Thailand Power Tools Market (2021-2027) | COVID-19 IMPACT, Forecast, Trends, Value, Companies, Outlook, Growth, Analysis, Revenue, Size, Industry & Share

Market forecast By Market Type (Organized Market, Unorganized Market), By Technology (Electric Power Tools (Corded Power Tools, Cordless Power Tools), Pneumatic Power Tools)), By Tool Types (Metal Power Tools (By Types (Driller, Cutter, Grinder), By Applications (Metal Manufacturing, Metal Fabrication & Others)), Concrete Power Tools (By Types (Demolition Hammer, Rotary Hammer), By Applications (Concrete Drilling, Concrete Grinding & Others)), Wood Power Tools (By Types (Saws, Planer, Router), By Applications (Wood Cutting, Wood Drilling & Others)), Other Power Tools (Shears & Nibblers, Sand Polisher)), By Verticals (Construction, Industrial, Residential & Others (Defence, Transportation, etc.)) and competitive landscape

| Product Code: ETC054273 | Publication Date: Mar 2021 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Thailand Power Tools Market | Country-Wise Share and Competition Analysis

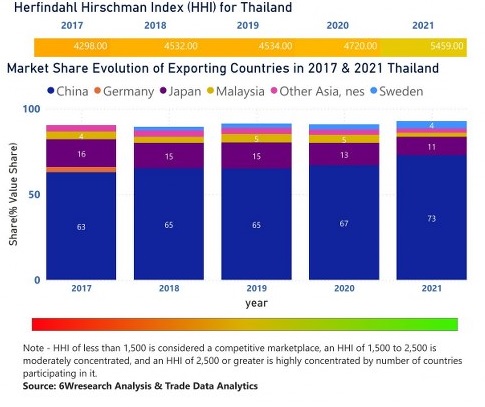

In the year 2021, China was the largest exporter in terms of value, followed by Japan. It has registered a growth of 48.7% over the previous year. While Japan registered a growth of 13.5% as compare to the previous year. In the year 2017 China was the largest exporter followed by Japan. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Thailand has the Herfindahl index of 4298 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 5459 which signifies high concentration in the market.

Thailand Power Tools Market - Export Market Opportunities

Thailand Power Tools Market report thoroughly covers the power tools market by market type, technology, tool types, and verticals. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, market drivers, and market share by companies, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

Thailand Power Tools Market Synopsis

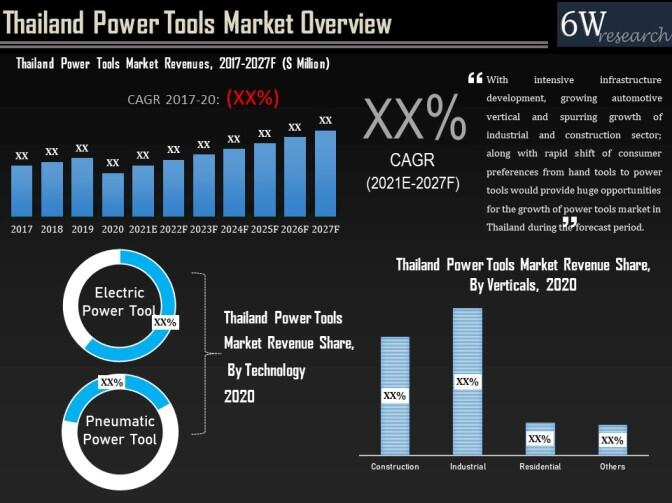

The Thailand Power Tools Market is anticipated to witness notable growth during the forecast period as a result of a rapid shift in consumer preference from hand tools to power tools on account of several factors such as better operational efficiency, durability, precision, and convenience. The majority of the demand for power tools in Thailand could be witnessed in verticals such as industrial, construction, and transportation. The Expanding construction industry, growing automotive vertical and spurring growth of the industrial sector; along with a rapid shift of consumer preferences from hand tools to power tools, would provide huge opportunities for the growth of the power tools market in Thailand during the forecast period. Global power tools giants like Makita, Ingersoll Rand, Bosch, etc., are working on several latest technologies for making high-end power tools with enhanced technology and innovation. Thus, the increasing industrial and construction projects along with government initiative for improving automobile, manufacturing and industrial sectors would bode well for Thailand power tools market in the forthcoming period.

However, the outbreak of the COVID-19 pandemic has brought a slowdown in the market during the year 2020 as a result of a halt in the construction and industrial projects, business operations, manufacturing units, and the stringent lockdown imposed across the country. Recovery is expected in market revenues post-2020, with a gradual opening of economic activities and restart of the construction activities and the manufacturing sector.

According to 6Wresearch, Thailand Power Tools Market size is projected to grow at CAGR of 9.0% during 2021-27. Attributed to the presence of a robust industrial sector in Thailand along with a rapidly growing automotive sector, the power tools market in the country accounted for a major share in the market. However, the market is projected to exhibit the highest growth rate on account of flourishing construction and industrial segments providing immense opportunities for the power tools demand in the country during the forecast period.

Market Analysis by Technology

In terms of technology type, electric power tools have emerged as a major market shareholder in the market in 2020, owing to its huge consumer preference as a result of comparatively lesser price, lower maintenance requirement, and more convenience to handle in comparison to pneumatic power tools. As technological advancements and innovations are taking place in power tools, the revenues and revenue share of cordless electric power tools is expected to increase further in the years to come. Moreover, a visible shift from corded to cordless power tools using lithium-ion batteries and dust control technology is seen among end-users. Hence, the cordless power tools segment is projected to witness substantial growth and high user acceptance during the forecast period owing to its certain key advantages such as portability, light-weight, and added-efficiency.

Market Analysis by Type

Among verticals, construction and industrial sector accounted for a major market revenue share with a cumulative share of more than 50% of the total market revenues in 2020. Industrial sector emerged as the dominant revenue share contributor in Thailand power tools market for the year 2020. The segment is projected to lead the market during the forecast period as well, attributed to forthcoming developmental projects and government policies towards industrial development in the country. An upsurge in manufacturing, oil & gas, metal, mining and utility segment would catalyse the growth of the power tools market in both countries during the forecast period.

Key Attractiveness of the Report:

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Thailand Power Tools Market Overview.

- Thailand Power Tools Market Outlook.

- Thailand Power Tools Market Forecast.

- Historical data and forecast of Thailand Power Tools Market Revenues and Volume, for the Period, 2017-2027F.

- Historical data and Forecast of Revenues and Volume, By Market Types, for the Period, 2017-2027F.

- Historical data and Forecast of Revenues and Volume, By Tool Types, for the Period, 2017-2027F.

- Historical data and Forecast of Revenues and Volume, By Technology, for the Period, 2017-2027F.

- Historical data and Forecast of Revenues and Volume, By Verticals, for the Period, 2017-2027F.

- Market Drivers and Restraints

- Thailand Power Tools Market Trends

- Industry Life Cycle and Value Chain Analysis & Ecosystem

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- Thailand Power Tools Market Share, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The report provides a detailed analysis of the following market segments:

By Market Type

- Organized Market

- Unorganized Market

By Technology

- Electric Power Tools

- Corded Power Tools

- Cordless Power Tools

- Pneumatic Power Tools

By Tool Types

Metal Power Tools

- By Types

- Driller

- Cutter

- Grinder

- By Applications

- Metal Manufacturing

- Metal Fabrication

- Others

Concrete Power Tools

- By Types

- Demolition Hammer

- Rotary Hammer

- By Applications

- Concrete Drilling

- Concrete Grinding

- Others

Wood Power Tools

- By Types

- Saws

- Planer

- Router

- By Applications

- Wood Cutting

- Wood Drilling

- Others

- Other Power Tools (Shears & Nibblers, Sand Polisher)

By Verticals

- Construction

- Industrial

- Residential

- Others (Defence, Transportation, etc.)

Thailand Power Tools Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Methodology Adopted & Key Data Points |

| 2.5 Assumptions |

| 3. Thailand Tools Market Overview |

| 3.1 Thailand Power Tools Market Revenues and Volume, 2017-2027F |

| 3.2 Thailand Power Tools Market-Industry Life Cycle |

| 3.3 Thailand Power Tools Market-Porter’s Five Forces |

| 3.4 Thailand Power Tools Market- Value Chain Analysis & Ecosystem |

| 3.5 Thailand Power Tools Market Revenue Share, By Market Type, 2020 & 2027F |

| 3.6 Thailand Power Tools Market Revenue Share, By Technology, 2020 & 2027F |

| 3.7 Thailand Power Tools Market Revenue Share, By Tool Types, 2020 & 2027F |

| 3.8 Thailand Power Tools Market Revenue Share, By Verticals, 2020 & 2027F |

| 4. Thailand Power Tools Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Thailand Power Tools Market Trends |

| 6. Thailand Power Tools Market Overview, By Market Type |

| 6.1 Thailand Power Tools Market Revenue Share, By Market Type, 2020 & 2027F |

| 6.2 Thailand Power Tools Market Revenues, By Market Type |

| 6.2.1 Thailand Organized Power Tools Market Revenues, 2017-2027F |

| 6.2.2 Thailand Unorganized Power Tools Market Revenues, 2017-2027F |

| 7. Thailand Power Tools Market Overview, By Technology |

| 7.1 Thailand Power Tools Market Revenue Share, By Technology, 2020 & 2027F |

| 7.2 Thailand Power Tools Market Revenues, By Technology |

| 7.2.1 Thailand Electric Power Tools Market Revenues, By Types |

| 7.2.1.1 Thailand Corded Electric Power Tools Market Revenues, 2017-2027F |

| 7.2.1.2 Thailand Cordless Electric Power Tools Market Revenues, 2017-2027F |

| 7.2.2 Thailand Pneumatic Power Tools Market Revenues, 2017-2027F |

| 8. Thailand Power Tools Market Overview, By Tool Types |

| 8.1 Thailand Power Tools Market Revenue Share & Volume Share, By Tool Types |

| 8.2 Thailand Metal Power Tools Market Overview |

| 8.2.1 Thailand Metal Power Tools Market Revenues & Volume, 2017-2027F |

| 8.2.2 Thailand Metal Power Tools Market Revenue Share & Revenues, By Types |

| 8.2.2.1 Thailand Metal Power Tools Market Revenues, By Driller, 2017-2027F |

| 8.2.2.2 Thailand Metal Power Tools Market Revenues, By Cutter, 2017-2027F |

| 8.2.2.3 Thailand Metal Power Tools Market Revenues, By Grinder, 2017-2027F |

| 8.2.3 Thailand Metal Power Tools Market Revenue Share, By Applications, 2020 & 2027F |

| 8.2.4 Thailand Metal Power Tools Market Revenus, By Applications |

| 8.2.4.1 Thailand Metal Power Tools Market Revenues, By Metal Manufacturing, 2017-2027F |

| 8.2.4.2 Thailand Metal Power Tools Market Revenues, By Metal Fabrication, 2017-2027F |

| 8.2.4.3 Thailand Metal Power Tools Market Revenues, By Other Applications, 2017-2027F |

| 8.3 Thailand Concrete Power Tools Market Overview |

| 8.3.1 Thailand Concrete Power Tools Market Revenues & Volume, 2017-2027F |

| 8.3.2 Thailand Concrete Power Tools Market Revenue Share & Revenues, By Types |

| 8.3.2.1 Thailand Concrete Power Tools Market Revenues, By Demolition Hammer, 2017-2027F |

| 8.3.2.2 Thailand Concrete Power Tools Market Revenues, By Rotary Hammer, 2017-2027F |

| 8.3.3 Thailand Concrete Power Tools Market Revenue Share, By Applications, 2020 & 2027F |

| 8.3.4 Thailand Concrete Power Tools Market Revenues, By Applications |

| 8.3.4.1 Thailand Concrete Power Tools Market Revenues, By Concrete Drilling, 2017-2027F |

| 8.3.4.2 Thailand Concrete Power Tools Market Revenues, By Concrete Grinding, 2017-2027F |

| 8.3.4.3 Thailand Concrete Power Tools Market Revenues, By Other Applications, 2017-2027F |

| 8.4 Thailand Wood Power Tools Market Overview |

| 8.4.1 Thailand Wood Power Tools Market Revenues & Volume, 2017-2027F |

| 8.4.2 Thailand Wood Power Tools Market Revenue Share & Revenues, By Types |

| 8.4.2.1 Thailand Wood Power Tools Market Revenues, By Saws, 2017-2027F |

| 8.4.2.2 Thailand Wood Power Tools Market Revenues, By Planer, 2017-2027F |

| 8.4.2.3 Thailand Wood Power Tools Market Revenues, By Router, 2017-2027F |

| 8.4.3 Thailand Wood Power Tools Market Revenue Share, By Applications, 2020 & 2027F |

| 8.4.4 Thailand Wood Power Tools Market Revenue, By Applications |

| 8.4.4.1 Thailand Wood Power Tools Market Revenues, By Wood Cutting, 2017-2027F |

| 8.4.4.2 Thailand Wood Power Tools Market Revenues, By Wood Drilling, 2017-2027F |

| 8.4.4.3 Thailand Wood Power Tools Market Revenues, By Other Applications, 2017-2027F |

| 8.5 Thailand Other Power Tools Market Overview |

| 8.5.1 Thailand Other Power Tools Market Revenues & Volume, 2017-2027F |

| 9. Thailand Power Tools Market Overview, By Verticals |

| 9.1 Thailand Power Tools Market Revenue Share, By Verticals, 2020 & 2027F |

| 9.2 Thailand Power Tools Market Revenues, By Verticals |

| 9.2.1 Thailand Power Tools Market Revenues, By Construction Vertical, 2017-2027F |

| 9.2.2 Thailand Power Tools Market Revenues, By Residential Vertical, 2017-2027F |

| 9.2.3 Thailand Power Tools Market Revenues, By Industrial Vertical, 2017-2027F |

| 9.2.4 Thailand Power Tools Market Revenues, By Others Vertical, 2017-2027F |

| 10. Thailand Power Tools Market Key Performance Indicators |

| 11. Thailand Power Tools Market Opportunity Assessment |

| 11.1 Thailand Power Tools Market Opportunity Assessment, By Technology, 2027F |

| 11.2 Thailand Power Tools Market Opportunity Assessment, By Tool Types, 2027F |

| 11.3 Thailand Power Tools Market Opportunity Assessment, By Verticals, 2027F |

| 12. Thailand Power Tools Market Competitive Landscape |

| 12.1 Thailand Power Tools Market Revenue Share, By Companies |

| 12.2 Thailand Power Tools Market Competitive Benchmarking |

| 12.2.1 Thailand Power Tools Market Competitive Benchmarking, By Technology |

| 12.2.2 Thailand Power Tools Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1 Snap-on Inc. |

| 13.2 Makita Corporation |

| 13.3 Hilti Corporation |

| 13.4 Atlas Copco AB |

| 13.5 Koki Holdings Co. Ltd, |

| 13.6 Robert Bosch Power Tools GmbH |

| 13.7 Ingersoll-Rand PLC |

| 13.8 Stanley Black & Decker, Inc. |

| 13.9 Techtronic Industries Co. Ltd. |

| 13.10 Keyang Power Tools |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero