Thailand Tire Market (2022-2028) | Trends, Value, Revenue, Outlook, Forecast, Size, Analysis, Growth, Industry, Share, Segmentation & COVID-19 IMPACT

Market Forecast By Origin (Local Manufacturing and Imports), By Types (Radial Tires and Bias Tires), By End Users (OEM and Replacement), By Vehicle Types (Trucks and Bus, Light Trucks, Two-Wheelers and Passenger Cars), and Competitive Landscape.

| Product Code: ETC001388 | Publication Date: Feb 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 78 | No. of Figures: 21 | No. of Tables: 13 |

Latest 2023 Development of The Thailand Tire Market

Thailand Tire Market is growing over the past few years with the increasing demand for tires across the globe. The expansion of manufacturing units by tire manufacturers to meet the increasing demand for tires globally. This has resulted in an increasing number of tire manufacturing units in Thailand and has helped in boosting the tire industry in Thailand. Thailand is one of the largest exporters of tires in the world which contributes to the growth of the tire market in Thailand and has increased the revenue generated by the industry. The tire industry in Thailand is also investing heavily in research and development to improve the quality and efficiency of tire manufacturing. The government has been supportive of the tire industry and has provided various tax incentives and subsidies to promote the growth of the industry which is helping in attracting more investment and has boosted the development of the tire market.

The growth of the automotive industry in Thailand has been a major factor in the development of the tire market as the increasing production of vehicles has increased the demand for tires in Thailand which has led to the growth of the tire market in Thailand. The tire market in Thailand is continuously growing and is anticipated to grow in the future years with the expansion of manufacturing units, investment in research and development, and support from the government.

Thailand Tire Market Synopsis

Thailand Tire Market is witnessing tremendous growth with the growing demand for commercial vehicles in the logistics industry due to the growing manufacturing industry across the country along with the development of the electric vehicle industry in Thailand, the demand for tires is projected to grow in the forecast period. Thailand Tire Market experienced a significant decline during the pandemic owing to government-imposed lockdown measures to stop the spread of the coronavirus, which affected the supply chain, and production operations, and put a stop to all trading activities across all sectors.

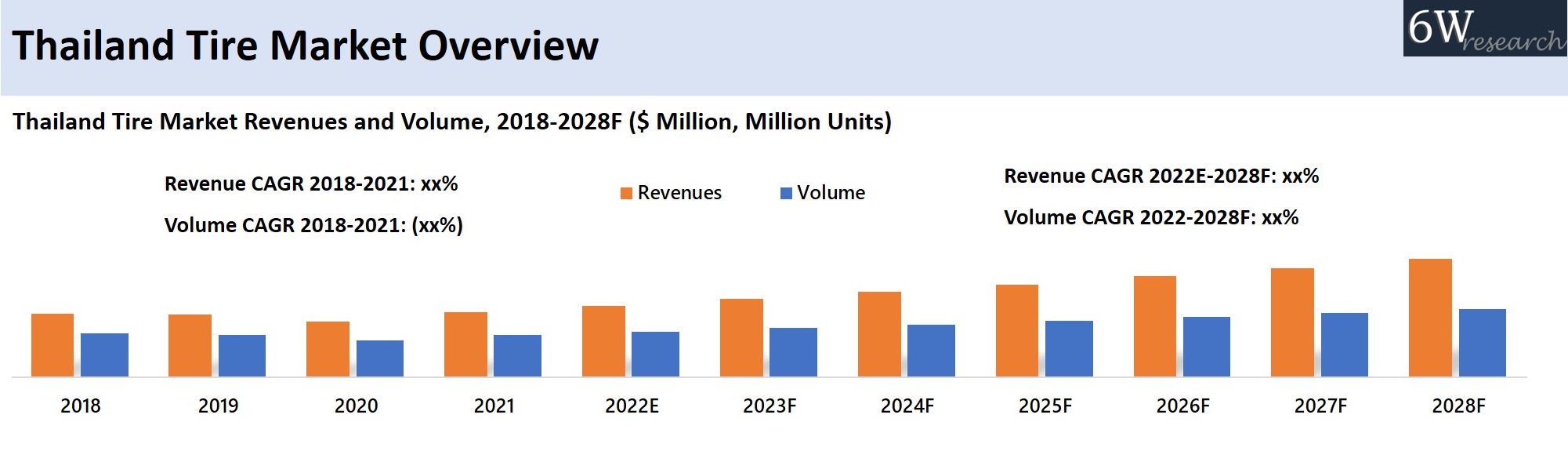

According to 6Wresearch, the Thailand Tire Market is projected to grow at a CAGR of 8.8% from 2022 to 2028. Thailand Tire Market is experiencing growth owing to the country's robust automotive sector. Over the years, Thailand's automobile fleet has been expanding, and the transportation infrastructure in the country is developing with extensive construction projects. OEMs are increasing their manufacturing & assembling facility capacity to serve the tire market owing to the growing demand of tires from the replacement segment. Moreover, the Thailand Tire Industry is expected to grow significantly in the forecast period as the demand for commercial vehicles has been growing for logistic proposes owing to rising manufacturing output and the growing e-commerce sector. However, Thailand tire industry would be hampered by the anti-dumping duties and regulatory framework which would affect the production of raw materials, i.e., rubber latex for the tire industry and the production of tires respectively in the country over the coming years.

Market by Vehicle Types

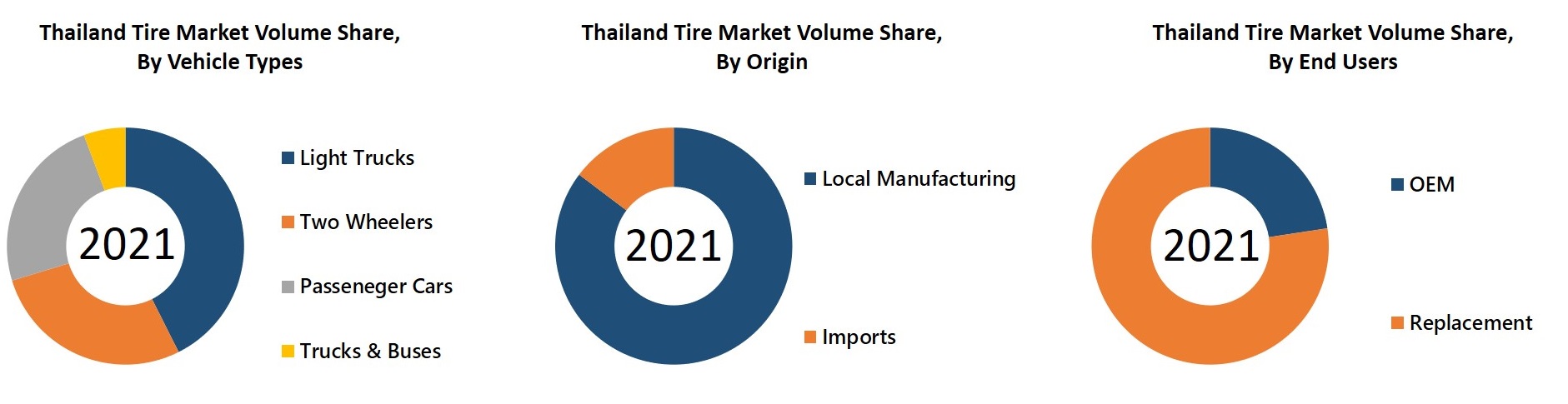

Light trucks accounted for the majority of vehicles produced in Thailand over the years, and the nation is the top exporter of these trucks. Also, consumers are shifting from 2-wheelers to 4-wheelers, especially pickup trucks.

Market by Origin

Thailand is one of the major producers of rubber in the world, many tire OEMs have set up their production bases in the country as the availability of raw materials is easy due to which local manufacturing of tires would continue to grow in the forecast period.

Market by End-Users

The replacement segment is expected to show the highest growth in the Thailand Tire Market in the coming years on the back of the continuous expansion of the automobile fleet, which would continue to fuel the replacement demand for tires in the forthcoming period.

COVID-19 impact on Thailand Tire Market

The COVID-19 pandemic has severely impacted the tire industry in Thailand. The pandemic resulted in a decreasing demand for tires due to the suspension of manufacturing activities and reduced consumer spending capacity. Moreover, the outburst caused disruptions in the supply chain which makes it difficult for tire manufacturers to access the raw materials to produce tires. Due to the pandemic, manufacturers have had to implement measures to protect their workers and reduce the spread of the virus which led to an increase in production costs.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2022

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Thailand Tire Market Overview

- Historical Data and Forecast of Thailand Tire Market Volume and Revenues, for the Period 2018-2028F

- Historical Data and Forecast of Thailand Tire Market Volume and Revenues, By Vehicle Types, for the Period 2018-2028F

- Historical Data and Forecast of Thailand Tire Market Volume, By Types, for the Period 2018-2028F

- Historical Data and Forecast of Thailand Tire Market Volume, By Origin, for the Period 2018-2028F

- Historical Data and Forecast of Thailand Tire Market Volume and Revenues, By End Users, for the Period 2018-2028F

- Impact of COVID-19 on the Thailand Tire Market

- Market Drivers, Restraints

- Market Trends

- Market Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Market Competitive Landscape

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Vehicle Types

- Truck and Bus

- Passenger Cars

- Two-Wheeler

- Light Trucks

By Origin

- Local Manufacturing

- Imports

By End-Users

- OEM

- Replacement

By Types

- Radial

- Bias

Thailand Tire Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Thailand Tire Market Overview |

| 3.1. Thailand Tire Market Revenues and Volume, 2018 - 2028F |

| 3.2. Thailand Tire Market - Industry Life Cycle |

| 3.3. Thailand Tire Market - Porter's Five Forces |

| 4. Thailand Tire Market - Impact Analysis of COVID-19 |

| 5. Thailand Tire Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.2.1 Increasing automotive sales in Thailand |

| 5.2.2 Growth in construction and infrastructure projects leading to higher demand for commercial vehicles |

| 5.2.3 Rise in consumer awareness towards road safety and vehicle maintenance |

| 5.3 Market Restraints |

| 6. Thailand Tire Market Trends |

| 7. Thailand Tire Market Overview, By Vehicle Types |

| 7.1. Thailand Tire Market Volume and Revenue Share, By Vehicle Types, 2021 & 2028F |

| 7.2. Thailand Tire Market Volume and Revenues, By Vehicle Types, 2018 - 2028F |

| 8. Thailand Tire Market Overview, By Vehicle Types |

| 8.1. Thailand Tire Market Volume Share and Volume, By Origin, 2018 - 2028F |

| 8.2. Thailand Tire Market Volume Share and Volume, By Origin – By Vehicle Types, 2018 - 2028F |

| 9. Thailand Tire Market Overview, By End User |

| 9.1. Thailand Tire Market Volume and Revenues Share, By End User, 2021 & 2028F |

| 9.2. Thailand Tire Market Volume and Revenues, By End User, 2018-2028F |

| 9.2. Thailand Tire Market Volume and Revenues, By End User – By Vehicle Types, 2018-2028F |

| 10. Thailand Tire Market Overview, By Types |

| 10.1. Thailand Trucks & Buses Tire Market Volume and Volume Share, By Types |

| 10.2. Thailand Light Tire Market Volume and Volume Share, By Types |

| 11. Thailand Tire Market Key Performance Indicators |

| 11.1 Average selling price of tires in Thailand |

| 11.2 Number of new vehicle registrations in the country |

| 11.3 Percentage of tires sold meeting safety standards |

| 11.4 Investment in RD for tire technology |

| 11.5 Adoption rate of eco-friendly tires in the market |

| 12. Thailand Tire Market Opportunity Assessment |

| 12.1. Thailand Tire Market Opportunity Assessment, By Origin, 2028F |

| 12.2. Thailand Tire Market Opportunity Assessment, By Vehicle Types, 2028F |

| 12.3. Thailand Tire Market Opportunity Assessment, By End User, 2028F |

| 13. Thailand Tire Market-Competitive Landscape |

| 13.1 Thailand Tire Market Revenue Ranking, By Companies, 2021 |

| 13.2 Thailand Tire Market Competitive Benchmarking, By Technical Parameters |

| 13.3 Thailand Tire Market Competitive Benchmarking, By Operating Parameters |

| 14. Company Profiles |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

| 1. Thailand Tire Market Revenues and Volume, 2018-2028F ($ Million, Million Units) |

| 2. Thailand Commercial Vehicles Sales and Production Volume, 2016-2021 (Thousand Units) |

| 3. Thailand Proportion of Transportation, 2021 |

| 4. Thailand EV Production Target 2025F-2035F (Million Units) |

| 5. Thailand Zero-emission Vehicles Production Target,2030 (Units) |

| 6. Thailand Tire Market Volume Share, By Origin, 2021 & 2028F |

| 7. Thailand Vehicles Production, 2017-2021 (Thousand Units) |

| 8. Thailand Number of New Vehicle Registration, 2017-2021 (Million Units) |

| 9. Thailand Tire Market Volume Share, By Vehicle Types, 2021 & 2028F |

| 10. Thailand Tire Market Revenue Share, By Vehicle Types, 2021 & 2028F |

| 11. Thailand Tire Market Volume Share, By End User, 2021 & 2028F |

| 12. Thailand Tire Market Revenue Share, By End User, 2021 & 2028F |

| 13. Thailand Tire Market Volume Share, By Origin, 2021 & 2028F |

| 14. Thailand Trucks & Buses Tire Market Volume Share, By Types, 2021 & 2028F |

| 15. Thailand Light Truck Tire Market Volume Share, By Types, 2021 & 2028F |

| 16. Thailand Automotive Sales, By Vehicle Types, 2021 & 2022 (Hundred Thousand Units) |

| 17. Number of Road, Highway and Expressway projects under the PPP Plan, 2020 |

| 18. Thailand Tire Market Opportunity Assessment, By Origin, 2028F (Million Units) |

| 19. Thailand Tire Market Opportunity Assessment, By End Users, 2028F (Million Units) |

| 20. Thailand Tire Market Opportunity Assessment, By Vehicle Types, 2028F (Million Units) |

| 21. Thailand Tire Market Revenue Share, By Companies, 2021 |

| List of Tables |

| 1. Thailand Tire Market Volume, By Vehicle Types, 2018-2028F (Million Units) |

| 2. Thailand Tire Market Revenues, By Vehicle Types, 2018-2028F ($ Million) |

| 3. Thailand Tire Market Volume, By End User, 2018-2028F (Million Units) |

| 4. Thailand Tire Market Revenues, By End User, 2018-2028F ($ Million) |

| 5. Thailand OEM Tire Market Volume, By Vehicle Type 2018-2028F (Million Units) |

| 6. Thailand Replacement Tire Market Volume, By Vehicle Type 2018-2028F (Million Units) |

| 7. Thailand Tire Market Volume, By Origin, 2018-2028F (Million Units) |

| 8. Thailand Locally Manufactured Tire Market Volume, By Vehicle Type 2018-2028F (Million Units) |

| 9. Thailand Imported Tire Market Volume, By Vehicle Type 2018-2028F (Million Units) |

| 10. Thailand Trucks & Buses Tire Market Volume, By Types, 2018-2028F (Million Units) |

| 11. Thailand Light Truck Tire Market Volume, By Types, 2018-2028F (Million Units) |

| 12. Thailand Automotive Production Volume, By Vehicle Types, 2021 & 2022 (Hundred Thousand Units) |

| 13. High Priority Road, Highway and Expressway Projects under the PPP Plan, 2020 |

Market Forecast By Origin (Local Manufacturing and Imports), By Types (Radial Tires and Bias Tires), By End Users (OEM and Replacement), By Vehicle Types (Trucks and Bus, Light Trucks, Two-Wheelers and Passenger Cars), and Competitive Landscape.

| Product Code: ETC001388 | Publication Date: Apr 2022 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 80 | No. of Figures: 34 | |

Thailand Tire Market has witnessed robust growth in tire sales during the past few years on account of a rising automotive fleet, growing middle-income population, developing transportation infrastructure, and rising automotive exports in the countries. The country is the export hub for tires in the South East Asia region.

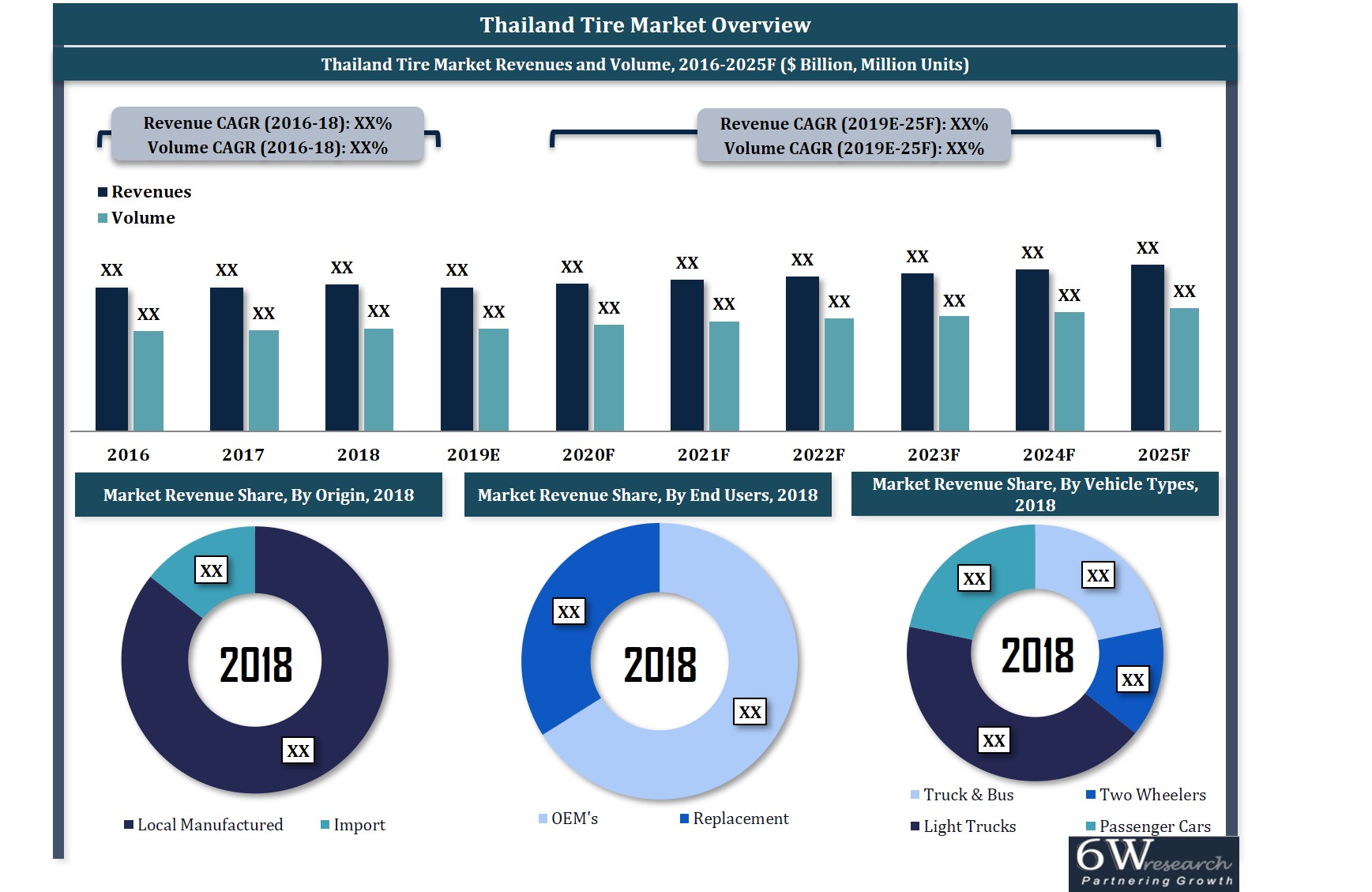

According to 6Wresearch, Thailand Tire Market size is projected to grow at a CAGR of 2.5% during 2019-2025. Steady automotive manufacturing driven by rising vehicle exports would present favorable opportunities for the Thailand Tire Market Growth during the forecast period. Radial tires are the key revenue-generating segment in the overall tire market, owing to high installations of radial tires in vehicles due to their better puncture resistance, flexible sidewalls, and lower life-cycle cost.

Passenger car tires are the leading revenue-generating segment in the overall Thailand tire market Revenue owing to an increase in passenger car fleet size and the establishment of new automobile manufacturers in the country. The majority of the tire brands have a manufacturing facility in the country due to favorable trade policies by the government. The trade war between USA and China, along with the ease of availability of raw materials, has made Thailand a top destination for tire companies to set up their base of operation. Additionally, the majority of the output in the country produced is for export rather than local consumption.

Development of transportation infrastructure coupled with increasing demand for tires owing to rising manufacturing of vehicles is adding to the Thailand Tire Market Share. Moreover, emerging manufacturers and plants in order to expand the automobile industry are further proliferating the growth of the market.

Thailand tire market report comprehensively covers the Thailand tire market by origin, types, vehicle types, and end-users. Thailand tire market outlook report provides an unbiased and detailed analysis of the ongoing Thailand tire market trends, opportunities/high growth areas, and market drivers which would help the stakeholders device and align their market strategies according to the current and future market dynamics.

Key highlights of the report

- Thailand Tire Market Overview

- Thailand Tire Market Outlook

- Thailand Tire Market Forecast

- Historical Data of Thailand Tire Market Revenues & Volume for the Period 2016-2018

- Thailand Tire Market Size and Thailand Tire Market Forecast of Revenues and Volume, Until 2025

- Historical Data of Thailand Tire Market Revenues & Volume for the Period 2016-2018, By Origin

- Market Size & Forecast of Thailand Tire Market Revenues & Volume until 2025F, By Origin

- Historic Data of Thailand Tire Market Revenues & Volume for the Period 2016-2018, By Vehicle Type

- Market Size & Forecast of Thailand Tire Market Revenues & Volume until 2025F, By Vehicle Types

- Historical Data of Thailand Tire Market Revenues & Volume for the Period 2016-2018, By End Users

- Market Size & Forecast of Thailand Tire Market Revenues & Volume until 2025F, By End Users

- Historical Data of Thailand Tire Market Revenues & Volume for the Period 2016-2018, By Types§ Market Size & Forecast of Thailand Tire Market Revenues & Volume until 2025F, By Types

- Thailand Tire Market Drivers and Restraints

- Thailand Tire Market Trends and Industry Life Cycle

- Thailand Tire Market Porter’s Five Force Analysis

- Thailand Tire Market Opportunity Assessment

- Thailand Tire Market Share, By Regions

- Thailand Tire Market Share, By Companies

- Thailand Tire Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The Thailand tire market report provides a detailed analysis of the following market segments:

By Origin

- Local Manufacturing

- Imports

By Vehicle Types

- Truck and Bus Tires

- Light Truck Tires

- Passenger Car Tires

- Two-Wheeler Tires

By End Users

- OEM (Original Equipment Manufacturer)

- Replacement

By Types

- Radial Tires

- Bias Tires

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero