Vietnam Medical Devices Market (2025-2031) | Size, Analysis, Value, Outlook, Industry, Trends, Share, Growth, Forecast, Companies & Revenue

| Product Code: ETC036470 | Publication Date: Aug 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

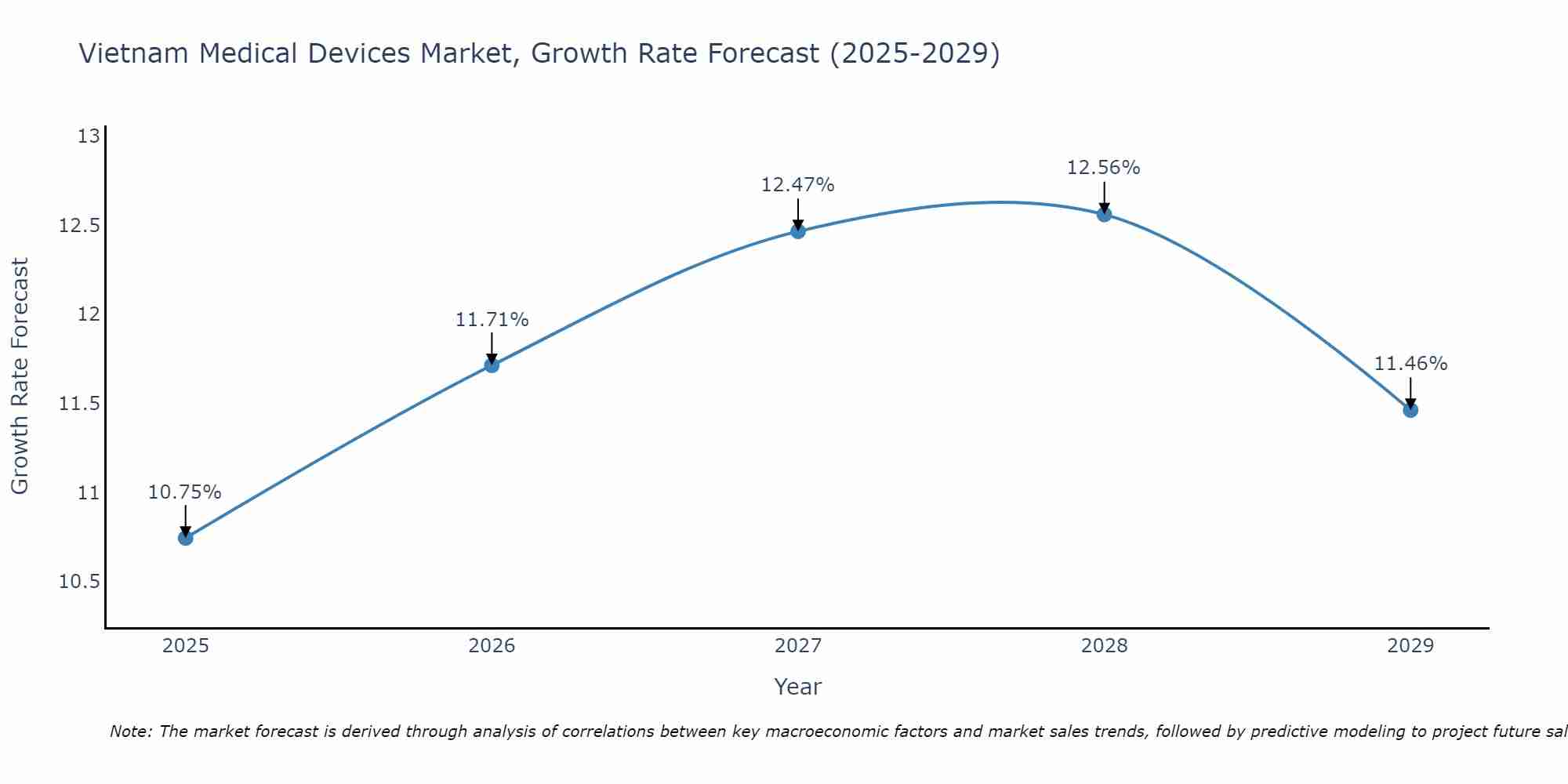

Vietnam Medical Devices Market Size Growth Rate

The Vietnam Medical Devices Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 10.75% in 2025, climbs to a high of 12.56% in 2028, and moderates to 11.46% by 2029.

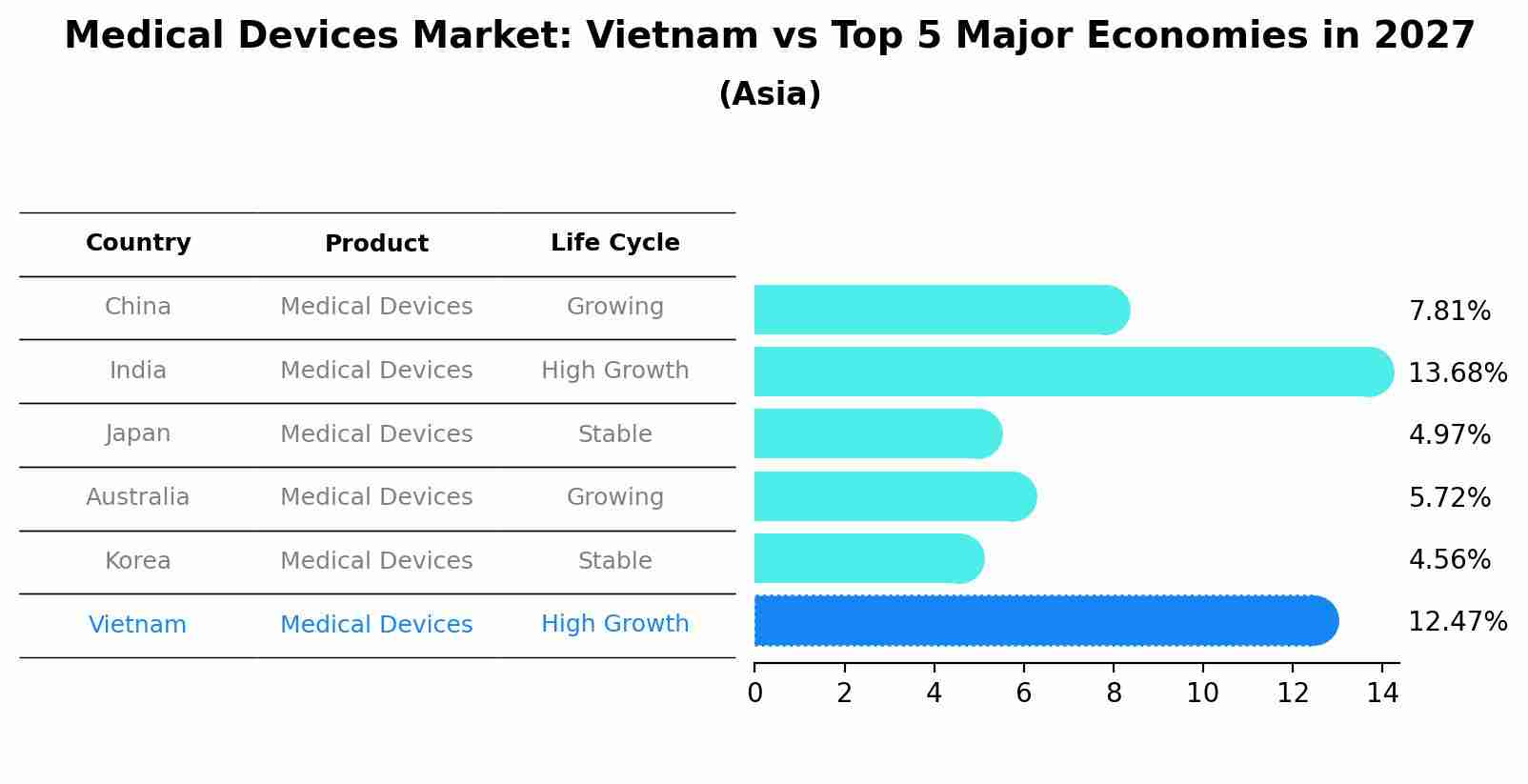

Medical Devices Market: Vietnam vs Top 5 Major Economies in 2027 (Asia)

By 2027, Vietnam's Medical Devices market is forecasted to achieve a high growth rate of 12.47%, with China leading the Asia region, followed by India, Japan, Australia and South Korea.

Vietnam Medical Devices Market Synopsis

The Vietnam medical devices market has experienced significant growth in recent years, driven by the country`s expanding healthcare sector, increasing demand for advanced medical technologies, and the government`s focus on improving healthcare infrastructure and services. Medical devices encompass a wide range of products used in healthcare settings for diagnosis, treatment, monitoring, and surgical procedures. As Vietnam economy continues to develop and healthcare services improve, the demand for medical devices has risen, contributing to the expansion of the market.

Drivers of the Market

The growth of the Vietnam medical devices market is influenced by several key drivers. Firstly, the government`s efforts to enhance healthcare access, expand health insurance coverage, and invest in medical facilities have driven the demand for medical devices across the country. Secondly, the rising prevalence of chronic diseases and the aging population have led to higher demand for medical devices for diagnosis and treatment. Additionally, the increasing awareness of healthcare and the adoption of advanced medical technologies have fueled the demand for innovative and sophisticated medical devices.

Challenges of the Market

Despite the market`s growth, the Vietnam medical devices industry faces certain challenges. Firstly, the high cost of advanced medical technologies and devices can be a barrier to adoption, especially in smaller healthcare facilities. The industry must focus on offering cost-effective solutions and establishing financing options for healthcare providers. Secondly, ensuring regulatory compliance and product quality is crucial for medical device manufacturers and distributors. The industry must prioritize product certification and adherence to international standards to gain trust and confidence among healthcare professionals and patients.

COVID-19 Impact on the Market

The COVID-19 pandemic had a significant impact on the Vietnam medical devices market. During the pandemic, the demand for medical devices, such as ventilators, personal protective equipment, and diagnostic devices, surged to support the healthcare system`s response to the virus. The pandemic also highlighted the importance of resilient and reliable medical devices in managing public health crises and providing quality healthcare services.

Key Highlights of the Report:

- Vietnam Medical Devices Market Outlook

- Market Size of Vietnam Medical Devices Market, 2024

- Forecast of Vietnam Medical Devices Market, 2031

- Historical Data and Forecast of Vietnam Medical Devices Revenues & Volume for the Period 2021-2031

- Vietnam Medical Devices Market Trend Evolution

- Vietnam Medical Devices Market Drivers and Challenges

- Vietnam Medical Devices Price Trends

- Vietnam Medical Devices Porter's Five Forces

- Vietnam Medical Devices Industry Life Cycle

- Historical Data and Forecast of Vietnam Medical Devices Market Revenues & Volume By Types for the Period 2021-2031

- Historical Data and Forecast of Vietnam Medical Devices Market Revenues & Volume By Orthopedic Devices for the Period 2021-2031

- Historical Data and Forecast of Vietnam Medical Devices Market Revenues & Volume By Cardiovascular Devices for the Period 2021-2031

- Historical Data and Forecast of Vietnam Medical Devices Market Revenues & Volume By Diagnostic Devices for the Period 2021-2031

- Historical Data and Forecast of Vietnam Medical Devices Market Revenues & Volume By IVD for the Period 2021-2031

- Historical Data and Forecast of Vietnam Medical Devices Market Revenues & Volume By MIS for the Period 2021-2031

- Historical Data and Forecast of Vietnam Medical Devices Market Revenues & Volume By Wound Management for the Period 2021-2031

- Historical Data and Forecast of Vietnam Medical Devices Market Revenues & Volume By Diabetes Care for the Period 2021-2031

- Historical Data and Forecast of Vietnam Orthopedic Devices Medical Devices Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Vietnam Medical Devices Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of Vietnam Medical Devices Market Revenues & Volume By Hospitals & Ambulatory Surgical Centers for the Period 2021-2031

- Historical Data and Forecast of Vietnam Medical Devices Market Revenues & Volume By Clinics for the Period 2021-2031

- Historical Data and Forecast of Vietnam Medical Devices Market Revenues & Volume By Others for the Period 2021-2031

- Vietnam Medical Devices Import Export Trade Statistics

- Market Opportunity Assessment By Types

- Market Opportunity Assessment By Applications

- Vietnam Medical Devices Top Companies Market Share

- Vietnam Medical Devices Competitive Benchmarking By Technical and Operational Parameters

- Vietnam Medical Devices Company Profiles

- Vietnam Medical Devices Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Vietnam Medical Devices Market Overview |

3.1 Vietnam Country Macro Economic Indicators |

3.2 Vietnam Medical Devices Market Revenues & Volume, 2021 & 2031F |

3.3 Vietnam Medical Devices Market - Industry Life Cycle |

3.4 Vietnam Medical Devices Market - Porter's Five Forces |

3.5 Vietnam Medical Devices Market Revenues & Volume Share, By Types, 2021 & 2031F |

3.6 Vietnam Medical Devices Market Revenues & Volume Share, By Applications, 2021 & 2031F |

4 Vietnam Medical Devices Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Vietnam Medical Devices Market Trends |

6 Vietnam Medical Devices Market, By Types |

6.1 Vietnam Medical Devices Market, By Types |

6.1.1 Overview and Analysis |

6.1.2 Vietnam Medical Devices Market Revenues & Volume, By Types, 2021-2031F |

6.1.3 Vietnam Medical Devices Market Revenues & Volume, By Orthopedic Devices, 2021-2031F |

6.1.4 Vietnam Medical Devices Market Revenues & Volume, By Cardiovascular Devices, 2021-2031F |

6.1.5 Vietnam Medical Devices Market Revenues & Volume, By Diagnostic Devices, 2021-2031F |

6.1.6 Vietnam Medical Devices Market Revenues & Volume, By IVD, 2021-2031F |

6.1.7 Vietnam Medical Devices Market Revenues & Volume, By MIS, 2021-2031F |

6.1.8 Vietnam Medical Devices Market Revenues & Volume, By Wound Management, 2021-2031F |

6.1.9 Vietnam Medical Devices Market Revenues & Volume, By Others, 2021-2031F |

6.1.10 Vietnam Medical Devices Market Revenues & Volume, By Others, 2021-2031F |

6.2 Vietnam Medical Devices Market, By Applications |

6.2.1 Overview and Analysis |

6.2.2 Vietnam Medical Devices Market Revenues & Volume, By Hospitals & Ambulatory Surgical Centers, 2021-2031F |

6.2.3 Vietnam Medical Devices Market Revenues & Volume, By Clinics, 2021-2031F |

6.2.4 Vietnam Medical Devices Market Revenues & Volume, By Others, 2021-2031F |

7 Vietnam Medical Devices Market Import-Export Trade Statistics |

7.1 Vietnam Medical Devices Market Export to Major Countries |

7.2 Vietnam Medical Devices Market Imports from Major Countries |

8 Vietnam Medical Devices Market Key Performance Indicators |

9 Vietnam Medical Devices Market - Opportunity Assessment |

9.1 Vietnam Medical Devices Market Opportunity Assessment, By Types, 2021 & 2031F |

9.2 Vietnam Medical Devices Market Opportunity Assessment, By Applications, 2021 & 2031F |

10 Vietnam Medical Devices Market - Competitive Landscape |

10.1 Vietnam Medical Devices Market Revenue Share, By Companies, 2024 |

10.2 Vietnam Medical Devices Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero