Vietnam Cement Tiles Market (2025-2031) Outlook | Size, Share, Growth, Analysis, Value, Industry, Trends, Companies, Forecast & Revenue

| Product Code: ETC273870 | Publication Date: Aug 2022 | Updated Date: Feb 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

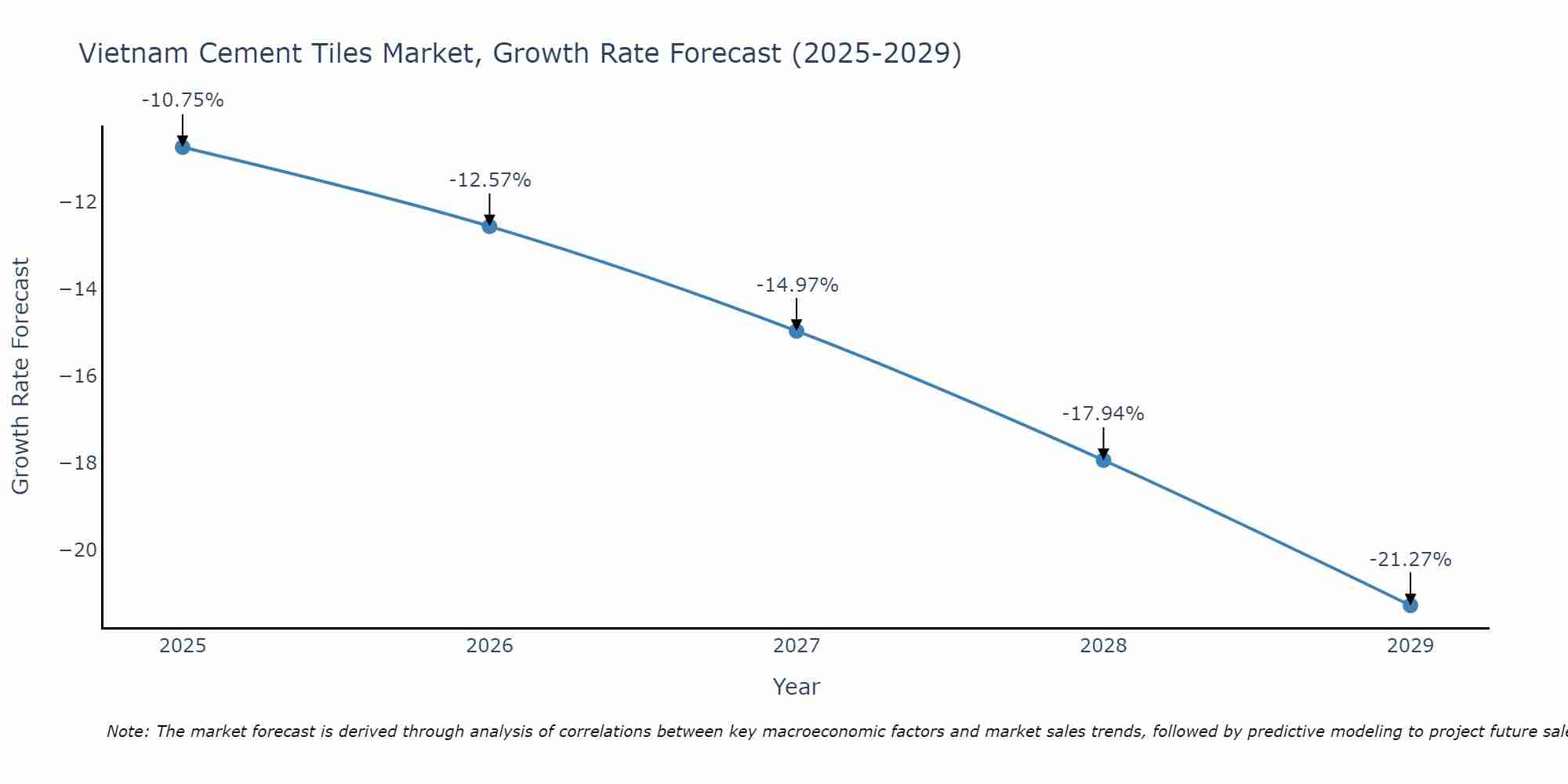

Vietnam Cement Tiles Market Size Growth Rate

The Vietnam Cement Tiles Market could see a tapering of growth rates over 2025 to 2029. Starting high at -10.75% in 2025, the market steadily declines to -21.27% by 2029.

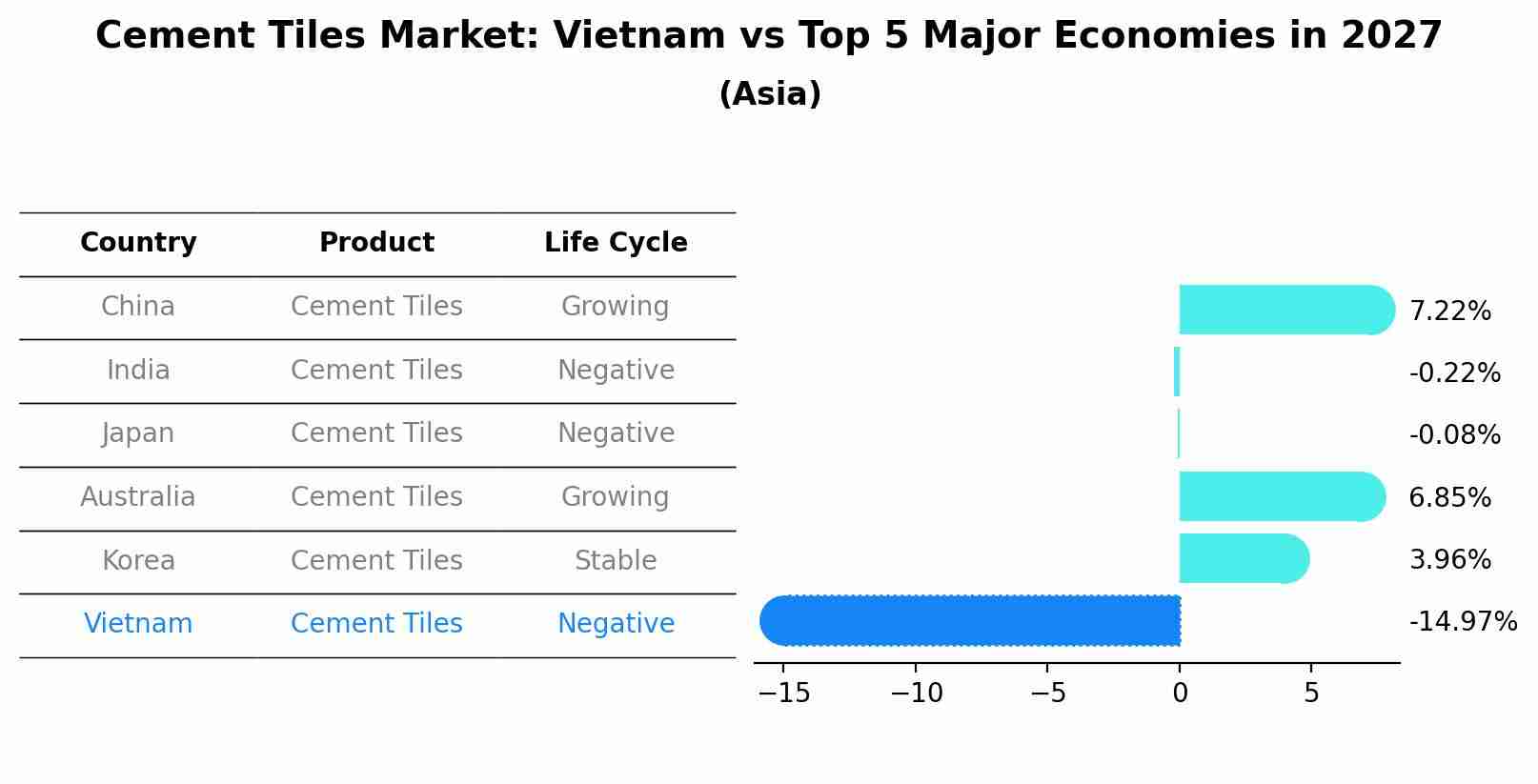

Cement Tiles Market: Vietnam vs Top 5 Major Economies in 2027 (Asia)

By 2027, Vietnam's Cement Tiles market is forecasted to achieve a negative growth rate of -14.97%, with China leading the Asia region, followed by India, Japan, Australia and South Korea.

Vietnam Cement Tiles Market Synopsis

The Vietnam cement tiles market encompasses cement-based tiles used for flooring and wall cladding in residential and commercial spaces. Cement tiles offer durability and decorative options for interior and exterior design. The market serves construction firms, architects, and homeowners seeking cement tile solutions.

Drivers of the Market

The Vietnam cement tiles market has witnessed growth attributed to its applications in flooring and roofing solutions. Cement tiles are durable and provide excellent thermal and acoustic insulation. Market expansion has been driven by the construction and real estate sectors` demand for sustainable and energy-efficient building materials, as well as the growth of residential and commercial construction projects. The market`s growth has been supported by advancements in cement tile designs, improved manufacturing processes, and the development of eco-friendly cement tiles that enhance building aesthetics and energy efficiency.

Challenges of the Market

Challenges in the Vietnam cement tiles market include competition from alternative flooring materials and the demand for aesthetically pleasing and durable cement tiles for residential and commercial spaces. Ensuring cement tile quality, design versatility, and cost-effectiveness while managing manufacturing costs and addressing flooring standards pose significant hurdles. Market players must also adapt to changing cement tile design trends and interior decoration preferences.

COVID-19 Impact on the Market

The Vietnam cement tiles market experienced fluctuations in demand during the COVID-19 pandemic. Cement tiles are commonly used in construction and home improvement projects. The pandemic initially disrupted construction activity and consumer spending, affecting the demand for cement tiles. However, as economic conditions improved and construction projects resumed, there was a gradual recovery in the market. Manufacturers in Vietnam had to adjust production and distribution strategies to cater to changing market dynamics and customer needs. The market demonstrated resilience by adapting to shifting demand patterns during the crisis.

Key Players in the Market

Prominent companies in the Vietnam cement tiles market include TileManufacturers Vietnam and BuildingMaterials Co., Ltd. They produce cement tiles known for their durability and aesthetic appeal in construction projects.

Key Highlights of the Report:

- Vietnam Cement Tiles Market Outlook

- Market Size of Vietnam Cement Tiles Market, 2024

- Forecast of Vietnam Cement Tiles Market, 2031

- Historical Data and Forecast of Vietnam Cement Tiles Revenues & Volume for the Period 2021-2031

- Vietnam Cement Tiles Market Trend Evolution

- Vietnam Cement Tiles Market Drivers and Challenges

- Vietnam Cement Tiles Price Trends

- Vietnam Cement Tiles Porter's Five Forces

- Vietnam Cement Tiles Industry Life Cycle

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Product for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By S Tile for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Corrugated Tiles for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Flat Tiles for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Square Tiles for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Rectangular Cement Tiles for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Hexagonal Cement Tiles for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Octagonal Cement Tiles for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Material Type for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Clay for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Concrete for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Application Channel for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Residential for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Commercial for the Period 2021-2031

- Historical Data and Forecast of Vietnam Cement Tiles Market Revenues & Volume By Industrial for the Period 2021-2031

- Vietnam Cement Tiles Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Material Type

- Market Opportunity Assessment By Application Channel

- Vietnam Cement Tiles Top Companies Market Share

- Vietnam Cement Tiles Competitive Benchmarking By Technical and Operational Parameters

- Vietnam Cement Tiles Company Profiles

- Vietnam Cement Tiles Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Vietnam Cement Tiles Market Overview |

3.1 Vietnam Country Macro Economic Indicators |

3.2 Vietnam Cement Tiles Market Revenues & Volume, 2021 & 2031F |

3.3 Vietnam Cement Tiles Market - Industry Life Cycle |

3.4 Vietnam Cement Tiles Market - Porter's Five Forces |

3.5 Vietnam Cement Tiles Market Revenues & Volume Share, By Product, 2021 & 2031F |

3.6 Vietnam Cement Tiles Market Revenues & Volume Share, By Material Type, 2021 & 2031F |

3.7 Vietnam Cement Tiles Market Revenues & Volume Share, By Application Channel, 2021 & 2031F |

4 Vietnam Cement Tiles Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Vietnam Cement Tiles Market Trends |

6 Vietnam Cement Tiles Market, By Types |

6.1 Vietnam Cement Tiles Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 Vietnam Cement Tiles Market Revenues & Volume, By Product, 2021-2031F |

6.1.3 Vietnam Cement Tiles Market Revenues & Volume, By S Tile, 2021-2031F |

6.1.4 Vietnam Cement Tiles Market Revenues & Volume, By Corrugated Tiles, 2021-2031F |

6.1.5 Vietnam Cement Tiles Market Revenues & Volume, By Flat Tiles, 2021-2031F |

6.1.6 Vietnam Cement Tiles Market Revenues & Volume, By Square Tiles, 2021-2031F |

6.1.7 Vietnam Cement Tiles Market Revenues & Volume, By Rectangular Cement Tiles, 2021-2031F |

6.1.8 Vietnam Cement Tiles Market Revenues & Volume, By Hexagonal Cement Tiles, 2021-2031F |

6.2 Vietnam Cement Tiles Market, By Material Type |

6.2.1 Overview and Analysis |

6.2.2 Vietnam Cement Tiles Market Revenues & Volume, By Clay, 2021-2031F |

6.2.3 Vietnam Cement Tiles Market Revenues & Volume, By Concrete, 2021-2031F |

6.3 Vietnam Cement Tiles Market, By Application Channel |

6.3.1 Overview and Analysis |

6.3.2 Vietnam Cement Tiles Market Revenues & Volume, By Residential, 2021-2031F |

6.3.3 Vietnam Cement Tiles Market Revenues & Volume, By Commercial, 2021-2031F |

6.3.4 Vietnam Cement Tiles Market Revenues & Volume, By Industrial, 2021-2031F |

7 Vietnam Cement Tiles Market Import-Export Trade Statistics |

7.1 Vietnam Cement Tiles Market Export to Major Countries |

7.2 Vietnam Cement Tiles Market Imports from Major Countries |

8 Vietnam Cement Tiles Market Key Performance Indicators |

9 Vietnam Cement Tiles Market - Opportunity Assessment |

9.1 Vietnam Cement Tiles Market Opportunity Assessment, By Product, 2021 & 2031F |

9.2 Vietnam Cement Tiles Market Opportunity Assessment, By Material Type, 2021 & 2031F |

9.3 Vietnam Cement Tiles Market Opportunity Assessment, By Application Channel, 2021 & 2031F |

10 Vietnam Cement Tiles Market - Competitive Landscape |

10.1 Vietnam Cement Tiles Market Revenue Share, By Companies, 2024 |

10.2 Vietnam Cement Tiles Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero