United States (US) Precious Metals Market Outlook | Forecast, Revenue, Share, Companies, Industry, Size, Growth, Value, COVID-19 IMPACT, Trends & Analysis

| Product Code: ETC205093 | Publication Date: May 2022 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Vasudha | No. of Pages: 60 | No. of Figures: 40 | No. of Tables: 7 |

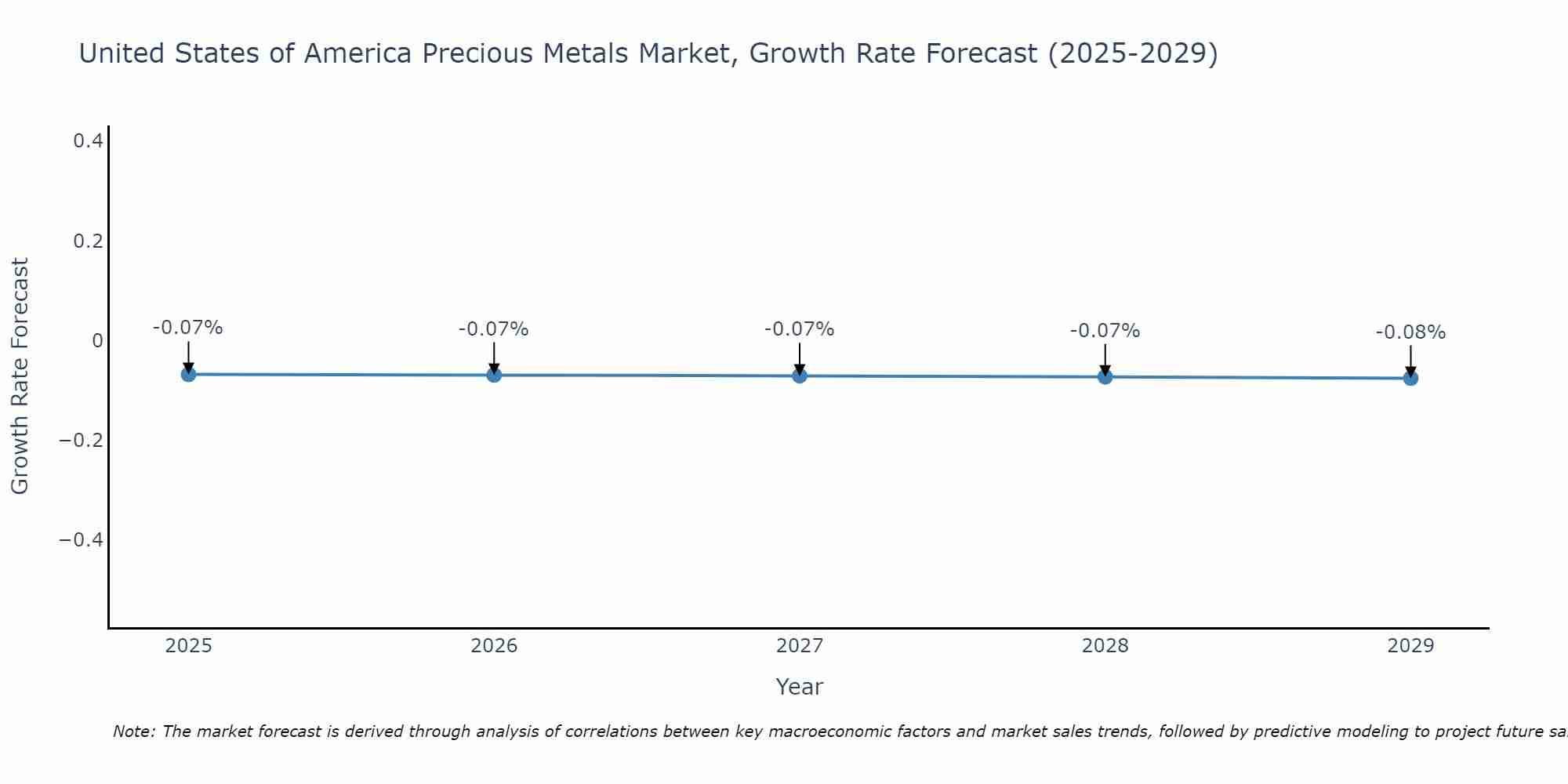

United States of America Precious Metals Market Size Growth Rate

The United States of America Precious Metals Market may undergo a gradual slowdown in growth rates between 2025 and 2029. Although the growth rate starts strong at -0.07% in 2025, it steadily loses momentum, ending at -0.08% by 2029.

United States (US) Precious Metals Market Overview

The United States Precious Metals Market is a significant sector within the country`s economy, comprising gold, silver, platinum, and palladium. Gold is widely regarded as a safe-haven investment during times of economic uncertainty, while silver is used in a variety of industrial applications in addition to being a store of value. Platinum and palladium are primarily used in the automotive industry for catalytic converters. The US is one of the world`s largest consumers and producers of precious metals, with a well-developed infrastructure for trading and storing these commodities. The market is influenced by factors such as economic indicators, geopolitical events, and investor sentiment, making it a dynamic and closely-watched sector for both individual and institutional investors.

United States (US) Precious Metals Market Trends

The United States Precious Metals Market is currently experiencing a surge in demand for physical gold and silver due to economic uncertainty and inflation concerns. Investors are flocking to these safe-haven assets as a hedge against market volatility and the depreciating value of fiat currencies. Additionally, the rise of digital currencies like Bitcoin has sparked interest in precious metals as a more traditional store of value. The US Mint reported record-breaking sales of American Eagle gold and silver coins in recent months, reflecting the growing interest in precious metals among retail investors. As the global economy navigates through the challenges posed by the pandemic, the US Precious Metals Market is likely to see continued strong demand for gold and silver as investors seek stability and wealth preservation.

United States (US) Precious Metals Market Challenges

In the US Precious Metals Market, challenges often revolve around market volatility, regulatory scrutiny, and fluctuating supply and demand dynamics. Market volatility can make it difficult for investors and industry players to predict price movements and make informed decisions. Regulatory scrutiny, including compliance with anti-money laundering regulations and tax laws, can add complexity and costs to operations. In addition, changes in supply and demand, influenced by factors such as economic conditions and geopolitical events, can impact the market`s stability. Overall, navigating these challenges requires a deep understanding of the market, proactive risk management strategies, and the ability to adapt to changing conditions in order to succeed in the US Precious Metals Market.

United States (US) Precious Metals Market Investment Opportunities

The US Precious Metals Market offers various investment opportunities for individuals seeking to diversify their portfolios and hedge against economic uncertainties. Investors can consider investing in physical precious metals such as gold, silver, platinum, and palladium, either in the form of coins, bars, or bullion. Additionally, exchange-traded funds (ETFs) that track the prices of precious metals provide a convenient way to gain exposure to this market without physically owning the metals. Futures and options contracts on precious metals are also popular among investors looking to speculate on price movements. Mining stocks of companies engaged in the exploration and production of precious metals offer another avenue for potential returns. Overall, the US Precious Metals Market presents a range of investment options catering to different risk appetites and investment objectives.

United States (US) Precious Metals Market Government Policy

Government policies related to the US Precious Metals Market primarily focus on regulation and oversight to prevent fraud, manipulation, and money laundering. The US Commodity Futures Trading Commission (CFTC) regulates the trading of precious metals futures contracts to ensure fair and transparent market practices. The Internal Revenue Service (IRS) also plays a role in taxing precious metals transactions and holdings. Additionally, the US Mint is responsible for producing and distributing precious metal coins, such as gold and silver coins, for investment purposes. Overall, these government policies aim to maintain the integrity of the precious metals market and protect investors from fraudulent activities.

United States (US) Precious Metals Market Future Outlook

The future outlook for the US Precious Metals Market remains positive, driven by various factors such as economic uncertainty, inflation concerns, and geopolitical tensions. Precious metals like gold, silver, and platinum are expected to continue being sought after as safe-haven assets, especially in times of market volatility. With ongoing economic recovery efforts post-pandemic and potential risks of inflation, investors are likely to turn to precious metals as a hedge against currency depreciation and as a store of value. Additionally, the increasing demand for precious metals in various industries, including technology and healthcare, is expected to contribute to the market`s growth. Overall, the US Precious Metals Market is anticipated to remain resilient and attractive for investors looking to diversify their portfolios and safeguard against market risks.

Key Highlights of the Report:

- United States (US) Precious Metals Market Outlook

- Market Size of United States (US) Precious Metals Market, 2021

- Forecast of United States (US) Precious Metals Market, 2031

- Historical Data and Forecast of United States (US) Precious Metals Revenues & Volume for the Period 2018 - 2031

- United States (US) Precious Metals Market Trend Evolution

- United States (US) Precious Metals Market Drivers and Challenges

- United States (US) Precious Metals Price Trends

- United States (US) Precious Metals Porter's Five Forces

- United States (US) Precious Metals Industry Life Cycle

- Historical Data and Forecast of United States (US) Precious Metals Market Revenues & Volume By Product for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Precious Metals Market Revenues & Volume By Gold for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Precious Metals Market Revenues & Volume By Silver for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Precious Metals Market Revenues & Volume By Platinum Group Metals (PGM) for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Precious Metals Market Revenues & Volume By Application for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Precious Metals Market Revenues & Volume By Jewelry for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Precious Metals Market Revenues & Volume By Industrial for the Period 2018 - 2031

- Historical Data and Forecast of United States (US) Precious Metals Market Revenues & Volume By Investment for the Period 2018 - 2031

- United States (US) Precious Metals Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Application

- United States (US) Precious Metals Top Companies Market Share

- United States (US) Precious Metals Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Precious Metals Company Profiles

- United States (US) Precious Metals Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Precious Metals Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Precious Metals Market Revenues & Volume, 2021 & 2031F |

3.3 United States (US) Precious Metals Market - Industry Life Cycle |

3.4 United States (US) Precious Metals Market - Porter's Five Forces |

3.5 United States (US) Precious Metals Market Revenues & Volume Share, By Product, 2021 & 2031F |

3.6 United States (US) Precious Metals Market Revenues & Volume Share, By Application, 2021 & 2031F |

4 United States (US) Precious Metals Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Economic uncertainty: Precious metals like gold and silver tend to perform well during times of economic uncertainty, as investors seek safe-haven assets. |

4.2.2 Inflation hedge: Precious metals are often seen as a hedge against inflation, attracting investors looking to protect their wealth. |

4.2.3 Geopolitical tensions: Political instability and geopolitical tensions can drive up demand for precious metals as investors seek assets perceived as safe during uncertain times. |

4.3 Market Restraints |

4.3.1 Price volatility: Precious metals prices can be highly volatile, which may deter some investors looking for more stable investment options. |

4.3.2 Regulatory changes: Changes in regulations or government policies related to precious metals trading and ownership can impact market dynamics and investor sentiment. |

5 United States (US) Precious Metals Market Trends |

6 United States (US) Precious Metals Market, By Types |

6.1 United States (US) Precious Metals Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Precious Metals Market Revenues & Volume, By Product, 2021-2031F |

6.1.3 United States (US) Precious Metals Market Revenues & Volume, By Gold, 2021-2031F |

6.1.4 United States (US) Precious Metals Market Revenues & Volume, By Silver, 2021-2031F |

6.1.5 United States (US) Precious Metals Market Revenues & Volume, By Platinum Group Metals (PGM), 2021-2031F |

6.2 United States (US) Precious Metals Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Precious Metals Market Revenues & Volume, By Jewelry, 2021-2031F |

6.2.3 United States (US) Precious Metals Market Revenues & Volume, By Industrial, 2021-2031F |

6.2.4 United States (US) Precious Metals Market Revenues & Volume, By Investment, 2021-2031F |

7 United States (US) Precious Metals Market Import-Export Trade Statistics |

7.1 United States (US) Precious Metals Market Export to Major Countries |

7.2 United States (US) Precious Metals Market Imports from Major Countries |

8 United States (US) Precious Metals Market Key Performance Indicators |

8.1 Gold-to-Silver Ratio: This ratio reflects the relative value of gold to silver and can indicate market trends and investor sentiment. |

8.2 Investment demand for ETFs: Tracking the demand for precious metals-backed exchange-traded funds (ETFs) can provide insights into investor interest in the market. |

8.3 Central bank purchases: Monitoring central bank purchases of precious metals can signal confidence in the market and influence prices. |

8.4 Jewelry demand: Tracking demand for precious metals in jewelry manufacturing can provide insights into consumer preferences and market trends. |

9 United States (US) Precious Metals Market - Opportunity Assessment |

9.1 United States (US) Precious Metals Market Opportunity Assessment, By Product, 2021 & 2031F |

9.2 United States (US) Precious Metals Market Opportunity Assessment, By Application, 2021 & 2031F |

10 United States (US) Precious Metals Market - Competitive Landscape |

10.1 United States (US) Precious Metals Market Revenue Share, By Companies, 2021 |

10.2 United States (US) Precious Metals Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- France Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Portugal Occupational Health & Safety Services Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Netherlands Occupational Health and Safety Services Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Belgium and Luxembourg Facility Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Russia Women Intimate Apparel Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Africa Chocolate Market (2025-2031) | Size, Share, Trends, Growth, Revenue, Analysis, Forecast, industry & Outlook

- Global Hydroxychloroquine And Chloroquine Market (2025-2031) | Industry, Trends, Size, Outlook, Growth, Value, Companies, Revenue, Analysis, Share, Forecast

- Saudi Arabia Plant Maintenance Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero