United States (US) Oximeter Market (2025-2031) Outlook | Growth, Size, Share, Revenue, Value, Companies, Industry, Forecast, Analysis & Trends

| Product Code: ETC072620 | Publication Date: Jun 2021 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Shubham Deep | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

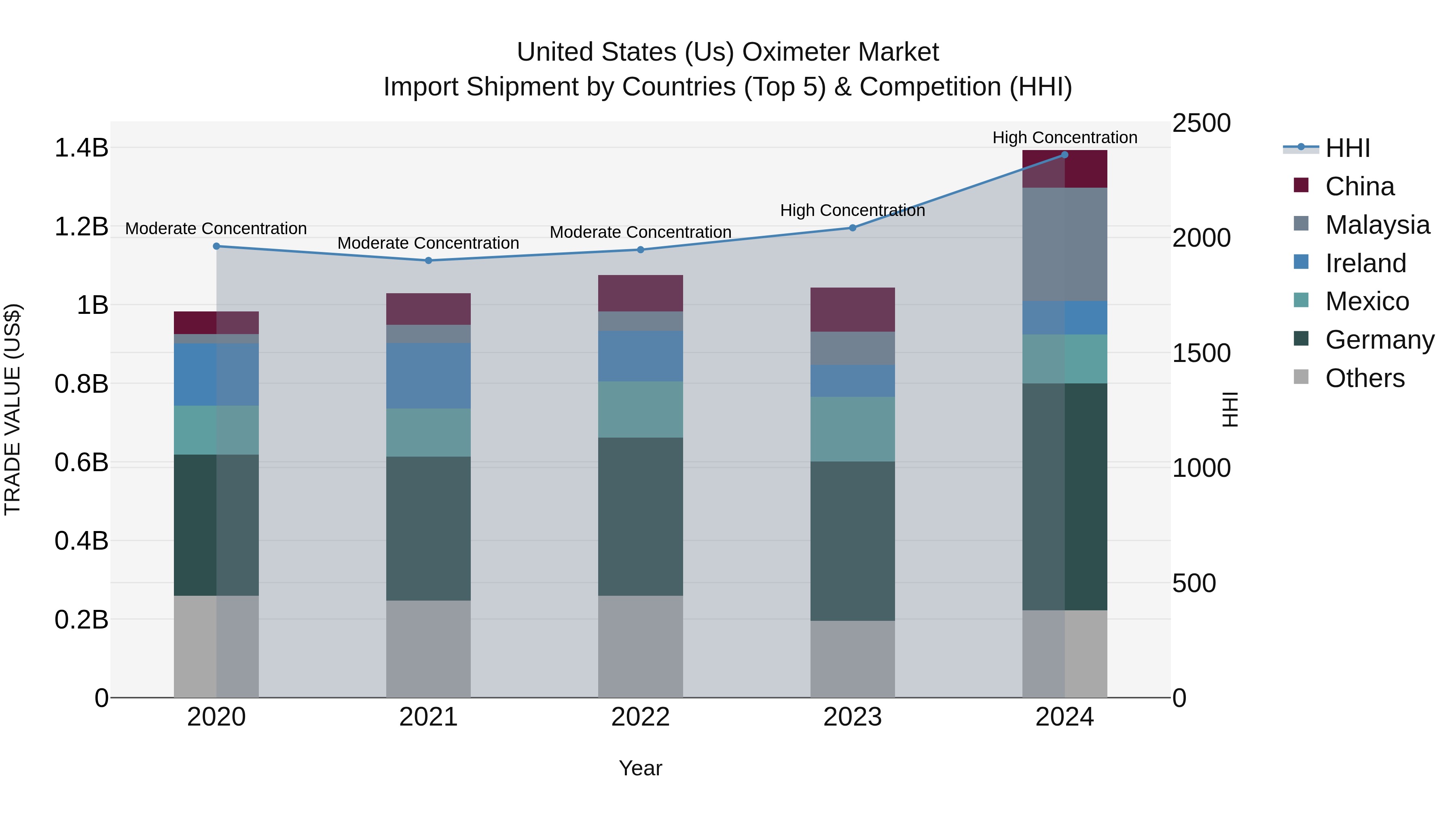

United States (US) Oximeter Market Top 5 Importing Countries and Market Competition (HHI) Analysis

The United States saw significant growth in oximeter import shipments in 2024, with Germany, Malaysia, Mexico, China, and Ireland emerging as the top exporting countries. The market continued to exhibit high concentration levels with a high Herfindahl-Hirschman Index (HHI). The compound annual growth rate (CAGR) from 2020 to 2024 stood at a robust 9.12%, indicating sustained expansion. Moreover, the growth rate from 2023 to 2024 surged to an impressive 33.54%, underscoring the increasing demand for oximeters in the US market.

United States (US) Oximeter Market Overview

The United States Oximeter Market is experiencing significant growth driven by the increasing prevalence of respiratory diseases such as chronic obstructive pulmonary disease (COPD) and asthma, particularly in the wake of the COVID-19 pandemic. Oximeters are essential devices for measuring blood oxygen levels, making them crucial for monitoring respiratory health in both clinical settings and home environments. The market is characterized by a wide range of products, including fingertip pulse oximeters, handheld oximeters, and wrist-worn oximeters, catering to diverse consumer needs. Key players in the US oximeter market include companies like Masimo Corporation, Medtronic plc, and Nonin Medical, among others. Technological advancements such as wireless connectivity and portable designs are driving product innovation and adoption, further fueling market growth.

United States (US) Oximeter Market Trends

The US Oximeter Market is experiencing steady growth driven by the increasing awareness about the importance of monitoring oxygen saturation levels, especially in light of the COVID-19 pandemic. Consumers are increasingly investing in personal oximeters for at-home monitoring, contributing to the rise in demand for portable and user-friendly devices. Technological advancements such as the integration of Bluetooth connectivity for remote monitoring and smartphone compatibility are also shaping the market. Additionally, the growing adoption of wearable oximeters and the development of smart healthcare devices are further fueling market growth. With a focus on health and wellness continuing to be a priority for consumers, the US Oximeter Market is expected to witness sustained growth in the coming years.

United States (US) Oximeter Market Challenges

The US Oximeter Market faces several challenges, including intense competition among a large number of players, which can lead to price wars and reduced profit margins. Additionally, regulatory requirements and standards for medical devices can be stringent, requiring companies to invest significantly in research and development to ensure compliance. Another challenge is the increasing demand for advanced oximeters with additional features such as Bluetooth connectivity and mobile app integration, which can drive up production costs. Moreover, the COVID-19 pandemic has created fluctuations in demand for oximeters, leading to supply chain disruptions and inventory management issues for manufacturers and retailers in the US market. Overall, companies operating in the US Oximeter Market need to navigate these challenges effectively to maintain a competitive edge and meet the evolving needs of healthcare providers and consumers.

United States (US) Oximeter Market Investment Opportunities

The US Oximeter Market presents various investment opportunities due to the increasing demand for these devices in the healthcare sector. With the rising prevalence of respiratory diseases such as COPD and asthma, there is a growing need for oximeters to monitor oxygen levels in patients. Additionally, the COVID-19 pandemic has further boosted the demand for oximeters for home use to monitor oxygen saturation levels. Investors can explore opportunities in both traditional pulse oximeters and newer technologies such as portable and wearable oximeters. The market also offers potential for growth through technological advancements, customization for specific patient groups, and expanding distribution channels. Overall, the US Oximeter Market presents a promising investment landscape driven by healthcare trends and the need for continuous monitoring of oxygen levels.

United States (US) Oximeter Market Government Policy

The US government has implemented various policies to regulate the Oximeter Market to ensure product safety and accuracy. The Food and Drug Administration (FDA) oversees the approval and regulation of oximeters to ensure they meet stringent standards for performance and reliability. Additionally, the Centers for Medicare and Medicaid Services (CMS) have established reimbursement policies to cover oximeter costs for eligible patients, providing access to these essential medical devices. The government also promotes transparency and competition in the market through regulations that require manufacturers to provide clear labeling and accurate information on oximeter products. Overall, these policies aim to safeguard public health, ensure product quality, and enhance accessibility to oximeters for individuals in need.

United States (US) Oximeter Market Future Outlook

The United States Oximeter Market is expected to witness steady growth in the coming years, fueled by the increasing adoption of remote patient monitoring technologies, rising prevalence of chronic diseases such as respiratory disorders, and the expanding geriatric population. The market is likely to benefit from technological advancements leading to the development of more accurate and user-friendly oximeters, as well as the growing awareness about the importance of monitoring oxygen levels for early detection of health issues. Additionally, the COVID-19 pandemic has highlighted the significance of oximeters in monitoring patients` respiratory health remotely, further boosting market demand. Overall, the US Oximeter Market is poised for continued expansion as healthcare providers and consumers alike recognize the value of these devices in maintaining optimal health and wellness.

Key Highlights of the Report:

- United States (US) Oximeter Market Outlook

- Market Size of United States (US) Oximeter Market, 2021

- Forecast of United States (US) Oximeter Market, 2031

- Historical Data and Forecast of United States (US) Oximeter Revenues & Volume for the Period 2021 - 2031

- United States (US) Oximeter Market Trend Evolution

- United States (US) Oximeter Market Drivers and Challenges

- United States (US) Oximeter Price Trends

- United States (US) Oximeter Porter's Five Forces

- United States (US) Oximeter Industry Life Cycle

- Historical Data and Forecast of United States (US) Oximeter Market Revenues & Volume By Product for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Oximeter Market Revenues & Volume By Finger-tip Oximeters for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Oximeter Market Revenues & Volume By Handheld Oximeters for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Oximeter Market Revenues & Volume By Table Top/Bedside Oximeters for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Oximeter Market Revenues & Volume By Wrist-worn Oximeters for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Oximeter Market Revenues & Volume By End-users for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Oximeter Market Revenues & Volume By Hospitals for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Oximeter Market Revenues & Volume By Clinics for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Oximeter Market Revenues & Volume By Healthcare Centers for the Period 2021 - 2031

- Historical Data and Forecast of United States (US) Oximeter Market Revenues & Volume By Others for the Period 2021 - 2031

- United States (US) Oximeter Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By End-users

- United States (US) Oximeter Top Companies Market Share

- United States (US) Oximeter Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Oximeter Company Profiles

- United States (US) Oximeter Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Oximeter Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Oximeter Market Revenues & Volume, 2021 & 2031F |

3.3 United States (US) Oximeter Market - Industry Life Cycle |

3.4 United States (US) Oximeter Market - Porter's Five Forces |

3.5 United States (US) Oximeter Market Revenues & Volume Share, By Form, 2021 & 2031F |

3.6 United States (US) Oximeter Market Revenues & Volume Share, By End-users, 2021 & 2031F |

4 United States (US) Oximeter Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing awareness about the importance of monitoring oxygen levels in various health conditions |

4.2.2 Technological advancements leading to the development of more accurate and user-friendly oximeters |

4.2.3 Rising prevalence of respiratory diseases such as asthma and COPD in the US |

4.3 Market Restraints |

4.3.1 High cost associated with oximeter devices |

4.3.2 Limited availability of oximeters in rural and underserved areas |

4.3.3 Regulatory challenges and compliance requirements in the healthcare industry |

5 United States (US) Oximeter Market Trends |

6 United States (US) Oximeter Market, By Types |

6.1 United States (US) Oximeter Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Oximeter Market Revenues & Volume, By Product, 2018 - 2027F |

6.1.3 United States (US) Oximeter Market Revenues & Volume, By Finger-tip Oximeters, 2018 - 2027F |

6.1.4 United States (US) Oximeter Market Revenues & Volume, By Handheld Oximeters, 2018 - 2027F |

6.1.5 United States (US) Oximeter Market Revenues & Volume, By Table Top/Bedside Oximeters, 2018 - 2027F |

6.1.6 United States (US) Oximeter Market Revenues & Volume, By Wrist-worn Oximeters, 2018 - 2027F |

6.2 United States (US) Oximeter Market, By End-users |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Oximeter Market Revenues & Volume, By Hospitals, 2018 - 2027F |

6.2.3 United States (US) Oximeter Market Revenues & Volume, By Clinics, 2018 - 2027F |

6.2.4 United States (US) Oximeter Market Revenues & Volume, By Healthcare Centers, 2018 - 2027F |

6.2.5 United States (US) Oximeter Market Revenues & Volume, By Others, 2018 - 2027F |

7 United States (US) Oximeter Market Import-Export Trade Statistics |

7.1 United States (US) Oximeter Market Export to Major Countries |

7.2 United States (US) Oximeter Market Imports from Major Countries |

8 United States (US) Oximeter Market Key Performance Indicators |

8.1 Adoption rate of oximeters in home healthcare settings |

8.2 Average selling price (ASP) of oximeter devices |

8.3 Number of new product launches and innovations in the oximeter market |

8.4 Percentage of healthcare professionals recommending oximeter usage |

8.5 Rate of reimbursement for oximeter devices by insurance providers |

9 United States (US) Oximeter Market - Opportunity Assessment |

9.1 United States (US) Oximeter Market Opportunity Assessment, By Product, 2021 & 2031F |

9.2 United States (US) Oximeter Market Opportunity Assessment, By End-users, 2021 & 2031F |

10 United States (US) Oximeter Market - Competitive Landscape |

10.1 United States (US) Oximeter Market Revenue Share, By Companies, 2021 |

10.2 United States (US) Oximeter Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero