Australia Cutlery Market (2025-2031) | Outlook, Industry, Share, Forecast, Size, Value, Growth, Trends, Revenue, Analysis & Companies

Market Forecast By Product Type (Forks, Spoons, Knives, Others), By Price Range (Low End, Medium Range, Premium), By Material (Stainless Steel, Plastic, Silver, Others) And Competitive Landscape

| Product Code: ETC028135 | Publication Date: Oct 2020 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

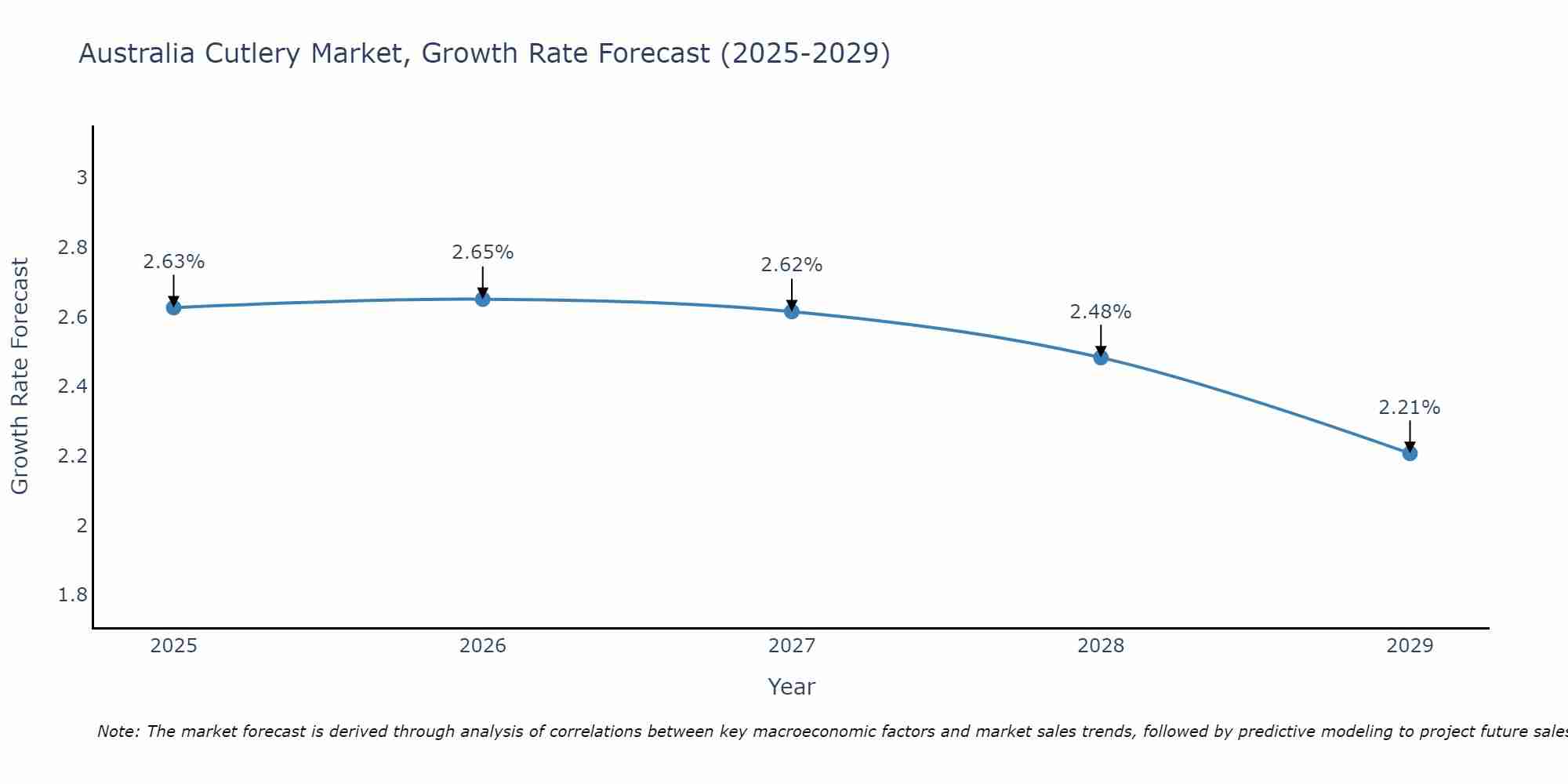

Australia Cutlery Market Size Growth Rate

The Australia Cutlery Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 2.63% in 2025, the market peaks at 2.65% in 2026, and settles at 2.21% by 2029.

Australia Cutlery market Highlights

| Report Name | Australia Cutlery market |

| Forecast Period | 2025-2031 |

| Market Size | USD 900 Million by 2031 |

| CAGR | 8.2% |

| Growing Sector | Food & Beverages |

Topics Covered in the Australia Cutlery Market Report

The Australia Cutlery market report thoroughly covers the market by product type, by price range and by material. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Australia Cutlery Market Size & Analysis

In 2025, the Australia Cutlery market is valued at approximately $ 640 million, with a projected compound annual growth rate (CAGR) of 8.2% over the next five years. Additionally, by 2031, the market is expected to reach around $ 900 million. The food and beverage segment holds significant position in the overall market.

Australia Cutlery Market Synopsis

The Australia cutlery market is characterized by a robust demand for high-quality and stylish kitchenware, driven by the country's diverse culinary culture and an increasing focus on home cooking and dining experiences. As Australian consumers become more discerning, there is a growing preference for premium materials, particularly stainless steel, which offers durability and aesthetic appeal. The market is also influenced by trends in sustainable living, with an increasing number of consumers seeking eco-friendly cutlery options made from recycled or biodegradable materials.

Additionally, the rise of e-commerce platforms has made it easier for consumers to access a wide variety of cutlery brands, enhancing competition among manufacturers and retailers. Overall, the Australian cutlery market is poised for steady growth, supported by evolving consumer preferences and a dynamic food culture that values quality, functionality, and design.

According to 6Wresearch, Australia Cutlery market size is projected to grow at a CAGR of 8.2% during 2025-2031. The Australia cutlery market is propelled by several key growth drivers, including the rising trend of home cooking and dining, fueled by the increasing interest in culinary experiences and gourmet food. As consumers spend more time at home, they are investing in high-quality kitchenware, including cutlery, to enhance their cooking and dining experiences. Additionally, the growing health consciousness among consumers is leading to a preference for durable and hygienic materials, with stainless steel becoming the material of choice due to its longevity and ease of maintenance. The expansion of e-commerce platforms has further facilitated access to a diverse range of cutlery brands and products, making it easier for consumers to shop online.

However, the Australia Cutlery industry faces challenges such as intense competition from both local and international brands, which can lead to price wars and pressure on profit margins. Fluctuations in raw material costs, particularly for stainless steel and other metals, can impact production expenses and pricing strategies. Moreover, compliance with safety and quality regulations remains a critical concern for manufacturers, necessitating continuous investment in quality control and assurance processes. Balancing these growth drivers with the challenges will be essential for companies aiming to thrive in the competitive Australian cutlery market.

Australia Cutlery Market Trends

- Sustainable Materials - Increasing consumer preference for eco-friendly cutlery made from recycled or biodegradable materials as sustainability becomes a priority.

- Premiumization - Rising demand for high-quality, premium cutlery sets that offer durability, functionality, and stylish designs, reflecting a shift towards luxury kitchenware.

- Custom and Personalized Options - Growing interest in customized cutlery, such as engraved utensils, catering to individual preferences and gifting opportunities.

- Smart Kitchenware - Emerging trends in technology-driven cutlery, including utensils with smart features that enhance usability and cooking efficiency.

- Health and Hygiene Focus - Heightened awareness of food safety leading to a preference for non-reactive, easy-to-clean materials like stainless steel that promote better hygiene practices.

Investment Opportunities in the Australia Cutlery Market

- Sustainable Product Lines - Developing and marketing eco-friendly cutlery made from recycled or biodegradable materials to meet the growing consumer demand for sustainable products.

- E-Commerce Expansion - Investing in online retail platforms or enhancing existing e-commerce capabilities to tap into the increasing trend of online shopping for kitchenware.

- Smart Kitchen Innovations - Exploring the development of technologically advanced cutlery with smart features that enhance user experience and functionality.

- Artisan Collaborations - Partnering with local artisans to create unique, handcrafted cutlery that appeals to consumers looking for distinctive and high-quality products.

- Customization Services - Offering personalized cutlery options, such as engraved utensils, to attract consumers interested in bespoke kitchenware and gifting solutions.

- R&D for Design Innovation - Investing in research and development to create innovative designs and functionalities that align with contemporary culinary trends and consumer preferences.

Key Players in the Australia Cutlery Market

Key The Australia cutlery market features several key companies known for their quality and innovation in kitchenware. Victorinox, renowned for its Swiss Army knives, also offers a range of premium cutlery that emphasizes functionality and durability. Scanpan, an Australian brand, specializes in high-quality stainless steel and non-stick cutlery, appealing to both home cooks and professional chefs.

Robert Welch Designs is another prominent player, recognized for its elegant designs and high craftsmanship in stainless steel cutlery. BergHOFF offers a variety of cutlery options that combine functionality with contemporary design, catering to diverse consumer preferences. Additionally, some of these players hold majority of the Australia Cutlery market share. Moreover, local artisan brands like Gordon Ramsay's knife collection and KitchenAid are gaining traction, focusing on stylish and durable products that enhance the cooking experience.

Government Regulations in the Australia Cutlery Market

The Australian cutlery market is subject to various government regulations aimed at ensuring consumer safety and product quality. The Australian Competition and Consumer Commission (ACCC) oversees compliance with the Australian Consumer Law (ACL), which mandates that all consumer goods, including cutlery, must be safe, fit for purpose, and accurately described. Additionally, cutlery products must comply with the Food Standards Australia New Zealand (FSANZ) regulations when applicable, particularly for items intended for food contact, ensuring that materials used do not leach harmful substances into food.

Furthermore, manufacturers are required to adhere to specific labeling requirements that provide clear information about materials, care instructions, and safety certifications. Further, these initiatives have further boosted the Australia Cutlery market revenues. Moreover, as sustainability becomes increasingly important, there are also emerging regulations focused on environmental impact, urging manufacturers to consider eco-friendly materials and practices.

Future Insights of the Australia Cutlery Market

The future of the Australia cutlery market looks promising, driven by evolving consumer preferences and lifestyle changes. As the trend of home cooking continues to gain traction, the demand for high-quality and stylish cutlery is expected to rise. Consumers are likely to seek out innovative and multifunctional products that enhance their culinary experiences, leading to increased interest in smart kitchenware and personalized options.

Sustainability will play a pivotal role in shaping product development, with manufacturers focusing on eco-friendly materials and production processes to meet growing environmental concerns. E-commerce will further expand its influence, enabling consumers to access a wider range of products and brands conveniently. Additionally, the rise of social media and cooking influencers will continue to inspire consumer choices, promoting aesthetically pleasing cutlery that complements modern dining experiences.

Spoons to Dominate the Market - By Product Type

According to Ravi Bhandari, Research Head, 6Wresearch, the spoons product category within the Australia cutlery market is experiencing significant growth, driven by the increasing popularity of home cooking and dining. As consumers engage more in culinary activities, there is a rising demand for a variety of spoon types, including soup spoons, serving spoons, and specialty spoons designed for specific cuisines.

This trend is further fueled by the influence of food culture and social media, where beautifully presented dishes are showcased, highlighting the importance of elegant and functional utensils. Manufacturers are responding to this demand by offering diverse designs, materials, and finishes, with a notable emphasis on high-quality stainless steel that combines durability with modern aesthetics. Additionally, the growing trend of entertaining at home is prompting consumers to invest in complete cutlery sets, including matching spoons, enhancing the overall dining experience.

Stainless Steel Category to Dominate the Market – By Material

The growth of stainless steel as the preferred material in the Australia cutlery market is driven by its durability, hygiene, and aesthetic appeal. Consumers increasingly favor stainless steel cutlery for its resistance to rust, staining, and corrosion, which ensures a longer lifespan compared to other materials. Additionally, the non-reactive nature of stainless steel makes it ideal for food contact, promoting health and safety in culinary applications.

The material's versatility allows for a wide range of designs, from sleek modern styles to more traditional aesthetics, catering to diverse consumer preferences. With rising health consciousness, many are also drawn to stainless steel cutlery for its easy maintenance and ability to withstand frequent washing, making it a practical choice for everyday use. As sustainability trends gain momentum, the recyclability of stainless steel further enhances its appeal, positioning it as a leading material in the cutlery market as consumers increasingly prioritize eco-friendly options.

Key Attractriveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year - 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Australia Cutlery Market (2024-2030): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Australia Cutlery Market Overview |

| 3.1 Australia Country Macro Economic Indicators |

| 3.2 Australia Cutlery Market Revenues & Volume, 2021 & 2031F |

| 3.3 Australia Cutlery Market - Industry Life Cycle |

| 3.4 Australia Cutlery Market - Porter's Five Forces |

| 3.5 Australia Cutlery Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.6 Australia Cutlery Market Revenues & Volume Share, By Price Range, 2021 & 2031F |

| 3.7 Australia Cutlery Market Revenues & Volume Share, By Material, 2021 & 2031F |

| 4 Australia Cutlery Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Australia Cutlery Market Trends |

| 6 Australia Cutlery Market, By Types |

| 6.1 Australia Cutlery Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Australia Cutlery Market Revenues & Volume, By Product Type, 2021 - 2031F |

| 6.1.3 Australia Cutlery Market Revenues & Volume, By Forks, 2021 - 2031F |

| 6.1.4 Australia Cutlery Market Revenues & Volume, By Spoons, 2021 - 2031F |

| 6.1.5 Australia Cutlery Market Revenues & Volume, By Knives, 2021 - 2031F |

| 6.1.6 Australia Cutlery Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.2 Australia Cutlery Market, By Price Range |

| 6.2.1 Overview and Analysis |

| 6.2.2 Australia Cutlery Market Revenues & Volume, By Low End, 2021 - 2031F |

| 6.2.3 Australia Cutlery Market Revenues & Volume, By Medium Range, 2021 - 2031F |

| 6.2.4 Australia Cutlery Market Revenues & Volume, By Premium, 2021 - 2031F |

| 6.3 Australia Cutlery Market, By Material |

| 6.3.1 Overview and Analysis |

| 6.3.2 Australia Cutlery Market Revenues & Volume, By Stainless Steel, 2021 - 2031F |

| 6.3.3 Australia Cutlery Market Revenues & Volume, By Plastic, 2021 - 2031F |

| 6.3.4 Australia Cutlery Market Revenues & Volume, By Silver, 2021 - 2031F |

| 6.3.5 Australia Cutlery Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 Australia Cutlery Market Import-Export Trade Statistics |

| 7.1 Australia Cutlery Market Export to Major Countries |

| 7.2 Australia Cutlery Market Imports from Major Countries |

| 8 Australia Cutlery Market Key Performance Indicators |

| 9 Australia Cutlery Market - Opportunity Assessment |

| 9.1 Australia Cutlery Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.2 Australia Cutlery Market Opportunity Assessment, By Price Range, 2021 & 2031F |

| 9.3 Australia Cutlery Market Opportunity Assessment, By Material, 2021 & 2031F |

| 10 Australia Cutlery Market - Competitive Landscape |

| 10.1 Australia Cutlery Market Revenue Share, By Companies, 2024 |

| 10.2 Australia Cutlery Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero