United States (US) Oxygen therapy equipment Market Outlook | Forecast, COVID-19 IMPACT, Companies, Analysis, Trends, Share, Size, Industry, Growth, Revenue & Value

| Product Code: ETC105920 | Publication Date: Jun 2021 | Updated Date: Jun 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Dhaval Chaurasia | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

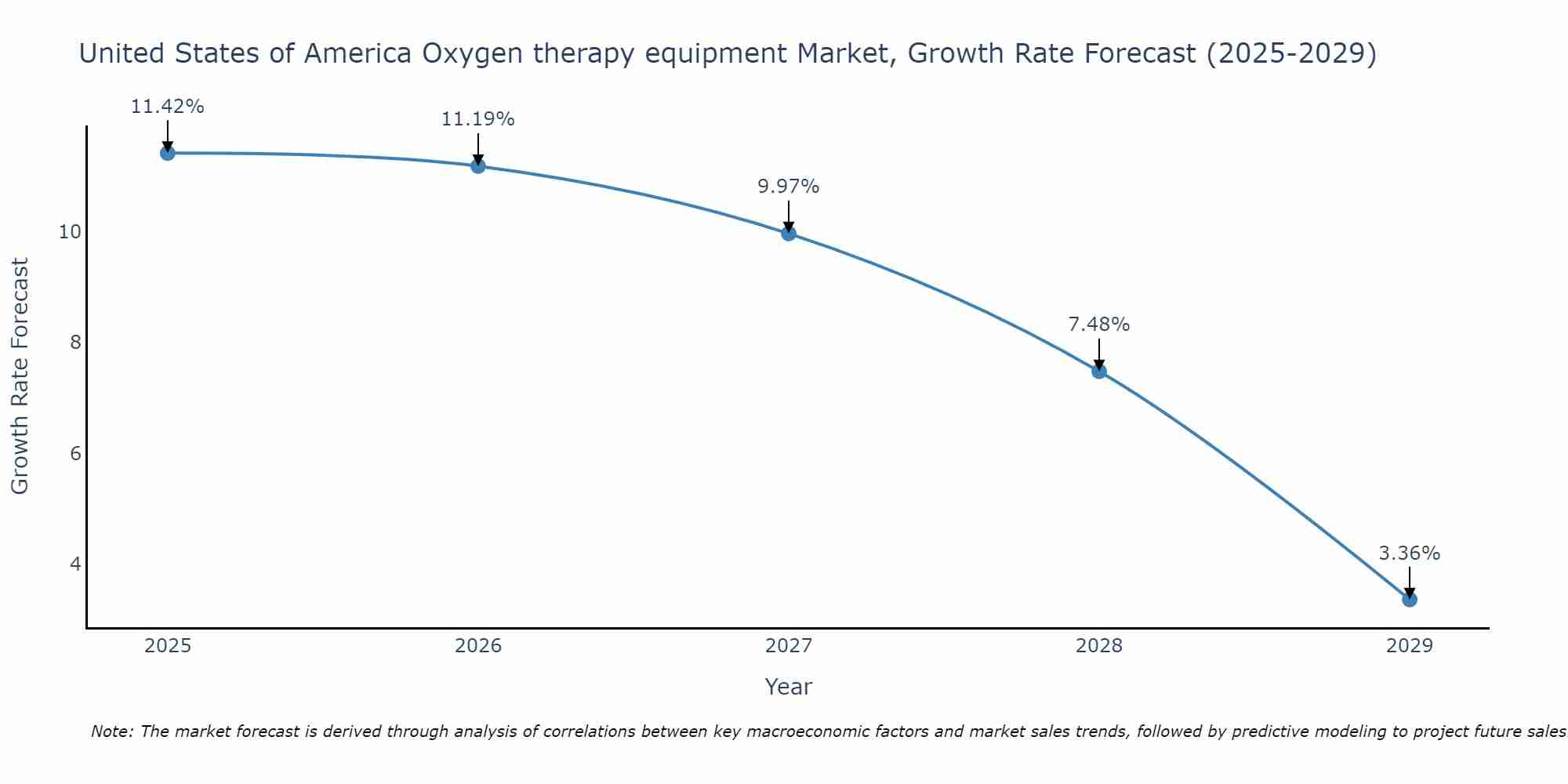

United States of America Oxygen therapy equipment Market Size Growth Rate

The United States of America Oxygen therapy equipment Market could see a tapering of growth rates over 2025 to 2029. Beginning strongly at 11.42% in 2025, growth softens to 3.36% in 2029.

United States (US) Oxygen therapy equipment Market Overview

The United States oxygen therapy equipment market is experiencing significant growth, driven by factors such as an aging population, increasing prevalence of respiratory disorders, and advancements in technology. The market comprises a wide range of products including oxygen concentrators, oxygen cylinders, liquid oxygen systems, and oxygen masks. Portable oxygen concentrators are gaining popularity due to their convenience and mobility, while home oxygen therapy remains a key segment. Key players in the US market include Philips Healthcare, Invacare Corporation, ResMed, and Drive DeVilbiss Healthcare. The market is characterized by intense competition, technological innovations, and a focus on improving patient outcomes. Government initiatives, reimbursement policies, and increasing awareness about respiratory health are expected to further fuel market growth in the coming years.

United States (US) Oxygen therapy equipment Market Trends

The United States oxygen therapy equipment market is experiencing steady growth due to factors such as the increasing prevalence of respiratory diseases like COPD and the rising geriatric population. Portable oxygen concentrators are gaining popularity among patients for their convenience and mobility, driving the market growth. Technological advancements, such as the development of smart oxygen delivery systems and integrated software solutions, are also shaping the market landscape. The COVID-19 pandemic has further fueled the demand for oxygen therapy equipment, leading to an increased focus on home healthcare solutions. Key players in the market are focusing on product innovation, partnerships, and strategic collaborations to capitalize on the growing demand for oxygen therapy equipment in the US market.

United States (US) Oxygen therapy equipment Market Challenges

In the United States, the Oxygen therapy equipment market faces several challenges. One major challenge is the high cost associated with acquiring and maintaining oxygen therapy equipment, which can be a barrier for individuals without adequate insurance coverage. Additionally, regulatory requirements and compliance standards add complexity to the market, requiring manufacturers to continuously invest in research and development to ensure their products meet quality and safety standards. Another challenge is the competitive nature of the market, with several established players and new entrants vying for market share, leading to price competition and pressure on profit margins. Moreover, the increasing prevalence of chronic respiratory diseases and aging population in the US poses a demand for more advanced and efficient oxygen therapy equipment, necessitating innovation and customization to cater to specific patient needs.

United States (US) Oxygen therapy equipment Market Investment Opportunities

The United States oxygen therapy equipment market presents several investment opportunities due to increasing prevalence of respiratory diseases, technological advancements in equipment, and growing aging population. Investors can consider opportunities in portable oxygen concentrators, oxygen cylinders, and accessories such as masks and tubing. The market is also driven by rising awareness about the benefits of oxygen therapy in treating chronic respiratory conditions like COPD and asthma. Additionally, the ongoing COVID-19 pandemic has further highlighted the importance of oxygen therapy, leading to increased demand for equipment. Investing in companies involved in manufacturing, distribution, and innovation within the oxygen therapy equipment sector can be promising for investors looking to capitalize on the growing healthcare market in the US.

United States (US) Oxygen therapy equipment Market Government Policy

The United States government has implemented various policies that impact the oxygen therapy equipment market. Medicare, the federal health insurance program for individuals aged 65 and older, covers oxygen therapy equipment for eligible beneficiaries, providing reimbursement for oxygen concentrators, tanks, and related supplies. Additionally, the Food and Drug Administration (FDA) regulates the manufacturing and sale of oxygen therapy equipment to ensure safety and effectiveness. The Centers for Medicare & Medicaid Services (CMS) sets guidelines for reimbursement rates and coverage criteria for oxygen therapy equipment, which can influence market trends and product development. Overall, government policies play a significant role in shaping the US oxygen therapy equipment market by influencing reimbursement, regulation, and market access for manufacturers and suppliers.

United States (US) Oxygen therapy equipment Market Future Outlook

The United States oxygen therapy equipment market is expected to exhibit steady growth in the coming years due to factors such as an aging population, increasing prevalence of respiratory diseases, and technological advancements in oxygen therapy devices. The market is likely to be driven by a growing awareness about the benefits of oxygen therapy, improved access to healthcare services, and the rising demand for portable and lightweight oxygen equipment. Additionally, the COVID-19 pandemic has highlighted the importance of respiratory care, leading to a greater emphasis on oxygen therapy solutions. With ongoing research and development efforts focusing on enhancing the efficiency and convenience of oxygen equipment, the US oxygen therapy equipment market is poised for expansion in the foreseeable future.

Key Highlights of the Report:

- United States (US) Oxygen therapy equipment Market Outlook

- Market Size of United States (US) Oxygen therapy equipment Market, 2021

- Forecast of United States (US) Oxygen therapy equipment Market, 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Revenues & Volume for the Period 2018 - 2027

- United States (US) Oxygen therapy equipment Market Trend Evolution

- United States (US) Oxygen therapy equipment Market Drivers and Challenges

- United States (US) Oxygen therapy equipment Price Trends

- United States (US) Oxygen therapy equipment Porter's Five Forces

- United States (US) Oxygen therapy equipment Industry Life Cycle

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By Product Type for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By Oxygen Source Equipment for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By Oxygen Delivery Devices for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By Portability for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By Standalone Devices for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By Portable Devices for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By Application for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By COPD for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By Asthma for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By Cystic Fibrosis for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By Respiratory Distress Syndrome for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By Pneumonia for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Oxygen therapy equipment Market Revenues & Volume By Other Diseases for the Period 2018 - 2027

- United States (US) Oxygen therapy equipment Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Portability

- Market Opportunity Assessment By Application

- United States (US) Oxygen therapy equipment Top Companies Market Share

- United States (US) Oxygen therapy equipment Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Oxygen therapy equipment Company Profiles

- United States (US) Oxygen therapy equipment Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Oxygen therapy equipment Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Oxygen therapy equipment Market Revenues & Volume, 2021 & 2027F |

3.3 United States (US) Oxygen therapy equipment Market - Industry Life Cycle |

3.4 United States (US) Oxygen therapy equipment Market - Porter's Five Forces |

3.5 United States (US) Oxygen therapy equipment Market Revenues & Volume Share, By Product Type, 2021 & 2027F |

3.6 United States (US) Oxygen therapy equipment Market Revenues & Volume Share, By Portability, 2021 & 2027F |

3.7 United States (US) Oxygen therapy equipment Market Revenues & Volume Share, By Application, 2021 & 2027F |

4 United States (US) Oxygen therapy equipment Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 United States (US) Oxygen therapy equipment Market Trends |

6 United States (US) Oxygen therapy equipment Market, By Types |

6.1 United States (US) Oxygen therapy equipment Market, By Product Type |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Oxygen therapy equipment Market Revenues & Volume, By Product Type, 2018 - 2027F |

6.1.3 United States (US) Oxygen therapy equipment Market Revenues & Volume, By Oxygen Source Equipment, 2018 - 2027F |

6.1.4 United States (US) Oxygen therapy equipment Market Revenues & Volume, By Oxygen Delivery Devices, 2018 - 2027F |

6.2 United States (US) Oxygen therapy equipment Market, By Portability |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Oxygen therapy equipment Market Revenues & Volume, By Standalone Devices, 2018 - 2027F |

6.2.3 United States (US) Oxygen therapy equipment Market Revenues & Volume, By Portable Devices, 2018 - 2027F |

6.3 United States (US) Oxygen therapy equipment Market, By Application |

6.3.1 Overview and Analysis |

6.3.2 United States (US) Oxygen therapy equipment Market Revenues & Volume, By COPD, 2018 - 2027F |

6.3.3 United States (US) Oxygen therapy equipment Market Revenues & Volume, By Asthma, 2018 - 2027F |

6.3.4 United States (US) Oxygen therapy equipment Market Revenues & Volume, By Cystic Fibrosis, 2018 - 2027F |

6.3.5 United States (US) Oxygen therapy equipment Market Revenues & Volume, By Respiratory Distress Syndrome, 2018 - 2027F |

6.3.6 United States (US) Oxygen therapy equipment Market Revenues & Volume, By Pneumonia, 2018 - 2027F |

6.3.7 United States (US) Oxygen therapy equipment Market Revenues & Volume, By Other Diseases, 2018 - 2027F |

7 United States (US) Oxygen therapy equipment Market Import-Export Trade Statistics |

7.1 United States (US) Oxygen therapy equipment Market Export to Major Countries |

7.2 United States (US) Oxygen therapy equipment Market Imports from Major Countries |

8 United States (US) Oxygen therapy equipment Market Key Performance Indicators |

9 United States (US) Oxygen therapy equipment Market - Opportunity Assessment |

9.1 United States (US) Oxygen therapy equipment Market Opportunity Assessment, By Product Type, 2021 & 2027F |

9.2 United States (US) Oxygen therapy equipment Market Opportunity Assessment, By Portability, 2021 & 2027F |

9.3 United States (US) Oxygen therapy equipment Market Opportunity Assessment, By Application, 2021 & 2027F |

10 United States (US) Oxygen therapy equipment Market - Competitive Landscape |

10.1 United States (US) Oxygen therapy equipment Market Revenue Share, By Companies, 2021 |

10.2 United States (US) Oxygen therapy equipment Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Belgium and Luxembourg Facility Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Russia Women Intimate Apparel Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Africa Chocolate Market (2025-2031) | Size, Share, Trends, Growth, Revenue, Analysis, Forecast, industry & Outlook

- Global Hydroxychloroquine And Chloroquine Market (2025-2031) | Industry, Trends, Size, Outlook, Growth, Value, Companies, Revenue, Analysis, Share, Forecast

- Saudi Arabia Plant Maintenance Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Africa Low Temperature Powder Coating Market (2025-2031) | Companies, Competition, Size, Challenges, Segmentation, Trends, Competitive, Industry, Supply, Strategy, Investment Trends, Growth, Segments, Restraints, Strategic Insights, Revenue, Share, Forecast, Drivers, Analysis, Pricing Analysis, Demand, Consumer Insights, Value, Opportunities, Outlook

- North America Low Temperature Coating Market (2025-2031) | Industry, Outlook, Pricing Analysis, Forecast, Segments, Competition, Restraints, Share, Opportunities, Revenue, Challenges, Strategy, Competitive, Size, Trends, Supply, Strategic Insights, Demand, Investment Trends, Drivers, Value, Segmentation, Companies, Analysis, Consumer Insights, Growth

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero