United States (US) Barite Market Outlook | Revenue, Forecast, Analysis, Companies, Industry, Growth, COVID-19 IMPACT, Trends, Size, Value & Share

| Product Code: ETC313981 | Publication Date: Aug 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

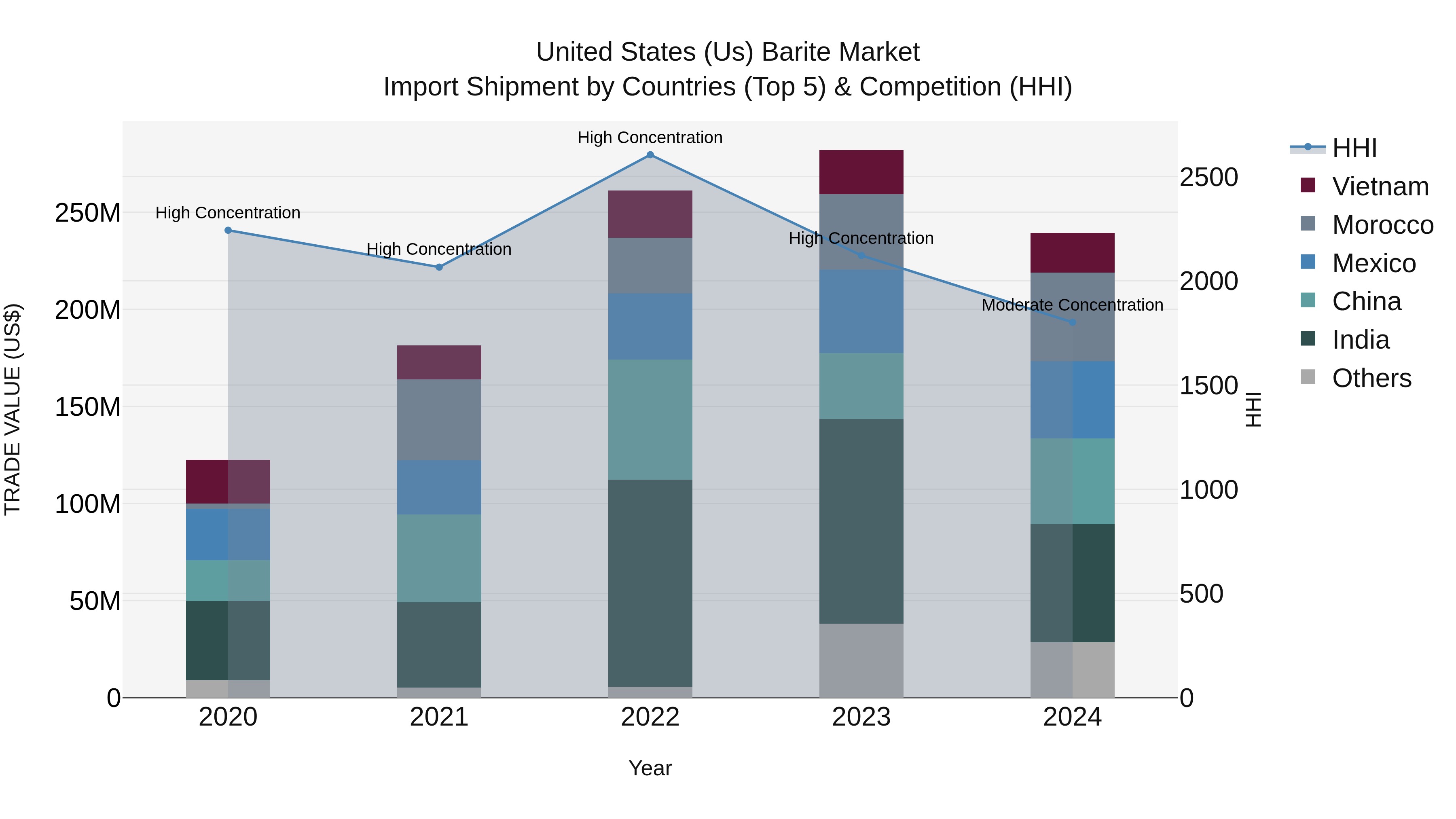

United States (US) Barite Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, the United States saw a shift in the concentration of barite import shipments, moving from high concentration in 2023 to moderate concentration. The top countries exporting to the USA were India, Morocco, China, Mexico, and Lao People`s Dem. Rep. With a CAGR of 18.25% from 2020 to 2024, the barite import market demonstrated strong growth. However, there was a decline in growth rate from 2023 to 2024 at -15.12%, signaling potential fluctuations in the market dynamics. It will be important to monitor these trends closely to understand the evolving landscape of barite imports in the US.

USA Export Potential Assessment For Barite Market (Values in USD Thousand)

United States (US) Barite Market Synopsis

The United States Barite Market is experiencing steady growth due to the increasing demand from various industries such as oil and gas, paints and coatings, and pharmaceuticals. Barite, a mineral composed of barium sulfate, is primarily used as a weighting agent in drilling fluids in the oil and gas industry. The growing oil and gas exploration activities in the US are driving the demand for barite. Additionally, barite is widely used in the production of paints and coatings for its high specific gravity, which enhances the performance of these products. The pharmaceutical industry also utilizes barite in various applications. With the increasing industrial activities in the US and the versatile applications of barite, the market is expected to continue its positive growth trajectory in the foreseeable future.

United States (US) Barite Market Trends

The US Barite market is experiencing a steady growth trajectory driven by the increasing demand from various industries such as oil and gas, pharmaceuticals, and construction. One of the key trends in the market is the rising preference for high-quality barite due to its superior properties in drilling fluids used in the oil and gas industry. Additionally, the growing exploration and production activities in the US shale gas sector are fueling the demand for barite as a weighting agent in drilling muds. Environmental concerns and regulations regarding barite mining practices are also influencing market dynamics, leading to a shift towards sustainable and eco-friendly extraction methods. Overall, the US Barite market is poised for continued growth, driven by the expanding industrial applications and emerging technologies in the sector.

United States (US) Barite Market Challenges

In the US Barite Market, challenges primarily stem from fluctuations in global demand and supply, as Barite is a commodity that is heavily dependent on the oil and gas industry. The market is susceptible to price volatility due to changes in drilling activity, geopolitical factors, and environmental regulations impacting drilling operations. Additionally, competition from alternative weighting materials and substitutes further adds pressure to the market. Infrastructure constraints and transportation costs also pose challenges for timely delivery and cost-effective supply chain management. Moreover, environmental concerns related to Barite mining and processing practices require adherence to stringent regulations, leading to increased operational costs and compliance challenges for industry players in the US Barite Market.

United States (US) Barite Market Investment Opportunities

The United States Barite Market presents several investment opportunities for potential investors. With the growing demand for barite in various industries such as oil and gas, pharmaceuticals, and construction, there is a steady market for this mineral. Investing in barite mining companies or companies involved in the processing and distribution of barite could yield favorable returns. Additionally, the increased focus on environmentally friendly and sustainable practices in the mining industry opens up opportunities for investments in companies that prioritize responsible mining practices in their operations. As the US continues to be a major consumer of barite, investing in this market could be a strategic move for investors looking for long-term growth potential.

Jordan Agar Market Government Policies

Government policies related to the US Barite Market primarily focus on ensuring the sustainable extraction and production of barite resources, as well as promoting domestic production to reduce reliance on imports. The US Bureau of Land Management (BLM) oversees the leasing of federal lands for barite mining operations, while the Department of the Interior and Environmental Protection Agency (EPA) enforce regulations to mitigate environmental impacts. Additionally, the US government has imposed tariffs on imported barite from countries like China and India to protect domestic producers. These policies aim to support the growth of the US barite market, enhance supply chain security, and maintain a competitive edge in the global market.

United States (US) Barite Market Future Outlook

The United States Barite Market is expected to witness steady growth in the coming years due to the increasing demand from industries such as oil and gas, paints and coatings, and pharmaceuticals. The growth in drilling activities in the oil and gas sector, coupled with the rising use of barite as a weighting agent in drilling fluids, will drive market expansion. Additionally, the growing construction and infrastructure development projects in the US will further boost the demand for barite in applications such as concrete production and road construction. However, factors such as fluctuating raw material prices and environmental regulations may pose challenges to market growth. Overall, with the continuous demand from key end-use industries, the US Barite Market is expected to show resilience and maintain a positive growth trajectory in the foreseeable future.

Key Highlights of the Report:

- United States (US) Barite Market Outlook

- Market Size of United States (US) Barite Market, 2021

- Forecast of United States (US) Barite Market, 2031

- Historical Data and Forecast of United States (US) Barite Revenues & Volume for the Period 2018 - 2031

- United States (US) Barite Market Trend Evolution

- United States (US) Barite Market Drivers and Challenges

- United States (US) Barite Price Trends

- United States (US) Barite Porter's Five Forces

- United States (US) Barite Industry Life Cycle

- Historical Data and Forecast of United States (US) Barite Market Revenues & Volume By Type for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Barite Market Revenues & Volume By Vein for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Barite Market Revenues & Volume By Residual for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Barite Market Revenues & Volume By Bedded for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Barite Market Revenues & Volume By Other Types for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Barite Market Revenues & Volume By End-user Industry for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Barite Market Revenues & Volume By Oil and Gas for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Barite Market Revenues & Volume By Chemical for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Barite Market Revenues & Volume By Rubber for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Barite Market Revenues & Volume By Other End-user Industries for the Period 2018 - 2031

- United States (US) Barite Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By End-user Industry

- United States (US) Barite Top Companies Market Share

- United States (US) Barite Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Barite Company Profiles

- United States (US) Barite Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Barite Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Barite Market Revenues & Volume, 2021 & 2031F |

3.3 United States (US) Barite Market - Industry Life Cycle |

3.4 United States (US) Barite Market - Porter's Five Forces |

3.5 United States (US) Barite Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 United States (US) Barite Market Revenues & Volume Share, By End-user Industry, 2021 & 2031F |

4 United States (US) Barite Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for barite in drilling fluids in the oil and gas industry |

4.2.2 Growing construction activities in the United States |

4.2.3 Rise in barite usage in the pharmaceutical and rubber industries |

4.3 Market Restraints |

4.3.1 Fluctuating raw material prices |

4.3.2 Stringent environmental regulations regarding mining and processing of barite |

4.3.3 Competition from alternative weighting agents in drilling fluids |

5 United States (US) Barite Market Trends |

6 United States (US) Barite Market, By Types |

6.1 United States (US) Barite Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Barite Market Revenues & Volume, By Type, 2021-2031F |

6.1.3 United States (US) Barite Market Revenues & Volume, By Vein, 2021-2031F |

6.1.4 United States (US) Barite Market Revenues & Volume, By Residual, 2021-2031F |

6.1.5 United States (US) Barite Market Revenues & Volume, By Bedded, 2021-2031F |

6.1.6 United States (US) Barite Market Revenues & Volume, By Other Types, 2021-2031F |

6.2 United States (US) Barite Market, By End-user Industry |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Barite Market Revenues & Volume, By Oil and Gas, 2021-2031F |

6.2.3 United States (US) Barite Market Revenues & Volume, By Chemical, 2021-2031F |

6.2.4 United States (US) Barite Market Revenues & Volume, By Rubber, 2021-2031F |

6.2.5 United States (US) Barite Market Revenues & Volume, By Other End-user Industries, 2021-2031F |

7 United States (US) Barite Market Import-Export Trade Statistics |

7.1 United States (US) Barite Market Export to Major Countries |

7.2 United States (US) Barite Market Imports from Major Countries |

8 United States (US) Barite Market Key Performance Indicators |

8.1 Barite consumption in the oil and gas sector |

8.2 Number of construction projects utilizing barite |

8.3 Percentage increase in barite usage in pharmaceutical and rubber applications |

9 United States (US) Barite Market - Opportunity Assessment |

9.1 United States (US) Barite Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 United States (US) Barite Market Opportunity Assessment, By End-user Industry, 2021 & 2031F |

10 United States (US) Barite Market - Competitive Landscape |

10.1 United States (US) Barite Market Revenue Share, By Companies, 2021 |

10.2 United States (US) Barite Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero