United Arab Emirates (UAE) Salt Market (2025-2031) Outlook | Revenue, Value, Growth, Size, Industry, Forecast, Share, Trends, Analysis, Companies

| Product Code: ETC074519 | Publication Date: Aug 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

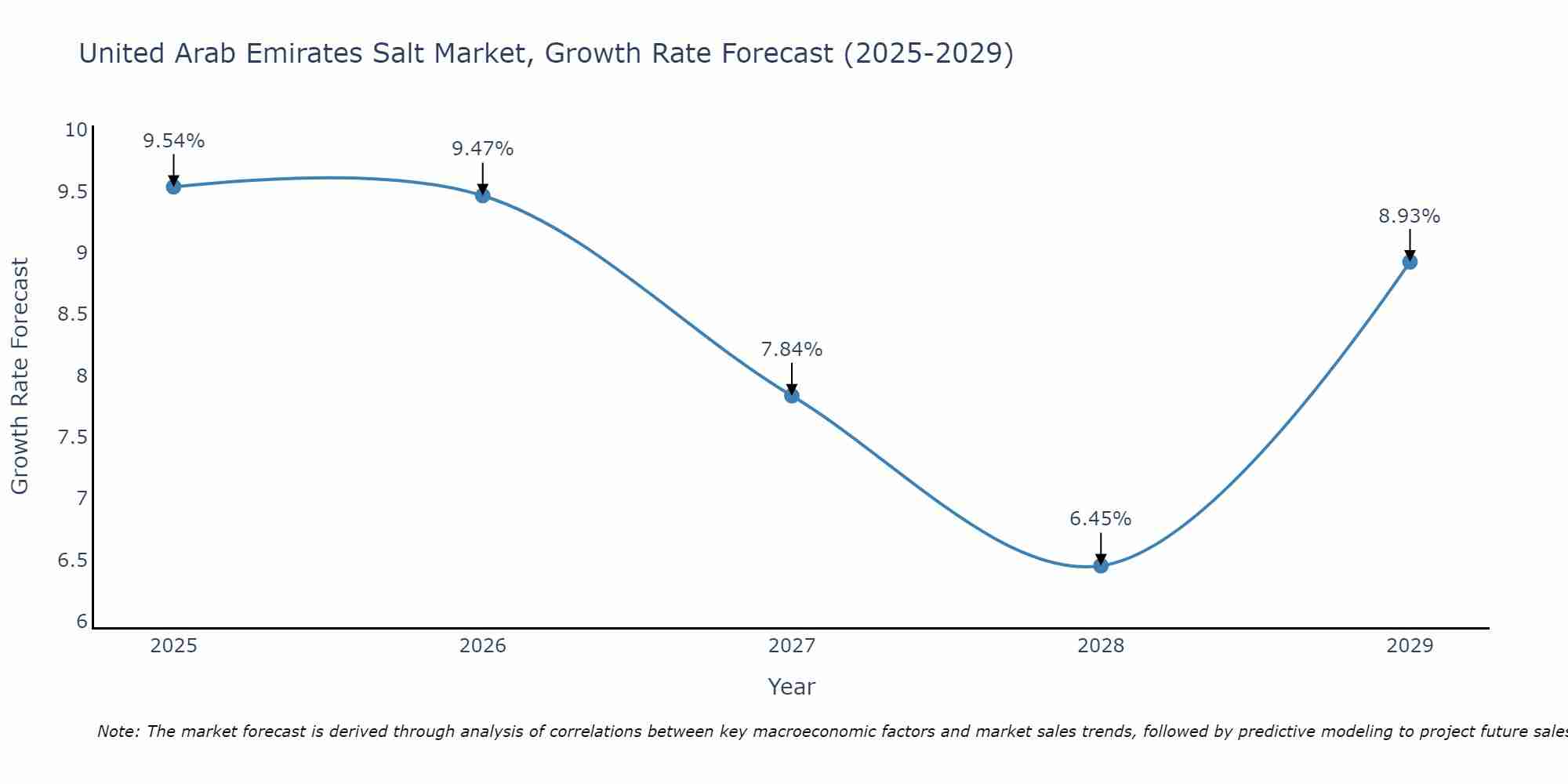

United Arab Emirates Salt Market Size Growth Rate

The United Arab Emirates Salt Market is projected to witness mixed growth rate patterns during 2025 to 2029. Beginning strongly at 9.54% in 2025, growth softens to 8.93% in 2029.

United Arab Emirates (UAE) Salt Market Synopsis

The salt market in the United Arab Emirates (UAE) has witnessed steady growth, driven by the country`s diverse industrial applications, food processing sector, and domestic consumption. Salt, as a fundamental ingredient in various industries and food preparations, holds significant importance in the UAE economy. The UAE growing population, increasing urbanization, and industrial expansion have been key drivers for the demand for salt in the country. Additionally, the country`s coastal geography and extensive salt production facilities contribute to the market`s expansion.

Drivers of the Market

Several factors drive the demand for salt in the UAE. Firstly, the UAE chemical and industrial sectors rely on salt for various processes, including chemical production, water treatment, and metallurgical applications. Secondly, the food processing industry in the UAE uses salt as a preservative, flavor enhancer, and seasoning agent in various food products. The country`s vibrant culinary culture and the presence of a diverse expatriate population further bolster the demand for salt in the food industry.

Challenges of the Market

Despite the positive growth prospects, the UAE salt market faces certain challenges. One significant challenge is the competition from imported salt. While the UAE has a significant salt production capacity, the demand for salt from various industries and consumers may lead to imports from neighboring countries. Ensuring a balance between domestic production and imports requires monitoring market dynamics and supply chains. Additionally, fluctuations in global salt prices and currency exchange rates can impact the cost of imported salt, affecting market dynamics.

Covid-19 Impact on the Market

The Covid-19 pandemic had a limited impact on the UAE salt market. While certain industrial sectors may have experienced temporary disruptions during lockdowns and restrictions, the essential nature of salt for food processing and other applications ensured continued demand. The resilience of the salt market during the pandemic is attributed to its critical role in multiple industries and the uninterrupted flow of essential goods.

Key Players of the Market

The UAE salt market comprises both local and international players. Key local players include Emirates National General Trading (ENGT) and Abu Dhabi Vegetable Oil Company (ADVOC), which have a significant presence in the salt market, supplying salt to various sectors and consumers in the UAE. Additionally, multinational salt producers and traders, such as Cargill, Tata Chemicals, and Salinas, have a strong market presence, providing a wide range of salt products to the UAE industrial and food processing sectors. The market`s competitiveness and growth are shaped by the efforts of these key players to maintain product quality, supply chain efficiency, and meet the diverse demands of the UAE salt consumers.

Key Highlights of the Report:

- United Arab Emirates (UAE) Salt Market Outlook

- Market Size of United Arab Emirates (UAE) Salt Market, 2024

- Forecast of United Arab Emirates (UAE) Salt Market, 2031

- Historical Data and Forecast of United Arab Emirates (UAE) Salt Revenues & Volume for the Period 2021-2031

- United Arab Emirates (UAE) Salt Market Trend Evolution

- United Arab Emirates (UAE) Salt Market Drivers and Challenges

- United Arab Emirates (UAE) Salt Price Trends

- United Arab Emirates (UAE) Salt Porter's Five Forces

- United Arab Emirates (UAE) Salt Industry Life Cycle

- Historical Data and Forecast of United Arab Emirates (UAE) Salt Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of United Arab Emirates (UAE) Salt Market Revenues & Volume By Rock Salt for the Period 2021-2031

- Historical Data and Forecast of United Arab Emirates (UAE) Salt Market Revenues & Volume By Brine for the Period 2021-2031

- Historical Data and Forecast of United Arab Emirates (UAE) Salt Market Revenues & Volume By Solar Salt for the Period 2021-2031

- Historical Data and Forecast of United Arab Emirates (UAE) Salt Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of United Arab Emirates (UAE) Salt Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of United Arab Emirates (UAE) Salt Market Revenues & Volume By Chemical Processing for the Period 2021-2031

- Historical Data and Forecast of United Arab Emirates (UAE) Salt Market Revenues & Volume By Road De-icing for the Period 2021-2031

- Historical Data and Forecast of United Arab Emirates (UAE) Salt Market Revenues & Volume By Food Processing for the Period 2021-2031

- Historical Data and Forecast of United Arab Emirates (UAE) Salt Market Revenues & Volume By Others for the Period 2021-2031

- United Arab Emirates (UAE) Salt Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Applications

- United Arab Emirates (UAE) Salt Top Companies Market Share

- United Arab Emirates (UAE) Salt Competitive Benchmarking By Technical and Operational Parameters

- United Arab Emirates (UAE) Salt Company Profiles

- United Arab Emirates (UAE) Salt Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United Arab Emirates (UAE) Salt Market Overview |

3.1 United Arab Emirates (UAE) Country Macro Economic Indicators |

3.2 United Arab Emirates (UAE) Salt Market Revenues & Volume, 2021 & 2031F |

3.3 United Arab Emirates (UAE) Salt Market - Industry Life Cycle |

3.4 United Arab Emirates (UAE) Salt Market - Porter's Five Forces |

3.5 United Arab Emirates (UAE) Salt Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 United Arab Emirates (UAE) Salt Market Revenues & Volume Share, By Applications, 2021 & 2031F |

4 United Arab Emirates (UAE) Salt Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 United Arab Emirates (UAE) Salt Market Trends |

6 United Arab Emirates (UAE) Salt Market, By Types |

6.1 United Arab Emirates (UAE) Salt Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 United Arab Emirates (UAE) Salt Market Revenues & Volume, By Type, 2018 - 2031F |

6.1.3 United Arab Emirates (UAE) Salt Market Revenues & Volume, By Rock Salt, 2018 - 2031F |

6.1.4 United Arab Emirates (UAE) Salt Market Revenues & Volume, By Brine , 2018 - 2031F |

6.1.5 United Arab Emirates (UAE) Salt Market Revenues & Volume, By Solar Salt, 2018 - 2031F |

6.1.6 United Arab Emirates (UAE) Salt Market Revenues & Volume, By Others, 2018 - 2031F |

6.2 United Arab Emirates (UAE) Salt Market, By Applications |

6.2.1 Overview and Analysis |

6.2.2 United Arab Emirates (UAE) Salt Market Revenues & Volume, By Chemical Processing, 2018 - 2031F |

6.2.3 United Arab Emirates (UAE) Salt Market Revenues & Volume, By Road De-icing, 2018 - 2031F |

6.2.4 United Arab Emirates (UAE) Salt Market Revenues & Volume, By Food Processing, 2018 - 2031F |

6.2.5 United Arab Emirates (UAE) Salt Market Revenues & Volume, By Others, 2018 - 2031F |

7 United Arab Emirates (UAE) Salt Market Import-Export Trade Statistics |

7.1 United Arab Emirates (UAE) Salt Market Export to Major Countries |

7.2 United Arab Emirates (UAE) Salt Market Imports from Major Countries |

8 United Arab Emirates (UAE) Salt Market Key Performance Indicators |

9 United Arab Emirates (UAE) Salt Market - Opportunity Assessment |

9.1 United Arab Emirates (UAE) Salt Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 United Arab Emirates (UAE) Salt Market Opportunity Assessment, By Applications, 2021 & 2031F |

10 United Arab Emirates (UAE) Salt Market - Competitive Landscape |

10.1 United Arab Emirates (UAE) Salt Market Revenue Share, By Companies, 2024 |

10.2 United Arab Emirates (UAE) Salt Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero