United States Vacuum Cleaners Market (2024-2030) | Trends, Analysis, Value, Revenue, Share, Forecast, Size, Outlook, Companies, Growth & Industry

Market Forecast By Products (Canister, Robotics, Upright & Others), By Distribution Channel (Online, Offline), By End Users (Industrial, Commercial, Residential) and Competitive Landscape

| Product Code: ETC004426 | Publication Date: Sep 2020 | Updated Date: Sep 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

US Vacuum Cleaners Market | Country-Wise Share and Competition Analysis

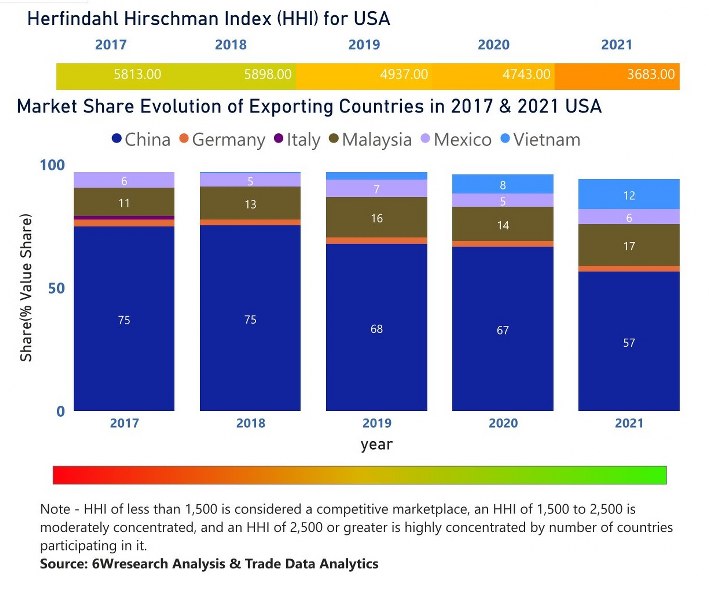

In the year 2021, China was the largest exporter in terms of value, followed by Malaysia. It has registered a growth of 1.58% over the previous year. While Malaysia registered a growth of 45.13% as compare to the previous year. In the year 2017 China was the largest exporter followed by Malaysia. In term of Herfindahl Index, which measures the competitiveness of countries exporting, USA has the Herfindahl index of 5813 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 3683 which signifies high concentration in the market.

US Vacuum Cleaners Market - Export Market Opportunities

Topics Covered in the United States Vacuum Cleaners Market Report

The United States Vacuum Cleaners Market report thoroughly covers the market by product type distribution channel and by end users. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

United States Vacuum Cleaners Market Synopsis

The United States Vacuum Cleaners Market is expected to witness steady growth in the coming years. The United States vacuum cleaners market has witnessed significant growth in recent years due to increasing consumer demand for more efficient and advanced cleaning solutions. The United States vacuum cleaners market report provides a comprehensive analysis of the current market trends, drivers, challenges, and opportunities in the industry.

According to 6Wresearch, the United States Vacuum Cleaners Market is expected to grow at a significant CAGR of 8.5% during the forecast period 2024-2030. The United States vacuum cleaners market has witnessed significant growth in recent years due to increasing consumer demand for more efficient and advanced cleaning solutions. Technological advancements such as smart features and cordless options have contributed to this growth. One of the key drivers for the growth of the vacuum cleaners market in the United States is the increasing awareness about hygiene and cleanliness among consumers. The rise in allergies and respiratory illnesses has also led to an increase in demand for high-performance vacuum cleaners that can effectively remove allergens and pollutants from indoor air. The growing trend towards smaller living spaces, such as apartments and condos, has resulted in a need for compact and versatile cleaning solutions. These factors will influence the United States Vacuum Cleaners Market Growth.

Despite the positive growth outlook, there are some challenges facing the vacuum cleaners market in the United States. One of these challenges is consumer preference shifting towards alternative cleaning solutions such as robotic vacuums. These devices offer hands-free cleaning and are becoming increasingly popular among busy homeowners. Additionally, the availability of low-cost manual alternatives, such as brooms and mops, may also hinder the growth of the vacuum cleaners market. Despite the challenges, there are also many opportunities for growth in the United States Vacuum Cleaners Market.

United States Vacuum Cleaners Market Leading Players

The United States Vacuum Cleaners Market is highly competitive, with the existence of several key players in the industry. Some of the major players operating in the United States Vacuum Cleaners Market are Dyson Ltd., SharkNinja Operating LLC, Bissell Inc., TTI Floor Care North America Inc., Miele, Inc., Electrolux AB, LG Electronics USA Inc. These companies have established a strong presence in the market through their innovative and high-quality products, extensive distribution networks, and strategic partnerships. They also continuously invest in research and development to stay ahead of competitors and cater to changing consumer needs.

United States Vacuum Cleaners Market Government Initiatives

The Vacuum Cleaners Market in the United States, which is an essential part of the North America Vacuum Cleaners Market, is subject to many government regulations aimed at ensuring energy efficiency, consumer safety, and environmental sustainability. One such initiative is the Energy Star program, which is led by the Environmental Protection Agency (EPA) and aims to reduce energy consumption and emissions through the promotion of energy-efficient products. Vacuum cleaners that meet certain standards for efficiency and performance are awarded an Energy Star label, making it easier for consumers to identify eco-friendly options. There are regulations in place that require vacuum cleaner manufacturers to adhere to specific noise level limitations. These measures not only promote sustainability but also ensure consumer safety and protection from potential health hazards associated with excessive noise levels. The government's involvement in promoting eco-friendly and safe cleaning solutions is expected to drive the growth of the United States vacuum cleaners market in the coming years.

Future Insights of the Market

The future of the United States vacuum cleaners market looks promising, with several key trends and insights that are expected to shape its growth in the coming years. One significant insight is the increasing demand for smart and connected vacuum cleaners, which offer advanced features such as app control, voice command, and automatic mapping and navigation. Consumers are becoming more conscious of their carbon footprint and seek eco-friendly options when it comes to household appliances. This has led to a rise in demand for energy-efficient and low noise level vacuum cleaners, which is expected to drive the development of more sustainable products by manufacturers. The increasing popularity of cordless vacuum cleaners is also expected to impact the market positively. United States vacuum cleaners market is expected to witness significant growth in terms of innovation and sales.

Market Segmentation by Product Type

According to Dhaval, Research Manager, 6Wresearch, the robotics segment of the United States vacuum cleaners market is expected to witness rapid growth in the coming years. This category includes autonomous vacuum cleaners that use sensors and artificial intelligence to navigate and clean floors without human intervention. These devices offer convenience and time-saving benefits, making them popular among busy households. With advancements in technology, robotic vacuums are becoming more efficient at cleaning different types of surfaces and handling obstacles such as furniture or stairs.

Market Segmentation by Distribution Channel

On the basis of distribution channel, the online sales have become increasingly popular for consumer goods, including household appliances like vacuum cleaners. With the rise of e-commerce platforms and online retail stores, consumers have a wider range of options to choose from and can make purchases conveniently from the comfort of their homes. Online sales also offer competitive pricing and discounts, making it an attractive option for budget-conscious consumers. This trend is expected to continue in the future, with more manufacturers leveraging online channels to reach a larger consumer base.

Market Segmentation by End Users

On the basis of end users, the residential segment is the largest and most significant end-user category for the United States vacuum cleaners market. With a high concentration of households in urban areas, there is a steady demand for household cleaning products, including vacuum cleaners. As more consumers prioritize convenience and efficiency in their cleaning routines, the demand for innovative and technologically advanced vacuum cleaners is expected to increase in the residential segment.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- United States Vacuum Cleaners Market Overview

- United States Vacuum Cleaners Market Outlook

- United States Vacuum Cleaners Market Forecast

- Historical Data of United States Vacuum Cleaners Market Revenues & Volume for the Period 2020-2030

- United States Vacuum Cleaners Market Size and United States Vacuum Cleaners Market Forecast of Revenues & Volume, Until 2026

- Historical Data of United States Vacuum Cleaners Market Revenues & Volume, by Products, for the Period 2020-2030

- Market Size & Forecast of United States Vacuum Cleaners Market Revenues & Volume, by Products, Until 2026

- Historical Data of United States Vacuum Cleaners Market Revenues, by Distribution Channel, for the Period 2020-2030

- Market Size & Forecast of United States Vacuum Cleaners Market Revenues, by Distribution Channel, Until 2026

- Historical Data of United States Vacuum Cleaners Market Revenues, by End Users, for the Period 2020-2030

- Market Size & Forecast of United States Vacuum Cleaners Market Revenues, by End Users, Until 2026

- Historical Data of Central Region Vacuum Cleaners Market Revenues, for the Period 2020-2030

- Market Size & Forecast of Central Region Vacuum Cleaners Market Revenues, Until 2026

- Historical Data of Western Region Vacuum Cleaners Market Revenues, for the Period 2020-2030

- Market Size & Forecast of Western Region Vacuum Cleaners Market Revenues, Until 2026

- Historical Data of Southern Region Vacuum Cleaners Market Revenues, for the Period 2020-2030

- Market Size & Forecast of Southern Region Vacuum Cleaners Market Revenues, Until 2026

- Historical Data of Eastern Region Vacuum Cleaners Market Revenues, for the Period 2020-2030

- Market Size & Forecast of Eastern Region Vacuum Cleaners Market Revenues, Until 2026

- Market Drivers and Restraints

- United States Vacuum Cleaners Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- United States Vacuum Cleaners Market Share, By Players

- United States Vacuum Cleaners Market Share, By Regions

- United States Vacuum Cleaners Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments

By Products Type

- Canister

- Robotics

- Upright

By Distribution Channel

- Online

- Offline

By End Users

- Industrial

- Commercial

- Residential

United States Vacuum Cleaners Market (2024-2030): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. United States Vacuum Cleaners Market Overview |

| 3.1 United States Country Indicators |

| 3.2 United States Vacuum Cleaners Market Revenues and Volume 2020-2030F |

| 3.3 United States Vacuum Cleaners Market Revenue Share, By-Products, 2020 & 2030F |

| 3.4 United States Vacuum Cleaners Market Revenue Share, By Distribution Channel, 2020 & 2030F |

| 3.5 United States Vacuum Cleaners Market Revenue Share, By End User, 2020 & 2030F |

| 3.6 United States Vacuum Cleaners Market Revenue Share, By Regions, 2020 & 2030F |

| 3.7 United States Vacuum Cleaners Market - Industry Life Cycle |

| 3.8 United States Vacuum Cleaners Market - Porter’s Five Forces |

| 4. United States Vacuum Cleaners Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. United States Vacuum Cleaners Market Trends |

| 6. United States Vacuum Cleaners Market Overview, By-Products |

| 6.1 United States Vacuum Cleaners Market Revenues and Volume, By Canister, 2020-2030F |

| 6.2 United States Vacuum Cleaners Market Revenues and Volume, By Upright, 2020-2030F |

| 6.3 United States Vacuum Cleaners Market Revenues and Volume, By Robotics, 2020-2030F |

| 6.4 United States Vacuum Cleaners Market Revenues and Volume, By Others, 2020-2030F |

| 7. United States Vacuum Cleaners Market Overview, By Distribution Channel |

| 7.1 United States Vacuum Cleaners Market Revenues and Volume, By Online, 2020-2030F |

| 7.2 United States Vacuum Cleaners Market Revenues and Volume, By Offline, 2020-2030F |

| 8. United States Vacuum Cleaners Market Overview, By End User |

| 8.1 United States Vacuum Cleaners Market Revenues and Volume, By Industrial, 2020-2030F |

| 8.2 United States Vacuum Cleaners Market Revenues and Volume, By Commercial, 2020-2030F |

| 8.3 United States Vacuum Cleaners Market Revenues and Volume, By Residential, 2020-2030F |

| 9. United States Vacuum Cleaners Market - Key Performance Indicators |

| 10. United States Vacuum Cleaners Market - Opportunity Assessment |

| 10.1 United States Vacuum Cleaners Market Opportunity Assessment, By-Products, 2030F |

| 10.2 United States Vacuum Cleaners Market Opportunity Assessment, By Distribution Channel, 2030F |

| 10.3 United States Vacuum Cleaners Market Opportunity Assessment, By End User, 2030F |

| 11. United States Vacuum Cleaners Market Competitive Landscape |

| 11.1 United States Vacuum Cleaners Market Revenue Share, By Company |

| 11.2 United States Vacuum Cleaners Market Competitive Benchmarking, By Operating & Technical Parameters |

| 12. Company Profiles |

| 15. Key Recommendations |

| 16. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Cogeneration Equipment Market (2024-2030) | Revenue, Analysis, Trends, Value, Outlook, Companies, Forecast, Share, Industry, Size & Growth

- Carbon Credit Market (2024-2030) | Trends, Value, Revenue, Outlook, Forecast, Size, Analysis, Growth, Industry, Share, Segmentation

- Chocolate Market (2024-2030) | Size, Value, Industry, Share, Revenue, Forecast, Trends, Growth, Analysis

- Czech Republic Crude Sulfate Turpentine Market Outlook | Size, Forecast, Growth, Share, Analysis, Trends, Value, Companies, COVID-19 IMPACT, Revenue & Industry

- Poland Crude Sulfate Turpentine Market Outlook | Revenue, Value, Share, Growth, Forecast, COVID-19 IMPACT, Size, Industry, Analysis, Trends & Companies

- Germany Stainless Steel Commercial Kitchen Appliances Market (2024-2030) | Segmentation, Growth, Outlook, Share, Analysis, Industry, Companies, Value, Size & Revenue, Forecast, Trends

- Bus Market (2024-2030) | Trends, Size, Value, Forecast, Growth, Share, Companies, Analysis, Revenue & Industry

- Canned Food Market (2024-2030) | companies, industry, Size, Share, Revenue, Forecast, Trends, Analysis, Growth, Value, Outlook

- India Video Surveillance Market (2024-2030) | Size, industry, Share, Trends, Revenue, Analysis, Forecast, Growth, Value, Outlook

- India Air Conditioner (AC) Market (2024-2030) | Share, Size, Growth, Industry, Segmentation, Trends, Value, Revenue, Analysis & Outlook

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines