Vietnam Pet Food Market (2025-2031) Outlook | Companies, Industry, Analysis, Revenue, Size, Trends, Share, Forecast, Growth & Value

| Product Code: ETC383910 | Publication Date: Aug 2022 | Updated Date: Feb 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

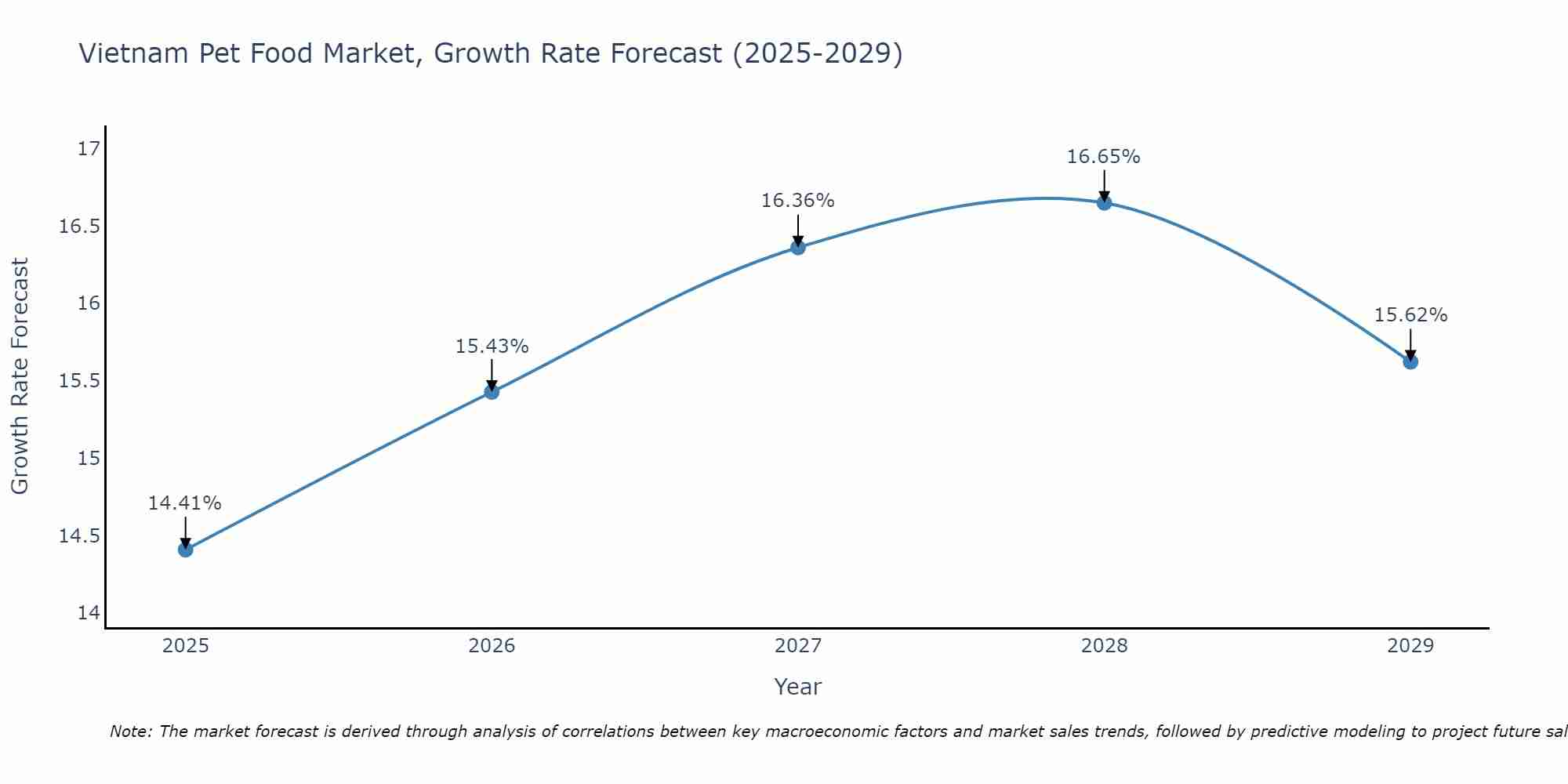

Vietnam Pet Food Market Size Growth Rate

The Vietnam Pet Food Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 16.65% in 2028, following an initial rate of 14.41%, before easing to 15.62% at the end of the period.

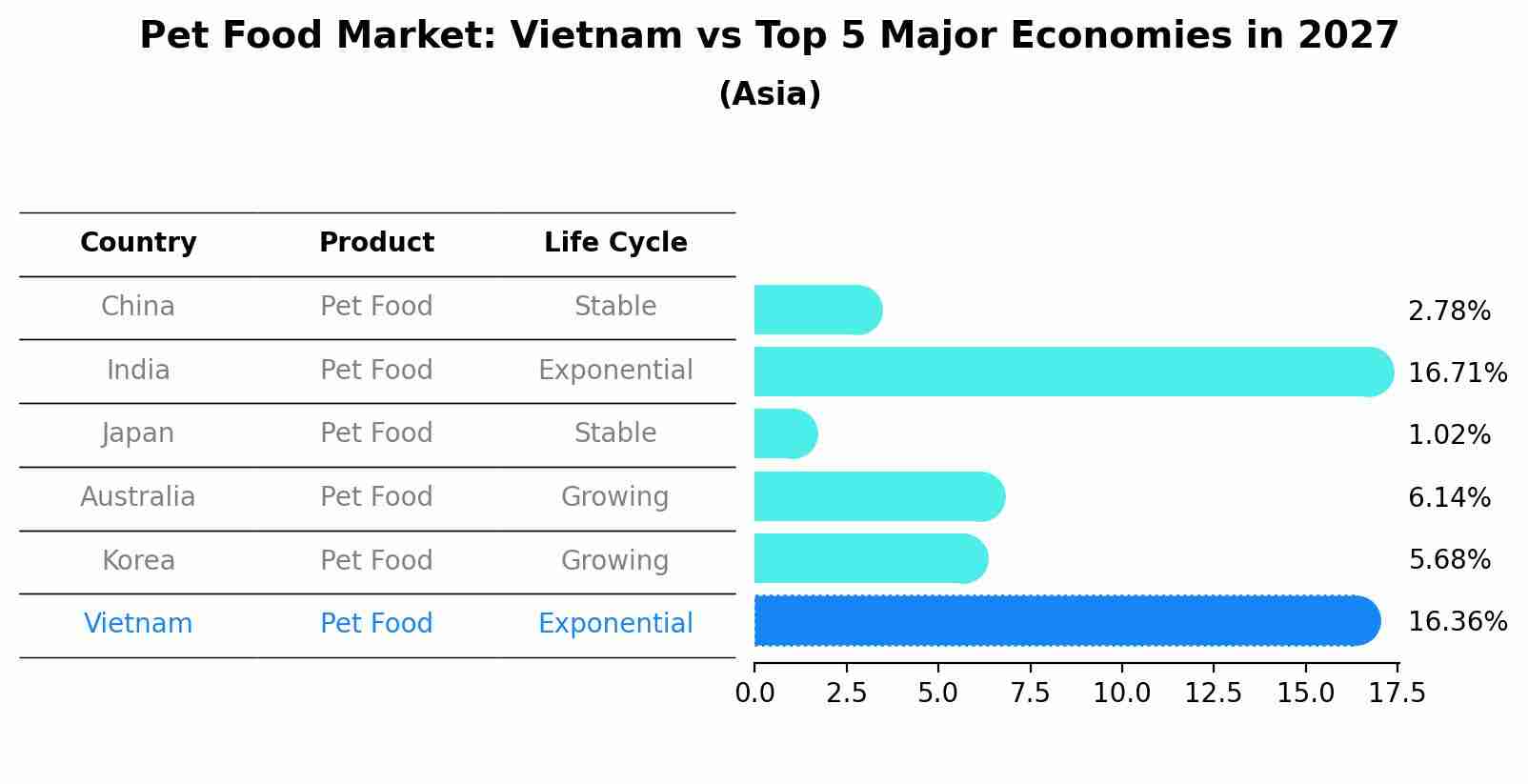

Pet Food Market: Vietnam vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Pet Food market in Vietnam is projected to expand at a exponential growth rate of 16.36% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Vietnam Pet Food Market Synopsis

The Vietnam pet food market has been on the rise, reflecting the increasing pet ownership and changing pet care trends in the country. Pet owners are seeking higher-quality and nutritionally balanced pet food options, leading to the growth of this market. Both domestic and international pet food brands have expanded their presence in Vietnam to cater to this demand. The market is segmented into various product categories, including dry kibble, wet food, and treats, with a focus on meeting the specific dietary needs of pets.

Drivers of the Market

The Vietnam pet food market is driven by the rising pet ownership rates and the growing humanization of pets. Pet owners are increasingly looking for high-quality and specialized pet food products. The expansion of pet specialty stores and online retail channels has made premium and specialized pet food options more accessible to consumers.

Challenges of the Market

The Vietnam pet food market faces challenges related to consumer preferences and trust. Many consumers may prioritize cost over the nutritional quality of pet food, leading to a preference for lower-priced options that may not meet pets` dietary needs. Additionally, concerns about the safety and authenticity of pet food products can affect consumer trust, especially in an unregulated market. The market also contends with competition from homemade and traditional pet food options, which may be perceived as more natural and healthy. Furthermore, distribution and logistics challenges can impact the availability of pet food in certain regions. Lastly, changes in pet ownership trends and the economic climate can influence the market`s growth and stability.

COVID-19 Impact on the Market

The COVID-19 pandemic had a mixed impact on the Vietnam pet food market. Initially, supply chain disruptions and reduced consumer spending affected the market, leading to challenges for manufacturers and retailers. However, as people spent more time at home with their pets, the demand for pet food and related products increased. Online sales and home delivery services gained prominence as consumers sought convenient ways to purchase pet food. The market is expected to continue evolving as pet ownership trends and consumer preferences adapt to the new normal.

Key Players in the Market

Leading pet food brands in Vietnam include Royal Canin, Pedigree, and Whiskas, which offer a range of pet food products.

Key Highlights of the Report:

- Vietnam Pet Food Market Outlook

- Market Size of Vietnam Pet Food Market, 2024

- Forecast of Vietnam Pet Food Market, 2031

- Historical Data and Forecast of Vietnam Pet Food Revenues & Volume for the Period 2021-2031

- Vietnam Pet Food Market Trend Evolution

- Vietnam Pet Food Market Drivers and Challenges

- Vietnam Pet Food Price Trends

- Vietnam Pet Food Porter's Five Forces

- Vietnam Pet Food Industry Life Cycle

- Historical Data and Forecast of Vietnam Pet Food Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Vietnam Pet Food Market Revenues & Volume By Dry Food for the Period 2021-2031

- Historical Data and Forecast of Vietnam Pet Food Market Revenues & Volume By Wet Food for the Period 2021-2031

- Historical Data and Forecast of Vietnam Pet Food Market Revenues & Volume By Snacks/Treats for the Period 2021-2031

- Historical Data and Forecast of Vietnam Pet Food Market Revenues & Volume By Animal for the Period 2021-2031

- Historical Data and Forecast of Vietnam Pet Food Market Revenues & Volume By Dog for the Period 2021-2031

- Historical Data and Forecast of Vietnam Pet Food Market Revenues & Volume By Cat for the Period 2021-2031

- Historical Data and Forecast of Vietnam Pet Food Market Revenues & Volume By Others for the Period 2021-2031

- Vietnam Pet Food Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Animal

- Vietnam Pet Food Top Companies Market Share

- Vietnam Pet Food Competitive Benchmarking By Technical and Operational Parameters

- Vietnam Pet Food Company Profiles

- Vietnam Pet Food Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero