Vietnam Diesel Genset Market (2025-2031) | Growth, Size, Value, Industry, Share, Trends, Analysis, Revenue, Segmentation, Outlook

Market Forecast By KVA Rating (5 KVA-75 KVA, 75.1 KVA-375 KVA, 375.1 KVA-750 KVA, 750.1 KVA-1000 KVA And Above 1000 KVA), By Applications (Residential, Commercial, Industrial, Transportation & Public Infrastructure), By Regions (Eastern, Northern, Western And Southern) And Competitive Landscape

| Product Code: ETC090029 | Publication Date: Dec 2023 | Updated Date: Sep 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Vietnam Diesel Genset Market Size Growth Rate

The Vietnam Diesel Genset Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 10.17% in 2025, the market peaks at 12.11% in 2028, and settles at 11.23% by 2029.

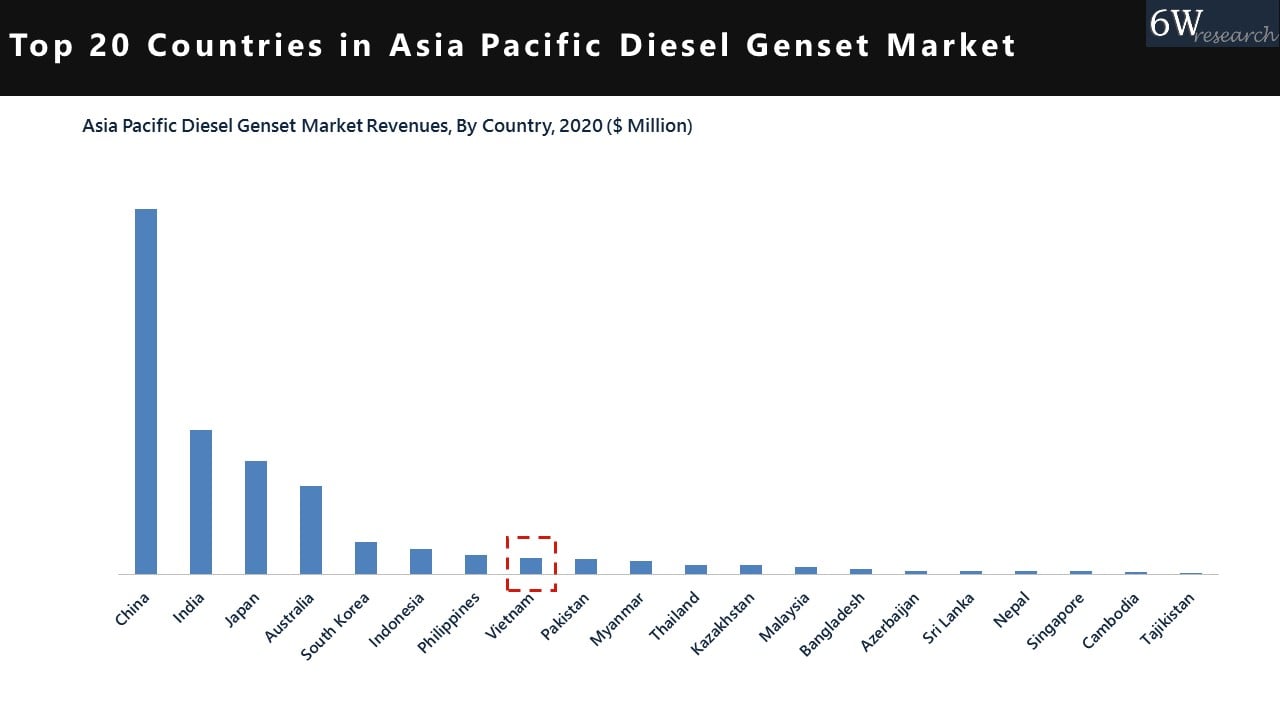

Diesel Genset Market: Vietnam vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Diesel Genset market in Vietnam is projected to expand at a high growth rate of 11.90% by 2027. The largest economy is China, followed by India, Japan, Australia, and South Korea.

Vietnam Diesel Genset Market Growth Rate

According to 6Wresearch's internal database and industry insights, the Vietnam diesel genset market is projected to reach a compound annual growth rate (CAGR) of 11.23% during the forecast period (2025–2029).

Vietnam Diesel Genset Market Highlights

| Report Name | Vietnam Diesel Genset Market |

| Forecast Period | 2025–2029 |

| CAGR | 11.23% |

| Growing Sector | Industrial & Public Infrastructure |

Topics Covered in the Vietnam Diesel Genset Market Report

The Vietnam Diesel Genset Market report thoroughly covers the market by kVA ratings, applications, and regions. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

Vietnam Diesel Genset Market Synopsis

Vietnam's diesel genset market growth has proliferated due to various factors, including rapid industrialization and rising infrastructure development across the country. Additionally, the demand for diesel generator sets has been increasing with the growing need for reliable power backup solutions across various sectors. Key players focus on technological advancements and compliance with stringent emission regulations to maintain competitiveness.

Evaluation of Growth Drivers in the Vietnam Diesel Genset Market

Below are some prominent drivers and their influence on the market dynamics:

| Driver | Primary Segments Affected | Why it matters (evidence) |

| Infrastructure Development | ≥750 kVA & >1000 kVA; Industrial, Public Infrastructure | Vietnam's ongoing urbanization, including the construction of new smart cities and megaprojects, boosts the need for large-scale power backup solutions. |

| Natural Disaster Preparedness | 75–750 kVA; Residential, Commercial | Frequent storms and other natural disasters push demand for backup power solutions to maintain operations during power outages. |

| Aging Population | 375–750 kVA; Healthcare | Expansion of healthcare infrastructure to accommodate the aging population increases the need for reliable genset backups. |

| Data Center Expansion | 375–750 kVA; Commercial (IT & ITES) | The digital transformation is driving demand for high-capacity gensets to back up IT infrastructure across Vietnam. |

| Government Green Initiatives | ≥750 kVA & >1000 kVA; Industrial, Public Infrastructure | Vietnam's energy transition plans are encouraging the integration of renewable energy, though diesel gensets remain critical for backup power. |

The Vietnam Diesel Genset Market size is projected to grow at a CAGR of 11.23%during the forecast period of 2025-2029. There are various factors bolstering the growth of the market. These growth drivers are the rising shift of the rural population towards urban areas, coupled with this country's rapid industrialization. As infrastructure projects expand, the demand for reliable power sources also increases, particularly in remote or off-grid locations. Additionally, various sectors, including the industrial and manufacturing sectors, such as construction, textiles, and agriculture, use diesel generators for uninterrupted operations during power outages or in areas with insufficient access to the grid.

Evaluation of Restraints in the Vietnam Diesel Genset Market

Below are some major restraints and their influence on the market dynamics:

| Restraint | Primary Segments Affected | What this means (evidence) |

| Strict Emission Regulations | New installs; all kVA | Vietnam enforces strict environmental standards for diesel gensets, raising compliance costs and limiting the use of older genset models in favor of cleaner alternatives. |

| High Operational Costs | Prime-power Industrial | High operational expenses associated with diesel fuel impact the affordability of gensets, particularly for large-scale applications in the industrial sector. |

| Transition to Renewable Energy | Public Infrastructure & Utilities | The government's push for renewable energy under its energy transition plans reduces dependency on diesel power for certain applications. |

| Regulatory Noise Restrictions | Residential & Commercial | Noise ordinances in urban areas limit genset installation, especially for residential and small commercial applications. |

| Dependence on Imports | Industrial & Commercial | Vietnam's heavy reliance on imported gensets leads to high procurement costs and supply chain vulnerabilities. |

Vietnam Diesel Genset Market Challenges

On the other hand, the market faces numerous challenges that need to be addressed. These challenges are the environmental impact of diesel generators and increasing government pressure for greener and more sustainable power solutions, such as renewable energy sources. These challenges need to be encountered to surge the market growth avenue in terms of size and share.

Vietnam Diesel Genset Market Trends

Several prominent trends reshaping the market growth include:

- Hybrid Energy Integration – In remote and off-grid areas, there is a high adoption of hybrid systems combining diesel and renewable energy sources.

- Rental Services – There is a high demand for rental gensets, predominantly in sectors such as construction and event management.

- Smart, IoT-Enabled Gensets – The rising deployment of telematics and remote monitoring systems to reduce downtime.

Investment Opportunities in the Vietnam Diesel Genset Industry

Some prominent investment opportunities in the market include:

- Premium Hybrid & Low-Emission Gensets – Develop and market hybrid diesel-solar systems to align with the government's green initiatives and infrastructure projects.

- Rental-as-a-Service (RaaS) – Offer flexible, on-demand genset rental services tailored to construction, temporary installations, and large-scale events.

- High-Capacity Fleets for Mega-Projects – Supply gensets ≥ 1000 kVA for mega-projects such as smart city developments, with service contracts for long-term support.

Top 5 Leading Players in the Vietnam Diesel Genset Market

Some leading players operating in the market include:

1. Kohler SDMO

| Company Name | Kohler SDMO |

| Established Year | 1966 |

| Headquarters | Brest, France |

| Official Website | Click Here |

Kohler SDMO is a French manufacturer of generators and a subsidiary of Kohler Company. SDMO is the leading manufacturer of generating sets in the European market

2. Caterpillar Inc.

| Company Name | Caterpillar Inc. |

| Established Year | 1925 |

| Headquarters | Peoria, Illinois, USA |

| Official Website | Click Here |

Caterpillar Inc. is a leading manufacturer of construction and mining equipment, engines, and industrial turbines. The company offers a range of diesel generators known for their durability and performance.

3. Cummins Inc.

| Company Name | Cummins Inc. |

| Established Year | 1919 |

| Headquarters | Columbus, Indiana, USA |

| Official Website | Click Here |

Cummins is a global leader in diesel power solutions, offering gensets for a wide range of applications across Vietnam.

4. Kohler Co.

| Company Name | Kohler Co. |

| Established Year | 1873 |

| Headquarters | Kohler, Wisconsin, USA |

| Official Website | Click Here |

Kohler Co. is a renowned manufacturer of diesel generators across the country, which offers products that combine advanced technology and fuel efficiency.

5. Atlas Copco AB

| Company Name | Atlas Copco AB |

| Established Year | 1873 |

| Headquarters | Nacka, Sweden |

| Official Website | Click Here |

Atlas Copco offers a range of diesel generators known for their efficiency. Their products are widely used across Vietnam's construction and industrial sectors.

Government Regulations Introduced in the Vietnam Diesel Genset Market

According to Vietnamese government data, the expansion of the market is likely to reshape positively, as it operates under strict emissions and efficiency standards established by the Ministry for the Ecological Transition and the Vietnam Energy Commission. These regulations focus on reducing the environmental impact of diesel-powered gensets across the country, ensuring they comply with stringent emission limits. As part of Vietnam's energy transition strategy, also to reduce dependency on diesel gensets, the government is encouraging the integration of hybrid and renewable energy solutions.

Future Insights of the Vietnam Diesel Genset Market

The Vietnam Diesel Genset Market's future seems promising as the rural population is shifting massively to the urban areas. In addition to this, growing infrastructure expansion and rising demand for backup power solutions will further boost the demand for Diesel Genset in the country. There is a push for digital transformation and large-scale infrastructure projects, whereas the adoption of hybrid energy systems and strict environmental regulations will further shape its evolution.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Above 1000 kVA to Dominate the Market– By KVA Rating

According to Mansi Ahuja, Senior Research Analyst at 6Wresearch, the Above 1000 kVA category holds the largest market share in the Vietnam Diesel Genset Market. This is due to the substantial demand for high-capacity gensets in industries such as oil & gas, large construction projects, and public infrastructure.

Industrial to Dominate the Market– By Applications

The Industrial segment dominates the Vietnam Diesel Genset Industry, primarily driven by the energy-intensive nature of Vietnam's industrial activities. The growing demand from the automotive, manufacturing, and petrochemical industries, along with the expansion of infrastructure projects.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam Diesel Genset Market Outlook

- Market Size of Vietnam Diesel Genset Market, 2024

- Forecast of Vietnam Diesel Genset Market, 2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume for the Period 2021 - 2031

- Vietnam Diesel Genset Market Trend Evolution

- Vietnam Diesel Genset Market Drivers and Challenges

- Vietnam Diesel Genset Market Price Trends

- Vietnam Diesel Genset Market Porter's Five Forces

- Vietnam Diesel Genset Market Industry Life Cycle

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and Volume by KVA ratings for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and Volume by 5 - 75 KVA for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and Volume by 75.1 - 375 KVA for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and Volume by 375.1 - 750 KVA for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and Volume by 750.1 - 1000 KVA for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and Volume by Above 1000 KVA for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and Volume by Application for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and Volume by Residential for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and Volume by Commercial for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and Volume by Industry for the Period 2021-2031

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues and Volume by Transportation and Public Infrastructure for the Period 2021-2031

- Vietnam Diesel Genset Market Import Export Trade Statistics

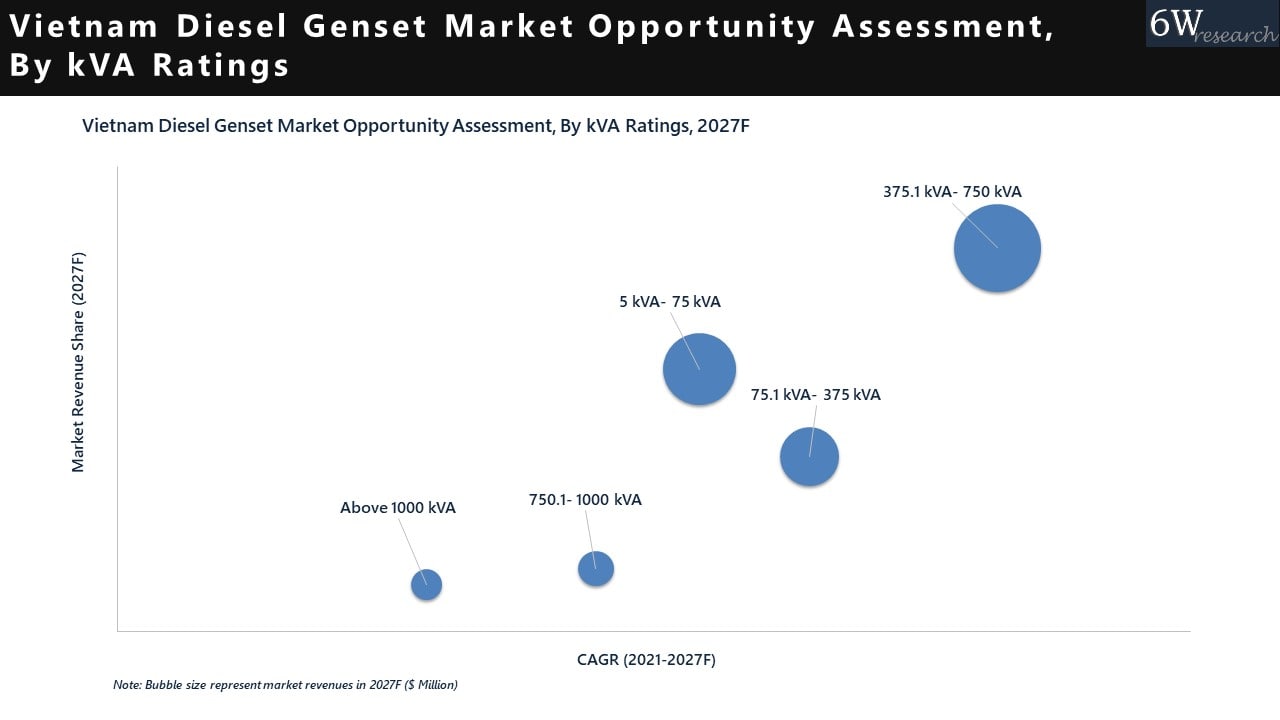

- Market Opportunity Assessment by KVA ratings

- Market Opportunity Assessment by Application

- Vietnam Diesel Genset Market Top Companies Market Share

- Vietnam Diesel Genset Market Competitive Benchmarking by Technical and Operational Parameters

- Vietnam Diesel Genset Market Company Profiles

- Vietnam Diesel Genset Market Key Strategic Recommendation

Markets Covered

The report offers a comprehensive analysis of the following market segments:

By kVA Rating:

- 5 kVA–75 kVA

- 75.1 kVA–375 kVA

- 375.1 kVA–750 kVA

- 750.1 kVA–1000 kVA

- Above 1000 kVA

By Applications:

- Residential

- Commercial

- Industrial

- Transportation & Public Infrastructure

Vietnam Diesel Genset Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Vietnam Diesel Genset Market Overview |

| 3.1 Vietnam Country Macro Economic Indicators |

| 3.2 Vietnam Diesel Genset Market Revenues & Volume, 2021 & 2031F |

| 3.3 Vietnam Diesel Genset Market- Industry Life Cycle |

| 3.4 Vietnam Diesel Genset Market- Porter's Five Forces |

| 3.5 Vietnam Diesel Genset Market Revenues & Volume Share, By KVA rating , 2021 & 2031F |

| 3.6 Vietnam Diesel Genset Market Revenues & Volume Share, By Application 2021 & 2031F |

| 4 Vietnam Diesel Genset Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for reliable backup power solutions in Vietnam |

| 4.2.2 Growth in industrial and commercial sectors driving the need for continuous power supply |

| 4.2.3 Government initiatives promoting the use of diesel gensets for reliable electricity supply |

| 4.3 Market Restraints |

| 4.3.1 Environmental concerns leading to a shift towards cleaner energy sources |

| 4.3.2 Fluctuating prices of diesel impacting the operational costs of diesel gensets |

| 4.3.3 Increasing competition from alternative power generation technologies |

| 5 Vietnam Diesel Genset Market Trends |

| 6. Vietnam Diesel Genset Market, By KVA Ratings |

| 6.1 Vietnam Diesel Genset Market Revenues & Volume, By 5 KVA-75 KVA 2021 & 2031F |

| 6.2 Vietnam Diesel Genset Market Revenues & Volume, By 75.1 KVA-375 KVA, 2021 & 2031F |

| 6.3 Vietnam Diesel Genset Market Revenues & Volume, By 375.1 KVA-750 KVA, 2021 & 2031F |

| 6.3 Vietnam Diesel Genset Market Revenues & Volume, By 750.1 KVA-1000 KVA , 2021 & 2031F |

| 6.3 Vietnam Diesel Genset Market Revenues & Volume, By Above 1000 KVA, 2021 & 2031F |

| 7 Vietnam Diesel Genset Market, By Application |

| 7.1 Vietnam Diesel Genset Market Revenues & Volume, By Residential, 2021 & 2031F |

| 7.2 Vietnam Diesel Genset Market Revenues & Volume, By Commercial, 2021 & 2031F |

| 7.3 Vietnam Diesel Genset Market Revenues & Volume, By Industrial, 2021 & 2031F |

| 7.3 Vietnam Diesel Genset Market Revenues & Volume, By Transportation & public Infrastructure 2021 & 2031F |

| 8 Vietnam Diesel Genset Market Import-Export Trade Statistics |

| 8.1 Vietnam Diesel Genset Market Export to Major Countries |

| 8.2 Vietnam Diesel Genset Market Imports from Major Countries |

| 9 Vietnam Diesel Genset Market Key Performance Indicators |

| 9.1 Average uptime percentage of diesel gensets in Vietnam |

| 9.2 Adoption rate of diesel gensets in key industries and sectors |

| 9.3 Maintenance cost as a percentage of initial investment for diesel gensets |

| 10 Vietnam Diesel Genset Market- Opportunity Assessment |

| 10.1 Vietnam Diesel Genset Market Opportunity Assessment, By KVA rating , 2031 |

| 10.2 Vietnam Diesel Genset Market Opportunity Assessment, By Application, 2031 |

| 11 Vietnam Diesel Genset Market- Competitive Landscape |

| 11.1 Vietnam Diesel Genset Market Revenue Share, By Companies, 2024 |

| 11.2 Vietnam Diesel Genset Market Competitive Benchmarking, By Operating and Technical Parameters |

| 12 Company Profiles |

| 13 Recommendations |

| 14 Disclaimer |

Market Forecast By KVA (5 - 75 KVA, 75.1 - 375 KVA, 375.1 - 750 KVA, 750.1 - 1000 KVA, Above 1000 KVA), By Application (Residential, Commercial, Industrial, Transportation & Public Infrastructure) And Competitive Landscape

| Product Code: ETC090029 | Publication Date: Jul 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Topics Covered in the Vietnam Diesel Genset Market

Vietnam Diesel Genset (Generator) Market report comprehensively covers the market by kVA ratings & application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Vietnam Diesel Genset (Generator) Market is projected to grow over the coming year. Vietnam Diesel Genset (Generator) Market report is a part of our periodical regional publication Asia Pacific Diesel Genset (Generator) Market outlook report. 6W tracks the diesel genset market for over 60 countries with individual country-wise market opportunity assessments and publishes the report titled Global Diesel Genset (Generator) Market outlook report annually.

Latest Development (2023) of the Vietnam Diesel Genset (Generator) Market

Vietnam Diesel Genset (Generator) Market is significantly growing on account of increasing industrialization and urbanization. There is a shift towards eco-friendly technologies due to rising awareness among people about the protection of the environment. The producers of diesel gensets are taking various measures to produce efficient and sustainable products. There is heavy investment in the research domain to develop and advance the technology that can easily reduce carbon emissions and improvised the efficiency of fuel. Due to economic growth, and a supportive and favorable regulatory environment for renewable energy sources, Vietnam is set to become the leading market in Asia. The producers are keeping up with the latest development and sustainability standards to cater to the needs of the consumers and due to this, Vietnam Diesel Genset (Generator) Industry is expanding.

Vietnam Diesel Genset Market Synopsis

Vietnam Diesel Genset Market is anticipated to gain momentum in the upcoming years. The key factor for the growth of the market on account of increasing disposable income coupled with rising demand for regular and reliable power supply. Increasing urbanization and infrastructure development are accelerating the Vietnam Diesel Generator Market Growth. The growing expansion of the industrial and construction sector coupled with increasing power blackouts triggers the potential growth of the market.

According to 6Wresearch, Vietnam Diesel Genset (Generator) Market size is projected to grow at a CAGR of 2.4% during 2021-2027. Vietnam occupies the 8th position in terms of market size in the APAC Diesel Genset Market. The lack of infrastructure and rising demand for a continuous supply of electricity is adding to the Vietnam Diesel Generator Market Share. The various industries and sectors are constantly demanding the uninterrupted power supply and this is leading to the growth of the market. The various government initiatives towards the development of the infrastructure are another factor that is boosting the market. Foreign investment in oil and gas exploration is another factor that is driving the growth of the market. There are numerous challenges present in the market. There should be more investment in the research and development domain to develop advanced products. The major companies should expand their distribution networks by collaborating with local distributors so that the market can grow at a rapid pace.

Market by KVA

Market by KVA

On the basis of KVA, the market is segmented into 5 - 75 KVA, 75.1 - 375 KVA, 375.1 - 750 KVA, 750.1 - 1000 KVA, and Above 1000 KVA.

Market by Application

Market by Application

According to Dhaval, Research Manager, 6Wresearch, on the basis of Application, the market is segmented into Residential, Commercial, Industrial, and Transportation & Public Infrastructure. The commercial segment will dominate the market due to its extensive use as a power backup source in various commercial establishments and it will lead to an increase in Vietnam Diesel Genset Market Share.

COVID-19 Impact on Vietnam Diesel Genset (Generator) Market

The Diesel Genset Market in Vietnam was significantly impacted by the sudden outbreak of the pandemic. There was a decline in the demand for the diesel genset due to lockdown measures and supply chain disruptions and it resulted in a drop in the sales of the machines. The construction industry primarily uses the diesel gensets and it has been severely affected by COVID-19. The demand for generators declined due to the cancellation of projects due to government-mandated lockdown and social distancing measures. There was a reduction in commercial operations that relied heavily on backup power and it led to less requirement of the generators in small and medium-sized industries.

Vietnam Diesel Genset (Generator) Market: Key Players

These are the key players in the market and they are extensively engaged in the production and distribution of the Genset (Generator) and it leading to Vietnam Diesel Genset (Generator) Market Share.

- Cummins Inc.

- Caterpillar Inc.

- Mitsubishi Heavy Industries, Ltd.

- Kohler Co.

- Atlas Copco AB

- Yanmar Holdings Co., Ltd.

- Himoinsa S.L.

- MTU Onsite Energy (a brand of Rolls-Royce Power Systems)

- Doosan Corporation

- Wuxi Kipor Power Co., Ltd.

Key attractiveness of the report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020.

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam Diesel Genset Market Outlook

- Market Size of Vietnam Diesel Genset Market, 2020

- Forecast of Vietnam Diesel Genset Market, 2027

- Historical Data and Forecast of Vietnam Diesel Genset Revenues & Volume for the Period 2017 - 2027

- Vietnam Diesel Genset Market Trend Evolution

- Vietnam Diesel Genset Market Drivers and Challenges

- Vietnam Diesel Genset Price Trends

- Vietnam Diesel Genset Porter's Five Forces

- Vietnam Diesel Genset Industry Life Cycle

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By KVA for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By 5 - 75 KVA for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By 75.1 - 375 KVA for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By 375.1 - 750 KVA for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By 750.1 - 1000 KVA for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By Above 1000 KVA for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By Application for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By Commercial for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By Industrial for the Period 2017 - 2027

- Historical Data and Forecast of Vietnam Diesel Genset Market Revenues & Volume By Transportation & Public Infrastructure for the Period 2017 - 2027

- Vietnam Diesel Genset Import Export Trade Statistics

- Market Opportunity Assessment By KVA

- Market Opportunity Assessment By Application

- Vietnam Diesel Genset Top Companies Market Share

- Vietnam Diesel Genset Competitive Benchmarking By Technical and Operational Parameters

- Vietnam Diesel Genset Company Profiles

- Vietnam Diesel Genset Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By KVA

- 5 - 75 KVA

- 75.1 - 375 KVA

- 375.1 - 750 KVA

- 750.1 - 1000 KVA

- Above 1000 KVA

By Application

- Residential

- Commercial

- Industrial

- Transportation & Public Infrastructure

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero