Brazil Cutlery Market (2025-2031) | Industry, Value, Companies, Outlook, Forecast, Revenue, Growth, Share, Analysis, Size & Trends

Market Forecast By Product Type (Forks, Spoons, Knives, Others), By Price Range (Low End, Medium Range, Premium), By Material (Stainless Steel, Plastic, Silver, Others) And Competitive Landscape

| Product Code: ETC028102 | Publication Date: Oct 2020 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

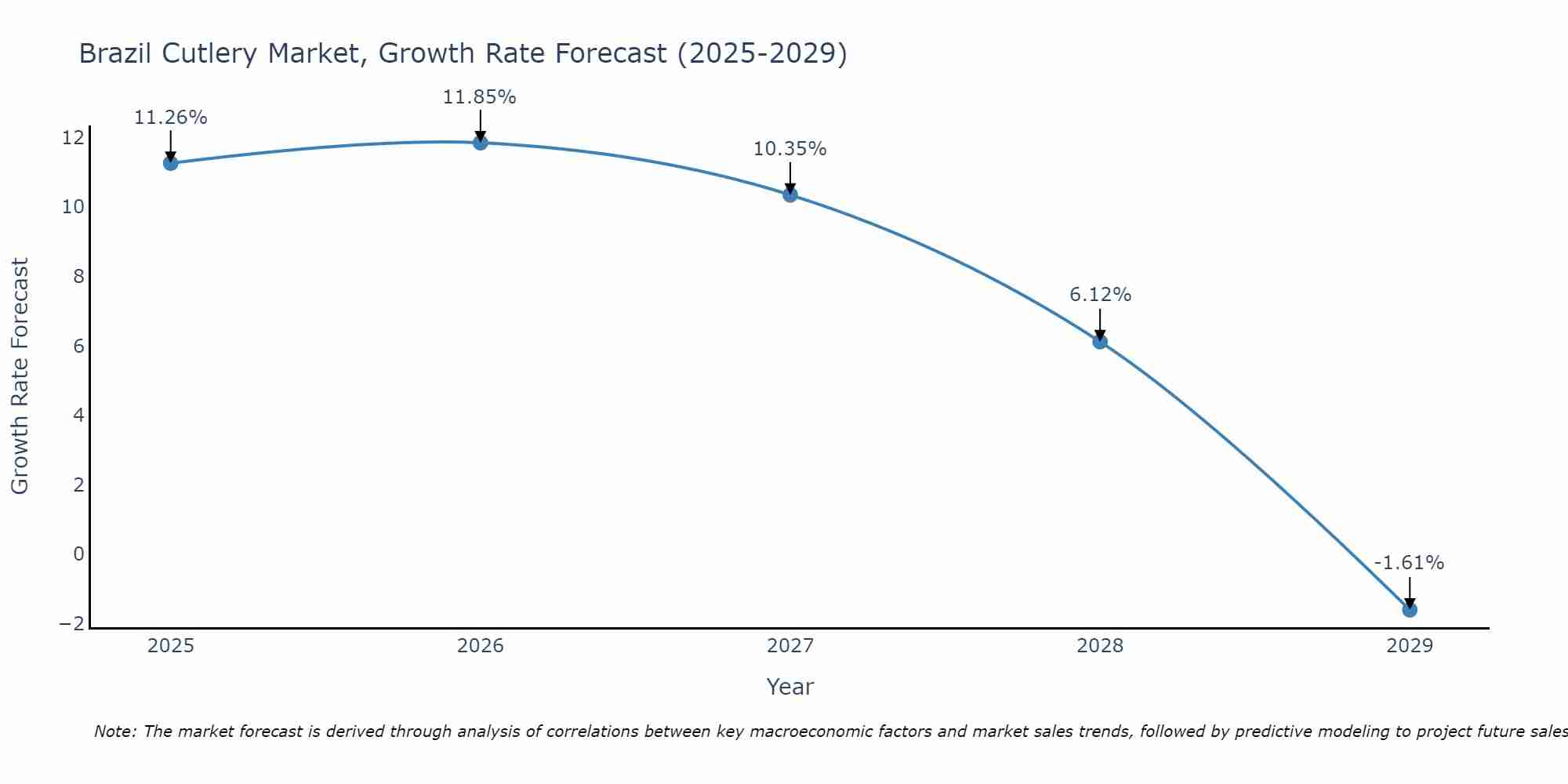

Brazil Cutlery Market Size Growth Rate

The Brazil Cutlery Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 11.26% in 2025, the market peaks at 11.85% in 2026, and settles at -1.61% by 2029.

Brazil Cutlery Market Highlights

| Report Name | Brazil Cutlery Market |

| Forecast Period | 2025-2031 |

| Market Size | USD 2.4 Billion – USD 5.2 Billion |

| CAGR | 6.8% |

| Growing Sector | Food and Beverage |

Topics Covered in the Brazil Cutlery Market Report

The Brazil Cutlery market report thoroughly covers the market by product type, by price range and by material. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Brazil Cutlery Market Size & Analysis

In 2025, the Brazil Cutlery market is valued at approximately $ 2.4 billion, with a projected CAGR of 6.8% over the next five years. Additionally, by 2031, the market is expected to reach around $ 5.2 billion. The food and beverage segment holds significant position in the overall market.

Brazil Cutlery Market Synopsis

The Brazil cutlery market is experiencing steady growth, driven by increasing consumer demand for both household and commercial dining products. With a rising middle class and growing interest in home cooking, there is heightened demand for high-quality and durable cutlery, including stainless steel and other premium materials. The market also benefits from the expansion of the hospitality and foodservice industries, further fueling demand for commercial-grade cutlery. Local manufacturers are focusing on innovation and design, while international brands continue to expand their presence, catering to a wide range of price segments in the Brazilian market.

According to 6Wresearch, Brazil Cutlery market size is projected to grow at a CAGR of 6.8% during 2025-2031. The growth of the Brazil cutlery market is primarily driven by the rising middle-class population, increased urbanization, and a growing interest in culinary activities at home, which has led to higher demand for quality kitchenware. The expanding hospitality and foodservice sectors, particularly in metropolitan areas, further boost the need for commercial-grade cutlery. Additionally, consumer preferences are shifting towards durable and aesthetically appealing products, with stainless steel cutlery seeing strong demand. However, the Brazil Cutlery industry faces challenges such as fluctuating raw material prices, particularly for metals like stainless steel, and competition from cheaper imported products, which can affect local manufacturers' market share. Economic fluctuations and inflation also pose hurdles, impacting consumer spending on non-essential items like premium cutlery. Despite these challenges, ongoing product innovation and brand differentiation are helping sustain growth in the market.

Brazil Cutlery Market Trends

- Sustainability Focus - Increasing consumer preference for eco-friendly and sustainable materials, such as biodegradable plastics and recycled metals, is shaping product offerings.

- Smart Kitchen Integration - Growth in smart kitchen appliances is influencing cutlery design, with an emphasis on multifunctional tools and smart cutlery that enhances cooking efficiency.

- Customization and Personalization - Rising demand for personalized and custom-made cutlery, including engraved or uniquely designed pieces, is becoming popular among consumers.

- Growth of Online Retail - The shift towards e-commerce platforms is making a wider variety of cutlery accessible to consumers, with a growing emphasis on convenience and home delivery.

- Health and Safety Awareness - Increased awareness about hygiene and safety, especially post-pandemic, is driving demand for easy-to-clean and antimicrobial cutlery.

- Trendy Designs - A surge in aesthetic-driven purchasing, with consumers looking for stylish and trendy designs that complement their kitchen decor.

Investment Opportunities in the Brazil Cutlery Market

- Eco-friendly Products - Invest in the development of sustainable cutlery options made from biodegradable or recycled materials to cater to the growing demand for eco-conscious products.

- Smart Cutlery Innovations - Explore opportunities in the smart kitchen segment by creating innovative cutlery integrated with technology for enhanced functionality and convenience.

- E-commerce Expansion - Invest in online retail platforms or partnerships to capture the growing consumer shift towards e-commerce for purchasing cutlery and kitchenware.

- Customization Services - Offer personalized cutlery services, such as custom engravings or unique designs, to attract consumers seeking individuality and personalization.

- High-Quality Stainless Steel Production - Invest in high-quality stainless steel production and processing to meet the demand for durable and long-lasting cutlery products.

Key Players in the Brazil Cutlery Market

Key The Brazil cutlery market features several key players, including Tramontina, a renowned manufacturer known for its wide range of high-quality kitchenware and cutlery products. Brahma Cutlery, another significant player, specializes in stainless steel cutlery, focusing on durability and design. Chef'sChoice is recognized for its innovative kitchen tools, including precision cutlery and sharpeners. Black & Decker also holds a presence in the market, offering a variety of cutlery options that cater to different consumer needs. Zyliss, known for its ergonomic designs and functionality, appeals to both home cooks and professional chefs. Additionally, some of these players hold majority of the Brazil Cutlery market share. Moreover, these companies are competitive in the Brazilian market, continually enhancing their product offerings and adapting to consumer trends to maintain market share.

Government Regulations in the Brazil Cutlery Market

In Brazil, the cutlery market is governed by various regulations aimed at ensuring product safety, quality, and compliance with health standards. The National Institute of Metrology, Standardization and Industrial Quality (INMETRO) sets forth mandatory standards for cutlery products, focusing on aspects such as material safety, performance, and durability. Additionally, cutlery manufacturers must adhere to regulations regarding labeling, which include information on materials used and proper care instructions to ensure consumer safety. Further, these initiatives have further boosted the Brazil Cutlery market revenues. Moreover, environmental regulations also play a significant role, promoting sustainable practices in manufacturing processes and the use of recyclable materials. Compliance with these regulations is crucial for companies to maintain market access and consumer trust in Brazil.

Future Insights of the Brazil Cutlery Market

The future of the cutlery market in Brazil is poised for growth, driven by several key trends. Increasing consumer interest in high-quality, sustainable products is likely to enhance demand for premium cutlery made from eco-friendly materials. Additionally, the rise of e-commerce is expected to transform distribution channels, allowing consumers easier access to a wider variety of cutlery options, including artisanal and specialty items. As the culinary scene in Brazil continues to evolve, influenced by global food trends and local gastronomy, there will be a growing need for innovative cutlery designs that cater to both functionality and aesthetics. Furthermore, the emphasis on home cooking, spurred by recent lifestyle changes, is anticipated to bolster the cutlery market as consumers invest in essential kitchen tools. Overall, the market is expected to expand, with significant opportunities for brands that focus on quality, sustainability, and effective online marketing strategies.

Spoons to Dominate the Market - By Product Type

According to Ravi Bhandari, Research Head, 6Wresearch, the spoons product category is experiencing notable growth, driven by a combination of consumer preferences for diverse dining experiences and the increasing popularity of home cooking. With a rising focus on culinary aesthetics, consumers are seeking stylish and functional spoon designs that enhance their dining presentations. Additionally, the growing trend towards sustainability is prompting brands to innovate with eco-friendly materials, appealing to environmentally conscious consumers. The expansion of the foodservice industry, including cafes and restaurants, further boosts demand for various types of spoons, including specialty and serving spoons. As dining habits evolve, the versatility of spoons in both everyday use and gourmet settings positions this product category for continued expansion in the market.

Stainless Steel Category to Dominate the Market – By Material

The growth of stainless steel as a preferred material in various industries, particularly in cutlery, is attributed to its durability, corrosion resistance, and aesthetic appeal. As consumers increasingly prioritize quality and longevity in their kitchenware, stainless steel has emerged as the go-to choice for cutlery products, including knives, forks, and spoons. The material's resistance to staining and rusting makes it ideal for both everyday use and professional settings, driving demand in households and restaurants alike. Additionally, the rising awareness of hygiene standards in food preparation and consumption is further enhancing the appeal of stainless steel, as it can be easily cleaned and sterilized. This trend is complemented by innovations in design and functionality, leading to an expanded range of stainless steel cutlery options that cater to diverse consumer preferences, ultimately contributing to its robust growth in the market.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year - 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Brazil Cutlery Market Outlook

- Market Size of Brazil Cutlery Market, 2024

- Forecast of Brazil Cutlery Market, 2031

- Historical Data and Forecast of Brazil Cutlery Revenues & Volume for the Period 2021 - 2031

- Brazil Cutlery Market Trend Evolution

- Brazil Cutlery Market Drivers and Challenges

- Brazil Cutlery Price Trends

- Brazil Cutlery Porter's Five Forces

- Brazil Cutlery Industry Life Cycle

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Product Type for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Forks for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Spoons for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Knives for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Price Range for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Low End for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Medium Range for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Premium for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Material for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Stainless Steel for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Plastic for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Silver for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Cutlery Market Revenues & Volume By Others for the Period 2021 - 2031

- Brazil Cutlery Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Price Range

- Market Opportunity Assessment By Material

- Brazil Cutlery Top Companies Market Share

- Brazil Cutlery Competitive Benchmarking By Technical and Operational Parameters

- Brazil Cutlery Company Profiles

- Brazil Cutlery Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product Type

- Forks

- Spoons

- Knives

- Others

By Price Range

- Low End

- Medium Range

- Premium

By Material

- Stainless Steel

- Plastic

- Silver

- Others

Brazil Cutlery Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Brazil Cutlery Market Overview |

| 3.1 Brazil Country Macro Economic Indicators |

| 3.2 Brazil Cutlery Market Revenues & Volume, 2021 & 2031F |

| 3.3 Brazil Cutlery Market - Industry Life Cycle |

| 3.4 Brazil Cutlery Market - Porter's Five Forces |

| 3.5 Brazil Cutlery Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.6 Brazil Cutlery Market Revenues & Volume Share, By Price Range, 2021 & 2031F |

| 3.7 Brazil Cutlery Market Revenues & Volume Share, By Material, 2021 & 2031F |

| 4 Brazil Cutlery Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Brazil Cutlery Market Trends |

| 6 Brazil Cutlery Market, By Types |

| 6.1 Brazil Cutlery Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Brazil Cutlery Market Revenues & Volume, By Product Type, 2021-2031F |

| 6.1.3 Brazil Cutlery Market Revenues & Volume, By Forks, 2021-2031F |

| 6.1.4 Brazil Cutlery Market Revenues & Volume, By Spoons, 2021-2031F |

| 6.1.5 Brazil Cutlery Market Revenues & Volume, By Knives, 2021-2031F |

| 6.1.6 Brazil Cutlery Market Revenues & Volume, By Others, 2021-2031F |

| 6.2 Brazil Cutlery Market, By Price Range |

| 6.2.1 Overview and Analysis |

| 6.2.2 Brazil Cutlery Market Revenues & Volume, By Low End, 2021-2031F |

| 6.2.3 Brazil Cutlery Market Revenues & Volume, By Medium Range, 2021-2031F |

| 6.2.4 Brazil Cutlery Market Revenues & Volume, By Premium, 2021-2031F |

| 6.3 Brazil Cutlery Market, By Material |

| 6.3.1 Overview and Analysis |

| 6.3.2 Brazil Cutlery Market Revenues & Volume, By Stainless Steel, 2021-2031F |

| 6.3.3 Brazil Cutlery Market Revenues & Volume, By Plastic, 2021-2031F |

| 6.3.4 Brazil Cutlery Market Revenues & Volume, By Silver, 2021-2031F |

| 6.3.5 Brazil Cutlery Market Revenues & Volume, By Others, 2021-2031F |

| 7 Brazil Cutlery Market Import-Export Trade Statistics |

| 7.1 Brazil Cutlery Market Export to Major Countries |

| 7.2 Brazil Cutlery Market Imports from Major Countries |

| 8 Brazil Cutlery Market Key Performance Indicators |

| 9 Brazil Cutlery Market - Opportunity Assessment |

| 9.1 Brazil Cutlery Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.2 Brazil Cutlery Market Opportunity Assessment, By Price Range, 2021 & 2031F |

| 9.3 Brazil Cutlery Market Opportunity Assessment, By Material, 2021 & 2031F |

| 10 Brazil Cutlery Market - Competitive Landscape |

| 10.1 Brazil Cutlery Market Revenue Share, By Companies, 2024 |

| 10.2 Brazil Cutlery Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero