UAE Diesel Genset Market (2021-2027) | Size, Share, industry, Growth, Revenue, Analysis, Forecast, Outlook & COVID-19 IMPACT

Market Forecast By KVA Rating (Upto-75 kVA, 75.1-375 kVA, 375.1-750 kVA, 750.1-1000 kVA and Above 1000 kVA), By Verticals (Residential), Commercial (Hospitality, Commercial Offices, Healthcare, Retail, Infrastructure & Transportation and Others including Educational Institutions, BFSI, Social Infrastructure, and Government Buildings), Industrial (Manufacturing, Oil & Gas and Power Utilities)), By Regions (Abu Dhabi, Dubai and Rest of Emirates) and Competitive Landscape

| Product Code: ETC054279 | Publication Date: Feb 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 100 | No. of Figures: 22 | No. of Tables: 10 |

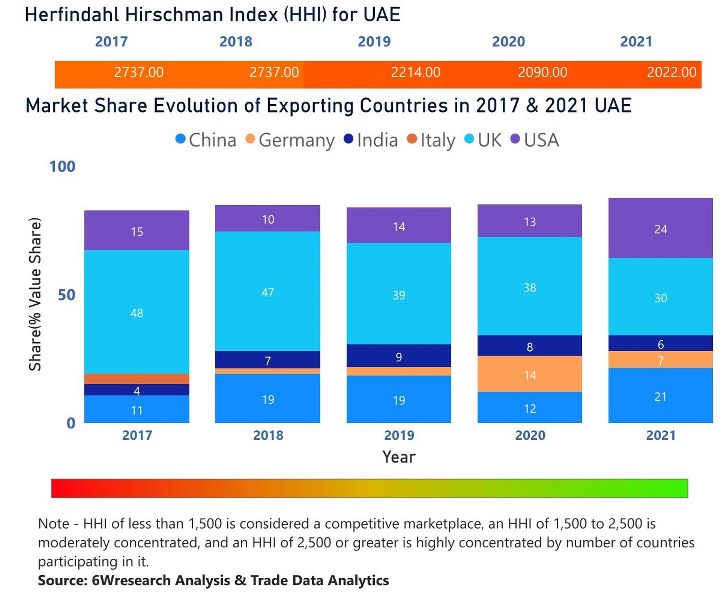

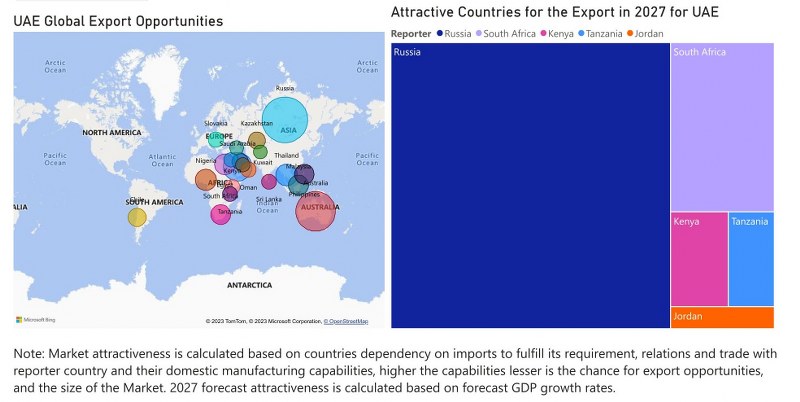

UAE Diesel Genset Market | Country-Wise Share and Competition Analysis

UAE Diesel Genset Market - Export Market Opportunities

Topics Covered in the UAE Diesel Genset Market

The UAE Diesel Genset market report comprehensively covers the diesel Genset market by kVA ratings, applications, and regions. The report provides an unbiased and detailed analysis of the diesel Genset market's ongoing trends, opportunities, high growth areas, market drivers, and market share by companies which would help the stakeholders to devise and align their market strategies to the current and future market dynamics.

Latest 2023 Development of the UAE Diesel Genset Market

UAE Diesel Genset Market is experiencing significant growth due to increasing construction activities, rising demand for electricity, and growing investments in infrastructure development. The market is primarily driven by the construction and industrial sectors, which require a reliable source of backup power to maintain their operations. Moreover, the government is taking several initiatives to develop the country's infrastructure. For instance, the construction of new airports, seaports, and power plants. They have created a significant demand for diesel gensets across the UAE. Leading companies are focusing on developing more efficient and technologically advanced diesel gensets to meet the growing demand in the industry.

With the rapid economic growth of the UAE and increasing urbanization, there is a growing demand for uninterrupted power supply and diesel gensets have the capacity to provide the uninterrupted power supply. Moreover, the UAE is home to a diverse range of industries, including manufacturing and construction. Diesel gensets are widely used in these sectors as backup power sources. There is an increasing focus on sustainable power sources which is also driving the UAE Diesel Genset Industry.

UAE Diesel Genset Market Synopsis

The UAE Diesel Genset market is anticipated to witness modest growth during the forecast period. Diesel generator in UAE is heavily deployed across various applications such as industrial, commercial, and transportation, among others, to provide a reliable and uninterrupted power supply. The growing electricity demand supported by the country’s economic diversification plans such as UAE Vision 2021, and Abu Dhabi Economic Vision 2030, along with the rising number of ongoing industrial projects such as the Hail and Ghasha Sour Gas Development, Sharjah Liquefied Natural Gas Import Terminal, Vision Hydra Executive, Rosewood Dubai, Taweelah Desalination Plant is the key factors, which would drive the market for a diesel generator in UAE in the coming years.

The outburst of COVID-19 has adversely impacted the country’s diesel Genset market in 2020 as the government imposed a nationwide lockdown which led to the closure of all construction operations and disrupted the demand and supply of diesel Genset systems. However, a recovery is expected in market revenues from the year 2021. A gradual opening of economic activities and supply chain

According to 6Wresearch, the UAE Diesel Genset Market size is projected to grow at CAGR of 3.3% during 2021-2027. Rapid industrialization has resulted in the increasing demand for a continuous and reliable source of electricity, which is expected to drive the diesel generator market in the coming years. Further, Dubai’s Industrial Strategy 2030, Plan Abu Dhabi 2030, Fujairah Plan 2040, and UAE Water Security Strategy 2036 are a few of the government initiatives which aims at developing and strengthening public sectors such as water supply, housing, transportation, infrastructure, and tourism, creating a huge demand for power backup equipment for the developmental activities, leading to a surge in demand for diesel gensets in the UAE.

Government policies and schemes introduced in the UAE Diesel Genset Market

The UAE government has been proactive in its policies to promote sustainable and energy-efficient solutions. The government plans to invest in renewable energy sources, primarily solar power, to reduce the dependence on diesel gensets as a backup power source. Additionally, the Abu Dhabi government has introduced the Green Building Regulations and Specifications, incentivizing the construction of energy-efficient buildings. The UAE government has initiated various measures to boost the country's diesel genset market. The government aims to enhance the alternative power sector and reduce the country's dependence on oil and gas by promoting the use of renewable energy. For instance, the Dubai Electricity and Water Authority launched a Comprehensive Energy Strategy 2050 to boost and enhance the use of renewable energy to meet growing demand.

Leading players in the UAE Diesel Genset Market

Several global and regional players have significant market presence in the Diesel genset market in UAE. These include Caterpillar, Cummins Middle East, MTU Onsite Energy, YorPower, and Perkins Engines. These players’ strategies include new product launches, partnerships, and investments in research and development.

Market Analysis by kVA Ratings

Diesel gensets with a rating of 75.1kVA - 375kVA, 375.1kVA- 750kVA and 750.1kVA- 1000kVA have a cumulative market share of more than 60% of the total market revenues in 2020. 75.1kVA - 375kVA which are majorly deployed as power backup systems in the hospitality, tourism, entertainment, and commercial sectors, account for the major market revenue share and are expected to retain their dominance over the forthcoming years. Moreover, the UAE government’s initiatives, such as UAE Energy Strategy 2050 and Dubai Smart City Project, are expected to attract a considerable amount of investment of around $500 billion by 2030 in the manufacturing, logistics, and industrial sectors, thereby driving the demand for diesel Genset market in the coming years.

Market Analysis by Application

Amongst the application, the Commercial and industrial segments account for a cumulative market share of more than 60% of the market revenues in 2020. Among applications, the commercial sector emerged as the leading revenue share contributor in UAE diesel genset market for the year 2020. The segment is projected to lead the market during the forecasted period due to a large number of upcoming infrastructure projects in the country. Additionally, upcoming projects such as Grand Millennium ADNEC, Mohammed bin Rashid City, Madinat Jumeirah Phase four, Vision Hydra Executive, along with Smart Dubai 2021 Vision, would contribute to the increase in deployment; of DGs in the commercial segment of UAE in the years to come.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- UAE Diesel Genset Market Overview

- UAE Diesel Genset Market Outlook

- UAE Diesel Genset Market Forecast

- Historical Data of UAE Diesel Genset Market Revenues and Volume for the Period 2017-2020

- Market Size & Forecast of UAE Diesel Genset Market Revenues and Volume until 2027F

- Historical Data of UAE Diesel Genset Market Revenues and Volume, By kVA Ratings for the Period 2017-2020.

- Market Size & Forecast of UAE Diesel Genset Market Revenues and Volume, By kVA Ratings until 2027F

- Historical Data of UAE Diesel Genset Market Revenues, By Applications for the Period 2017-2020.

- Market Size & Forecast of UAE Diesel Genset Market Revenues, By Applications until 2027F

- Historical Data of UAE Diesel Genset Market Revenues, By Regions for the Period 2017-2020.

- Market Size & Forecast of UAE Diesel Genset Market Revenues, By Regions until 2027F

- UAE Diesel Genset Market Drivers and Restraints

- UAE Diesel Genset Market Trends

- UAE Diesel Genset Market Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- UAE Diesel Genset Market Revenues Share, By Players

- UAE Diesel Genset Market Overview on Competitive Benchmarking

- Key Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By KVA Rating

- Upto-75 kVA

- 75.1-375 kVA

- 375.1-750 kVA

- 750.1-1000 kVA and

- Above 1000 kVA

By Verticals

- Residential

- Commercial

- Hospitality

- Commercial Offices

- Healthcare

- Retail

- Infrastructure & Transportation and

- Others

- including Educational Institutions

- BFSI

- Social Infrastructure and

- Government Buildings

- Industrial

- Manufacturing

- Oil & Gas and Power Utilities

By Regions

- Abu Dhabi

- Dubai and Rest of Emirates

UAE Diesel Genset Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of The Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. the Middle East and Africa Diesel Genset Market Overview |

| 3.1. the Middle East and Africa Diesel Genset Market Revenues & Volume, 2017-2027F |

| 3.2. the Middle East and Africa Diesel Genset Market Revenues & Volume Shares, By Countries 2020 & 2027F |

| 3.2.1 the Middle East and Africa Diesel Genset Market Revenues & Volume, By Countries 2017-2027F |

| 4. UAE Diesel Genset Market Overview |

| 4.1. UAE Diesel Genset Market Revenues & Volume, 2017-2027F |

| 4.2. UAE Diesel Genset Market - Industry Life Cycle, 2020 |

| 4.3. UAE Diesel Genset Market - Porter’s Five Forces |

| 4.4. UAE Diesel Genset Market Revenues Share, By Regions, 2020 & 2027F |

| 5. UAE Diesel Genset Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Growing demand for reliable and uninterrupted power supply in the UAE |

| 5.2.2 Increasing construction activities and infrastructure development projects |

| 5.2.3 Expansion of industrial sector driving the need for backup power solutions |

| 5.3. Market Restraints |

| 5.3.1 Environmental regulations and increasing focus on renewable energy sources |

| 5.3.2 Volatility in diesel fuel prices impacting operational costs |

| 5.3.3 Competition from alternative power sources such as natural gas and solar energy |

| 6. UAE Diesel Genset Market Trends |

| 7. UAE Diesel Genset Market Overview, By kVA Ratings |

| 7.1. UAE Diesel Genset Market Revenues Share, By kVA Ratings, 2020 & 2027F |

| 7.2. UAE Diesel Genset Market Volume Share, By kVA Ratings, 2020 & 2027F |

| 7.3. UAE Diesel Genset Market Revenues & Volume, By kVA Ratings, 2017-2027F |

| 7.3.1. UAE Up to 75 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F |

| 7.3.2. UAE 75.1-375 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F |

| 7.3.3. UAE 375.1-750 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F |

| 7.3.4. UAE 750.1-1000 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F |

| 7.3.5. UAE Above 1000 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F |

| 8. UAE Diesel Genset Market Overview, By Applications |

| 8.1. UAE Diesel Genset Market Revenues Share, By Applications, 2020 & 2027F |

| 8.1.1. UAE Diesel Genset Market Revenues, By Commercial Application, 2017-2027F |

| 8.1.2. UAE Diesel Genset Market Revenues, By Industrial Application, 2017-2027F |

| 8.1.3. UAE Diesel Genset Market Revenues, By Residential Application, 2017-2027F |

| 8.1.4. UAE Diesel Genset Market Revenues, By Transportation & Infrastructure Application, 2017-2027F |

| 9. UAE Diesel Genset Market Overview, By Regions |

| 9.1. UAE Diesel Genset Market Revenues, By Abu Dhabi Region, 2017-2027F |

| 9.2. UAE Diesel Genset Market Revenues, By Dubai Region, 2017-2027F |

| 9.3. UAE Diesel Genset Market Revenues, By Rest of Emirates Region, 2017-2027F |

| 10. UAE Diesel Genset Market – Key Performance Indicators |

| 11. UAE Diesel Genset Market Import Statistics |

| 11.1. UAE Up to 75 kVA Diesel Gensets Import, By Country, 2019 |

| 11.2. UAE 75.1 - 375 kVA Diesel Gensets Import, By Country, 2019 |

| 11.3. UAE Above 375 kVA Diesel Gensets Import, By Country, 2019 |

| 12. UAE Diesel Genset Market Opportunity Assessment |

| 12.1. UAE Diesel Genset Market Opportunity Assessment, By kVA Ratings, 2027F |

| 12.2. UAE Diesel Genset Market Opportunity Assessment, By Applications, 2027F |

| 13. UAE Diesel Genset Market Competitive Landscape |

| 13.1. UAE Diesel Genset Market Competitive Benchmarking, By Technical Parameters |

| 13.2. UAE Diesel Genset Market Competitive Benchmarking, By Operating Parameters |

| 13.3. UAE Diesel Genset Market Revenues Share, By Company, 2020 |

| 14. Company Profiles |

| 14.1. Atlas Copco Industrial Equipment Co. |

| 14.2. Caterpillar Inc. |

| 14.3. Cummins Middle East FZE. |

| 14.4. Aksa Power Generation |

| 14.5. Himoinsa Middle East, FZE |

| 14.6. Kirloskar Oil Engines Limited |

| 14.7. Yanmar Holdings Co., Ltd. |

| 14.8. Kohler Co. |

| 14.9. MTU Onsite Energy Corporation |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

| 1. the Middle East and Africa Diesel Genset Market Revenues and Volume, 2017-2027F ($ Million, Thousand Units) |

| 2. the Middle East and Africa Diesel Genset Market Revenues Share, By Countries, 2020 & 2027F |

| 3. the Middle East and Africa Diesel Genset Market Volume Share, By Countries, 2020 & 2027F |

| 4. UAE Diesel Genset Market Revenues and Volume, 2017-2027F ($ Million, Thousand Units) |

| 5. Non-Oil Sector Gross Domestic Product, 2017-2021F ($ Billion) |

| 6. UAE Diesel Genset Market Revenues Share, By kVA Ratings, 2020 & 2027F |

| 7. UAE Diesel Genset Market Volume Share, By kVA Ratings, 2020 & 2027F |

| 8. UAE Up to 75 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| 9. UAE 75.1- 375 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| 10. UAE 375.1- 750 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| 11. UAE 750.1-1000 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| 12. UAE Above 1000 kVA Rating Diesel Genset Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| 13. UAE Diesel Genset Market Revenues Share, By Applications, 2020 & 2027F |

| 14. UAE Diesel Genset Market Revenues, By Abu Dhabi Region, 2017–2027F ($ Million) |

| 15. UAE Diesel Genset Market Revenues, By Dubai Region, 2017–2027F ($ Million) |

| 16. UAE Diesel Genset Market Revenues, By Rest of Emirates Region, 2017–2027F ($ Million) |

| 17. UAE Up to 75 kVA Diesel Genset Import, By Country, 2019 ($ Thousand) |

| 18. UAE 75.1 - 375 kVA Diesel Gensets Import, By Country, 2019 ($ Thousand) |

| 19. UAE Above 375 kVA Diesel Gensets Import, By Country, 2019 ($ Thousand) |

| 20. UAE Diesel Genset Market Opportunity Assessment, By kVA Ratings, 2027F |

| 21. UAE Diesel Genset Market Opportunity Assessment, By Applications, 2027F |

| 22. UAE Diesel Genset Market Revenue Share, By Companies, 2020 |

| List of Tables |

| 1. the Middle East and Africa Diesel Genset Market Revenue, By Countries, 2017-2027F ($ Million) |

| 2. the Middle East and Africa Diesel Genset Market Volume, By Countries, 2017-2027F (Thousand Units) |

| 3. UAE Diesel Genset Market Revenues, By Applications, 2017–2027F ($ Million) |

| 4. UAE Oil & Gas Sector Upcoming Mega Projects, 2021-26 |

| 5. UAE Recently Completed Malls 2019-20 |

| 6. Dubai Recently Completed/ Ongoing Construction Projects, 2019-23 |

| 7. UAE Ongoing/ Upcoming Hospitality Projects, 2021-25 |

| 8. UAE Under Execution and Committed Water Transmission Network Development Projects, 2021-22 |

| 9. UAE Upcoming/On-going Projects in Water Management Sector, 2021-24 |

| 10. UAE Under Construction Residential Projects, 2021 |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero