UAE Fire Safety Systems and Equipment Market (2020-2026) | Size, Share, Forecast, Opportunities, Trends, Growth, Revenue, Outlook & COVID-19 IMPACT

Market Forecast By Types (Fire Fighting Equipment, Fire Detection and Alarm Systems, Emergency and Exit Lighting Systems), By Fire Fighting Equipment Types (Fire Suppression Systems, Fire Extinguishers, Fire Sprinklers), By Fire Suppression Systems Types (Clean Agent, Carbon Dioxide, Wet Chemical, Dry Chemical), By Clean Agent Fire Suppression Systems Types (Inert Gas, Halo Carbons), By Fire Suppression Systems Applications (Residential, Commercial offices & Buildings, industrial, Hospitality, retail, Oil & Gas, Data Center, Food Processing, Others), By Fire Extinguishers Types (Clean agent, carbon dioxide, wet chemical, dry chemical, foam), By fire sprinkler types (wet pipe, pre action, deluge, dry pipe), by fire detection & alarm systems type (control panels, control panel accessories, detectors, aspiration), by control panel types (conventional, addressable), by detector types (smoke, heat, gas, flame, beam, multi-sensor, optical), Fire detections & alarm systems by distribution types (sMB, enterprise, industrial), Fire detections & alarm systems by standard types (UL Standard, EN standard) Fire detections & alarm systems by Applications (Residential, Commercial offices & Buildings, industrial, Hospitality, retail, Oil & Gas, Data Center, Food Processing, Others), Emergency and Exit lighting systems by power systems (self-contained systems, central battery systems, self-contained with monitoring), Emergency and Exit lighting systems

| Product Code: ETC004602 | Publication Date: Aug 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 34 | No. of Tables: 24 |

Latest Development (2022) in UAE Fire Safety Systems & Equipment Market

UAE Fire Safety Systems & Equipment Market is expected to project substantial growth in upcoming years on account of the rapid development of smoke detectors coupled with the development of big data technologies. Expansion of smoke detectors coupled with the rapid development of technology is adding to the UAE Fire Safety Systems & Equipment Market Growth. Increasing innovation in the system along with the introduction of smart fire detectors is driving the development of the market. Fire Safety Systems & Equipment facilitates easy monitoring of the battery status.

UAE Fire Safety Systems & Equipment Market Synopsis

UAE Fire Safety Systems & Equipment Market report is a part of the Middle East Fire Safety Systems & Equipment Market report that thoroughly covers the market by types and applications. UAE fire safety systems & equipment market outlook report provides an unbiased and detailed analysis of the ongoing UAE fire safety systems & equipment market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

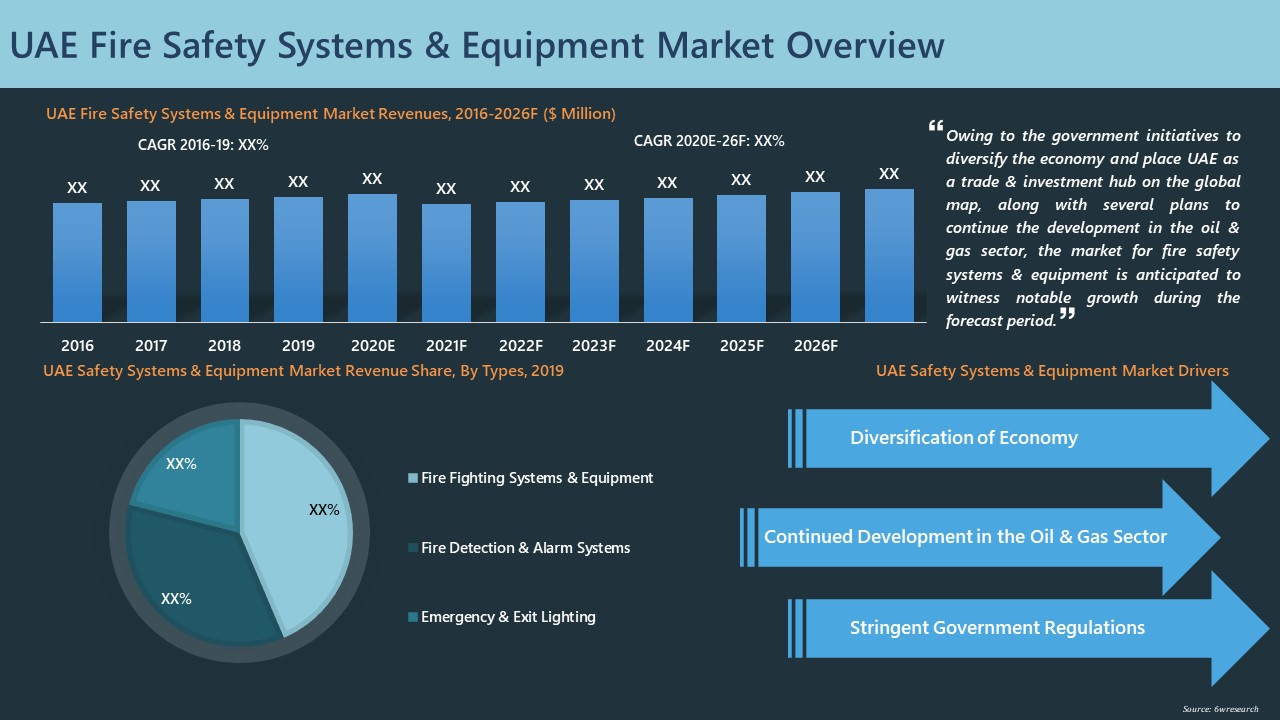

UAE Fire Safety Systems & Equipment Market witnessed moderate growth during the period 2016-2019 underpinned by rapid growth in the construction sector as the government was spending heavily on infrastructure development during this period in preparation for Dubai Expo 2020 (now postponed to 2021). The recovering oil & gas sector and the growing industrial sector, along with the implementation of stringent safety norms are the other major factors driving the demand for fire safety systems & equipment in UAE.

According to 6Wresearch, UAE Fire Safety Systems & Equipment Market size is projected to grow at CAGR of 2.0% during 2020-2026. Rising investment in the industrial sector with the aim of diversifying the economy and social infrastructure development projects under various programs such as the UAE Vision 2021, Maritime Vision 2030, and Dubai’s Industrial Strategy 2030 would drive the demand for fire safety systems & equipment in the UAE in the near future. Furthermore, upcoming projects such as Barakah nuclear power plant, Ruwais industrial complex, chemical pipelines, Hatta Hydroelectric power station, Fujairah F3 Power Plant, and Al Taweelah Alumina Refinery along with Abu Dhabi Economic Vision 2030 would propel the demand for fire safety systems & equipment market in the UAE over the years to come.

COVID-19 Impact on UAE Fire Safety Systems & Equipment Market

The outbreak of the COVID-19 pandemic is anticipated to bring a slowdown in the market during the year 2020 as a result of a halt in construction projects and suspension of economic activities due to social distancing measures adopted in order to curtail the community spread of coronavirus. Recovery is expected in market revenues post-2020, with a gradual opening of economic activities and restarts of construction projects that would result in an increased demand for fire safety systems & equipment across the country. However, the ongoing global pandemic COVID-19 hampered the overall economic growth of the UAE, thus, restraining the growth of the Fire Safety Systems & Equipment market as well.

Government Initiatives Introduced in the UAE Fire Safety System and Equipment Market

The UAE government has implemented fire safety regulations that strictly monitor the installation and maintenance of fire safety systems and equipment in buildings. The regulation involves the mandatory inspection of fire systems and equipment in buildings, which has created a huge market for the service providers. Likewise, these cunnings have advanced the overall UAE Fire Safety System and Equipment Market share. Further, the growing adoption of advanced fire safety systems, including fire suppression systems, fire alarm and detection systems, and evacuation systems, has also contributed to the expansion of the fire safety systems and equipment market.

Market by Type

According to Ravi Bhandari, Research Head, 6Wresearch, the growth of fire extinguishers is evident in the UAE, where these products are becoming increasingly popular, especially in commercial and industrial settings. This is because, in these environments, fires caused by combustible materials like oil, gasoline, or other flammable liquids are not uncommon. Dry chemical extinguishers are particularly effective in these scenarios because they contain a powdered combination of monoammonium phosphate and ammonium sulfate, which works to interrupt the chain reaction of fire eventually. Moreover, the CO2 fire extinguishers are also gaining traction in the UAE fire safety systems and equipment market. This is because CO2 gas is not only effective in extinguishing fires in electrical equipment and machinery, but it also leaves no residue or by-products after the fire is extinguished. This means there is no need for extensive cleaning after the fact, which is essential in commercial or industrial settings. Furthermore, CO2 extinguishers do not cause damage to the targeted equipment and are safe to use in confined areas.

Market by Verticals

With large commercial and industrial sectors, fire safety systems and equipment are a necessity to protect people, property, and businesses. Additionally, in the commercial settings, fire safety systems and equipment are essential to protect businesses and their employees. Fire alarms, sprinkler systems, and smoke detectors are commonly used in commercial buildings to alert occupants and suppress fires. Not only do these systems save lives, but they can also help to prevent significant property damage. Additionally, commercial kitchens are legally required to have fire suppression systems installed to prevent kitchen fires from spreading. Moreover, in the industrial settings, fire safety systems and equipment are necessary to protect machinery, equipment, and the employees operating them. Also, the industrial settings hook huge UAE Fire Safety System and Equipment market revenues. Various hazards exist in an industrial workplace, including flammable liquids, combustible dust, and electrical hazards. Fire suppression systems can prevent fires from starting and spreading to other parts of the facility. Fireproofing materials, such as fire-resistant coatings, can protect structures and prevent them from collapsing in the event of a fire.

Key Players in the market

Some of the key players in the UAE Fire Safety Systems & Equipment market:

- NAFFCO

- Tyco

- UTC

- FireX

- SFFECO

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- UAE Fire Safety Systems & Equipment Market Overview

- UAE Fire Safety Systems & Equipment Market Outlook

- UAE Fire Safety Systems & Equipment Market Forecast

- UAE Fire Safety Systems & Equipment Market Share, By Types

- Historical Data and Forecast of UAE Fire Safety Systems & Equipment Market Revenues, for the Period 2015-2026F

- Historical Data and Forecast of UAE Fire Safety Systems & Equipment Market Revenues, By Types, for the Period 2015-2026F

- Historical Data and Forecast of UAE Fire Fighting Equipment Market Revenues, for the Period 2015-2026F

- Historical Data and Forecast of UAE Fire Fighting Equipment Market Revenues, By Types, for the Period 2015-2026F

- Historical Data and Forecast of UAE Fire Suppression Systems Market Revenues, By Applications, for the Period 2015-2026F

- Historical Data and Forecast of UAE Fire Detection and Alarm Systems Market Revenues, for the Period 2015-2026F

- Historical Data and Forecast of UAE Fire Detection and Alarm Systems Market Revenues, By Types, for the Period 2015-2026F

- Historical Data and Forecast of UAE Fire Detection and Alarm Systems Market Revenues, By Control Panel Types, for the Period 2015-2026F

- Historical Data and Forecast of UAE Fire Detection and Alarm Systems Market Revenues, By Detector Types, for the Period 2015-2026F

- Historical Data and Forecast of UAE Fire Detection and Alarm Systems Market Revenues, By Distribution Types, for the Period 2015-2026F

- Historical Data and Forecast of UAE Fire Detection and Alarm Systems Market Revenues, By Standard Types, for the Period 2015-2026F

- Historical Data and Forecast of UAE Fire Detection and Alarm Systems Market Revenues, By Applications, for the Period 2015-2026F

- Historical Data and Forecast of UAE Emergency and Exit Lighting Systems Market Revenues, for the Period 2015-2026F

- Historical Data and Forecast of UAE Emergency and Exit Lighting Systems Market Revenues, By Power Systems, for the Period 2015-2026F

- Historical Data and Forecast of UAE Emergency and Exit Lighting Systems Market Revenues, By Applications, for the Period 2015-2026F

- Market Drivers, Restraints, and Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Market Player’s Revenue Shares

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By Types

- Fire Fighting Equipment

- Fire Detection and Alarm Systems

- Emergency and Exit Lighting Systems

By Fire Fighting Equipment Types

- Fire Suppression Systems

- Fire Extinguishers

- Fire Sprinklers

By Fire Suppression Systems Types

- Clean Agent

- Carbon Dioxide

- Wet Chemical

- Dry Chemical

By Clean Agent Fire Suppression Systems Types

- Inert Gas

- Halo Carbons

By Fire Suppression Systems Applications

- Residential

- Commercial offices & Buildings

- industrial Hospitality

- retail

- Oil & Gas

- Data Center

- Food Processing

- Others

By Fire Extinguishers Types

- Clean agent

- carbon dioxide

- wet chemical

- dry chemical

- foam

By fire sprinkler types

- wet pipe

- pre action

- deluge

- dry pipe

By fire detection & alarm systems type

- control panels

- control panel accessories

- detectors aspiration

By control panel types

- conventional

- addressable

By detector types

- smoke

- heat

- gas

- flame

- beam

- multi-sensor

- optical

- Fire detections & alarm systems by distribution types

- sMB

- enterprise

- industrial

- Fire detections & alarm systems

By standard types

- UL Standard

- EN standard

- Fire detections & alarm systems

By Applications

- Residential

- Commercial offices & Buildings

- industrial

- Hospitality

- retail

- Oil & Gas

- Data Center

- Food Processing

- Others

- Emergency and Exit lighting systems

By power systems

- self-contained systems

- central battery systems

- self-contained with monitoring

- Emergency and Exit lighting systems

UAE Fire Safety Systems & Equipment Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Methodology Adopted & Key Data Points |

| 2.5. Assumptions |

| 3. UAE Fire Safety Systems & Equipment Market Overview |

| 3.1. UAE Fire Safety Systems & Equipment Market Revenues, 2015-2026F |

| 3.2. UAE Fire Safety Systems & Equipment Market-Industry Life Cycle |

| 3.3. UAE Fire Safety Systems & Equipment Market-Porter’s Five Forces |

| 3.4. UAE Fire Safety Systems & Equipment Market-Ecosystem |

| 3.5. UAE Fire Safety Systems & Equipment Market-Classification of Fire |

| 4. UAE Fire Safety Systems & Equipment Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing stringency of fire safety regulations in the UAE |

| 4.2.2 Growth in construction activities and infrastructure development |

| 4.2.3 Rising awareness about the importance of fire safety measures in the UAE |

| 4.3 Market Restraints |

| 4.3.1 High initial costs associated with installing fire safety systems and equipment |

| 4.3.2 Lack of skilled professionals for proper maintenance and operation of fire safety systems |

| 4.3.3 Economic fluctuations impacting investment in fire safety measures |

| 5. UAE Fire Safety Systems & Equipment Market Trends |

| 6. UAE Fire Fire Fighting Equipment Market Overview |

| 6.1 UAE Fire Fighting Equipment Market Revenues, 2015-2026F |

| 6.2 UAE Fire Fighting Equipment Market Revenue Share, By Types 2015-2026F |

| 6.2.1 UAE Fire Suppression Systems Market Revenues, 2015-2026F |

| 6.2.2 UAE Fire Extinguisher Market Revenues, 2015-2026F |

| 6.2.3 UAE Fire Sprinkler Market Revenues, 2015-2026F |

| 6.3 UAE Fire Suppression Systems Market Revenue Share, By Types, 2019 & 2026F |

| 6.3.1 UAE Clean Agent Fire Suppression Systems Market Revenues, 2015-2026F |

| 6.3.2 UAE Carbon dioxide Fire Suppression Systems Market Revenues, 2015-2026F |

| 6.3.3 UAE Wet Chemical Fire Suppression Systems Market Revenues, 2015-2026F |

| 6.3.4 UAE Dry Chemical Fire Suppression Systems Market Revenues, 2015-2026F |

| 6.4 UAE Clean Agent Fire Suppression Systems Market Revenue Share, By Types, 2019 & 2026F |

| 6.4.1 UAE Clean Agent Fire Suppression Systems Market Revenues, By Inert Gas, 2015-2026F |

| 6.4.2 UAE Clean Agent Fire Suppression Systems Market Revenues, By Halocarbons, 2015-2026F |

| 6.5 UAE Fire Suppression Systems Market Revenue Share. By Applications, 2019 & 2026F |

| 6.5.1 UAE Fire Suppression Systems Market Revenues, By Residential Application, 2015-2026F |

| 6.5.2 UAE Fire Suppression Systems Market Revenues, By Commercial Offices & Buildings Application, 2015-2026F |

| 6.5.3 UAE Fire Suppression Systems Market Revenues, By Industrial Application, 2015-2026F |

| 6.5.4 UAE Fire Suppression Systems Market Revenues, By Hospitality Application, 2015-2026F |

| 6.5.5 UAE Fire Suppression Systems Market Revenues, By Retail Application, 2015-2026F |

| 6.5.6 UAE Fire Suppression Systems Market Revenues, By Oil & Gas Application, 2015-2026F |

| 6.5.7 UAE Fire Suppression Systems Market Revenues, By Datacenter Application, 2015-2026F |

| 6.5.8 UAE Fire Suppression Systems Market Revenues, By Food Processing Application, 2015-2026F |

| 6.5.9 UAE Fire Suppression Systems Market Revenues, By Other Applications, 2015-2026F |

| 6.6 UAE Fire Extinguisher Market Revenue Share, By Types, 2019 & 2026F |

| 6.6.1 UAE Dry Chemical Fire Extinguisher Market Revenues, 2015-2026F |

| 6.6.2 UAE Carbon dioxide Fire Extinguisher Market Revenues, 2015-2026F |

| 6.6.3 UAE Clean Agent Fire Extinguisher Market Revenues, 2015-2026F |

| 6.6.4 UAE Foam Fire Extinguisher Market Revenues, 2015-2026F |

| 6.6.5 UAE Wet Chemical Fire Extinguisher Market Revenues, 2015-2026F |

| 6.6.6 UAE Water Fire Extinguisher Market Revenues, 2015-2026F |

| 6.7 UAE Fire Sprinkler Market Revenue Share. By Types, 2019 & 2026F |

| 6.7.1 UAE Wet Pipe Sprinkler Systems Market Revenues, 2015-2026F |

| 6.7.2 UAE Pre Action Sprinkler Systems Market Revenues, 2015-2026F |

| 6.7.3 UAE Deluge Sprinkler Systems Market Revenues, 2015-2026F |

| 6.7.4 UAE Dry Pipe Sprinkler Systems Market Revenues, 2015-2026F |

| 7. UAE Fire Detection and Alarm Systems Market Overview |

| 7.1 UAE Fire Detection and Alarm Systems Market Revenues, 2015-2026F |

| 7.2 UAE Fire Detection and Alarm Systems Market Revenue Share, By Types, 2019 & 2026F |

| 7.2.1 UAE Control Panels Market Revenues, 2015- 2026F |

| 7.2.2 UAE Control Panel Accessories Market Revenues, 2015-2026F |

| 7.2.3 UAE Detectors Market Revenues, 2015-2026F |

| 7.2.4 UAE Aspiration Market Revenues, 2015-2026F |

| 7.3 UAE Fire Detection and Alarm Systems Market Revenue Share, By Control Panel Types, 2019 & 2026F |

| 7.3.1 UAE Conventional Systems Market Revenues, 2015- 2026F |

| 7.3.2 UAE Addressable Systems Market Revenues, 2015- 2026F |

| 7.4 UAE Fire Detection and Alarm Systems Market Revenue Share, By Detector Types, 2019 & 2026F |

| 7.4.1 UAE Smoke Detectors Market Revenues, 2015- 2026F |

| 7.4.2 UAE Heat Detectors Market Revenues, 2015- 2026F |

| 7.4.3 UAE Gas Detectors Market Revenues, 2015- 2026F |

| 7.4.4 UAE Flame Detectors Market Revenues, 2015- 2026F |

| 7.4.5 UAE Beam Detectors Market Revenues, 2015- 2026F |

| 7.4.6 UAE Multi-Sensor Detectors Market Revenues, 2015- 2026F |

| 7.4.7 UAE Optical Detectors Market Revenues, 2015- 2026F |

| 7.5 UAE Fire Detection and Alarm Systems Market Revenue Share, By Distribution Types, 2019 & 2026F |

| 7.5.1 UAE Fire Detection and Alarm Systems Market Revenues, By, SMB, 2015- 2026F |

| 7.5.2 UAE Fire Detection and Alarm Systems Market Revenues, By, Enterprise, 2015- 2026F |

| 7.5.3 UAE Fire Detection and Alarm Systems Market Revenues, By, Industrial, 2015- 2026F |

| 7.6 UAE Fire Detection and Alarm Systems Market Revenue Share, By Standard Types, 2019 & 2026F |

| 7.6.1 UAE Fire Detection and Alarm Systems Market Revenues, By UL Standard, 2015-2026F |

| 7.6.2 UAE Fire Detection and Alarm Systems Market Revenues, By EN Standard, 2015-2026F |

| 7.7 UAE Fire Detection and Alarm Systems Market Revenue Share, By Applications, 2019 & 2026F |

| 7.7.1 UAE Fire Detection and Alarm Systems Market Revenues, By Residential Application, 2015-2026F |

| 7.7.2 UAE Fire Detection and Alarm Systems Market Revenues, By Commercial Offices & Buildings Application, 2015-2026F |

| 7.7.3 UAE Fire Detection and Alarm Systems Market Revenues, By industrial Application, 2015-2026F |

| 7.7.4 UAE Fire Detection and Alarm Systems Market Revenues, By Hospitality Application, 2015-2026F |

| 7.7.5 UAE Fire Detection and Alarm Systems Market Revenues, By Retail Application, 2015-2026F |

| 7.7.6 UAE Fire Detection and Alarm Systems Market Revenues, By Oil & Gas Application, 2015-2026F |

| 7.7.7 UAE Fire Detection and Alarm Systems Market Revenues, By DataCenter Application, 2015-2026F |

| 7.7.8 UAE Fire Detection and Alarm Systems Market Revenues, By Food Processing Application, 2015-2026F |

| 7.7.9 UAE Fire Detection and Alarm Systems Market Revenues, By Other Applications, 2015-2026F |

| 8. UAE Emergency and Exit Lighting Systems Market Overview |

| 8.1 UAE Emergency and Exit Lighting Systems Market Revenues, 2015-2026F |

| 8.2 UAE Emergency and Exit Lighting Systems Market Revenue Share, By Power Systems, 2019 & 2026F |

| 8.2.1 UAE Emergency and Exit Lighting Systems Market Revenues, By Self-Contained Systems, 2015-2026F |

| 8.2.2 UAE Emergency and Exit Lighting Systems Market Revenues, By Central Battery Systems, 2015-2026F |

| 8.2.3 UAE Emergency and Exit Lighting Systems Market Revenues, By Self-Contained Systems with Monitoring, 2015-2026F |

| 8.3 UAE Emergency and Exit Lighting Systems Market Revenue Share, By Applications, 2019 & 2026F |

| 8.3.1 UAE Emergency and Exit Lighting Systems Market Revenues, By Residential Application, 2015-2026F |

| 8.3.2 UAE Emergency and Exit Lighting Systems Market Revenues, By Commercial Offices & Buildings Application, 2015-2026F |

| 8.3.3 UAE Emergency and Exit Lighting Systems Market Revenues, By Industrial Application, 2015-2026F |

| 8.3.4 UAE Emergency and Exit Lighting Systems Market Revenues, By Hospitality Application, 2015-2026F |

| 8.3.5 UAE Emergency and Exit Lighting Systems Market Revenues, By Retail Application, 2015-2026F |

| 8.3.6 UAE Emergency and Exit Lighting Systems Market Revenues, By Oil & Gas Application, 2015-2026F |

| 8.3.7 UAE Emergency and Exit Lighting Systems Market Revenues, By Datacenter Application, 2015-2026F |

| 8.3.8 UAE Emergency and Exit Lighting Systems Market Revenues, By Food Processing Application, 2015-2026F |

| 8.3.9 UAE Emergency and Exit Lighting Systems Market Revenues, By Other Applications, 2015-2026F |

| 9. UAE Public Address and Voice Alarm (PAVA) Systems Market Overview |

| 9.1 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, 2015-2026F |

| 9.2 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenue Share, By Types, 2019 & 2026F |

| 9.2.1 UAE Digital PAVA Systems Market Revenues, 2015-2026F |

| 9.2.2 UAE Analog PAVA Systems Market Revenues, 2015-2026F |

| 9.3 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenue Share, By Product Types, 2019 & 2026F |

| 9.3.1 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Controllers, 2015-2026F |

| 9.3.2 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Amplifiers, 2015-2026F |

| 9.3.3 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Speakers, 2015-2026F |

| 9.4 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenue Share, By Placement Types, 2019 & 2026F |

| 9.4.1 UAE Distributed PAVA Systems Market Revenues, 2015-2026F |

| 9.4.2 UAE Centralized PAVA Systems Market Revenues, 2015-2026F |

| 9.5 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenue Share, By Applications, 2019 & 2026F |

| 9.5.1 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Commercial Offices & Buildings Application, 2015-2026F |

| 9.5.2 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Industrial, 2015-2026F |

| 9.5.3 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Hospitality Application, 2015-2026F |

| 9.5.4 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Retail Application, 2015-2026F |

| 9.5.5 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Oil & Gas Application, 2015-2026F |

| 9.5.6 UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Other Applications, 2015-2026F |

| 10. UAE Fire Safety Systems & Equipment Market Key Performance Indicators |

| 10.1 Number of fire incidents reported annually in the UAE |

| 10.2 Adoption rate of advanced fire safety technologies in key industries |

| 10.3 Level of compliance with fire safety regulations in commercial and residential buildings |

| 11. UAE Fire Safety Systems & Equipment Market Opportunity Assessment |

| 12. UAE Fire Safety Systems & Equipment Market Competitive Landscape |

| 12.1 UAE Fire Safety Systems & Equipment Market Revenue Share, By Companies, 2019 |

| 12.2 UAE Fire Safety Systems & Equipment Market Competitive Benchmarking |

| 12.2.1 UAE Fire Safety Systems & Equipment Market Competitive Benchmarking, By Technical Parameters |

| 12.2.2 UAE Fire Safety Systems & Equipment Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1 Johnson Controls International PLC |

| 13.2 Honeywell International Inc. |

| 13.3 Robert Bosch Middle East FZE |

| 13.4 Siemens Middle East Limited |

| 13.5 Emirates Fire Fighting Equipment Factory (FIREX) |

| 13.6 NAFFCO FZCO |

| 13.7 Eaton Corporation PLC |

| 13.8 Viking Arabia FZE |

| 13.9 UTC Fire & Security EMEA BV |

| 13.10 Amerex Corporation |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures: |

| 1. UAE Fire Safety Systems & Equipment Market Revenues, 2015-2026F ($ Million) |

| 2. Average Crude Oil Price, 2018-2021 ($ per Barrel) |

| 3. UAE Fire Fighting Equipment Market Revenue Share in the Overall Fire Safety Systems & Equipment Market, 2019 & 2026F |

| 4. UAE Fire Fighting Equipment Market Revenues, 2015-2026F ($ Million) |

| 5. UAE Fire Fighting Equipment Market Revenue Share, By Types, 2019 & 2026F |

| 6. UAE Fire Suppression Systems Market Revenue Share, By Types, 2019 & 2026F |

| 7. UAE Clean Agent Fire Suppression Systems Market Revenue Share, By Types, 2019 & 2026F |

| 8. UAE Fire Suppression Systems Market Revenue Share, By Applications, 2019 & 2026F |

| 9. UAE Fire Extinguishers Market Revenue Share, By Types, 2019 & 2026F |

| 10. UAE Fire Sprinklers Market Revenue Share, By Types, 2019 & 2026F |

| 11. UAE Fire Detection and Alarm Systems Market Revenue Share in the Overall Fire Safety Systems & Equipment Market, 2019 & 2026F |

| 12. UAE Fire Detection and Alarm Systems Market Revenues, 2015-2026F ($ Million) |

| 13. UAE Fire Detection and Alarm Systems Market Revenue Share, By Types, 2019 & 2026F |

| 14. UAE Fire Detection and Alarm Systems Market Revenue Share, By Control Panel Types, 2019 & 2026F |

| 15. UAE Fire Detection and Alarm Systems Market Revenue Share, By Detector Types, 2019 & 2026F |

| 16. UAE Fire Detection and Alarm Systems Market Revenue Share, By Distribution Types, 2019 & 2026F |

| 17. UAE Fire Detection and Alarm Systems Market Revenue Share, By Standard Types, 2019 & 2026F |

| 18. UAE Fire Detection and Alarm Systems Market Revenue Share, By Applications, 2019 & 2026F |

| 19. UAE Emergency and Exit Lighting Systems Market Revenue Share in the Overall Fire Safety Systems & Equipment Market, 2019 & 2026F |

| 20. UAE Emergency and Exit Lighting Systems Market Revenues, 2015-2026F ($ Million) |

| 21. UAE Emergency and Exit Lighting Systems Market Revenue Share, By Power Systems, 2019 & 2026F |

| 22. UAE Emergency and Exit Lighting Systems Market Revenue Share, By Applications, 2019 & 2026F |

| 23. UAE Public Address and Voice Alarm Systems Market Revenue Share in the overall Fire Safety Systems & Equipment Market, 2019 & 2026F |

| 24. UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, 2015-2026F ($ Million) |

| 25. UAE Public Address and Voice Alarm (PAVA) Systems Market Revenue Share, By Types, 2019 & 2026F |

| 26. UAE Public Address and Voice Alarm (PAVA) Systems Market Revenue Share, By Product Types, 2019 & 2026F |

| 27. UAE Public Address and Voice Alarm (PAVA) Systems Market Revenue Share, By Placement Types, 2019 & 2026F |

| 28. UAE Public Address and Voice Alarm (PAVA) Systems Market Revenue Share, By Applications, 2019 & 2026F |

| 29. Growth of Dubai’s population, 2018-2023 (Million) |

| 30. UAE Fire Safety Systems & Equipment Market Opportunity Assessment, By Types, 2026F |

| 31. UAE Fire Fighting Equipment Market Revenue Share, By Companies, 2019 |

| 32. UAE Fire Detection & Alarm Systems Market Revenue Share, By Companies, 2019 |

| 33. UAE Emergency and Exit Lighting Systems Market Revenue Share, By Companies, 2019 |

| 34. UAE Public Address and Voice Alarm (PAVA) Systems Market Revenue Share, By Companies, 2019 |

| List of Tables: |

| 1. Upcoming Construction Projects in the Middle East as on November 2019 |

| 2. UAE Imports, Non-Oil Exports and Re-Exports Values, 2018-2019 ($ Billion) |

| 3. Technical Advancement in PAVA systems: A Comparison Between Analog and Digital PAVA |

| 4. UAE Fire Fighting Equipment Market Revenues, By Types, 2015-2026F ($ Million) |

| 5. UAE Fire Suppression Systems Market Revenues, By Types, 2015-2026F ($ Million) |

| 6. UAE Clean Agent Fire Suppression Systems Market Revenues, By Types, 2015-2026F ($ Million) |

| 7. UAE Fire Suppression Systems Market Revenues, By Applications, 2015- 2026F ($ Million) |

| 8. UAE Fire Extinguishers Market Revenues, By Types, 2015-2026F ($ Million) |

| 9. UAE Fire Sprinklers Market Revenues, By Types, 2015-2026F ($ Million) |

| 10. UAE Fire Detection and Alarm Systems Market Revenues, By Types, 2015-2026F ($ Million) |

| 11. UAE Fire Detection and Alarm Systems Market Revenues, By Control Panel Types, 2015-2026F ($ Million) |

| 12. UAE Fire Detection and Alarm Systems Market Revenues, By Detector Types, 2015-2026F ($ Million) |

| 13. UAE Fire Detection and Alarm Systems Market Revenues, By Distribution Types, 2015-2026F ($ Million) |

| 14. UAE Fire Detection and Alarm Systems Market Revenues, By Standard Types, 2015-2026F ($ Million) |

| 15. UAE Fire Detection and Alarm Systems Market Revenues, By Applications, 2015- 2026F ($ Million) |

| 16. UAE Emergency and Exit Lighting Systems Market Revenues, By Power Systems, 2015-2026F ($ Million) |

| 17. UAE Emergency and Exit Lighting Systems Market Revenues, By Applications, 2015- 2026F ($ Million) |

| 18. UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Types, 2015-2026F ($ Million) |

| 19. UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Product Types, 2015-2026F ($ Million) |

| 20. UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Placement Types, 2015-2026F ($ Million) |

| 21. UAE Public Address and Voice Alarm (PAVA) Systems Market Revenues, By Applications, 2015- 2026F ($ Million) |

| 22. UAE Hospitality Sector Upcoming Projects |

| 23. UAE Residential Sector Upcoming Projects |

| 24. Oil & Gas Sector Upcoming Mega Projects in UAE |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero