United States (US) Automotive Tail Light Market (2025-2031) Outlook | Industry, Size, Revenue, Value, Trends, Growth, Analysis, Companies, Share & Forecast

| Product Code: ETC258241 | Publication Date: Aug 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Shubham Padhi | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

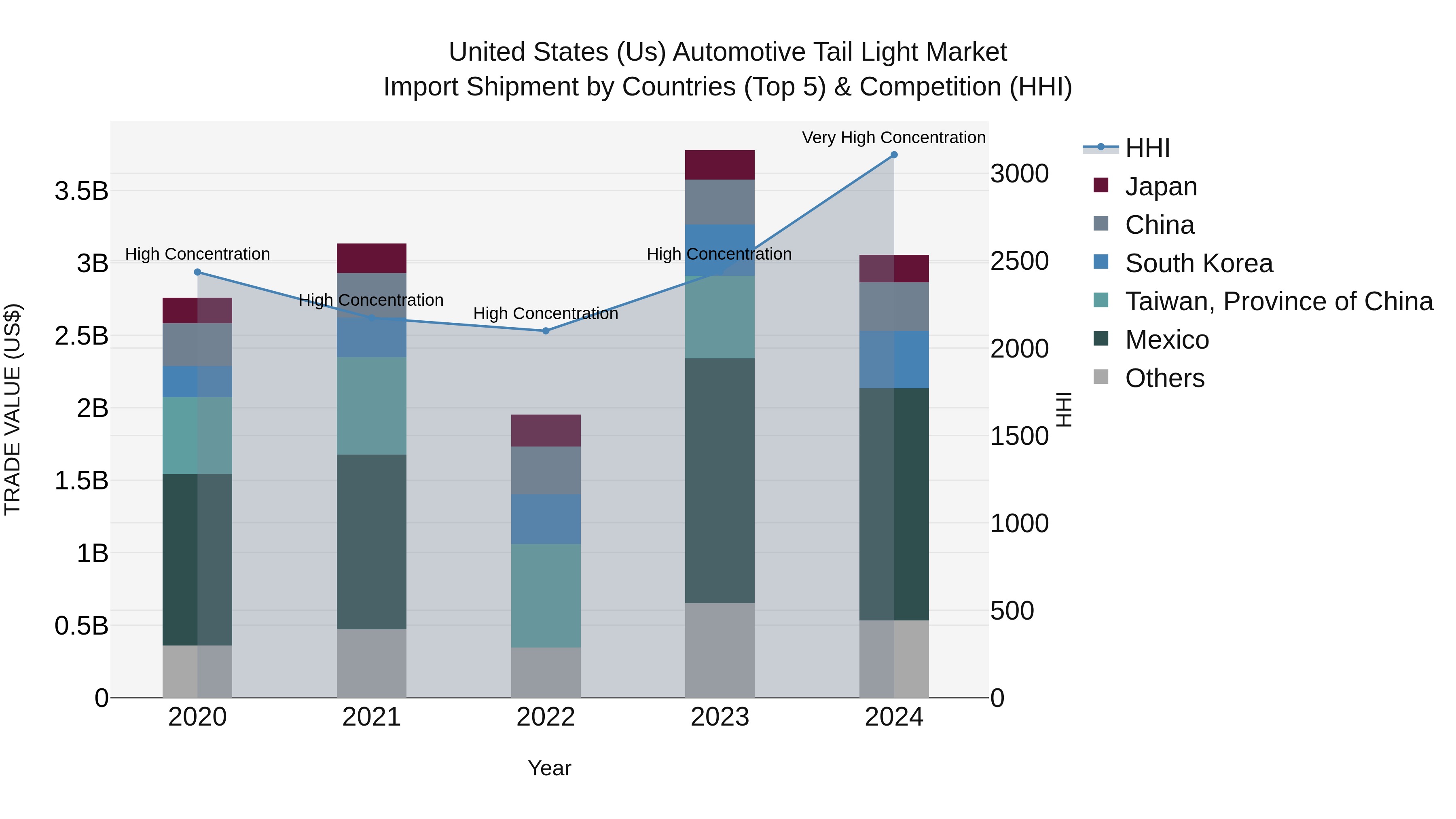

United States (US) Automotive Tail Light Market Top 5 Importing Countries and Market Competition (HHI) Analysis

The United States continues to see a steady inflow of automotive tail light imports, with Mexico, South Korea, China, Japan, and Canada being the top exporting countries in 2024. The market concentration, as measured by the HHI, has significantly increased from 2023 to 2024, indicating a high level of dominance by these key exporting nations. Despite a moderate compound annual growth rate (CAGR) of 2.58% from 2020 to 2024, there was a notable decline in growth rate from 2023 to 2024 at -19.11%. This shift suggests potential shifts in market dynamics and competition within the automotive tail light import sector in the U.S.

United States (US) Automotive Tail Light Market Overview

The United States Automotive Tail Light Market is a significant segment within the country`s automotive industry, driven by factors such as vehicle safety regulations, technological advancements, and consumer preferences. The market consists of various types of tail lights, including LED, halogen, and xenon, catering to different vehicle models and designs. With increasing emphasis on vehicle safety and aesthetics, manufacturers are focusing on developing innovative tail light designs that offer improved visibility, energy efficiency, and durability. Key players in the US market include companies like Hella, Magneti Marelli, Osram, and Valeo, competing based on product quality, pricing, and distribution networks. The market is expected to witness steady growth driven by rising vehicle sales, technological advancements, and growing consumer awareness regarding safety features in automobiles.

United States (US) Automotive Tail Light Market Trends

The US Automotive Tail Light Market is witnessing several key trends. One major trend is the increasing adoption of LED technology in tail lights, offering improved energy efficiency, longevity, and design flexibility. Customization options, such as dynamic turn signals and sequential lighting patterns, are becoming popular among consumers looking to personalize their vehicles. Another trend is the rise of connected tail lights that integrate with advanced driver assistance systems (ADAS) for enhanced safety features. Additionally, there is a growing demand for eco-friendly and sustainable materials in tail light manufacturing, driven by consumer preferences for environmentally conscious products. Overall, these trends are shaping the US Automotive Tail Light Market towards innovation, safety, and sustainability.

United States (US) Automotive Tail Light Market Challenges

In the US Automotive Tail Light Market, some key challenges include increasing competition from foreign manufacturers offering lower-priced alternatives, stringent regulatory requirements for energy efficiency and safety standards, and the rapid technological advancements leading to a shift towards more advanced lighting solutions such as LED lights. Additionally, fluctuations in raw material prices, supply chain disruptions, and the impact of economic downturns on consumer spending habits can also pose challenges for companies operating in this market. To remain competitive, companies need to focus on innovation, cost-efficiency, and compliance with regulatory standards while also adapting to changing consumer preferences and market trends.

United States (US) Automotive Tail Light Market Investment Opportunities

The US Automotive Tail Light Market presents several investment opportunities for growth and innovation. With the increasing demand for energy-efficient and stylish lighting solutions in vehicles, investing in LED technology for automotive tail lights is a promising avenue. Additionally, there is a growing trend towards advanced safety features in vehicles, creating opportunities for investments in smart tail light systems that incorporate sensors and adaptive lighting capabilities. Furthermore, as electric vehicles gain popularity, there is potential for investments in tail lights specifically designed for EVs to enhance their efficiency and aesthetics. Overall, the US Automotive Tail Light Market offers opportunities for investors to capitalize on technological advancements, safety requirements, and consumer preferences driving the industry forward.

United States (US) Automotive Tail Light Market Government Policy

Government policies related to the US Automotive Tail Light Market primarily focus on safety regulations and environmental standards. The Department of Transportation (DOT) sets rigorous guidelines for the design and performance of automotive lighting systems, including tail lights, to ensure visibility and safety on the roads. These regulations cover aspects such as brightness, color, and placement of tail lights to enhance vehicle conspicuity and prevent accidents. Additionally, there are increasing efforts towards promoting energy-efficient lighting solutions to reduce carbon emissions and enhance sustainability. Manufacturers in the US Automotive Tail Light Market need to comply with these regulatory standards to ensure the quality and safety of their products, thereby contributing to a safer and more environmentally friendly automotive industry.

United States (US) Automotive Tail Light Market Future Outlook

The United States Automotive Tail Light Market is expected to witness steady growth in the coming years, driven by factors such as increasing vehicle sales, technological advancements in lighting systems, and growing focus on vehicle safety regulations. With the rising demand for energy-efficient LED tail lights and the integration of advanced features like adaptive lighting and smart connectivity, the market is poised for innovation and expansion. Additionally, the growing trend of customization and personalization in the automotive industry is likely to create opportunities for tail light manufacturers to offer unique and stylish lighting solutions. Overall, the US Automotive Tail Light Market is anticipated to experience a positive trajectory, with a focus on enhancing safety, aesthetics, and functionality in vehicles.

Key Highlights of the Report:

- United States (US) Automotive Tail Light Market Outlook

- Market Size of United States (US) Automotive Tail Light Market, 2024

- Forecast of United States (US) Automotive Tail Light Market, 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Revenues & Volume for the Period 2021 - 2031

- United States (US) Automotive Tail Light Market Trend Evolution

- United States (US) Automotive Tail Light Market Drivers and Challenges

- United States (US) Automotive Tail Light Price Trends

- United States (US) Automotive Tail Light Porter's Five Forces

- United States (US) Automotive Tail Light Industry Life Cycle

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By Source for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By LED for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By Halogen for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By Vehicle Type for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By Passenger Cars for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By Two-Wheelers for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By HCVs for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By LCVs for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By Material Type for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By Plastic for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By Metal for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By Sales Channel for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By Aftermarkets for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Automotive Tail Light Market Revenues & Volume By OEM for the Period 2021 - 2031

- United States (US) Automotive Tail Light Import Export Trade Statistics

- Market Opportunity Assessment By Source

- Market Opportunity Assessment By Vehicle Type

- Market Opportunity Assessment By Material Type

- Market Opportunity Assessment By Sales Channel

- United States (US) Automotive Tail Light Top Companies Market Share

- United States (US) Automotive Tail Light Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Automotive Tail Light Company Profiles

- United States (US) Automotive Tail Light Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Automotive Tail Light Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Automotive Tail Light Market Revenues & Volume, 2021 & 2031F |

3.3 United States (US) Automotive Tail Light Market - Industry Life Cycle |

3.4 United States (US) Automotive Tail Light Market - Porter's Five Forces |

3.5 United States (US) Automotive Tail Light Market Revenues & Volume Share, By Source, 2021 & 2031F |

3.6 United States (US) Automotive Tail Light Market Revenues & Volume Share, By Vehicle Type, 2021 & 2031F |

3.7 United States (US) Automotive Tail Light Market Revenues & Volume Share, By Material Type, 2021 & 2031F |

3.8 United States (US) Automotive Tail Light Market Revenues & Volume Share, By Sales Channel, 2021 & 2031F |

4 United States (US) Automotive Tail Light Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for energy-efficient LED tail lights |

4.2.2 Technological advancements in automotive lighting systems |

4.2.3 Stricter government regulations regarding vehicle safety and visibility |

4.3 Market Restraints |

4.3.1 Fluctuating raw material prices impacting manufacturing costs |

4.3.2 Intense competition among market players leading to pricing pressures |

4.3.3 Slowdown in the automotive industry affecting new vehicle sales and aftermarket demand |

5 United States (US) Automotive Tail Light Market Trends |

6 United States (US) Automotive Tail Light Market, By Types |

6.1 United States (US) Automotive Tail Light Market, By Source |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Automotive Tail Light Market Revenues & Volume, By Source, 2021 - 2031F |

6.1.3 United States (US) Automotive Tail Light Market Revenues & Volume, By LED, 2021 - 2031F |

6.1.4 United States (US) Automotive Tail Light Market Revenues & Volume, By Halogen, 2021 - 2031F |

6.2 United States (US) Automotive Tail Light Market, By Vehicle Type |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Automotive Tail Light Market Revenues & Volume, By Passenger Cars, 2021 - 2031F |

6.2.3 United States (US) Automotive Tail Light Market Revenues & Volume, By Two-Wheelers, 2021 - 2031F |

6.2.4 United States (US) Automotive Tail Light Market Revenues & Volume, By HCVs, 2021 - 2031F |

6.2.5 United States (US) Automotive Tail Light Market Revenues & Volume, By LCVs, 2021 - 2031F |

6.3 United States (US) Automotive Tail Light Market, By Material Type |

6.3.1 Overview and Analysis |

6.3.2 United States (US) Automotive Tail Light Market Revenues & Volume, By Plastic, 2021 - 2031F |

6.3.3 United States (US) Automotive Tail Light Market Revenues & Volume, By Metal, 2021 - 2031F |

6.4 United States (US) Automotive Tail Light Market, By Sales Channel |

6.4.1 Overview and Analysis |

6.4.2 United States (US) Automotive Tail Light Market Revenues & Volume, By Aftermarkets, 2021 - 2031F |

6.4.3 United States (US) Automotive Tail Light Market Revenues & Volume, By OEM, 2021 - 2031F |

7 United States (US) Automotive Tail Light Market Import-Export Trade Statistics |

7.1 United States (US) Automotive Tail Light Market Export to Major Countries |

7.2 United States (US) Automotive Tail Light Market Imports from Major Countries |

8 United States (US) Automotive Tail Light Market Key Performance Indicators |

8.1 Average lifespan of automotive tail lights |

8.2 Consumer satisfaction and feedback on tail light design and functionality |

8.3 Adoption rate of smart tail light features in new vehicle models |

9 United States (US) Automotive Tail Light Market - Opportunity Assessment |

9.1 United States (US) Automotive Tail Light Market Opportunity Assessment, By Source, 2021 & 2031F |

9.2 United States (US) Automotive Tail Light Market Opportunity Assessment, By Vehicle Type, 2021 & 2031F |

9.3 United States (US) Automotive Tail Light Market Opportunity Assessment, By Material Type, 2021 & 2031F |

9.4 United States (US) Automotive Tail Light Market Opportunity Assessment, By Sales Channel, 2021 & 2031F |

10 United States (US) Automotive Tail Light Market - Competitive Landscape |

10.1 United States (US) Automotive Tail Light Market Revenue Share, By Companies, 2024 |

10.2 United States (US) Automotive Tail Light Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero