United States Ethanol Market (2025-2031) | Industry, Size, Outlook, Revenue, Trends, Growth, Forecast, Share, Segmentation

MarketForecastBy Purity (Denatured, Non-Denatured), By Sources (Sugar & Molasses Based, Grained Based, Second Generation) By Application (Industrial Solvent, Fuel & Fuel Additives, Beverages, Disinfectant, Personal Care, Others) And Competitive Landscape

| Product Code: ETC003088 | Publication Date: Jun 2020 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

US Ethanol Market | Country-Wise Share and Competition Analysis

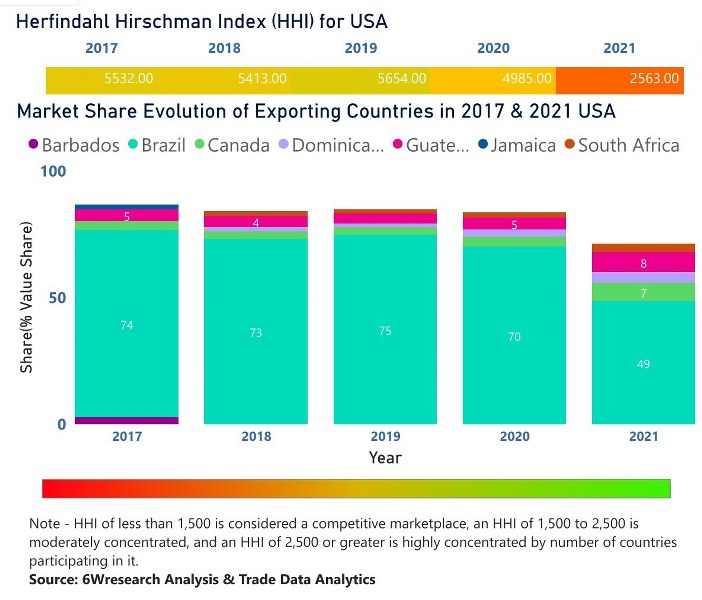

In the year 2021, Brazil was the largest exporter in terms of value, followed by Guatemala. It has registered a decline of -51.61% over the previous year. While Guatemala registered a growth of 20.26% as compared to the previous year. In the year 2017, Brazil was the largest exporter followed by Guatemala. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, the USA has a Herfindahl index of 5532 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 2563 which signifies high concentration in the market.

![US Ethanol Market | Country-Wise Share and Competition Analysis]() US Ethanol Market - Export Market Opportunities

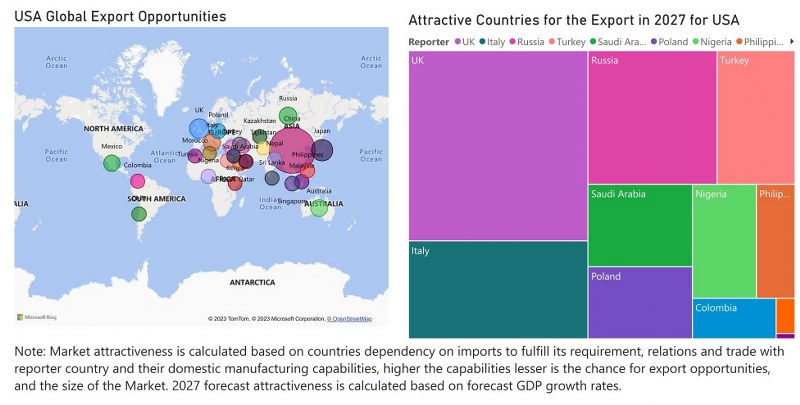

US Ethanol Market - Export Market Opportunities![US Ethanol Market - Export Market Opportunities]()

Topics Covered in United States Ethanol Market Report

The United States Ethanol Market report comprehensively covers the market by Purity, Sources, and Application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high-growth areas, and market drivers, which would help stakeholders devise and align their market strategies according to the current and future market dynamics.

United States Ethanol Market Synopsis

The United States Ethanol Market is witnessing consistent growth, primarily driven by the increasing demand for biofuels and the rising emphasis on renewable energy sources.

According to 6Wresearch, the United States Ethanol Market is expected to grow at a CAGR of 5.8% from 2025-2031. The fuel and fuel additives segment is experiencing significant growth, supported by the government's push for sustainable energy and the implementation of favorable regulatory policies. Ethanol's versatility as a solvent, disinfectant, and key ingredient in beverages also contributes to its widespread application. The market benefits from advancements in production technologies and a robust supply chain that supports diverse end-user needs.

Despite the optimistic outlook, the market faces challenges including volatility in raw material prices and competition from alternative energy sources. The fluctuating cost of feedstock, particularly grain-based sources, can impact profit margins and price stability. Additionally, the ethanol industry must navigate stringent environmental regulations aimed at reducing carbon emissions, which may require substantial investments in cleaner production processes. The growing debate over the food vs. fuel use of agricultural resources also poses ethical and market challenges.

United States Ethanol Market: Leading Players

Key players in the United States Ethanol Market include Archer Daniels Midland Company, POET LLC, and Green Plains Inc. Archer Daniels Midland Company is a leading producer with a comprehensive portfolio, offering high-purity ethanol for various industrial and fuel applications. POET LLC stands out for its innovation in second-generation ethanol production, utilizing advanced biorefining technologies. Green Plains Inc. is recognized for its extensive production capacity and focus on sustainable and efficient production processes, catering to the growing demand for renewable fuels.

United States Ethanol Industry: Government Initiatives

The U.S. government actively supports the ethanol market through various policies and subsidies aimed at promoting renewable energy and reducing carbon emissions. Key initiatives include the Renewable Fuel Standard (RFS), which mandates the blending of renewable fuels like ethanol with gasoline. Tax incentives and grants are also provided to encourage the adoption of advanced biofuel technologies. Additionally, the government is investing in research and development to improve ethanol production efficiency and explore new feedstock sources. These efforts are aligned with the broader goal of achieving energy independence and reducing the environmental impact of transportation fuels.

Future Insights of the Market

The United States Ethanol Market is projected to continue its growth trajectory, driven by increasing consumer demand for cleaner energy sources and the expansion of ethanol blending mandates. The shift towards second-generation ethanol, produced from non-food biomass, is expected to gain momentum, addressing both sustainability concerns and the food vs. fuel debate. Technological advancements in production processes will likely enhance efficiency and reduce costs, making ethanol more competitive with fossil fuels. Additionally, the growing focus on reducing greenhouse gas emissions will boost demand for ethanol as a lower-carbon alternative. The market will also benefit from the diversification of applications, including in personal care products and disinfectants, offering new growth opportunities for producers.

Market Segmentation By Purity

According to Ravi Bhandari, Research Head, 6Wresearch, denatured ethanol dominates the market due to its widespread use in industrial applications and fuel blends.

Market Segmentation By Sources

Grain-based ethanol holds a significant share, supported by the availability of feedstock. However, second-generation ethanol, made from non-food biomass, is gaining traction.

Market Segmentation By Application

The fuel & fuel additives segment leads the market, driven by government mandates and the push for renewable energy. Beverages and disinfectants also represent key applications.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- United States Ethanol Market Overview

- The United States Ethanol Market Outlook

- The United States Ethanol Market Forecast

- Historical Data of United States Ethanol Market Revenues and Volumes, for the Period 2021-2031.

- Market Size & Forecast of United States Ethanol Market Revenues and Volumes, until 2031.

- Historical Data of United States Ethanol Market Revenues and Volumes, by purity, for the Period 2021-2031.

- Market Size & Forecast of United States Ethanol Market Revenues and Volumes, by purity, until 2031.

- Historical Data of United States Ethanol Market Revenues and Volumes, by Source, for the Period 2021-2031.

- Market Size & Forecast of United States Ethanol Market Revenues and Volumes, by source, until 2031.

- Historical Data of United States Ethanol Market Revenues and Volumes, by application, for the Period 2021-2031.

- Market Size & Forecast of United States Ethanol Market Revenues and Volumes, by application, until 2031.

- Market Drivers and Restraints

- The United States Ethanol Market Price Trends

- The United States Ethanol Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- The United States Ethanol Market Share, By Players

- United States Ethanol Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Purity

- Denatured

- Non-Denatured

By Sources

- Sugar & Molasses Based

- Grained Based

- Second Generation

By Application

- Industrial Solvent

- Fuel & Fuel Additives

- Beverages

- Disinfectant

- Personal Care

- Others

United States Ethanol Market 2025 - 2031: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. the United States Ethanol Market Overview |

| 3.1 United States Ethanol Market Revenues and Volume, 2021-2031F |

| 3.2 United States Ethanol Market Revenue Share, By Purity, 2021 & 2031F |

| 3.3 United States Ethanol Market Revenue Share, By Source, 2021 & 2031F |

| 3.4 United States Ethanol Market Revenue Share, By Application, 2021 & 2031F |

| 3.5 United States Ethanol Market - Industry Life Cycle |

| 3.6 United States Ethanol Market - Porter’s Five Forces |

| 4. the United States Ethanol Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing focus on renewable energy sources and sustainability efforts |

| 4.2.2 Government mandates and incentives promoting ethanol production and consumption |

| 4.2.3 Growing demand for biofuels as an alternative to fossil fuels |

| 4.3 Market Restraints |

| 4.3.1 Fluctuations in feedstock prices affecting ethanol production costs |

| 4.3.2 Competition from other biofuels and alternative energy sources |

| 4.3.3 Regulatory challenges and policy uncertainties impacting the ethanol market |

| 5. the United States Ethanol Market Trends |

| 6. United States Ethanol Market Overview, by Source |

| 6.1 United States Sugar & Molasses Based Ethanol Market Revenues and Volume, 2021-2031F |

| 6.2 United States Grained Based Ethanol Market Revenues and Volume, 2021-2031F |

| 6.3 United States Second Generation Ethanol Market Revenues and Volume, 2021-2031F |

| 7. United States Ethanol Market Overview, by Purity |

| 7.1 United States Ethanol Market Revenue and Volumes, By Denatured, 2021-2031F |

| 7.2 United States Ethanol Market Revenue and Volumes, By Non-Denatured, 2021-2031F |

| 8. United States Ethanol Market Overview, by Application |

| 8.1 United States Ethanol Market Revenue and Volumes, By Industrial Solvent, 2021-2031F |

| 8.2 United States Ethanol Market Revenue and Volumes, By Fuel & Fuel Additives, 2021-2031F |

| 8.3 United States Ethanol Market Revenue and Volumes, By Beverages, 2021-2031F |

| 8.4 United States Ethanol Market Revenue and Volumes, By Disinfectant, 2021-2031F |

| 8.5 United States Ethanol Market Revenue and Volumes, By Personal Care, 2021-2031F |

| 8.6 United States Ethanol Market Revenue and Volumes, By Others, 2021-2031F |

| 9. the United States Ethanol Market Key Performance Indicators |

| 9.1 Average ethanol blending rate in gasoline |

| 9.2 Number of ethanol plants in operation |

| 9.3 Carbon intensity of ethanol production |

| 9.4 Investment in research and development for ethanol technology |

| 9.5 Adoption rate of flexible fuel vehicles (FFVs) |

| 10. the United States Ethanol Market Opportunity Assessment |

| 10.1 United States Ethanol Market Opportunity Assessment, By Purity, 2031F |

| 10.2 United States Ethanol Market Opportunity Assessment, By Source, 2031F |

| 10.3 United States Ethanol Market Opportunity Assessment, By Application, 2031F |

| 11. the United States Ethanol Market Competitive Landscape |

| 11.1 United States Ethanol Market By Companies, 2024 |

| 11.2 United States Ethanol Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero