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, Thailand has a Herfindahl index of 3535 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 4759 which signifies high concentration in the market.

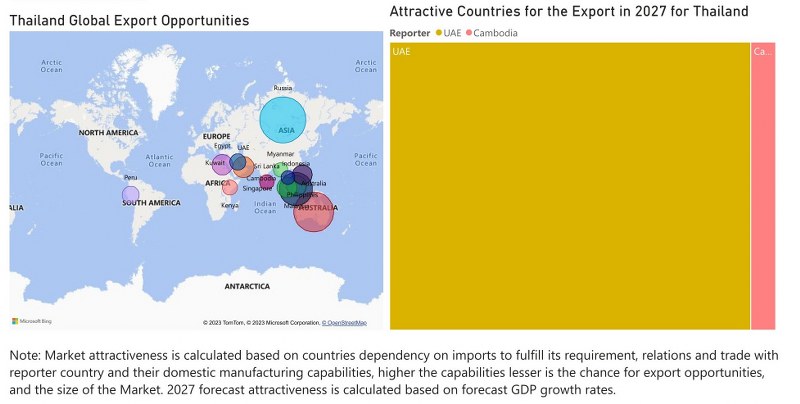

Thailand Diesel Genset Market - Export Market Opportunities

![Thailand Diesel Genset Market - Export Market Opportunities]() Topics Covered in the Thailand Diesel Genset (Generator) Market

Topics Covered in the Thailand Diesel Genset (Generator) Market

Thailand Diesel Genset Market report comprehensively covers the market by kVA ratings and application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Thailand Diesel Genset (Generator) Market is projected to grow over the coming year. Thailand Diesel Genset (Generator) Market report is a part of our periodical regional publication Asia Pacific Diesel Genset (Generator) Market outlook report. 6W tracks the diesel genset market for over 60 countries with individual country-wise market opportunity assessment and publishes the report titled Global Diesel Genset (Generator) Market outlook report annually.

Latest Development (2023) of the Thailand Diesel Genset (Generator) Market

Thailand Diesel Genset (Generator) Market is progressing due to advancements in technology. The manufacturers are now producing efficient and powerful engines with the help of the latest technology to increase the efficiency of the fuel and lower the impact on the environment. The incorporation of smart technologies is the latest trend that is gaining momentum. The generators are now equipped with the latest software and censors that allows real-time monitoring. The downtime is reduced and the generator’s performance is maximized. The need for clean and pure energy has led producers to manufacture hybrid models to provide reliable power sources to various industries. The need for portable generators is also rising in the various industries and due to this, the producers have responded back by creating designs that don’t compromise on quality, output measures, and reliability. The future of the market is strong due to these exciting developments in the markets.

Thailand Diesel Genset (Generator) Market Synopsis

Thailand Diesel Generator Market is likely to register sound revenues during the upcoming years owing to the increasing penetration towards infrastructure development. The growing construction sector attributed to the establishment of government offices, private complexes, and shopping malls beholds the growth of the market. Moreover, rising tourism in the country backed by an increasing number of hotels is driving the need for increased power supply further leading to the growth of the Diesel Generator Market in Thailand.

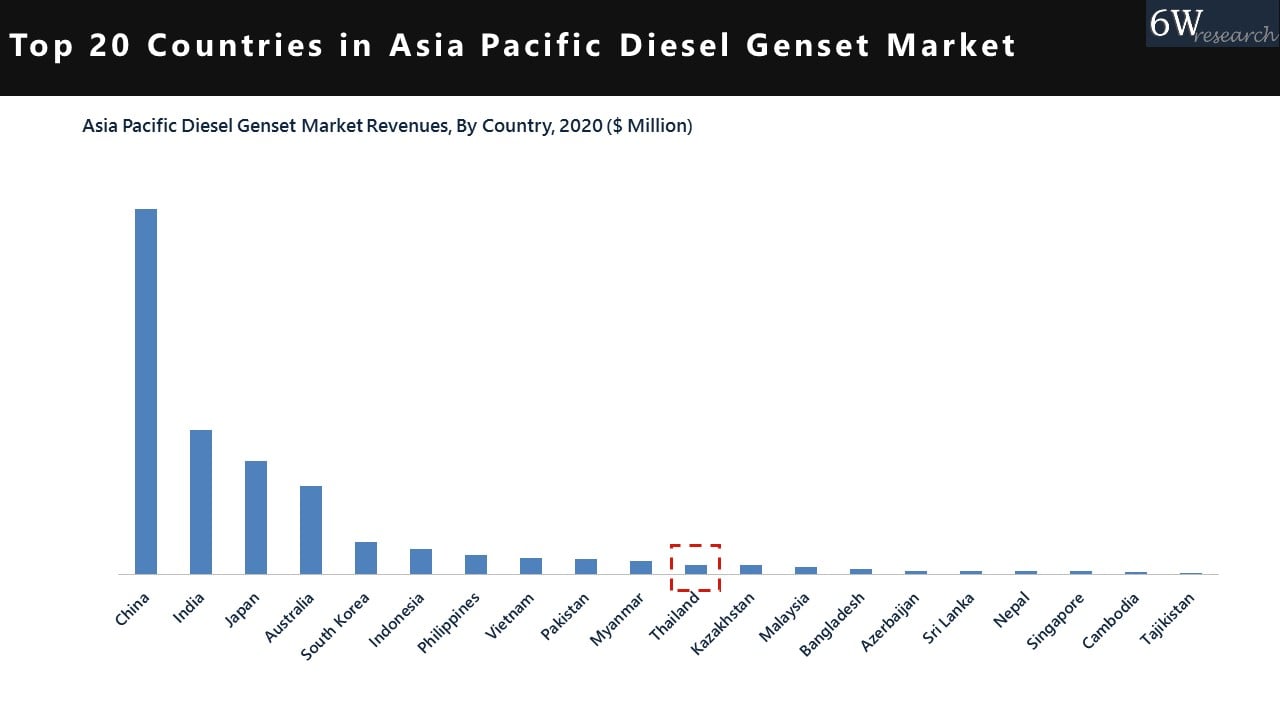

According to 6Wresearch, Thailand Diesel Genset Market size is projected to grow at a CAGR of 2.1% during 2021-2027. Thailand occupies the 11th position in terms of market size in the APAC Diesel Genset Market. Increasing urbanization coupled with growing residential, commercial, and industrial sectors beholds the increasing development of the market. Additionally, the ease of availability of fossil fuels is further adding to the growth of the market. However, the increasing penetration of renewable sources beholds the declining growth of the market. The outbreak of COVID-19 negatively affected the growth of the market backed by a nationwide lockdown causing shutting down of production units. Restrictions on public gatherings have added to the negative growth of the market.

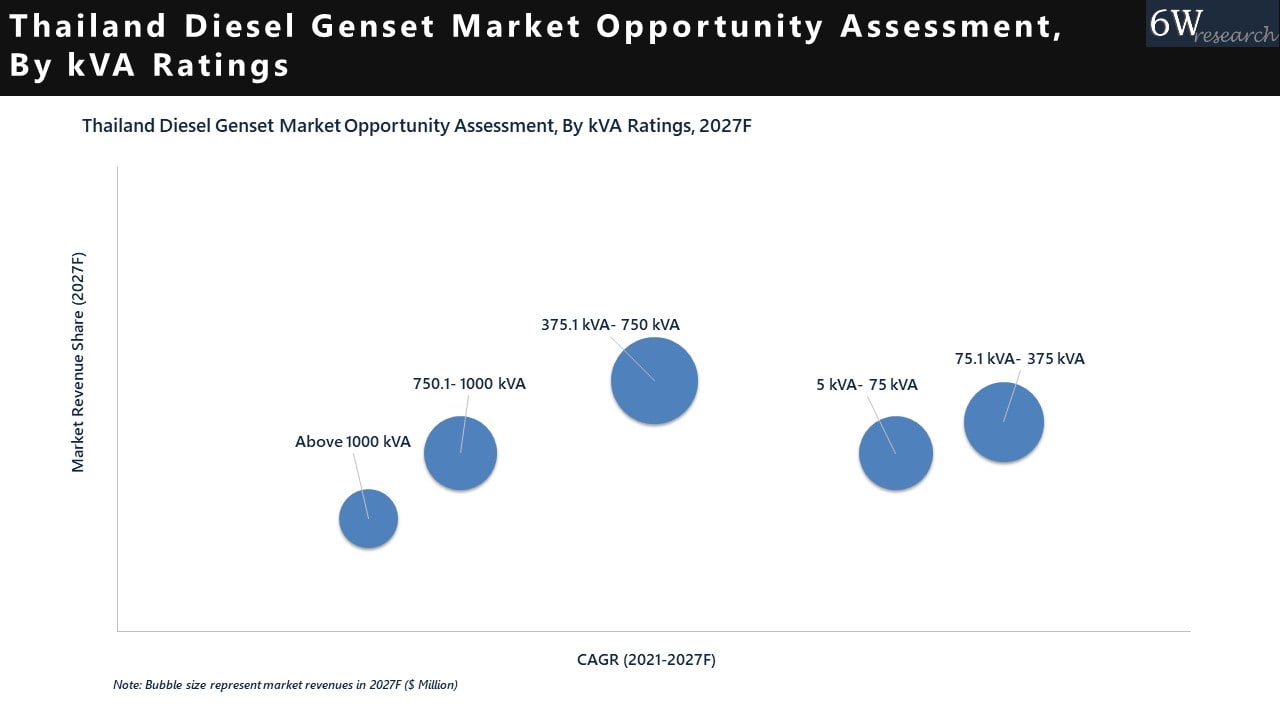

Market Analysis by kVA Ratings

In terms of market by kVA ratings, 375.1KVA-750KVA dominates the market and is expected to remain in a dominant position in the coming years. However, the 75.1KVA-375KVA rating is expected to have the fastest growth rate among all ratings.

![Thailand Diesel Genset Market]() Market Analysis by Application

Market Analysis by Application

In terms of application, Commercial dominates the market and is expected to remain in a dominant position in the coming years with the fastest growth rate among all applications.

COVID-19 Impact on Thailand Diesel Genset (Generator) Market

Various industries across the world were affected by the COVID-19 pandemic and the Diesel Genset Market in Thailand was no exception. Due to the halt of several construction projects and a decrease in industrial activities, the demand for diesel generators decreased. Due to shut down of many businesses and the reduction in operation, the sales and revenue declined for the companies operating within this domain. There was a disruption in the global supply chain on account of border closures and restrictions on travel. The manufacturers found it difficult to cater to the demand of the customers and it led to delays in the deliveries.

Thailand Diesel Genset (Generator) Market: Key players

These are the notable players in the market which offers a variety of generator products to meet the requirement of various industries.

- Caterpillar Inc.

- Cummins Inc.

- Kohler Co.

- Mitsubishi Heavy Industries, Ltd.

- Wärtsilä Corporation

- Atlas Copco AB

- Yanmar Holdings Co., Ltd.

- Himoinsa S.L.

- Generac Power Systems, Inc.

- Doosan Corporation

Key Highlights of the Report:

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Thailand Diesel Genset (Generator) Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Thailand Diesel Genset Market Overview |

| 3.1 Thailand Diesel Genset Market Revenues & Volume, 2017 - 2027F |

| 3.2 Thailand Diesel Genset Market - Industry Life Cycle |

| 3.3 Thailand Diesel Genset Market - Porter's Five Forces |

| 3.4 Thailand Diesel Genset Market Revenues & Volume Share, By KVA, 2020 & 2027F |

| 3.5 Thailand Diesel Genset Market Revenues & Volume Share, By Application, 2020 & 2027F |

| 4 Thailand Diesel Genset Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for reliable backup power solutions in Thailand |

| 4.2.2 Growth in industrial and commercial sectors leading to higher need for continuous power supply |

| 4.2.3 Government initiatives promoting the use of diesel gensets for reliable electricity supply |

| 4.3 Market Restraints |

| 4.3.1 Stringent emission regulations impacting the adoption of diesel gensets |

| 4.3.2 Fluctuating diesel prices affecting operating costs for end-users |

| 4.3.3 Competition from alternative power generation technologies such as solar and wind energy |

| 5 Thailand Diesel Genset Market Trends |

| 6 Thailand Diesel Genset Market Segmentation |

| 6.1 Thailand Diesel Genset Market, By KVA |

| 6.1.1 Overview and Analysis |

| 6.1.2 Thailand Diesel Genset Market Revenues & Volume, By KVA, 2017 - 2027F |

| 6.1.3 Thailand Diesel Genset Market Revenues & Volume, By 5 - 75 KVA, 2017 - 2027F |

| 6.1.4 Thailand Diesel Genset Market Revenues & Volume, By 75.1 - 375 KVA, 2017 - 2027F |

| 6.1.5 Thailand Diesel Genset Market Revenues & Volume, By 375.1 - 750 KVA, 2017 - 2027F |

| 6.1.6 Thailand Diesel Genset Market Revenues & Volume, By 750.1 - 1000 KVA, 2017 - 2027F |

| 6.1.7 Thailand Diesel Genset Market Revenues & Volume, By Above 1000 KVA, 2017 - 2027F |

| 6.2 Thailand Diesel Genset Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Thailand Diesel Genset Market Revenues & Volume, By Residential, 2017 - 2027F |

| 6.2.3 Thailand Diesel Genset Market Revenues & Volume, By Commercial , 2017 - 2027F |

| 6.2.4 Thailand Diesel Genset Market Revenues & Volume, By Industrial, 2017 - 2027F |

| 6.2.5 Thailand Diesel Genset Market Revenues & Volume, By Transportation & Public Infrastructure, 2017 - 2027F |

| 7 Thailand Diesel Genset Market Import-Export Trade Statistics |

| 7.1 Thailand Diesel Genset Market Export to Major Countries |

| 7.2 Thailand Diesel Genset Market Imports from Major Countries |

| 8 Thailand Diesel Genset Market Key Performance Indicators |

| 8.1 Average utilization rate of diesel gensets in Thailand |

| 8.2 Number of new industrial/commercial establishments using diesel gensets |

| 8.3 Adoption rate of diesel gensets in remote or off-grid areas |

| 9 Thailand Diesel Genset Market - Opportunity Assessment |

| 9.1 Thailand Diesel Genset Market Opportunity Assessment, By KVA, 2020 & 2027F |

| 9.2 Thailand Diesel Genset Market Opportunity Assessment, By Application, 2020 & 2027F |

| 10 Thailand Diesel Genset Market - Competitive Landscape |

| 10.1 Thailand Diesel Genset Market Revenue Share, By Companies, 2020 |

| 10.2 Thailand Diesel Genset Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero