Vietnam Tissue Paper Market (2025-2031) Outlook | Industry, Value, Companies, Size, Share, Analysis, Forecast, Revenue, Growth & Trends

| Product Code: ETC350070 | Publication Date: Aug 2022 | Updated Date: Feb 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

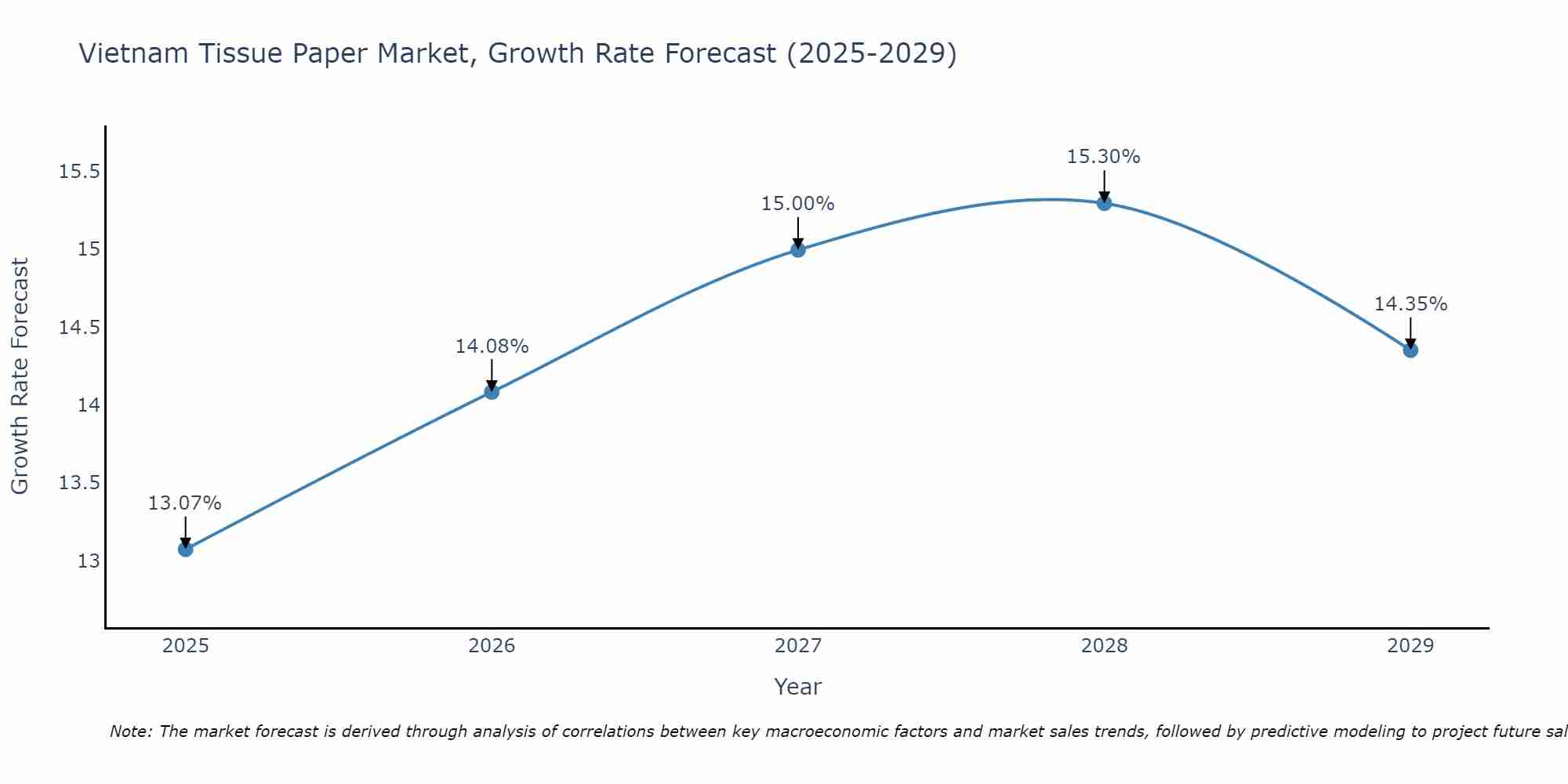

Vietnam Tissue Paper Market Size Growth Rate

The Vietnam Tissue Paper Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 13.07% in 2025, the market peaks at 15.30% in 2028, and settles at 14.35% by 2029.

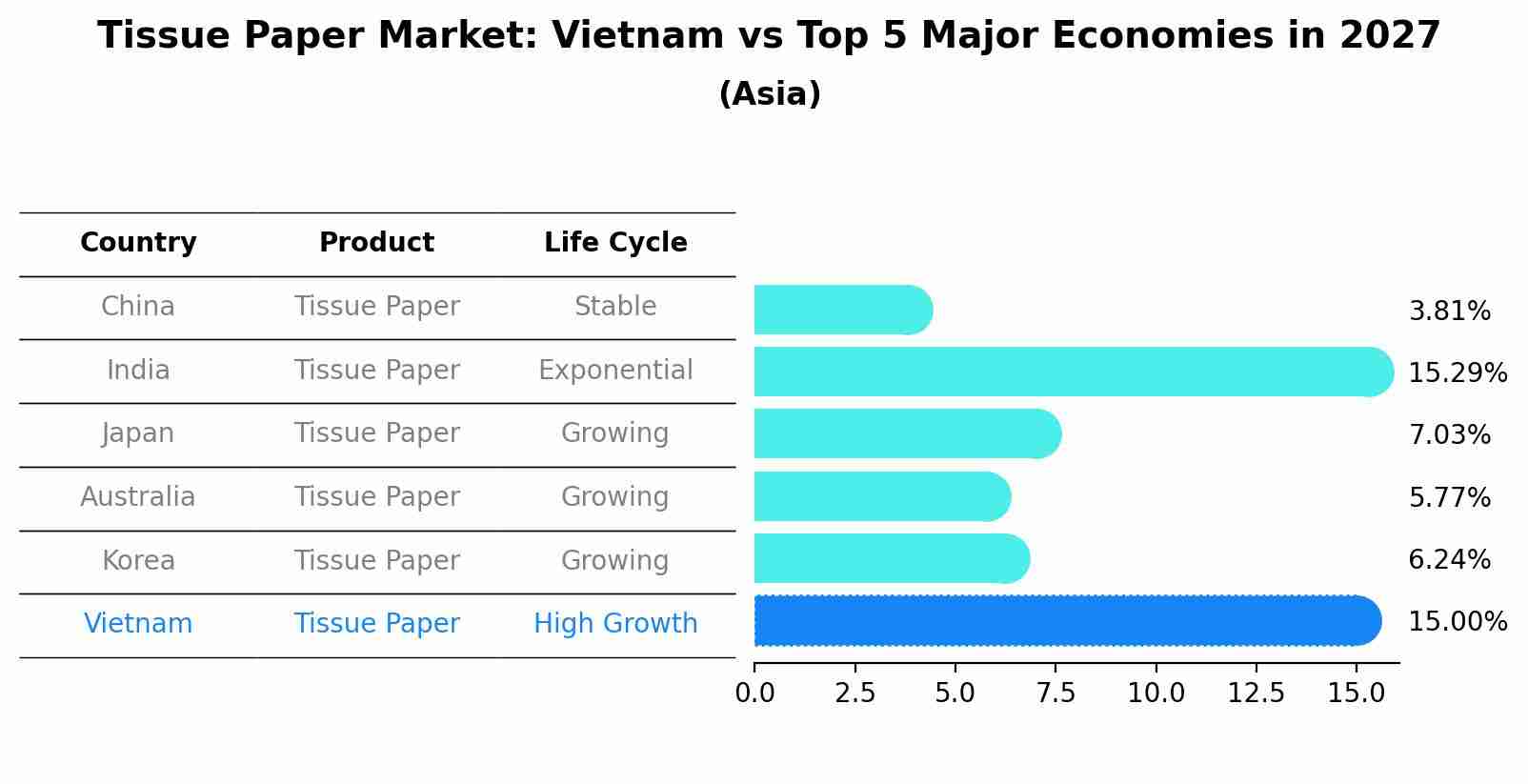

Tissue Paper Market: Vietnam vs Top 5 Major Economies in 2027 (Asia)

The Tissue Paper market in Vietnam is projected to grow at a high growth rate of 15.00% by 2027, within the Asia region led by China, along with other countries like India, Japan, Australia and South Korea, collectively shaping a dynamic and evolving market environment driven by innovation and increasing adoption of emerging technologies.

Vietnam Tissue Paper Market Synopsis

The Vietnam tissue paper market is flourishing, driven by changing consumer lifestyles, hygiene awareness, and the growth of the hospitality and healthcare sectors. Tissue paper products, including facial tissues, toilet paper, and paper towels, are in high demand. Manufacturers are focusing on product innovation, such as eco-friendly options, to cater to environmentally conscious consumers.

Drivers of the Market

The tissue paper market in Vietnam is growing due to changing consumer hygiene preferences and the expansion of the hospitality and foodservice sectors. Tissue paper products, including facial tissues, toilet paper, and paper towels, are essential in daily life and commercial establishments. The increasing awareness of hygiene and sanitation, especially in the wake of health concerns, has driven higher consumption of tissue paper products. Additionally, the rise in tourism and the hospitality industry has bolstered demand for these products in hotels, restaurants, and public places.

Challenges of the Market

The Vietnam tissue paper market faces challenges related to sustainability and competition. Environmental concerns related to paper production and deforestation require sustainable practices and compliance with regulations. The market is competitive, with a focus on product quality, variety, and cost-effectiveness. Competition from alternative materials and digital solutions poses a challenge. Market players must also adapt to changing consumer preferences for eco-friendly and sustainable tissue paper products. Additionally, supply chain management and logistics are critical for timely and cost-effective production and delivery. Maintaining brand loyalty and building awareness of sustainable tissue paper options are vital for market success.

COVID-19 Impact on the Market

The tissue paper market in Vietnam experienced fluctuations during the COVID-19 pandemic. Initially, panic buying and stockpiling of tissue products led to a surge in demand. However, supply chain disruptions and shifts in consumer behavior affected the production and distribution of tissue paper. As the pandemic continued, there was an emphasis on hygiene and sanitation, which sustained demand for tissue paper products. The market adapted by introducing innovative and eco-friendly tissue paper options to meet changing consumer preferences.

Key Players in the Market

The tissue paper market in Vietnam features a mix of local and international brands. Kimberly-Clark Vietnam and SCA Hygiene Products are prominent players, offering a wide range of tissue paper products.

Key Highlights of the Report:

- Vietnam Tissue Paper Market Outlook

- Market Size of Vietnam Tissue Paper Market, 2024

- Forecast of Vietnam Tissue Paper Market, 2031

- Historical Data and Forecast of Vietnam Tissue Paper Revenues & Volume for the Period 2021-2031

- Vietnam Tissue Paper Market Trend Evolution

- Vietnam Tissue Paper Market Drivers and Challenges

- Vietnam Tissue Paper Price Trends

- Vietnam Tissue Paper Porter's Five Forces

- Vietnam Tissue Paper Industry Life Cycle

- Historical Data and Forecast of Vietnam Tissue Paper Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Vietnam Tissue Paper Market Revenues & Volume By At Home for the Period 2021-2031

- Historical Data and Forecast of Vietnam Tissue Paper Market Revenues & Volume By Away From Home for the Period 2021-2031

- Historical Data and Forecast of Vietnam Tissue Paper Market Revenues & Volume By Product Type for the Period 2021-2031

- Historical Data and Forecast of Vietnam Tissue Paper Market Revenues & Volume By Paper Tissues for the Period 2021-2031

- Historical Data and Forecast of Vietnam Tissue Paper Market Revenues & Volume By Wet Wipes for the Period 2021-2031

- Historical Data and Forecast of Vietnam Tissue Paper Market Revenues & Volume By Facial Tissue for the Period 2021-2031

- Historical Data and Forecast of Vietnam Tissue Paper Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Vietnam Tissue Paper Market Revenues & Volume By Distribution Channel for the Period 2021-2031

- Historical Data and Forecast of Vietnam Tissue Paper Market Revenues & Volume By Offline for the Period 2021-2031

- Historical Data and Forecast of Vietnam Tissue Paper Market Revenues & Volume By Online for the Period 2021-2031

- Vietnam Tissue Paper Import Export Trade Statistics

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Distribution Channel

- Vietnam Tissue Paper Top Companies Market Share

- Vietnam Tissue Paper Competitive Benchmarking By Technical and Operational Parameters

- Vietnam Tissue Paper Company Profiles

- Vietnam Tissue Paper Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Vietnam Tissue Paper Market Overview |

3.1 Vietnam Country Macro Economic Indicators |

3.2 Vietnam Tissue Paper Market Revenues & Volume, 2021 & 2031F |

3.3 Vietnam Tissue Paper Market - Industry Life Cycle |

3.4 Vietnam Tissue Paper Market - Porter's Five Forces |

3.5 Vietnam Tissue Paper Market Revenues & Volume Share, By Application, 2021 & 2031F |

3.6 Vietnam Tissue Paper Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

3.7 Vietnam Tissue Paper Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

4 Vietnam Tissue Paper Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Vietnam Tissue Paper Market Trends |

6 Vietnam Tissue Paper Market, By Types |

6.1 Vietnam Tissue Paper Market, By Application |

6.1.1 Overview and Analysis |

6.1.2 Vietnam Tissue Paper Market Revenues & Volume, By Application, 2021-2031F |

6.1.3 Vietnam Tissue Paper Market Revenues & Volume, By At Home, 2021-2031F |

6.1.4 Vietnam Tissue Paper Market Revenues & Volume, By Away From Home, 2021-2031F |

6.2 Vietnam Tissue Paper Market, By Product Type |

6.2.1 Overview and Analysis |

6.2.2 Vietnam Tissue Paper Market Revenues & Volume, By Paper Tissues, 2021-2031F |

6.2.3 Vietnam Tissue Paper Market Revenues & Volume, By Wet Wipes, 2021-2031F |

6.2.4 Vietnam Tissue Paper Market Revenues & Volume, By Facial Tissue, 2021-2031F |

6.2.5 Vietnam Tissue Paper Market Revenues & Volume, By Others, 2021-2031F |

6.3 Vietnam Tissue Paper Market, By Distribution Channel |

6.3.1 Overview and Analysis |

6.3.2 Vietnam Tissue Paper Market Revenues & Volume, By Offline, 2021-2031F |

6.3.3 Vietnam Tissue Paper Market Revenues & Volume, By Online, 2021-2031F |

7 Vietnam Tissue Paper Market Import-Export Trade Statistics |

7.1 Vietnam Tissue Paper Market Export to Major Countries |

7.2 Vietnam Tissue Paper Market Imports from Major Countries |

8 Vietnam Tissue Paper Market Key Performance Indicators |

9 Vietnam Tissue Paper Market - Opportunity Assessment |

9.1 Vietnam Tissue Paper Market Opportunity Assessment, By Application, 2021 & 2031F |

9.2 Vietnam Tissue Paper Market Opportunity Assessment, By Product Type, 2021 & 2031F |

9.3 Vietnam Tissue Paper Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

10 Vietnam Tissue Paper Market - Competitive Landscape |

10.1 Vietnam Tissue Paper Market Revenue Share, By Companies, 2024 |

10.2 Vietnam Tissue Paper Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero