Turkey Gas turbine Market Outlook | Forecast, Analysis, Share, COVID-19 IMPACT, Industry, Value, Trends, Growth, Revenue, Size & Companies

Market Forecast By Technology (Open Cycle, Combined Cycle), By Application (Power Generation, Oil & Gas, Other), By Design Type (Heavy Duty, Aeroderivative), By Capacity (?200 MW, >200 MW) And Competitive Landscape

| Product Code: ETC089817 | Publication Date: Jun 2021 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Shubham Padhi | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

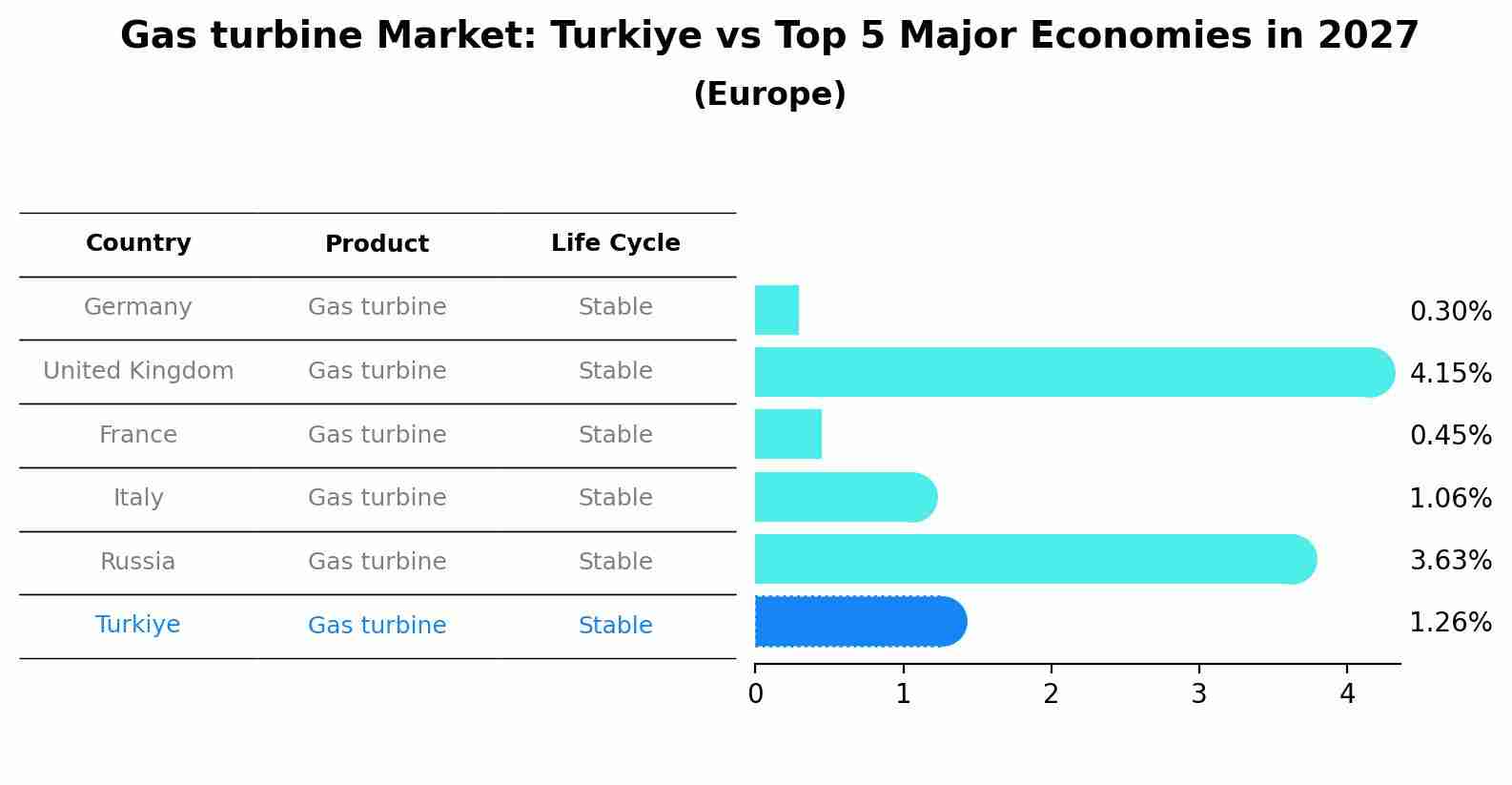

Gas turbine Market: Turkiye vs Top 5 Major Economies in 2027 (Europe)

Turkiye's Gas turbine market is anticipated to experience a stable growth rate of 1.26% by 2027, reflecting trends observed in the largest economy Germany, followed by United Kingdom, France, Italy and Russia.

Turkey Gas turbine Market Overview

The Turkey gas turbine market is a growing sector driven by increasing energy demand, industrial development, and government initiatives to diversify the energy mix. Key players in the market include Siemens AG, General Electric Company, and Mitsubishi Hitachi Power Systems, among others. The market is witnessing a shift towards more efficient and environmentally friendly gas turbine technologies to meet stringent emission regulations. Combined cycle power plants are increasingly being adopted in Turkey to enhance power generation efficiency. Additionally, the market is experiencing a trend towards digitization and automation to improve operational efficiency and reliability. As Turkey aims to reduce its dependence on imported energy sources, the gas turbine market is expected to witness further growth and innovation in the coming years.

Turkey Gas turbine Market Trends

The Turkey gas turbine market is experiencing several key trends. One major trend is the increasing demand for more efficient and environmentally friendly gas turbines to meet the country`s energy needs while reducing emissions. Another notable trend is the growing adoption of combined cycle power plants, which offer higher efficiency and lower operational costs compared to traditional thermal power plants. Additionally, there is a rising interest in flexible and modular gas turbine technologies to accommodate the fluctuating energy demands of the grid. The market is also witnessing a shift towards digitalization and predictive maintenance solutions to improve operational efficiency and reduce downtime. Overall, these trends indicate a shift towards more sustainable and technologically advanced solutions in the Turkey gas turbine market.

Turkey Gas turbine Market Challenges

In the Turkey gas turbine market, several challenges are being faced. These include regulatory uncertainties and changing government policies affecting the energy sector, which can create instability and impact investment decisions. Additionally, competition from other energy sources such as renewables and the need for significant capital investments in gas turbine technology pose challenges for market players. Fluctuating energy prices and geopolitical tensions in the region also contribute to the volatility of the market. Furthermore, issues related to environmental concerns and the need for sustainable energy solutions are becoming increasingly important, requiring gas turbine companies to innovate and adapt to meet stringent emissions standards and consumer preferences for cleaner energy sources. Overall, the Turkey gas turbine market faces a complex and evolving landscape that necessitates strategic planning and agility to navigate successfully.

Turkey Gas turbine Market Investment Opportunities

The Turkey gas turbine market presents a promising investment opportunity due to the country`s increasing energy demand, growing industrial sector, and government initiatives to diversify its energy mix. With a focus on reducing reliance on imported energy sources, there is a push towards investing in domestic gas turbine technology for power generation. Additionally, Turkey`s strategic location as an energy hub between Europe and Asia further enhances the market potential. Investors can explore opportunities in supplying gas turbines for power plants, industrial applications, and combined heat and power projects. Furthermore, the growing interest in renewable energy integration and energy efficiency improvements offer avenues for investment in innovative gas turbine technologies that align with Turkey`s energy transition goals.

Turkey Gas turbine Market Government Policy

The Turkish government has implemented various policies to support the growth of the gas turbine market in the country. These policies include incentives for renewable energy projects, such as feed-in tariffs and tax benefits, to promote the use of gas turbines for power generation. Additionally, there are regulations in place to encourage the development of more efficient and environmentally friendly gas turbine technologies. The government also supports research and development initiatives in the gas turbine sector to enhance domestic capabilities and competitiveness. Overall, the government`s policies aim to increase the use of gas turbines in Turkey`s energy mix, improve energy security, and reduce carbon emissions in line with international commitments.

Turkey Gas turbine Market Future Outlook

The Turkey Gas Turbine Market is expected to witness steady growth in the coming years driven by increasing energy demand, industrial expansion, and government initiatives to improve energy efficiency. The market is likely to benefit from investments in renewable energy projects, such as wind and solar power, which will complement the gas turbine sector. Additionally, the modernization of existing power plants and the need for reliable and efficient energy sources are anticipated to propel market growth. Technological advancements, such as the development of more efficient and environmentally friendly gas turbines, are also expected to contribute to the market`s expansion. Overall, the Turkey Gas Turbine Market is poised for growth with opportunities for both domestic and international players to capitalize on the country`s evolving energy landscape.

Key Highlights of the Report:

- Turkey Gas turbine Market Outlook

- Market Size of Turkey Gas turbine Market, 2021

- Forecast of Turkey Gas turbine Market, 2027

- Historical Data and Forecast of Turkey Gas turbine Revenues & Volume for the Period 2018 - 2027

- Turkey Gas turbine Market Trend Evolution

- Turkey Gas turbine Market Drivers and Challenges

- Turkey Gas turbine Price Trends

- Turkey Gas turbine Porter's Five Forces

- Turkey Gas turbine Industry Life Cycle

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By Technology for the Period 2018 - 2027

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By Open Cycle for the Period 2018 - 2027

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By Combined Cycle for the Period 2018 - 2027

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By Application for the Period 2018 - 2027

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By Power Generation for the Period 2018 - 2027

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By Oil & Gas for the Period 2018 - 2027

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By Other for the Period 2018 - 2027

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By Design Type for the Period 2018 - 2027

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By Heavy Duty for the Period 2018 - 2027

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By Aeroderivative for the Period 2018 - 2027

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By Capacity for the Period 2018 - 2027

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By 200 MW for the Period 2018 - 2027

- Historical Data and Forecast of Turkey Gas turbine Market Revenues & Volume By >200 MW for the Period 2018 - 2027

- Turkey Gas turbine Import Export Trade Statistics

- Market Opportunity Assessment By Technology

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Design Type

- Market Opportunity Assessment By Capacity

- Turkey Gas turbine Top Companies Market Share

- Turkey Gas turbine Competitive Benchmarking By Technical and Operational Parameters

- Turkey Gas turbine Company Profiles

- Turkey Gas turbine Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Turkey Gas Turbine Market Overview |

| 3.1 Turkey Country Macro Economic Indicators |

| 3.2 Turkey Gas Turbine Market Revenues & Volume, 2021 & 2027F |

| 3.3 Turkey Gas Turbine Market - Industry Life Cycle |

| 3.4 Turkey Gas Turbine Market - Porter's Five Forces |

| 3.5 Turkey Gas Turbine Market Revenues & Volume Share, By Technology, 2021 & 2027F |

| 3.6 Turkey Gas Turbine Market Revenues & Volume Share, By Application, 2021 & 2027F |

| 3.7 Turkey Gas Turbine Market Revenues & Volume Share, By Design Type, 2021 & 2027F |

| 3.8 Turkey Gas Turbine Market Revenues & Volume Share, By Capacity, 2021 & 2027F |

| 4 Turkey Gas Turbine Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing energy demand in Turkey |

| 4.2.2 Government initiatives to promote clean energy sources |

| 4.2.3 Growth in industrial sector leading to higher demand for power generation solutions |

| 4.2.1 Growing electricity demand across industrial and residential sectors |

| 4.2.2 Government initiatives toward cleaner and efficient energy technologies |

| 4.2.3 Increased focus on energy diversification and grid reliability |

| 4.2.4 Technological advancements in turbine efficiency and modular designs |

| 4.2.5 Growth in oil & gas exploration and production activities |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating prices of natural gas |

| 4.3.2 Competition from alternative energy sources like solar and wind power |

| 4.3.3 Regulatory challenges and policy uncertainties |

| 4.3.1 High capital and maintenance costs of gas turbines |

| 4.3.2 Dependence on natural gas supply and price volatility |

| 4.3.3 Competition from renewable energy sources |

| 4.3.4 Environmental concerns regarding emissions and thermal pollution |

| 4.3.5 Delays in project approvals and long construction timelines |

| 4.4 Market KPI |

| 4.4.1 Installed gas turbine capacity (MW) |

| 4.4.2 Capacity utilization rate (%) |

| 4.4.3 Gas turbine operating efficiency (%) |

| 4.4.4 Average cost per MW installed (USD) |

| 4.4.5 Share of gas turbines in Turkey’s total power generation (%) |

| 5 Turkey Gas Turbine Market Trends |

| 6 Turkey Gas Turbine Market, By Types |

| 6.1 Turkey Gas Turbine Market, By Technology |

| 6.1.1 Overview and Analysis |

| 6.1.2 Turkey Gas Turbine Market Revenues & Volume, By Technology, 2018 - 2027F |

| 6.1.3 Turkey Gas Turbine Market Revenues & Volume, By Open Cycle, 2018 - 2027F |

| 6.1.4 Turkey Gas Turbine Market Revenues & Volume, By Combined Cycle, 2018 - 2027F |

| 6.2 Turkey Gas Turbine Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Turkey Gas Turbine Market Revenues & Volume, By Power Generation, 2018 - 2027F |

| 6.2.3 Turkey Gas Turbine Market Revenues & Volume, By Oil & Gas, 2018 - 2027F |

| 6.2.4 Turkey Gas Turbine Market Revenues & Volume, By Other, 2018 - 2027F |

| 6.3 Turkey Gas Turbine Market, By Design Type |

| 6.3.1 Overview and Analysis |

| 6.3.2 Turkey Gas Turbine Market Revenues & Volume, By Heavy Duty, 2018 - 2027F |

| 6.3.3 Turkey Gas Turbine Market Revenues & Volume, By Aeroderivative, 2018 - 2027F |

| 6.4 Turkey Gas Turbine Market, By Capacity |

| 6.4.1 Overview and Analysis |

| 6.4.2 Turkey Gas Turbine Market Revenues & Volume, By ≤200 MW, 2018 - 2027F |

| 6.4.3 Turkey Gas Turbine Market Revenues & Volume, By >200 MW, 2018 - 2027F |

| 7 Turkey Gas Turbine Market Import-Export Trade Statistics |

| 7.1 Turkey Gas Turbine Market Export to Major Countries |

| 7.2 Turkey Gas Turbine Market Imports from Major Countries |

| 8 Turkey Gas Turbine Market Key Performance Indicators |

| 8.1 Capacity utilization rate of gas turbines |

| 8.2 Number of new energy projects utilizing gas turbines |

| 8.3 Investment in research and development for improving gas turbine efficiency and performance |

| 9 Turkey Gas Turbine Market - Opportunity Assessment |

| 9.1 Turkey Gas Turbine Market Opportunity Assessment, By Technology, 2021 & 2027F |

| 9.2 Turkey Gas Turbine Market Opportunity Assessment, By Application, 2021 & 2027F |

| 9.3 Turkey Gas Turbine Market Opportunity Assessment, By Design Type, 2021 & 2027F |

| 9.4 Turkey Gas Turbine Market Opportunity Assessment, By Capacity, 2021 & 2027F |

| 10 Turkey Gas Turbine Market - Competitive Landscape |

| 10.1 Turkey Gas Turbine Market Revenue Share, By Companies, 2021 |

| 10.2 Turkey Gas Turbine Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero