United Kingdom Cogeneration Equipment Market (2025-2031) | Outlook, Companies, Forecast, Growth, Trends, Size, Industry, Share, Value, Analysis & Revenue

Market Forecast By Capacity (Up to 30 MW, 31 MW – 60 MW and Above 60 MW), By Fuel (Natural Gas, Biomass, Coal, and Others), By Applications (Residential, Commercial and Industrial), By Technology (Reciprocating Engine, Steam Turbine, Combined Cycle, Gas Turbine, and Others) And Competitive Landscape

| Product Code: ETC150354 | Publication Date: Jan 2025 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

United Kingdom Cogeneration Equipment Market Highlights

| Report Name | United Kingdom Cogeneration Equipment Market |

| CAGR | 6.3% |

| Growing Sector | Industrial |

| Forecast Period | 2025-2031 |

Topics Covered in United Kingdom Cogeneration Equipment Market Report

The United Kingdom Cogeneration Equipment Market report thoroughly covers the market by capacity, by fuel, by technology, and by application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

United Kingdom Cogeneration Equipment Market Synopsis

The United Kingdom cogeneration equipment market has been experiencing steady growth, driven by increasing demand for energy efficiency and sustainable energy solutions. Cogeneration, or combined heat and power (CHP), is an effective way of simultaneously producing electricity and useful heat from the same energy source, thus optimizing the energy output and reducing waste. In the UK, the push towards reducing carbon emissions and meeting renewable energy targets has further fueled the adoption of cogeneration technology across various sectors, including industrial, commercial, and residential. Technological advancements and supportive government policies, aimed at incentivizing energy-efficient practices, are expected to continue propelling the cogeneration equipment market forward in the coming years.

According to 6Wresearch, United Kingdom Cogeneration Equipment Market size is projected to witness a CAGR of 6.3% during the forecast period of 2025-2031. One primary driver is the increasing focus on energy efficiency and sustainability. As the UK government and industries strive to reduce carbon emissions and promote cleaner energy solutions, cogeneration, also known as combined heat and power (CHP), offers a practical method to improve energy efficiency. This market is also bolstered by policy support and incentives that encourage the adoption of cogeneration technologies across various sectors.

High initial capital investment and installation costs remain a barrier for small and medium-sized enterprises looking to adopt cogeneration systems. Additionally, regulatory complexities and the need for skilled labor to install and maintain these systems can impede widespread implementation. Addressing these challenges is crucial for the cogeneration equipment market to achieve its full potential in the UK.

United Kingdom Cogeneration Equipment Market: Leading Players

The United Kingdom's cogeneration equipment market is characterized by a diverse array of leading players who drive innovation and efficiency in energy solutions. Some of the prominent companies include Siemens AG, GE Power, ABB Ltd., and Mitsubishi Hitachi Power Systems. These industry leaders are recognized for their contribution to developing cutting-edge cogeneration technologies that optimize energy production, reduce emissions, and offer sustainable solutions to meet the country's growing power demands. They continually invest in research and development to enhance the performance and reliability of their cogeneration equipment, ensuring competitive edge in the market.

United Kingdom Cogeneration Equipment Market: Government Initiatives

The United Kingdom has been actively promoting the use of cogeneration equipment as part of its energy strategy, aiming to enhance energy efficiency and reduce carbon emissions. Government initiatives have played a pivotal role in this endeavor by introducing policies that support and incentivize the use of combined heat and power (CHP) systems. These include providing financial support mechanisms such as the Renewable Heat Incentive (RHI), which encourages businesses and households to adopt CHP technologies through tariff payments. Additionally, regulatory measures that establish favorable conditions for cogeneration, like relaxing grid connection standards and reducing administrative burdens, have significantly increased the adoption rate. As the UK continues to focus on sustainable energy solutions, government support remains crucial in shaping the cogeneration equipment market.

Future Insights of United Kingdom Cogeneration Equipment Market

The future of the United Kingdom cogeneration equipment market promises a period of dynamic growth and transformation. As the nation focuses on reducing carbon emissions and optimizing energy efficiency, the demand for cogeneration—or combined heat and power (CHP) systems—is expected to increase. With government initiatives supporting sustainable energy solutions, cogeneration equipment will likely become integral to both industrial and commercial energy strategies. Advancements in technology are anticipated to enhance the efficiency and affordability of these systems, further accelerating their adoption. Additionally, the integration of renewable energy sources into cogeneration systems could revolutionize the energy landscape, providing cleaner and more sustainable energy solutions across the UK.

United Kingdom Cogeneration Equipment Market trends

- Rising Demand for Energy Efficiency – There is a growing emphasis on energy-efficient technologies, driving the adoption of cogeneration equipment to reduce energy consumption and greenhouse gas emissions.

- Government Initiatives and Support – The UK government is providing incentives and regulatory support for cogeneration projects, encouraging both public and private sectors to invest in cogeneration equipment.

- Increasing Industrial Applications - Industries such as manufacturing, food processing, and chemical production are increasingly implementing cogeneration systems to optimize energy use and cut costs.

Investment opportunities in United Kingdom Cogeneration Equipment Market

- Collaboration between Industries – Collaborative efforts between different industries can lead to shared cogeneration facilities, reducing costs and increasing efficiency for all parties involved. This trend is expected to continue as businesses look for ways to reduce expenses and increase productivity.

- Potential for Diversification – Cogeneration can be applied in various industries such as healthcare, hospitality, data centers, and commercial buildings, providing opportunities for investors to diversify their portfolio and mitigate risks.

- Growing Industrial Sector - The expansion of the UK's industrial sector, particularly in manufacturing and processing, requires stable and efficient power solutions, increasing the demand for cogeneration equipment.

Above 60MW to dominate the market - By capacity

According to Ravi Bhandari, Research Head, 6Wresearch, the cogeneration equipment market in the United Kingdom above 60MW is experiencing considerable growth due to increasing demand for efficient energy systems. As industries seek to reduce carbon footprints and improve energy efficiency, large-scale cogeneration systems offer a practical solution. These systems produce both electricity and useful heat simultaneously, thereby maximizing energy use and reducing waste. In the UK, regulatory support and incentives for sustainable energy production further drive the adoption of cogeneration technologies. This trend is also fueled by advancements in technology that enhance the performance and reliability of cogeneration equipment, making it a viable choice for large industrial facilities and urban districts aiming to optimize their energy usage.

Biomass to dominate the market – By fuel

Biomass plays a significant role in the expansion of the cogeneration equipment market in the United Kingdom. As a renewable energy source, biomass is gaining traction as industries and policymakers aim to transition towards cleaner energy alternatives. In cogeneration systems, biomass fuels such as wood chips, agricultural residues, and organic waste are utilized to produce both electricity and thermal energy. This dual benefit aligns with the UK's sustainability goals, offering an environmentally friendly option to meet energy demands while reducing carbon emissions. Government incentives and support for biomass energy projects further bolster its adoption within the cogeneration market, providing a promising avenue for sustainable growth.

Industrial to dominate the market – By application

The industrial sector in the United Kingdom is increasingly adopting cogeneration equipment to meet its energy requirements more efficiently. Industrial facilities, which are often energy-intensive, benefit significantly from cogeneration systems by reducing their operational costs and minimizing their ecological footprint. These systems allow industries to generate electricity and thermal energy on-site, leading to reduced dependency on external power supplies. As the UK government continues to push for carbon reduction and energy efficiency, many industries are turning to cogeneration as a strategic solution. Sectors such as manufacturing, food processing, and chemical production are at the forefront of this transition, driven by both regulatory pressures and the economic advantages offered by cogeneration technology.

Gas turbine to dominate the market – By technology

Gas turbines play a crucial role in the United Kingdom's cogeneration equipment market due to their ability to efficiently convert natural gas into electricity and thermal energy. These turbines are well-suited for various industrial applications where both power and heat are essential. In cogeneration systems, gas turbines contribute to enhanced energy efficiency by utilizing the waste heat produced during electricity generation. This process not only optimizes fuel usage but also reduces emissions, aligning with the UK's stringent environmental standards. Additionally, the flexibility of gas turbines to operate on different types of gaseous fuels makes them a versatile option for diverse industry sectors.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- United Kingdom Cogeneration Equipment Market Outlook

- Market Size of United Kingdom Cogeneration Equipment Market, 2024

- Forecast of United Kingdom Cogeneration Equipment Market, 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Revenues & Volume for the Period 2021 - 2031

- United Kingdom Cogeneration Equipment Market Trend Evolution

- United Kingdom Cogeneration Equipment Market Drivers and Challenges

- United Kingdom Cogeneration Equipment Price Trends

- United Kingdom Cogeneration Equipment Porter's Five Forces

- United Kingdom Cogeneration Equipment Industry Life Cycle

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume By capacity for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Up to 30 MW for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by 31 MW – 60 MW, for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Above 60 MW for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by fuel for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume By Natural Gas for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Biomass, for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Coal for the Period 2021 - 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Others for the Period 2021 – 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by application for the Period 2021 – 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Residential for the Period 2021 – 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Commercial for the Period 2021 – 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Industrial for the Period 2021 – 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Technology for the Period 2021 – 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Reciprocating Engine for the Period 2021 – 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Steam Turbine for the Period 2021 – 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Combined Cycle for the Period 2021 – 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Gas Turbine for the Period 2021 – 2031

- Historical Data and Forecast of United Kingdom Cogeneration Equipment Market Revenues & Volume by Others for the Period 2021 – 2031

- United Kingdom Cogeneration Equipment Import Export Trade Statistics

- Market Opportunity Assessment By application

- Market Opportunity Assessment by Product Type

- United Kingdom Cogeneration Equipment Top Companies Market Share

- United Kingdom Cogeneration Equipment Competitive Benchmarking by Technical and Operational Parameters

- United Kingdom Cogeneration Equipment Company Profiles

- United Kingdom Cogeneration Equipment Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Capacity

- Up to 30 MW

- 31 MW – 60 MW

- Above 60 MW

By Fuel

- Natural Gas

- Biomass

- Coal

- Others

By Applications

- Residential

- Commercial

- Industrial

By Technology

- Reciprocating Engine

- Steam Turbine

- Combined Cycle Gas Turbine

- Others

United Kingdom Cogeneration Equipment Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. United Kingdom Cogeneration Equipment Market Overview |

| 3.1 United Kingdom Cogeneration Equipment Market Revenues, 2021-2031F |

| 3.2 United Kingdom Cogeneration Equipment Market Revenue Share, By Fuel, 2021 & 2031F |

| 3.3 United Kingdom Cogeneration Equipment Market Revenue Share, By Applications, 2021 & 2031F |

| 3.4 United Kingdom Cogeneration Equipment Market Revenue Share, By Technology, 2021 & 2031F |

| 3.5 United Kingdom Cogeneration Equipment Market Revenue Share, By Capacity, 2021 & 2031F |

| 3.6 United Kingdom Cogeneration Equipment Market Industry Life Cycle |

| 3.7 United Kingdom Cogeneration Equipment Market- Porter’s Five Forces |

| 4. United Kingdom Cogeneration Equipment Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing focus on renewable energy sources and sustainability initiatives in the UK |

| 4.2.2 Government support and incentives for cogeneration projects |

| 4.2.3 Growing demand for energy efficiency and cost savings in industries |

| 4.3 Market Restraints |

| 4.3.1 High initial investment costs associated with cogeneration equipment |

| 4.3.2 Fluctuating prices of natural gas, a common fuel source for cogeneration systems |

| 4.3.3 Limited awareness and understanding of cogeneration technology among potential end-users |

| 5. United Kingdom Cogeneration Equipment Market Trends |

| 6. United Kingdom Cogeneration Equipment Market Overview, By Fuel |

| 6.1 United Kingdom Natural Gas Market Revenues, 2021-2031F |

| 6.2 United Kingdom Biomass Market Revenues, 2021-2031F |

| 6.3 United Kingdom Coal Market Revenues, 2021-2031F |

| 6.4 United Kingdom Other Fuels Market Revenues, 2021-2031F |

| 7. United Kingdom Cogeneration Equipment Market Overview, By Applications |

| 7.1 United Kingdom Commercial Cogeneration Equipment Market Revenues, 2021-2031F |

| 7.2 United Kingdom Residential Cogeneration Equipment Market Revenues, 2021-2031F |

| 7.3 United Kingdom Industrial Cogeneration Equipment Market Revenues, 2021-2031F |

| 8. United Kingdom Cogeneration Equipment Market Overview, By Technology |

| 8.1 United Kingdom Reciprocating Engine Market Revenues, 2021-2031F |

| 8.2 United Kingdom Steam Turbine Market Revenues, 2021-2031F |

| 8.3 United Kingdom Combined Cycle Gas Turbine Market Revenues, 2021-2031F |

| 8.4 United Kingdom Other Technology Market Revenues, 2021-2031F |

| 9. United Kingdom Cogeneration Equipment Market Overview, By Capacity |

| 9.1 United Kingdom Upto 30 MW Market Revenues, 2021-2031F |

| 9.2 United Kingdom 31 MW-60 MW Market Revenues, 2021-2031F |

| 9.3 United Kingdom Above 60 MW Market Revenues, 2021-2031F |

| 14. United Kingdom Cogeneration Equipment Market - Opportunity Assessment |

| 14.1 United Kingdom Cogeneration Equipment Market Opportunity Assessment, By Fuel, 2031F |

| 14.2 United Kingdom Cogeneration Equipment Market Opportunity Assessment, By Applications, 2031F |

| 14.3 United Kingdom Cogeneration Equipment Market Opportunity Assessment, By Technology, 2031F |

| 14.4 United Kingdom Cogeneration Equipment Market Opportunity Assessment, By Capacity, 2031F |

| 15. United Kingdom Cogeneration Equipment Market - Competitive Landscape |

| 15.1 United Kingdom Cogeneration Equipment Market Revenue Share, By Companies, 2024 |

| 15.2 United Kingdom Cogeneration Equipment Market Competitive Benchmarking, By Operating Parameters, 2024 |

| 16. Company Profiles |

| 17. Strategic Recommendations |

| 18. Disclaimer |

Market Forecast By Capacity (Up to 30 MW, 31 MW – 60 MW and Above 60 MW), By Fuel (Natural Gas, Biomass, Coal, and Others), By Applications (Residential, Commercial and Industrial), By Technology (Reciprocating Engine, Steam Turbine, Combined Cycle, Gas Turbine, and Others) And Competitive Landscape

| Product Code: ETC150354 | Publication Date: Jan 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 80 | No. of Figures: 14 | No. of Tables: 3 |

United Kingdom Cogeneration Equipment Market report thoroughly covers the market by capacity, by fuel, by applications, and by technology. The report provides an unbiased and detailed analysis of the on-going United Kingdom cogeneration equipment market trends, opportunities/high growth areas, and market drivers, which would help the stakeholders to device and align the market strategies according to the current and future market dynamics.

United Kingdom Cogeneration Equipment Market Synopsis

The UK cogeneration market has seen significant growth in demand for energy-efficient solutions, sustainable electricity, and heat generation in recent years. In the coming years, the country's vast potential dependence on natural gas and coal would shrink as the country commits to reducing its carbon footprint. In addition, under the CODE (Cogeneration Observatory and Dissemination Europe), the government aims to increase the contribution of electricity production from cogeneration sources. However, the Covid-19 pandemic had slowed down the market in terms of the supply of the product during 2020. While on the other hand, the demand-side also fell victim to the slowdown due to the market being closed during the lockdown period. Currently, the market has recovered gradually and is likely to witness growth over the coming years.

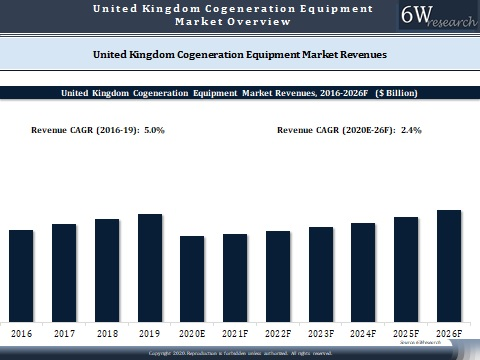

According to 6Wresearch, United Kingdom Cogeneration Equipment market size is expected to grow at a CAGR of 2.4% during 2020-2026. The UK has aimed an objective to reduce greenhouse gas emissions by 2050 by 80% compared to 1990 levels. This would result in a fuel-switching from coal to low carbon fuels such as waste, biomass, and biogas, thereby leading to an increase in demand for cogeneration equipment in the country in the coming years.

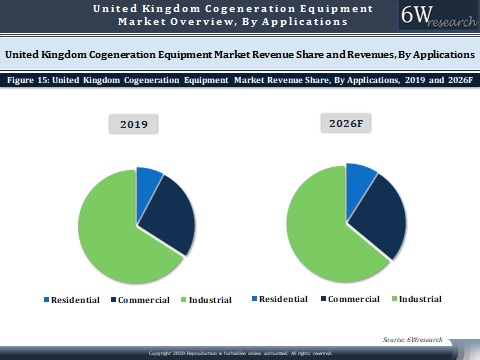

Market Analysis By Applications

In terms of applications, the industrial vertical dominated the overall United Kingdom cogeneration equipment market in 2019 and held the majority of the share. Additionally, the commercial vertical also held the majority of the market revenue share. Further, the residential vertical is likely to register moderate growth over the coming years.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2020.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- United Kingdom Cogeneration Equipment Market Overview

- United Kingdom Cogeneration Equipment Market Outlook

- United Kingdom Cogeneration Equipment Market Forecast

- Historical Data of United Kingdom Cogeneration Equipment Market Revenues for the Period 2017-2029

- United Kingdom Cogeneration Equipment Market Size and Market Forecast of Revenues, Until 2026

- Historical Data of United Kingdom Cogeneration Equipment Market Revenues, by Fuel, for the Period 2017-2019

- Market Size & Forecast of United Kingdom Cogeneration Equipment Market Revenues, by Fuel, until 2026

- Historical Data of United Kingdom Cogeneration Equipment Market Revenues, by Applications, for the Period 2017-2019

- Market Size & Forecast of United Kingdom Cogeneration Equipment Market Revenues, by Applications, until 2026

- Historical Data of United Kingdom Cogeneration Equipment Market Revenues, by Capacity, for the Period 2017-2019

- Market Size & Forecast of United Kingdom Cogeneration Equipment Market Revenues, by Capacity, until 2026

- Historical Data of United Kingdom Cogeneration Equipment Market Revenues, by Technology, for the Period 2017-2019

- Market Size & Forecast of United Kingdom Cogeneration Equipment Market Revenues, by Technology, until 2026

- Market Drivers and Restraints

- United Kingdom Cogeneration Equipment Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- United Kingdom Cogeneration Equipment Market Share, By Players

- United Kingdom Cogeneration Equipment Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The United Kingdom cogeneration equipment market report provides a detailed analysis of the following market segments:

By Capacity:

- Up to 30 MW

- 31 MW – 60 MW

- Above 60 MW

By Fuel:

- Natural Gas

- Biomass

- Coal

- Others

By Applications:

- Residential

- Commercial

- Industrial

By Technology:

- Reciprocating Engine

- Steam Turbine

- Combined Cycle Gas Turbine

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero