United Kingdom (UK) Recloser Market Outlook (2018-2024) | Companies, Share, COVID-19 IMPACT, Analysis, Forecast, Size, Trends, Value, Industry, Growth & Revenue

Market Forecast By Voltage Rating (< 27 KV And 27 KV & Above), By Insulation Type (Gas, Vacuum And Others), By Applications (Power Distribution And Industrial), By End Users (Distribution Utilities And Others Including Railway And Industrial), And Competitive Landscape

| Product Code: ETC004644 | Publication Date: Jul 2022 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 80 | No. of Figures: 14 | No. of Tables: 8 |

United Kingdom (UK) Recloser market report comprehensively covers the market by voltage types, insulation types, applications, end-users, and countries. The UK recloser market outlook report provides an unbiased and detailed analysis of the UK recloser market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

UK Recloser Market Synopsis

UK recloser market is anticipated to project substantial growth on account of expansion of the power sector. Additionally, construction of large-scale commercial projects, strengthening of non-oil sectors, as well as infrastructure development activities will further boost growth of the market over the coming years. However, the market witnessed slow growth during the outbreak of Covid-19 pandemic.

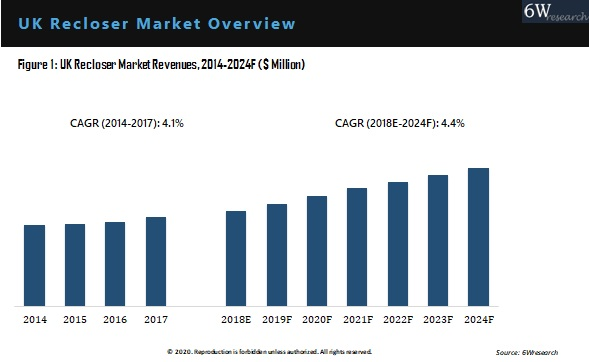

According to 6Wresearch, UK Recloser market size grew at a CAGR of 4.4% during 2018-24. The recloser market in UK has reached around $20.7 million in 2017 and it is projected to reach $27.3 million by 2024 growing with a CAGR of 4.4% from 2018 to 2024. Demand for the recloser would be high in coming years owing to the building of new gas power plants to shift to the low carbon sources of electricity production and also expected to reach to 86% of overall power generation with low carbon sources by 2035.

Market Analysis By Applications

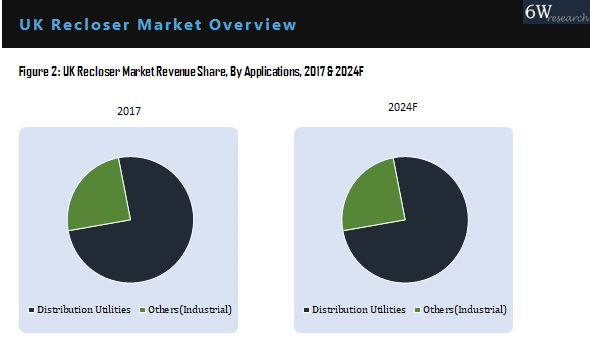

The distribution utilities application acquired the highest revenue share in the overall UK Recloser market. Additionally, the country is aiming to increase the share of renewables in its final energy consumption to 15% by 2020 which would also drive the demand for reclosers in the country.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 6 Years Market Numbers.

- Estimated Data Starting from 2018 to 2024F.

- Base Year: 2017

- Forecast Data Until 2024F.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- UK Recloser Market Overview

- UK Recloser Market Outlook

- UK Recloser Market Forecast

- Historical Data of UK Recloser Market Revenues for the Period, 2014-2017

- UK Recloser Market Size & UK Recloser Market Forecast, until 2024

- Historical Data of UK Recloser Market Revenues for the Period, 2014-2017

- Market Size & Forecast of UK Recloser Market Revenues, until 2024

- Historical Data of UK Recloser Market Revenues for the Period, 2014-2017

- Market Size & Forecast of UK Recloser Market Revenues, until 2024

- Historical Data of UK Recloser Market Revenues by Voltage Type for the Period, 2014-2017

- Market Size & Forecast of UK Recloser Market Revenues, until 2024

- Historical Data of UK Recloser Market Revenues by Voltage Type for the Period, 2014-2017

- Market Size & Forecast of UK Recloser Market Revenues by Voltage Type, until 2024

- Historical Data of UK Recloser Market Revenues by Voltage Type for the Period, 2014-2017

- Market Size & Forecast of UK Recloser Market Revenues by Voltage Type, until 2024

- Historical Data of UK Recloser Market Revenues by Voltage Type for the Period, 2014-2017

- Market Size & Forecast of UK Recloser Market Revenues by Voltage Type, until 2024

- Market Drivers and Restraints

- UK Recloser Market Trends and Developments

- UK Recloser Market Overview on Competitive Landscape

- UK Recloser Market Share, By Players

- Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

- By Voltage Ratings

- < 27 KV

- 27 KV and Above

- By Insulation Types:

- Gas

- Vacuum

- Others

- By Applications:

- Power Distribution

- Industrial

- By End Users:

- Distribution Utilities

- Others (Railway and Industrial)

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Methodology Adopted and Key Data Points |

| 2.5. Assumptions |

| 3. United Kingdom (UK) Recloser Market Overview |

| 3.1. UK Recloser Market Revenues, 2014-2024F |

| 3.2. UK Recloser Market Revenue Share, 2017 & 2024 |

| 3.3. UK Recloser Market - Industry Life Cycle, 2017 |

| 3.4. UK Recloser Market - Porter's Five Forces, 2017 |

| 4. UK Recloser Market Dynamics |

| 4.1. Market Dynamics & Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing demand for reliable electricity distribution infrastructure in the UK |

| 4.2.2 Growing focus on smart grid technology and automation in the power sector |

| 4.2.3 Government initiatives and regulations promoting the adoption of reclosers for grid modernization |

| 4.3. Market Restraints |

| 4.3.1 High initial investment cost associated with installing reclosers |

| 4.3.2 Limited awareness about the benefits and capabilities of reclosers among end-users |

| 4.3.3 Challenges related to interoperability and integration with existing grid infrastructure |

| 5. UK Recloser Market Trends |

| 6. UK Country Indicators |

| 6.1 UK Recloser Market Overview |

| 6.2 UK Recloser Market Revenues, 2014-2024 |

| 6.3 UK Recloser Market Revenue Share, By Insulation, 2017 & 2024F |

| 6.4 UK Recloser Market Revenue Share, By Voltage Rating, 2017 & 2024F |

| 6.5 UK Recloser Market Revenue Share, By Applications, 2017 & 2024F |

| 6.6 UK Recloser Market Revenues, By Insulation, 2014-2024 |

| 6.7 UK Recloser Market Revenues, By Voltage, 2014-2024 |

| 6.8 UK Recloser Market Revenues, By Applications, 2014-2024 |

| 7. UK Recloser Market Key Performance Indicator |

| 7.1 UK Construction Sector Outlook |

| 7.2 UK Power Sector Overview |

| 8. UK Recloser Market Opportunity Assessment |

| 8.1 UK Recloser Market Opportunity Assessment, 2024 |

| 9. Competitive Landscape |

| 9.1 UK Recloser Market Revenue Share, By Company, 2017 |

| 10. Company Profiles |

| 10.1. Schneider Electric SE |

| 10.2. ABB Ltd. |

| 10.3. Hubbell Incorporated |

| 10.4. Efacec Power Solutions, SA. |

| 10.5. Tavrida Electric AG |

| 10.6. Ghorit Electrical Co., Ltd |

| 10.7. Siemens AG |

| 10.8. NOJA Power Switchgear Pty Ltd |

| 10.9. G&W Electric Co. |

| 11. Strategic Recommendations |

| 12. Disclaimer |

| List of Figures |

| 1. UK Recloser Market Revenue Share, By Insulation, 2017 & 2024F |

| 2. UK Recloser Market Revenue Share, By Voltage Rating, 2017 & 2024F |

| 3. UK Recloser Market Revenue Share, By Applications, 2017 & 2024F |

| 4. UK Gas Insulated Load Break Switch Market Revenues, 2014-2024F ($ Million) |

| 5. UK Vacuum Insulated Load Break Switch Market Revenues, 2014-2024F ($ Million) |

| 6. UK Below 27kV Load Break Switch Market Revenues, 2014-2024F ($ Million) |

| 7. UK Above 27 kV Load Break Switch Market Revenues, 2014-2024F ($ Million) |

| 8. UK Recloser Market Revenues, By Power Distribution Applications, 2014-2024F ($ Million) |

| 9. UK Recloser Market Revenues, By Industrial Applications, 2014-2024F ($ Million) |

| List of Tables |

| 1. UK Upcoming Renewable Energy Sector Projects |

| 2. UK Planned Transmission Interconnection Projects (380 KV) |

| 3. UK Upcoming Oil & Gas Projects |

| 4. Upcoming Construction Projects |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero