Turkey Bread Market (2025-2031) | Outlook, Trends, Growth, Companies, Size, Share, Industry, Analysis, Forecast, Value & Revenue

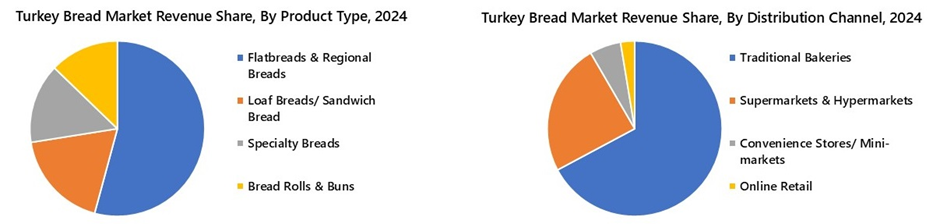

Market Forecast By Product Type (Loaf Breads/ Sandwich bread, Flatbreads & Regional Breads, Bread rolls & Buns, Specialty Breads (Artisanal Sourdough, Baguette, Gluten-Free, etc.)), By Ingredient Type (Wheat Bread, Rye Bread, Multigrain & Seeded Breads, Others (Corn Bread, Barley Bread, Potato Bread, etc.)), By Distribution Channel (Traditional Bakeries, Supermarkets & Hypermarkets, Convenience Stores/ Mini-markets, Online Retail) And Competitive Landscape

| Product Code: ETC023878 | Publication Date: Oct 2020 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 67 | No. of Figures: 20 | No. of Tables: 4 |

Turkey Bread Market Size, Growth Rate, and Competitive Analysis

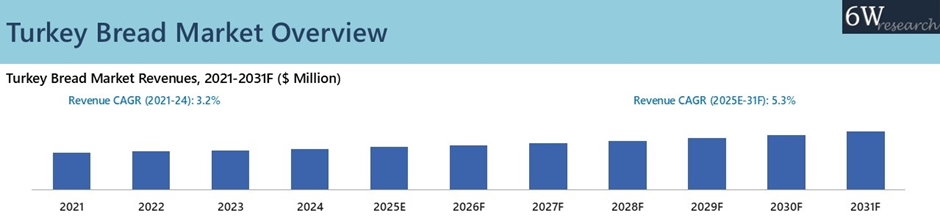

The Turkey Bread Market was valued at around USD 11,826 million in 2024, registered a CAGR of around 3.2% and is expected to reach approximately USD 16,800.7 million by 2031 at a CAGR of 5.3% during the forecast period.

Here is the list of top companies in the Turkey Bread Market:

- Grupo Bimbo - A leading global bakery company headquartered in Mexico, known for its extensive range of packaged breads, pastries, and baked goods.

- Ankara Halk Ekmek Fabrikası - A state-supported Turkish bakery organization providing affordable and high-quality bread products to meet the daily consumption needs of Ankara’s residents.

- Backhaus Professional Solutions – A Turkish bakery brand specializing in premium-quality bread and pastry products, catering to both retail consumers and the hospitality sector.

Topics Covered in Turkey Bread Market Report

Turkey Bread Market Report thoroughly covers the market by product type, by ingredient type and by distribution channel. Turkey Bread Market Outlook report provides an unbiased and detailed analysis of the ongoing Turkey Bread Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Turkey Bread Market Synopsis

The Turkey bread market has experienced growth, driven by rising consumer demand, population growth, and the expansion of modern retail and e-commerce channels. With the population increasing from 2022 to 2024, demand for bread, a staple in Turkish households, has grown significantly. The modern grocery retail network has strengthened, exemplified by BIM expanding stores in 2023 from 2022, while Migros added some outlets over the same period. This expansion, coupled with the growing adoption of online grocery platforms—where Turkish internet users shop for groceries weekly—has enhanced the visibility, convenience, and accessibility of bread, further boosting market growth. Additionally, during festive periods such as Ramadan and Eid, stores offer promotions and loyalty programs, boosting brand visibility and repeat purchases. Combined with urbanization and modern lifestyles, these initiatives drive growth specifically in Turkey’s bread market.

According to 6Wresearch, Turkey Bread Market is forecasted to expand at a CAGR of 5.3% in revenue from 2025 to 2031. The Turkey bread market is poised for significant growth in the coming years, driven by the country’s recovering tourism industry, which is fueling demand for traditional staple products across the HoReCa sector. Turkey’s tourism rebound is evident, with total revenue in Q1 2025 rising as compared to Q1 2024. This growth is further supported by the launch of key hospitality projects, including the Coffee Factory outlet in Istanbul (early 2025), Corendon Hotels & Resorts (completion by 2026), and DoubleTree by Hilton Bursa Nilüfer (planned for 2026).

Simultaneously, with the population projected to reach more by 2030, urban consumers are increasingly relying on convenient packaged breads to meet their daily needs. Products such as loaf breads, flatbreads, and multigrain & seeded breads are gaining popularity across modern retail channels, including supermarkets, convenience stores, and online platforms. The combined effect of rising tourism, expanding hospitality infrastructure, and growing urban demand is expected to sustain robust growth for both traditional and specialty breads in Turkey, positioning the market for continued expansion over the forecast period.

Market Segmentation By Product Type

The specialty bread segment is projected to witness the highest growth between 2025 and 2031, driven by evolving consumer tastes and the rising demand for premium, artisanal, and functional bread varieties. Increasing interest in sourdough, rye, and gluten-free options, along with a growing café culture and expanding foodservice channels, would boost category momentum.

Market Segmentation By Ingredient Type

The multigrain and seeded bread segment is expected to record the highest growth between 2025 and 2031, driven by rising health consciousness and demand for fiber-rich, nutrient-dense bakery options. Growing preference for whole grain, chia, and flaxseed varieties, along with expanding product innovation by major brands, would fuel rapid adoption.

Market Segmentation By Distribution Channel

The online retail segment is projected to witness the fastest growth between 2025 and 2031, supported by Turkey’s booming e-commerce ecosystem, rising smartphone penetration, and growing preference for convenient grocery shopping. As consumers increasingly seek fresh, healthy, and specialty bread options through digital channels, online retail is set to record robust growth.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Turkey Bread Market Overview

- Turkey Bread Market Outlook

- Turkey Bread Market Forecast

- Historical Data and Forecast of Turkey Bread Market Revenues, for the Period 2021-2031F

- Historical Data and Forecast of Turkey Bread Market Revenues, By Product Type, for the Period 2021-2031F

- Historical Data and Forecast of Turkey Power Breads Market Revenues, By Ingredient Type, for the Period 2021-2031F

- Historical Data and Forecast of Turkey Distribution Breads Market Revenues, By Distribution Channel, for the Period 2021-2031F

- Turkey Bread Market Key Performance Indicators

- Turkey Bread Market Opportunity Assessment

- Turkey Bread Market Competitive Landscape

- Turkey Bread Market Revenue Ranking, By Top 3 Companies

- Market Competitive Benchmarking

- Company Profiles

- Turkey Bread Market Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Product Type

- Loaf Breads/ Sandwich bread

- Flatbreads & Regional Breads

- Bread rolls & Buns

- Specialty Breads (Artisanal Sourdough, Baguette, Gluten-Free, etc.)

By Ingredient Type

- Wheat Bread

- Rye Bread

- Multigrain & Seeded Breads

- Others (Corn Bread, Barley Bread, Potato Bread, etc.)

By Distribution Channel

- Traditional Bakeries

- Supermarkets & Hypermarkets

- Convenience Stores/ Mini-markets

- Online Retail

Turkey Bread Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Global Bread Market Overview |

| 3.1. Global Bread Market Revenues, 2021 - 2031F |

| 4. Turkey Bread Market Overview |

| 4.1. Turkey Bread Market - Macroeconomic Indicators |

| 4.2. Turkey Bread Market Revenues, 2021 - 2031F |

| 4.3. Turkey Bread Market - Industry Life Cycle |

| 274.4. Turkey Bread Market - Porter's Five Forces |

| 5. Turkey Bread Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.3. Market Restraints |

| 6. Turkey Bread Market Trends and Evolution |

| 7. Turkey Bread Market Overview, By Product Type |

| 7.1 Turkey Bread Market Revenue Share, By Product Type, 2024 & 2031F |

| 7.1.1. Turkey Bread Market Revenues, By Loaf Breads/ Sandwich bread, 2021-2031F |

| 7.1.2. Turkey Bread Market Revenues, By Flatbreads & Regional Breads, 2021-2031F |

| 7.1.3. Turkey Bread Market Revenues, By Bread rolls & Buns, 2021-2031F |

| 7.1.4. Turkey Bread Market Revenues, By Specialty Breads, 2021-2031F |

| 8. Turkey Bread Market Overview, By Ingredient Type |

| 8.1 Turkey Bread Market Revenue Share, By Ingredient Type, 2024 & 2031F |

| 8.1.1. Turkey Bread Market Revenues, By Wheat Bread, 2021-2031F |

| 8.1.2. Turkey Bread Market Revenues, By Rye Bread, 2021-2031F |

| 8.1.3. Turkey Bread Market Revenues, By Multigrain & Seeded Breads, 2021-2031F |

| 8.1.4. Turkey Bread Market Revenues, By Others, 2021-2031F |

| 9. Turkey Bread Market Overview, By Distribution Channel |

| 9.1 Turkey Bread Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| 9.1.1. Turkey Bread Market Revenues, By Traditional Bakeries, 2021-2031F |

| 9.1.2. Turkey Bread Market Revenues, By Supermarkets & Hypermarkets, 2021-2031F |

| 9.1.3. Turkey Bread Market Revenues, By Convenience Stores/ Mini-markets, 2021-2031F |

| 9.1.4. Turkey Bread Market Revenues, By Online Retail, 2021-2031F |

| 10. Turkey Bread Market Key Performance Indicators |

| 11. Turkey Bread Market Opportunity Assessment |

| 11.1. Turkey Bread Market Opportunity Assessment, By Product Type, 2031F |

| 11.2. Turkey Bread Market Opportunity Assessment, By Ingredient Type, 2031F |

| 11.3. Turkey Bread Market Opportunity Assessment, By Distribution Channel, 2031F |

| 12. Turkey Bread Market Competitive Landscape |

| 12.1. Turkey Bread Market Revenue Ranking, By Top 3 Companies, CY2024 |

| 12.2. Turkey Bread Market Competitive Benchmarking, By Operating Parameters |

| 12.3. Turkey Bread Market Competitive Benchmarking, By Technical Parameters |

| 13. Company Profiles |

| 13.1. Grupo Bimbo |

| 13.2. La Lorraine Bakery Group NV |

| 13.3. Unmaş Unlu Mamüller Sanayi ve Ticaret A.Ş. |

| 13.4. Donuk Fırıncılık Ürünleri A.Ş |

| 13.5. Ankara Halk Ekmek Fabrikası |

| 13.6. Ekmek Unlu Gıda |

| 13.7. Backhaus Professional Solutions |

| 13.8. ÖZMA Unlu Mamuller Gıda San. Ltd. Şti., |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. Global Bread Market Revenues, 2021-2031F ($ Billion) |

| 2. Turkey Real GDP Growth, 2021-2025E, (%) |

| 3. Population Growth in Turkey, 2021-2026F & 2030F, (in Million) |

| 4. Turkey Inflation Rate (Average Consumer Prices, 2021-2024, (in %) |

| 5. Turkey Bread Market Revenues, 2021-2031F ($ Million) |

| 6. Share of Top 10 Organized Grocery Retailers in Turkey, 2023, (in %) |

| 7. Number of Grocery Outlets of Leading Retail Chains in Turkey, 2022-2023 |

| 8. Turkey Mean Annual Household Disposable Income |

| 9. Turkey Rise in Urbanization, 2021 – 2024, (in Million) |

| 10. Turkey Bread Market Revenue Share, By Product Type, 2023 & 2030F |

| 11. Turkey Bread Market Revenue Share, By Ingredient Type, 2023 & 2030F |

| 12. Turkey Bread Market Revenue Share, By Distribution Channel, 2023 & 2030F |

| 13. Sales of Food Retailers by Channel in Turkey, 2023, (in $ Million) |

| 14. Turkey Food Retail Turnover, 2021-2023, (in $ Billion) |

| 15. Turkey E-commerce Volume, By Sector, 2024, (in $ Billion) |

| 16. Turkey Tourist Arrivals, 2021-2024, (in Million) |

| 17. Turkey Bread Market Opportunity Assessment, By Product Type, 2031F |

| 18. Turkey Bread Market Opportunity Assessment, By Ingredient Type, 2031F |

| 19. Turkey Bread Market Opportunity Assessment, By Distribution Channel, 2031F |

| 20. Turkey Bread Market Revenue Ranking, By Top 3 Companies, 2024 |

| List of Tables |

| 1. Turkey Bread Market Revenues, By Product Type, 2021-2031F ($ Million) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero