Vietnam Beer Market (2025-2031) | Value, Size, Trends, Outlook, Share, Analysis, Revenue, Forecast, Companies, Growth, Industry

Market Forecast By Type (Lager, Ale, Stout & Porter, Malt, Others), By Category (Popular Price, Premium, Super Premium), By Packaging (Glass, PET Bottle, Metal Can, Others), By Production (Macro-brewery, Micro-brewery, Craft Brewery, Others) And Competitive Landscape

| Product Code: ETC048310 | Publication Date: Aug 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

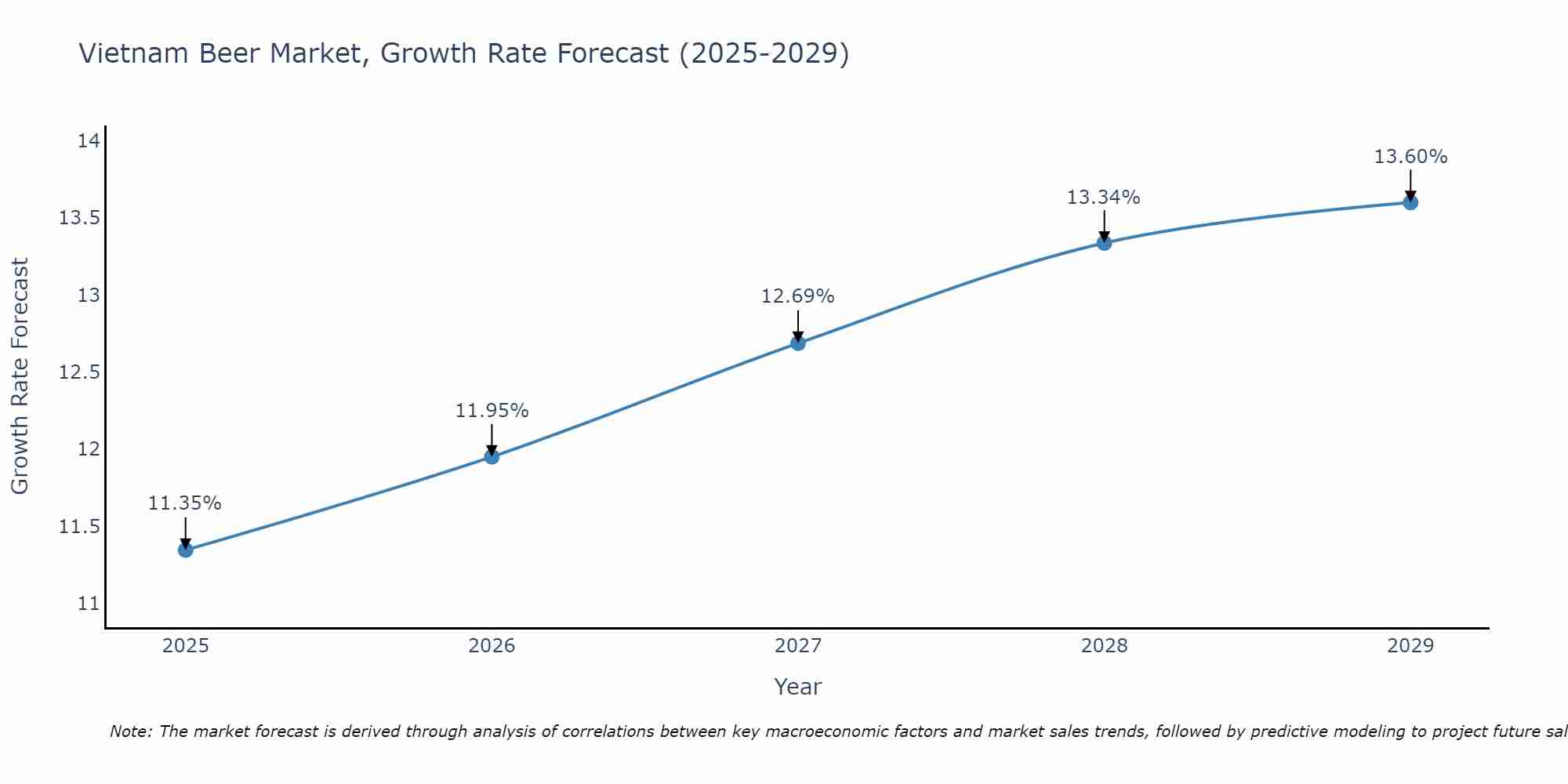

Vietnam Beer Market Size Growth Rate

The Vietnam Beer Market is poised for steady growth rate improvements from 2025 to 2029. The growth rate starts at 11.35% in 2025 and reaches 13.60% by 2029.

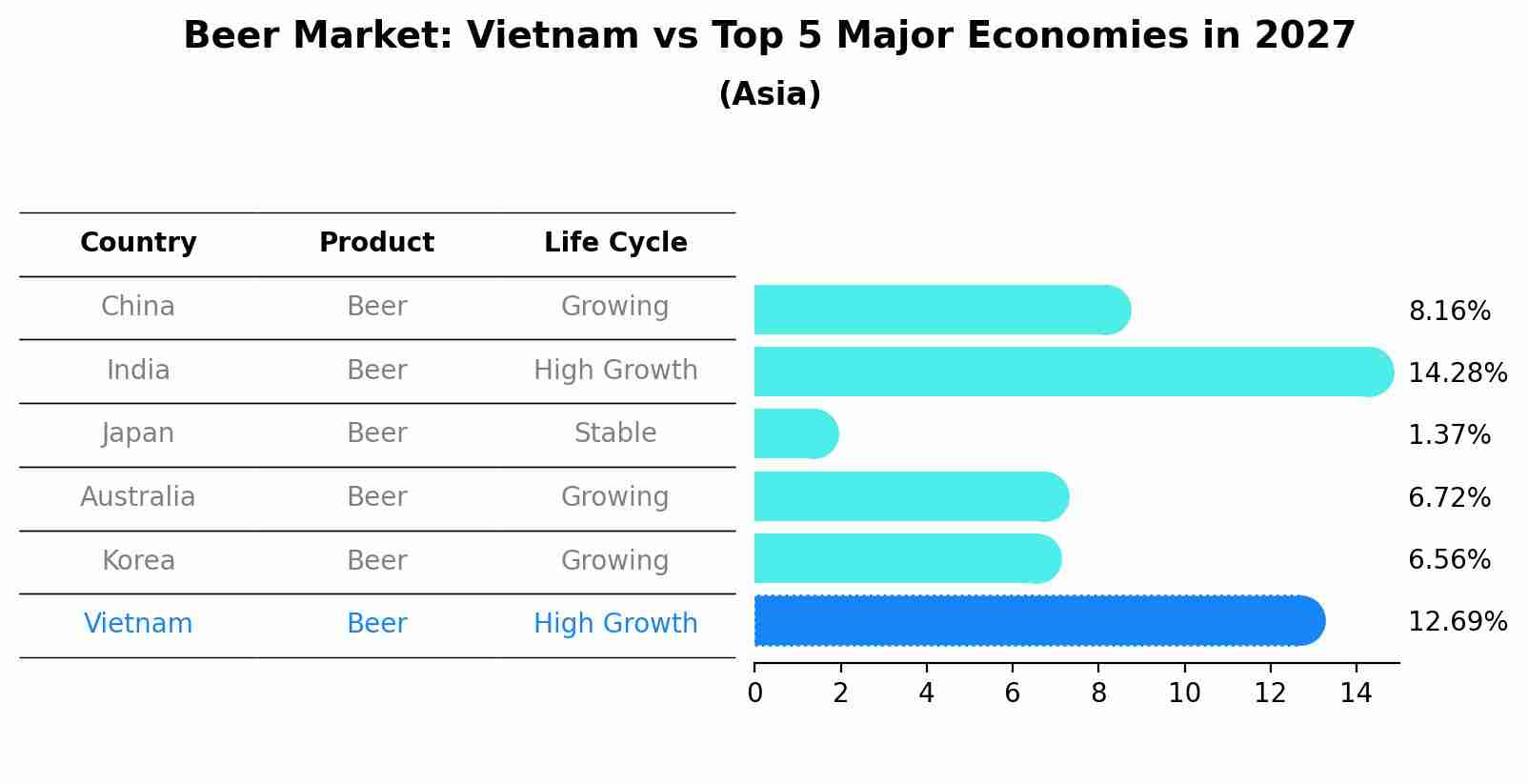

Beer Market: Vietnam vs Top 5 Major Economies in 2027 (Asia)

The Beer market in Vietnam is projected to grow at a high growth rate of 12.69% by 2027, within the Asia region led by China, along with other countries like India, Japan, Australia and South Korea, collectively shaping a dynamic and evolving market environment driven by innovation and increasing adoption of emerging technologies.

Vietnam Beer Market Highlights

| Report Name | Vietnam Beer Market |

| Forecast period | 2025-2031 |

| CAGR | 8.86% |

| Growing Sector | Premium & Super Premium Beers Sector |

Topics Covered in the Vietnam Beer Market Report

Vietnam Beer Market report thoroughly covers the market By Type, By Category, By Packaging, and By Production. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Vietnam Beer Market Synopsis

The Vietnam beer market is experiencing robust growth driven by rising disposable income, a young and expanding population, and shifting consumer preferences. The increasing popularity of beer among young adults, combined with Vietnam’s strong beer culture, particularly in urban areas, is fueling this expansion. Domestic brands such as Saigon Beer and Bia Hanoi, alongside international players, are leading the market. The growth is also supported by the growing trend of social drinking, evolving lifestyles, and greater accessibility through both traditional retail and online platforms.

According to 6Wresearch, the Vietnam Beer Market Size is expected to reach a significant CAGR of 8.86% during the forecast period 2025-2031. This rising trajectory signifies increasing demand driven by factors such as a growing young population, rising disposable incomes, and a vibrant social drinking culture. Key trends shaping the market include the popularity of premium and craft beer options as Vietnamese consumers increasingly gravitate toward high-quality, differentiated offerings. Additionally, beer companies are focusing on innovative marketing strategies and product diversification to cater to evolving consumer preferences. This robust growth is indicative of Vietnam's position as one of Southeast Asia's key beer markets, providing lucrative opportunities for both domestic brewers and international players aiming to expand in the region.

The Vietnam beer market faces several significant restraints that could impact its growth trajectory. One key challenge is the increasing enforcement of stricter regulations on alcohol sales and consumption, including higher taxes and stricter advertising rules. This has led to additional operational costs and reduced promotional opportunities for beer companies. Additionally, growing health awareness among consumers has shifted preferences toward non-alcoholic beverages, potentially decreasing beer consumption in the long term.

Vietnam Beer Market Trends

Vietnam Beer Market in Europe is gaining traction as international brewers recognize its potential appeal overseas. With an increasing demand for diverse beer flavors and the rising popularity of Asian beverages, Vietnamese beer brands are finding an audience among European consumers. The export of premium and craft beer varieties is a focal point, as these products cater to the sophisticated and adventurous palates in Europe. Additionally, promotional efforts and partnerships with European distributors are helping Vietnamese breweries establish their presence in a competitive market.

Investment Opportunities in the Vietnam Beer Market

Vietnam Beer Market Industry offers a wealth of investment opportunities driven by its robust growth and increasing global recognition. Domestically, rising urbanization, a young population, and evolving consumer preferences are fueling demand for premium and craft beers. Investors can tap into these trends by supporting local breweries or launching joint ventures to capture a share of the expanding market. Internationally, partnerships with Vietnamese beer brands to access European and other global markets present lucrative prospects. Additionally, investment in sustainable brewing practices and innovative product lines can attract environmentally-conscious consumers. With its dynamic growth and adaptability, the Vietnam beer industry remains an attractive sector for both regional and global investors.

Leading Players in the Vietnam Beer Market

Leading players in the market that are fueling the Vietnam Beer Market share include Sabeco (Saigon Beer-Alcohol-Beverage Corporation), Heineken Vietnam Brewery, and Habeco (Hanoi Beer-Alcohol-Beverage Corporation). Sabeco, as one of the largest producers, leverages its extensive distribution network and strong brand identity to capture significant market share. Heineken Vietnam, renowned for its premium branding and global expertise, plays a crucial role in driving growth, particularly in the urban premium beer segment. Meanwhile, Habeco continues to maintain a loyal customer base with its focus on traditional and regional appeal. These key players' strategic investments and diverse product offerings drive competition, innovation, and growth within the dynamic Vietnam beer market.

Government Regulations

Government regulations play a pivotal role in shaping the Vietnam beer market. Strict policies on alcohol advertising and limitations on operating hours for beer establishments are designed to promote responsible consumption and curb alcohol-related issues. The government also implements high excise taxes on alcoholic beverages, impacting production costs and pricing strategies for manufacturers. Additionally, there is a growing push for environmental compliance, requiring companies to adopt sustainable practices in packaging and production. These regulations influence market dynamics, encouraging businesses to innovate while balancing profitability with societal and environmental responsibilities, ultimately ensuring a well-regulated and sustainable beer industry in Vietnam.

Future Insights of the Vietnam Beer Market

Vietnam Beer Market Growth is expected to remain robust in the coming years, driven by rising consumer demand and evolving preferences. The increasing shift towards premium and craft beer segments, inspired by a rising middle class with higher disposable incomes, is projected to fuel market expansion. Additionally, the integration of advanced brewing technologies is set to enhance production efficiency and product diversity. Emerging trends like low-alcohol and non-alcoholic beer variants also cater to health-conscious consumers, further diversifying market offerings. However, businesses must adapt to stricter regulations and environmental standards, to ensure sustainability. Overall, the Vietnam beer market promises significant growth opportunities while requiring innovative and adaptable strategies from industry players.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Lager to Dominate the Market-By Type

The Vietnam beer market is projected to witness lager dominating as the preferred beer type among consumers. Known for its smooth taste and light profile, lager has become the go-to choice for Vietnam's rapidly growing younger demographic and urban population.

Popular Price to Dominate the Market-By Category

According to Ravi Bhandari, Research Head, 6Wresearch, the popular price segment is expected to dominate the Vietnam beer market, driven by its broad appeal among price-sensitive consumers. Positioned as an affordable yet quality option, beers in this category cater to both urban and rural markets.

Glass to Dominate the Market-By Packaging

In the Vietnam beer market, glass packaging is expected to dominate due to its long-standing popularity and association with premium products. Glass bottles offer superior taste preservation and are preferred for traditional and local beer brands, especially in the premium and super-premium segments.

Craft Breweries to Dominate the Market-By Production

In the Vietnam beer market, craft breweries are expected to dominate production due to the rising demand for unique, high-quality, and locally produced beers. With consumers increasingly seeking distinctive flavors and artisanal experiences, craft breweries are capitalizing on this trend, offering a diverse range of beers that cater to evolving tastes.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam Beer Market Outlook

- Market Size of Vietnam Beer Market, 2024

- Forecast of Vietnam Beer Market, 2031

- Historical Data and Forecast of Vietnam Beer Revenues & Volume for the Period 2021-2031

- Vietnam Beer Market Trend Evolution

- Vietnam Beer Market Drivers and Challenges

- Vietnam Beer Price Trends

- Vietnam Beer Porter's Five Forces

- Vietnam Beer Industry Life Cycle

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Lager for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Ale for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Stout & Porter for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Malt for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Category for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Popular Price for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Premium for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Super Premium for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Packaging for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Glass for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By PET Bottle for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Metal Can for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Production for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Macro-brewery for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Micro-brewery for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Craft Brewery for the Period 2021-2031

- Historical Data and Forecast of Vietnam Beer Market Revenues & Volume By Others for the Period 2021-2031

- Vietnam Beer Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Category

- Market Opportunity Assessment By Packaging

- Market Opportunity Assessment By Production

- Vietnam Beer Top Companies Market Share

- Vietnam Beer Competitive Benchmarking By Technical and Operational Parameters

- Vietnam Beer Company Profiles

- Vietnam Beer Key Strategic Recommendations

Markets Covered

The market report has been segmented and sub-segmented into the following categories

By Type

- Lager

- Ale

- Stout & Porter

- Malt

- Others

By Category

- Popular Price

- Premium

- Super Premium

By Packaging

- Glass

- PET Bottle

- Metal Can

- Other

By Production

- Macro-Brewery

- Micro-Brewery

- Craft Brewery

- Other

Vietnam Beer Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Vietnam Beer Market Overview |

| 3.1 Vietnam Country Macro Economic Indicators |

| 3.2 Vietnam Beer Market Revenues & Volume, 2021 & 2031F |

| 3.3 Vietnam Beer Market - Industry Life Cycle |

| 3.4 Vietnam Beer Market - Porter's Five Forces |

| 3.5 Vietnam Beer Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.6 Vietnam Beer Market Revenues & Volume Share, By Category, 2021 & 2031F |

| 3.7 Vietnam Beer Market Revenues & Volume Share, By Packaging, 2021 & 2031F |

| 3.8 Vietnam Beer Market Revenues & Volume Share, By Production, 2021 & 2031F |

| 4 Vietnam Beer Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Vietnam Beer Market Trends |

| 6 Vietnam Beer Market, By Types |

| 6.1 Vietnam Beer Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Vietnam Beer Market Revenues & Volume, By Type, 2023 - 2031F |

| 6.1.3 Vietnam Beer Market Revenues & Volume, By Lager, 2023 - 2031F |

| 6.1.4 Vietnam Beer Market Revenues & Volume, By Ale, 2023 - 2031F |

| 6.1.5 Vietnam Beer Market Revenues & Volume, By Stout & Porter, 2023 - 2031F |

| 6.1.6 Vietnam Beer Market Revenues & Volume, By Malt, 2023 - 2031F |

| 6.1.7 Vietnam Beer Market Revenues & Volume, By Others, 2023 - 2031F |

| 6.2 Vietnam Beer Market, By Category |

| 6.2.1 Overview and Analysis |

| 6.2.2 Vietnam Beer Market Revenues & Volume, By Popular Price, 2023 - 2031F |

| 6.2.3 Vietnam Beer Market Revenues & Volume, By Premium, 2023 - 2031F |

| 6.2.4 Vietnam Beer Market Revenues & Volume, By Super Premium, 2023 - 2031F |

| 6.3 Vietnam Beer Market, By Packaging |

| 6.3.1 Overview and Analysis |

| 6.3.2 Vietnam Beer Market Revenues & Volume, By Glass, 2023 - 2031F |

| 6.3.3 Vietnam Beer Market Revenues & Volume, By PET Bottle, 2023 - 2031F |

| 6.3.4 Vietnam Beer Market Revenues & Volume, By Metal Can, 2023 - 2031F |

| 6.3.5 Vietnam Beer Market Revenues & Volume, By Others, 2023 - 2031F |

| 6.4 Vietnam Beer Market, By Production |

| 6.4.1 Overview and Analysis |

| 6.4.2 Vietnam Beer Market Revenues & Volume, By Macro-brewery, 2023 - 2031F |

| 6.4.3 Vietnam Beer Market Revenues & Volume, By Micro-brewery, 2023 - 2031F |

| 6.4.4 Vietnam Beer Market Revenues & Volume, By Craft Brewery, 2023 - 2031F |

| 6.4.5 Vietnam Beer Market Revenues & Volume, By Others, 2023 - 2031F |

| 7 Vietnam Beer Market Import-Export Trade Statistics |

| 7.1 Vietnam Beer Market Export to Major Countries |

| 7.2 Vietnam Beer Market Imports from Major Countries |

| 8 Vietnam Beer Market Key Performance Indicators |

| 9 Vietnam Beer Market - Opportunity Assessment |

| 9.1 Vietnam Beer Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Vietnam Beer Market Opportunity Assessment, By Category, 2021 & 2031F |

| 9.3 Vietnam Beer Market Opportunity Assessment, By Packaging, 2021 & 2031F |

| 9.4 Vietnam Beer Market Opportunity Assessment, By Production, 2021 & 2031F |

| 10 Vietnam Beer Market - Competitive Landscape |

| 10.1 Vietnam Beer Market Revenue Share, By Companies, 2024 |

| 10.2 Vietnam Beer Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero