Vietnam Furniture Market (2025-2031) | Industry, Value, Analysis, Growth, Forecast, Size, Revenue, Companies, Trends, Share & Outlook

Market Forecast By Material Types (Plastic, Wood, Metal, Other), By Applications (Residential, Commercial) And Competitive Landscape

| Product Code: ETC009770 | Publication Date: Jun 2023 | Updated Date: Mar 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

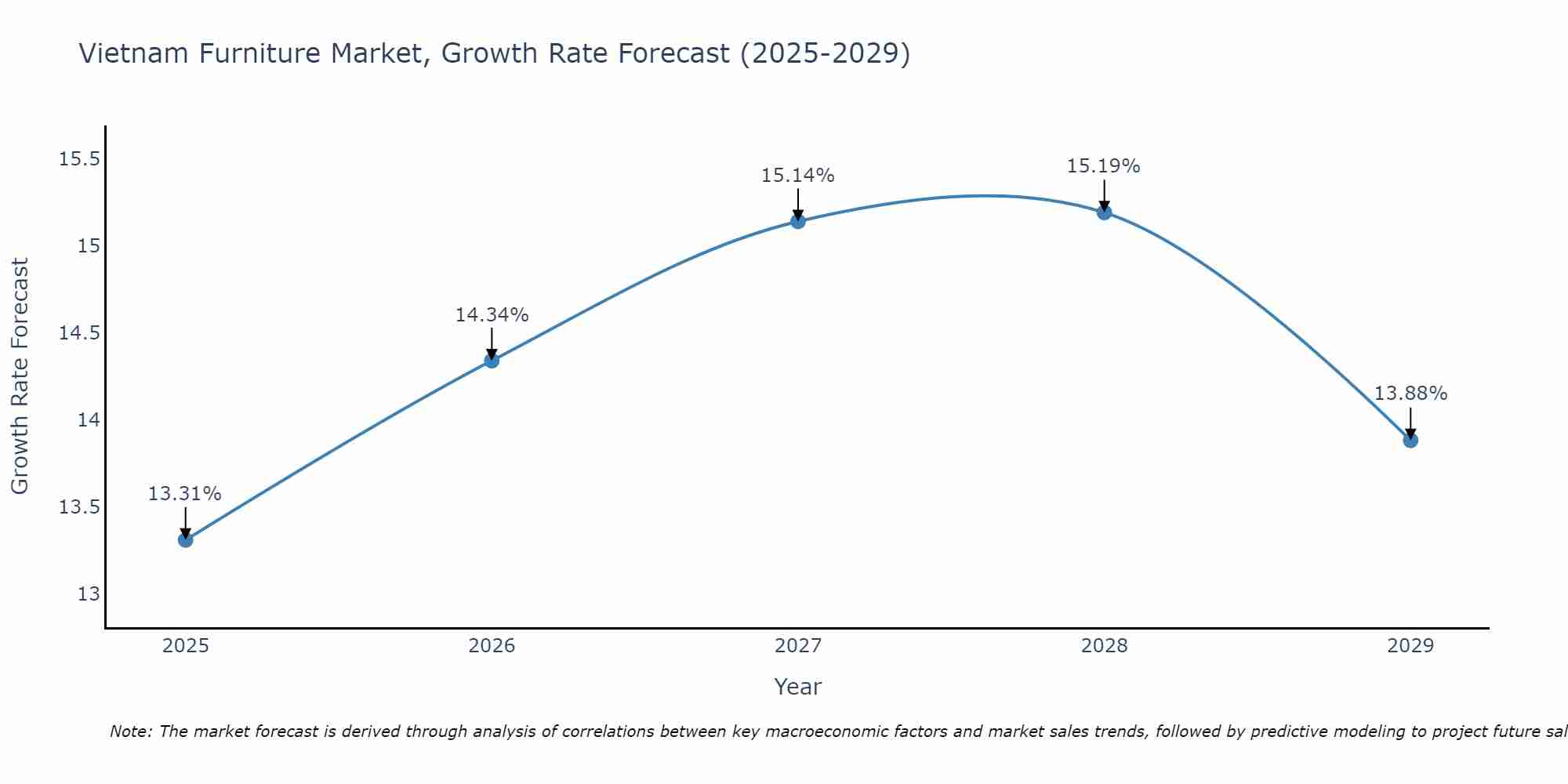

Vietnam Furniture Market Size Growth Rate

The Vietnam Furniture Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 13.31% in 2025, climbs to a high of 15.19% in 2028, and moderates to 13.88% by 2029.

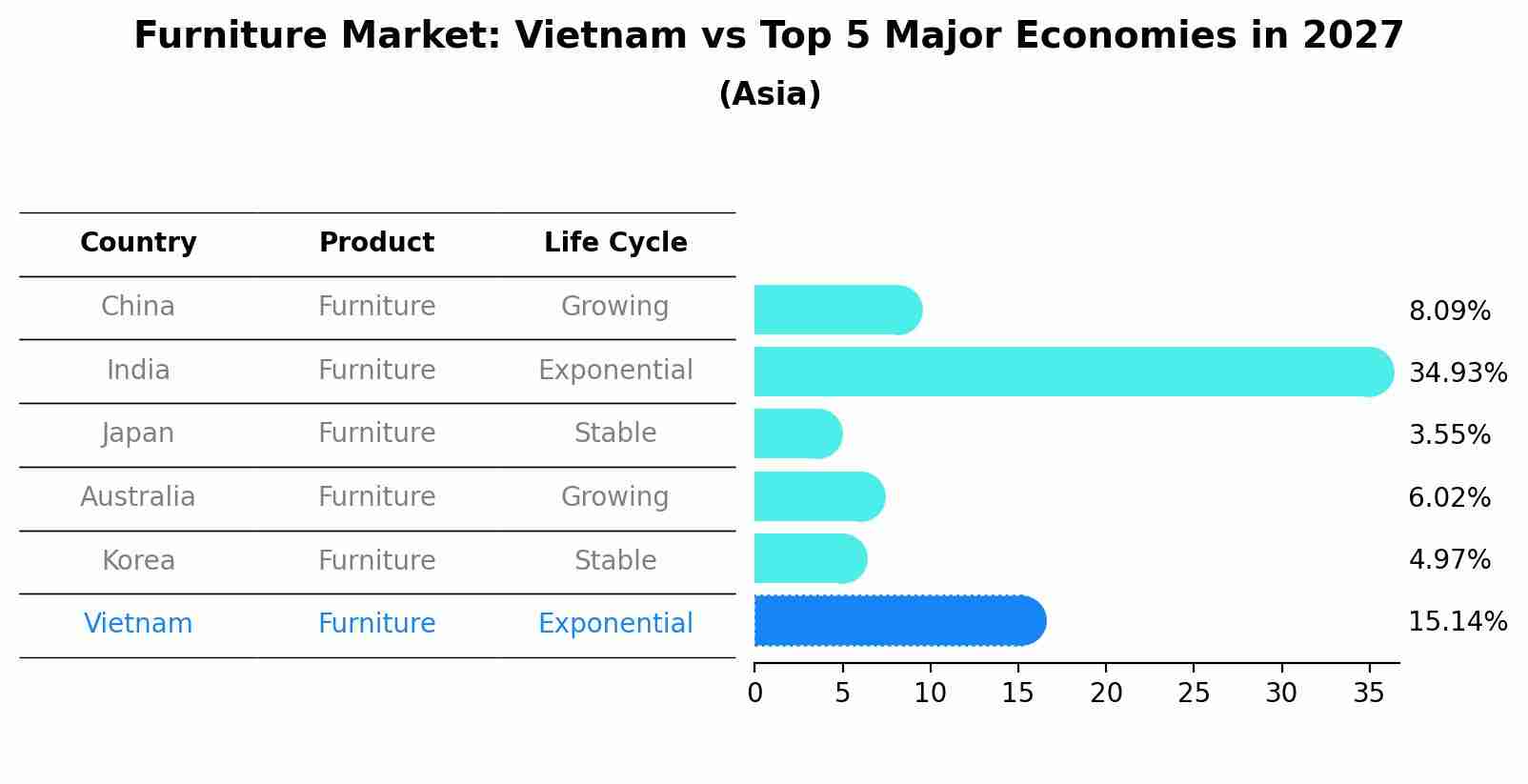

Furniture Market: Vietnam vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Furniture market in Vietnam is projected to expand at a exponential growth rate of 15.14% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Vietnam furniture Market Highlights

| Report Name | Vietnam furniture Market |

| Forecast period | 2025-2031 |

| CAGR | 5.2% |

| Growing Sector | Home and Living |

Topics Covered in the Vietnam Furniture Market Report

The Vietnam Furniture Market report thoroughly covers the market by Material Type and by Application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Vietnam Furniture Market Synopsis

The Vietnam Furniture Market has emerged as a dynamic and fast-growing sector, driven by rising domestic demand and significant export activities. Known for its high-quality craftsmanship and competitive pricing, Vietnam has become one of the leading furniture exporters globally, catering to markets such as the United States, Europe, and Asia. The sector benefits from abundant natural resources, including timber, and a skilled workforce. Additionally, government support and favorable trade agreements have further drive the Vietnam Furniture Market Growth.

According to 6Wresearch, the Vietnam Furniture Market is predicted to grow at a CAGR of 5.2% during the forecast period 2025-2031. The market has experienced remarkable growth in recent years, placing itself as one of the leading exporters of furniture in the world. This growth is driven by the abundance natural resources of the country, such as timber, and a skilled workforce capable of producing high-quality products at competitive prices. The strategic location of Vietnam in the Southeast Asia also provides an advantage in terms of access to major markets, including North America, Europe, and Asia. Moreover, international trade agreements, such as the EVFTA (EU-Vietnam Free Trade Agreement), have reduced excise duties and upheld the competitiveness of market globally.

Despite its impressive growth, the Vietnam furniture Industry faces several challenges that could impact its long-term sustainability. For instance, increasing pressure of environmental regulations and the need to adopt sustainable practices in sourcing and production to meet global standards. Furthermore, competition from other emerging furniture manufacturing hubs, such as India and Indonesia, continues to post a threat. The industry also contends with fluctuations in raw material costs and the ongoing impact of supply chain interruptions, which have become more pronounced in recent years. Developing more robust infrastructure, improving compliance with international standards, and investing in sustainable practices will be crucial to maintaining the momentum of competitiveness globally.

Vietnam Furniture Market Trends

The Vietnam Furniture Market has been experiencing significant growth in recent years, driven by both domestic demand and export opportunities. Known for its craftsmanship and competitive manufacturing costs, Vietnam has become a major center for furniture production. The rise in sustainable and eco-friendly furniture has also shaped market trends, with a growing preference for materials like bamboo and rattan. Additionally, the increasing adoption of e-commerce platforms has made furniture more accessible to millions of customers, both local and international level. These trends highlight the potential of the country to remain a key player in the global furniture industry.

Investment Opportunities in the Vietnam Furniture Market

The Vietnam Furniture Market presents a wealth of investment opportunities, driven by the robust manufacturing capability of country, competitive labour costs, and increasing exports to global markets. As one of the world's leading furniture exporters, Vietnam benefits from its extensive supply of raw materials like timber, as well as favourable trade agreements that ease access to international buyers. The growing demand for sustainable and eco-friendly furniture also aligns with Vietnam's ramping up of green production practices.

Leading Players in the Vietnam Furniture Market

The Vietnam furniture market is characterized by its dynamic growth and the presence of several key players leading the industry. Companies such as Scansia Pacific and AA Corporation have established themselves as major exporters, specializing in high-quality wooden furniture that caters to global demand. Xuan Hoa and Hoa Phat Furniture are prominent domestic leaders, offering a wide range of products including office and home furniture designed for functionality and style. Additionally, Duc Loi and Minh Duong Furniture emphasize craftsmanship and innovative manufacturing processes. These companies, along with numerous small and medium-sized manufacturers, contribute to the position of Vietnam as a global hub for furniture production and export.

Government Regulations

The Vietnam furniture market growth is shaped by a series of government regulations aimed at promoting sustainable development and global competitiveness. Authorities have implemented policies to encourage the use of certified wood and environmentally friendly production methods to combat illegal logging and deforestation. Further, export regulations, including compliance with international quality standards and trade agreements, are strictly enforced to ensure Vietnam remains a key player in the global furniture market. Government incentives, such as tax breaks for eco-friendly enterprises and investment in industrial zones, further drive the modernization and growth of the industry.

Future Insights of the Vietnam Furniture Market

The Vietnam Furniture Market is going to be secure significant growth in the coming years, driven by increasing global demand for sustainable and cost-effective furniture solutions. The strong manufacturing capabilities, abundant raw materials, and skilled workforce would make Vietnam country a major player in the global furniture supply chain. Additionally, rising investments in technology and modernized production methods are responsible for enhancing the efficiency and quality of products. As we can see the E-commerce sector expanding, Vietnam furniture businesses are also leveraging online platforms to reach wider international markets. The free trade agreements have supported this market to access wider opportunities throughout the world and positioned itself as the hub for furniture export.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Furniture to Dominate the Market - By Product

According to Vasu, Senior Research Analyst, 6Wresearch, the furniture segment is expected to witness significant growth, with furniture emerging as a leading product segment. The demand for furniture is driven by its important role in both residential and commercial spaces, supported by rapid urbanization and rising expendable incomes in the country. Other product categories, such as home decor items, household appliances, and electronics, are also gaining traction, driven by variations in consumer preferences and modern lifestyles.

Online Channels to Dominate the Market - By Distribution Channel

Online distribution channels are predicted to drive the Vietnam furniture market share, as e-commerce continues to gain popularity for its convenience and wide selection. Supermarkets/hypermarkets and specialty furniture stores remain vital, offering consumers a tactual shopping experience. Further, local outlets and department stores play a key role in ensuring accessibility across various regions. Balancing the online and offline platforms will be crucial in meeting the growing demand for quality furniture and other products, ensuring the retail landscape in Vietnam adapts to changing consumer behaviors.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- Vietnam Furniture Market Outlook

- Market Size of Vietnam Furniture Market, 2024

- Forecast of Vietnam Furniture Market, 2031

- Historical Data and Forecast of Vietnam Furniture Revenues & Volume for the Period 2021 - 2031

- Vietnam Furniture Market Trend Evolution

- Vietnam Furniture Market Drivers and Challenges

- Vietnam Furniture Price Trends

- Vietnam Furniture Porter's Five Forces

- Vietnam Furniture Industry Life Cycle

- Historical Data and Forecast of Vietnam Furniture Market Revenues & Volume By Material Types for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Furniture Market Revenues & Volume By Plastic for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Furniture Market Revenues & Volume By Wood for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Furniture Market Revenues & Volume By Metal for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Furniture Market Revenues & Volume By Other for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Furniture Market Revenues & Volume By Applications for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Furniture Market Revenues & Volume By Residential for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Furniture Market Revenues & Volume By Commercial for the Period 2021 - 2031

- Vietnam Furniture Import Export Trade Statistics

- Market Opportunity Assessment By Material Types

- Market Opportunity Assessment By Applications

- Vietnam Furniture Top Companies Market Share

- Vietnam Furniture Competitive Benchmarking By Technical and Operational Parameters

- Vietnam Furniture Company Profiles

- Vietnam Furniture Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments and their leading categories.

By Material Type

- Plastic

- Wood

- Metal

- Other

By Applications

- Residential

- Commercial

Vietnam Furniture Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Vietnam Furniture Market Overview |

| 3.1 Vietnam Country Macro Economic Indicators |

| 3.2 Vietnam Furniture Market Revenues & Volume, 2021 & 2031F |

| 3.3 Vietnam Furniture Market - Industry Life Cycle |

| 3.4 Vietnam Furniture Market - Porter's Five Forces |

| 3.5 Vietnam Furniture Market Revenues & Volume Share, By Material Types, 2022 & 2031F |

| 3.6 Vietnam Furniture Market Revenues & Volume Share, By Applications, 2022 & 2031F |

| 4 Vietnam Furniture Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Vietnam Furniture Market Trends |

| 6 Vietnam Furniture Market, By Types |

| 6.1 Vietnam Furniture Market, By Material Types |

| 6.1.1 Overview and Analysis |

| 6.1.2 Vietnam Furniture Market Revenues & Volume, By Material Types, 2021 - 2031F |

| 6.1.3 Vietnam Furniture Market Revenues & Volume, By Plastic, 2021 - 2031F |

| 6.1.4 Vietnam Furniture Market Revenues & Volume, By Wood, 2021 - 2031F |

| 6.1.5 Vietnam Furniture Market Revenues & Volume, By Metal, 2021 - 2031F |

| 6.1.6 Vietnam Furniture Market Revenues & Volume, By Other, 2021 - 2031F |

| 6.2 Vietnam Furniture Market, By Applications |

| 6.2.1 Overview and Analysis |

| 6.2.2 Vietnam Furniture Market Revenues & Volume, By Residential, 2021 - 2031F |

| 6.2.3 Vietnam Furniture Market Revenues & Volume, By Commercial, 2021 - 2031F |

| 7 Vietnam Furniture Market Import-Export Trade Statistics |

| 7.1 Vietnam Furniture Market Export to Major Countries |

| 7.2 Vietnam Furniture Market Imports from Major Countries |

| 8 Vietnam Furniture Market Key Performance Indicators |

| 9 Vietnam Furniture Market - Opportunity Assessment |

| 9.1 Vietnam Furniture Market Opportunity Assessment, By Material Types, 2021 & 2031F |

| 9.2 Vietnam Furniture Market Opportunity Assessment, By Applications, 2021 & 2031F |

| 10 Vietnam Furniture Market - Competitive Landscape |

| 10.1 Vietnam Furniture Market Revenue Share, By Companies, 2024 |

| 10.2 Vietnam Furniture Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero