UAE Air Purifier Market (2020-2026) | Size, Share, Growth, Forecast, Revenue, Trends, Analysis, Outlook & COVID-19 IMPACT

Market Forecast By Technology (Type-I (HEPA + Carbon), Type-II (HEPA + Carbon + Ionizer), Type-III (HEPA + Carbon+ UV), Type-IV (HEPA + Carbon + Electrostatic), Type-V (HEPA + Carbon + Ionizer + UV + Electrostatic), Other Technologies), By Applications (Residential, Commercial, Industrial), By CADR Values (Low (Up To 250 M3/H), Medium (251 To 500 M3/H), High (Above 500 M3/H)) And Competitive Landscape

| Product Code: ETC037295 | Publication Date: Mar 2023 | Updated Date: May 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 95 | No. of Figures: 13 | No. of Tables: 15 | |

UAE Air Purifier Market Size Growth Rate

The UAE Air Purifier Market is projected to grow at a CAGR of 11.9% during 2020–2026. This strong growth is fueled by increasing air pollution due to urbanization and industrialization, heightened public health awareness, and the rising popularity of smart, sensor-equipped purifiers.

UAE Air Purifier Market | Country-Wise Share and Competition Analysis

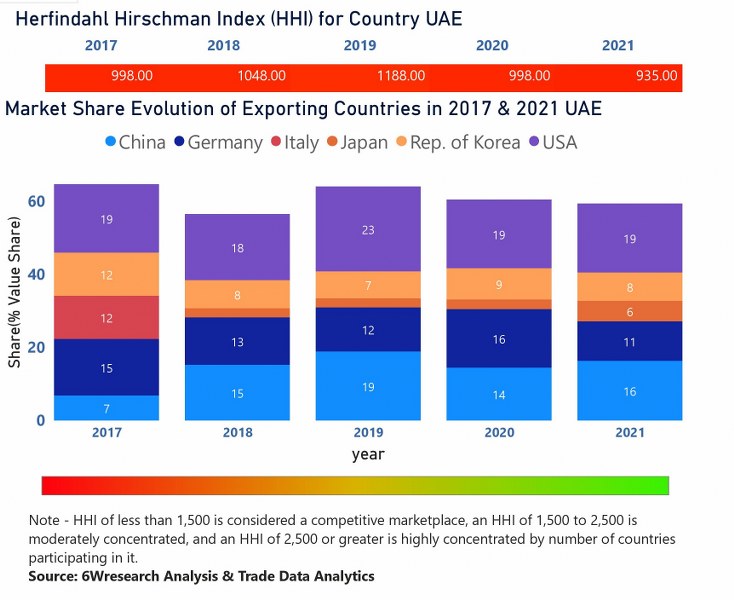

In the year 2021, the USA was the largest exporter in terms of value, followed by China. It has registered a growth of 19.76% over the previous year. While China registered a growth of 33.96% over the previous year. While in 2017 the USA was the largest exporter followed by Germany. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, the United Arab Emirates has a Herfindahl index of 998 in 2017 which signifies high competitiveness while in 2021 it registered a Herfindahl index of 935 which signifies high competitiveness in the market

![UAE Air Purifier Market | Country-Wise Share and Competition Analysis]() UAE Air Purifier Market - Export Market Opportunities

UAE Air Purifier Market - Export Market Opportunities![UAE Air Purifier Market - Export Market Opportunities]()

Topics Covered in the UAE Air Purifier Market

The UAE Air Purifier Market report thoroughly covers the market by technology, applications, and CADR values. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latest 2023 Development of the UAE Air Purifier Market

UAE Air Purifier Market has seen steady growth due to increasing concerns about indoor air quality and the health risks associated with air pollution. Some of the latest developments in the UAE air purifier market include the adoption of smart air purifiers as they are becoming popular among consumers. These devices can be controlled and monitored through a smartphone app based on the air quality data collected from built-in sensors. The demand for air purifiers in commercial settings is also growing in the UAE. Air purifier manufacturers in the UAE are investing in innovative technologies to improve the performance of their products.

The UAE air purifier industry is expected to grow in the coming years due to several growth factors which include increasing awareness about air pollution, and growing concern for health as people are becoming more health-conscious and are looking for ways to improve indoor air quality. In general, air purifiers are becoming more advanced, with innovative technologies such as HEPA filters and UV-C lights. Furthermore, with the UAE's growing urban population, the demand for air purifiers is increasing as urban areas tend to have higher levels of air pollution, making air purifiers a necessity for individuals.

UAE Air Purifier Market Synopsis

UAE Air Purifier Market is anticipated to register significant growth during the forecast period on account of deteriorating air quality due to growing urbanization, an increasing number of vehicles on roads, and an expanding industrial sector in the country. Additionally, particulate matter, which is present in high concentrations in arid, desert areas such as the United Arab Emirates, is associated with chronic respiratory diseases and increases the mortality rates of these diseases. The growing awareness among people about the harmful health effects of air pollutants would propel the demand for air purifiers in the country over the coming years.

According to 6Wresearch, the UAE Air Purifier Market size is projected to grow at a CAGR of 11.9% during 2020-2026. The air quality in the United Arab Emirates is deemed unsafe based on guidelines issued by the World Health Organization. In 2019, the PM2.5 concentration in the country was approximately 3 times above the WHO exposure recommendation of 10µg/m³. Government initiatives and corporate efforts to increase awareness about the importance of clean air quality among people would drive the demand for air purifiers in the country over the coming years. Furthermore, people in the UAE tend to spend more time indoors to avoid the heat, thereby propelling concerns about indoor air quality, which would, in turn, bolster the air purifier market in the country during the forecast period. The coronavirus pandemic is expected to restrict the growth of the air purifier market in the country in 2020, owing to supply chain disruptions, the slowdown of commercial and industrial activities, and the unwillingness of people to spend on unessential goods. However, the resumption of commercial and industrial operations, combined with increasing apprehensions among people about health and communicable diseases would drive the market recovery over the coming years. Improvement in the standard of living is also one of the major factors adding to the development of the industry. Additionally, rising awareness regarding healthy living and improving the quality of air is propelling the growth of the industry.

Market Analysis by End-user

Based on technology, Type-I air purifiers acquired the majority share in the overall market in revenue terms in 2019 and are expected to maintain their position over the coming years on account of the improved cost/efficiency ratio offered by it, compared to other technologies. Additionally, Type-I air purifiers are expected to witness considerable growth in demand, owing to the preference of people in a relatively new air purifier market to opt for entry-level products. Moreover, the demand for air purifiers from residential and commercial sectors is projected to grow substantially, on account of rising health concerns in households, as well as growing requirements for healthy working conditions in commercial spaces including hospitals and schools.

COVID-19 Impact on the UAE Air Purifier Market

The COVID-19 pandemic had a mixed impact on the UAE Air Purifier industry. COVID-19 virus had created the awareness and need for air purifiers to cease the airborne infection indoors, as people staying at home were concerned about the air quality. Hence this factor increased the demand for air purifiers, nevertheless, limited availability of air purifiers due to the disruption and delays in the product supply led to reducing the air purifiers demand and further affected the market growth by declining the air purifiers adoption rate to some extent.

Key Players in the UAE Air Purifier Market

Several key companies have gained popularity in the market by offering top-notch quality air purifiers in the country including:

- Dyson is a British technology company leading in the UAE, which offers a range of air purifiers integrated with HEPA filters and advanced air filtration technology.

- Philips is a Dutch company that supplies premium quality air purifiers with smart features like real-time air quality monitoring.

- Honeywell is an American company that provides a spectrum range of air purifiers with HEPA filters in the UAE.

- Blueair is a Swedish company that has a strong reputation in the country and offers a range of air purifiers with advanced filtration technology which includes activated carbon filters.

- Coway is a South Korean company that provides a comprehensive range of air purifiers with advanced filtration systems

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- UAE Air Purifier Market Overview

- UAE Air Purifier Market Outlook

- UAE Air Purifier Market Forecast

- UAE Air Purifier Market Size

- Historical Data of UAE Air Purifier Market Revenues and Volume for the period, 2017-2019

- UAE Air Purifier Market Forecast of Revenues and Volume, Until 2026

- Historical Data of UAE Air Purifier Market Revenues and Volume for the period, By Technology, 2017-2019

- Forecast of UAE Air Purifier Market Revenues and Volume, By Technology, Until 2026

- Historical Data of UAE Air Purifier Market Revenues and Volume for the period, By CADR Values, 2017-2019

- Forecast of UAE Air Purifier Market Revenues and Volume, By CADR Values, Until 2026

- Historical Data of UAE Air Purifier Market Revenues for the period, By Applications, 2017-2019

- Forecast of UAE Air Purifier Market Revenues, By Applications, Until 2026

- UAE Air Purifier Market Outlook on Drivers and Restraints

- UAE Air Purifier Market Trends

- UAE Air Purifier Industry Life Cycle

- Porter’s Five Force Analysis

- UAE Air Purifier Market Opportunity Assessment

- UAE Air Purifier Market Revenue Share, By Company

- UAE Air Purifier Market Competitive Landscape

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Technology

- Type-I (HEPA + Carbon)

- Type-II (HEPA + Carbon + Ionizer)

- Type-III (HEPA + Carbon+ UV)

- Type-IV (HEPA + Carbon + Electrostatic)

- Type-V (HEPA + Carbon + Ionizer + UV + Electrostatic)

- Other Technologies

By Applications

- Residential

- Commercial

- Industrial

By CADR Values

- Low (Up To 250 M3/H)

- Medium (251 To 500 M3/H)

- High (Above 500 M3/H)

UAE Air Purifier Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. UAE Air Purifier Market Overview |

| 3.1. UAE Air Purifier Market Revenues & Volume, 2016-2026F |

| 3.5. UAE Air Purifier Market – Industry Life Cycle |

| 3.6. UAE Air Purifier Market – Porter’s Five Forces |

| 4. UAE Air Purifier Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. UAE Air Purifier Market Trends |

| 6. UAE Air Purifier Market Overview, By Technology |

| 6.1. UAE Air Purifier Market Revenue and Volume Share, By Technology, 2019 & 2026F |

| 6.2. UAE Type-I (HEPA + Carbon) Air Purifier Market Revenues and Volume, 2016-2026F |

| 6.3. UAE Type-II (HEPA + Carbon + Ionizer) Air Purifier Market Revenues and Volume, 2016-2026F |

| 6.4. UAE Type-III (HEPA + Carbon+ UV) Air Purifier Market Revenues and Volume, 2016-2026F |

| 6.5. UAE Type-IV (HEPA + Carbon + Electrostatic) Air Purifier Market Revenues and Volume, 2016-2026F |

| 6.6. UAE Type-V (HEPA + Carbon + Ionizer + UV + Electrostatic) Air Purifier Market Revenues and Volume, 2016-2026F |

| 6.7. UAE Other Technologies Air Purifier Market Revenues and Volume, 2016-2026F |

| 7. UAE Air Purifier Market Overview, By CADR Values |

| 7.1. UAE Air Purifier Market Revenue and Volume Share, By CADR Values, 2019 & 2026F |

| 7.2. UAE Low CADR Air Purifier Market Revenues and Volume, 2016-2026F |

| 7.3. UAE Medium CADR Air Purifier Market Revenues and Volume, 2016-2026F |

| 7.4. UAE High CADR Air Purifier Market Revenues Volume, 2016-2026F |

| 8. UAE Air Purifier Market Overview, By Applications |

| 8.1. UAE Air Purifier Market Revenue Share, By Applications, 2019 & 2026F |

| 8.2. UAE Residential Air Purifier Market Revenues, 2016-2026F |

| 8.3. UAE Commercial Air Purifier Market Revenues, 2016-2026F |

| 8.4. UAE Industrial Air Purifier Market Revenues, 2016-2026F |

| 9. UAE Air Purifier Market Key Performance Indicators |

| 10. UAE Air Purifier Market Product Performance Indicators |

| 11. UAE Air Purifier Market Additional Requirements |

| 11.1. UAE Key Economic Indicators |

| 11.2. UAE Business Environment |

| 11.3. UAE Air Purifier Market- COVID-19 Impact |

| 11.4. UAE Foreign Investment |

| 12. UAE Air Purifier Market Opportunity Assessment |

| 12.1. UAE Air Purifier Market Opportunity Assessment, By Technology, 2026F |

| 12.2. UAE Air Purifier Market Opportunity Assessment, By Applications, 2026F |

| 13. UAE Air Purifier Market Competitive Landscape |

| 13.1. UAE Air Purifier Market Revenue Share, By Company, 2019 |

| 13.2. UAE Air Purifier Market - Prominent Models, 2019 |

| 13.3. UAE Air Purifier Market Competitive Benchmarking, By Technical Parameters |

| 14. Company Profiles |

| 14.1. Daikin Middle East & Africa FZE |

| 14.2. Dyson Ltd. |

| 14.3. Hitachi Ltd. |

| 14.4. Panasonic Marketing Middle East & Africa FZE |

| 14.5. Royal Philips Group |

| 14.6. Samsung Gulf Electronics Co. Ltd. |

| 14.7. Sharp Middle East FZE |

| 14.8. Unilever Group |

| 14.9. Coway Co. Ltd. |

| 14.10. Xiaomi Corporation |

| 14.11. Carrier |

| 14.12. LG Electronics, Inc. |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

| 1. UAE Air Purifier Market Revenues and Volume, 2016-2026F ($ Million, Thousand Units) |

| 2. UAE Construction Sector YoY Growth Rate (%), 2019-2021F |

| 3. Abu Dhabi Quarterly Industrial Production Index (IPI), Q1 2019- Q2 2020 |

| 4. UAE Air Purifier Market Revenue Share, By Technology, 2019 & 2026F |

| 5. UAE Air Purifier Market Volume Share, By Technology, 2019 & 2026F |

| 6. UAE Air Purifier Market Revenue Share, By CADR Value, 2019 & 2026F |

| 7. UAE Air Purifier Market Volume Share, By CADR Value, 2019 & 2026F |

| 8. UAE Air Purifier Market Revenue Share, By Applications, 2019 & 2026F |

| 9. Number of Medical Tourists to Dubai, 2018-2021F |

| 10. UAE Overall Health Care Spending, 2014 & 2024F ($Billion) |

| 11. UAE Air Purifier Market Opportunity Assessment, By Technology, 2026F |

| 12. UAE Air Purifier Market Opportunity Assessment, By Applications, 2026F |

| 13. UAE Air Purifier Market Revenues Share, By Companies, 2019 |

| List of Tables |

| 1. UAE Estimated Emissions from the Energy Mobile Sector by Pollutant, Air Emissions Inventory Project 2019 (in tonnes) |

| 2. UAE Air Purifier Market Revenues, By Technology, 2016-2026F ($ Thousand) |

| 3. UAE Air Purifier Market Volume, By Technology, 2016-2026F (Thousand Units) |

| 4. UAE Air Purifier Market Revenues, By CADR Value, 2016-2026F ($ Million) |

| 5. UAE Air Purifier Market Volume, By CADR Value, 2016-2026F (Thousand Units) |

| 6. UAE Air Purifier Market Revenues, By Applications, 2016-2026F ($ Million) |

| 7. UAE Most Polluted City Ranking, as of 23 October 2020 |

| 8. UAE Under Construction Residential Projects, 2020-2021 |

| 9. UAE Upcoming Malls, 2019-2020 |

| 10. UAE Upcoming Construction Projects, 2020-2023 |

| 11. E?ectiveness of Puri?cation Technology on Different Pollutants |

| 12. Air Filters’ Performance in Terms of Efficiency and Pressure Drop |

| 13. UAE Corporate Tax Rate |

| 14. UAE Foreign Direct Investments, 2017-2019 |

| 15. UAE Prominent Air Purifier Models, 2019 |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero