Bahrain Candle Market (2025-2031) | Trends, Outlook, Revenue, Growth, Companies, Industry, Analysis, Size, Share, Forecast & Value

| Product Code: ETC048864 | Publication Date: Jan 2021 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

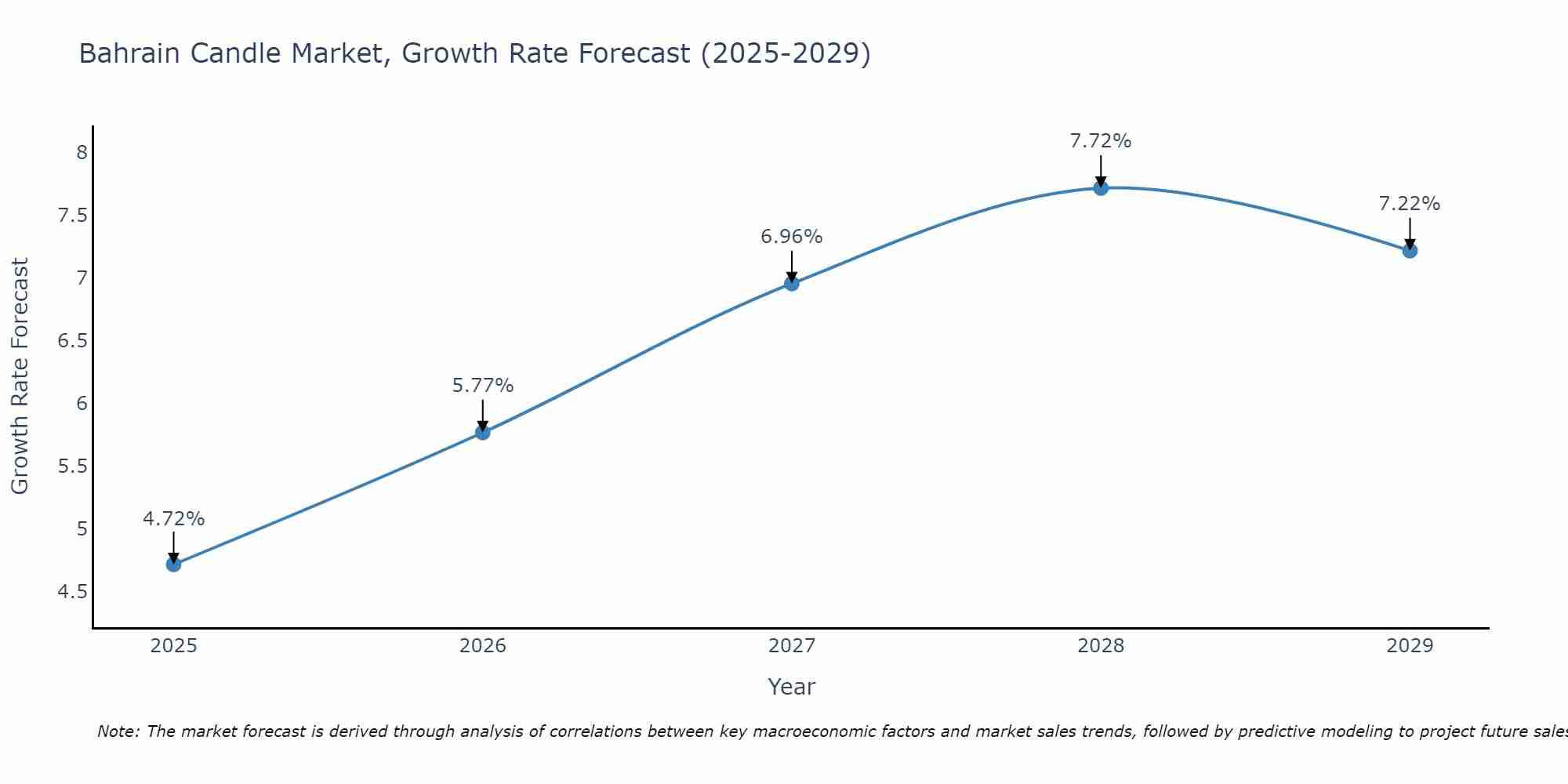

Bahrain Candle Market Size Growth Rate

The Bahrain Candle Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 4.72% in 2025, the market peaks at 7.72% in 2028, and settles at 7.22% by 2029.

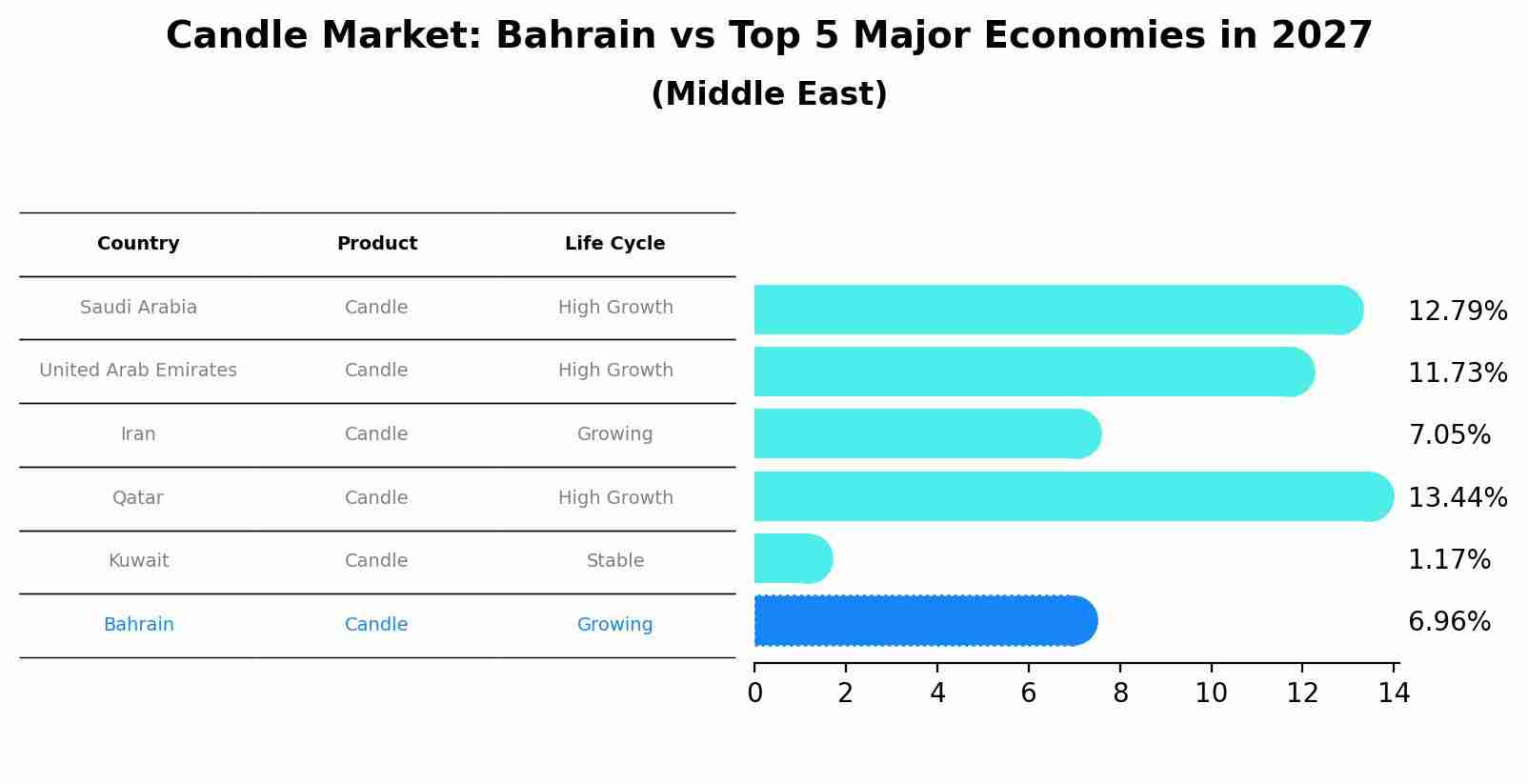

Candle Market: Bahrain vs Top 5 Major Economies in 2027 (Middle East)

By 2027, the Candle market in Bahrain is anticipated to reach a growth rate of 6.96%, as part of an increasingly competitive Middle East region, where Saudi Arabia remains at the forefront, supported by United Arab Emirates, Iran, Qatar and Kuwait, driving innovations and market adoption across sectors.

Bahrain Candle Market Overview

The candle market in Bahrain is experiencing growth, fueled by rising demand for decorative, aromatic, and functional candles in both homes and commercial spaces. Candles are increasingly used for home decor, relaxation, and gifting, making them popular among consumers. The market is characterized by a shift towards high-quality, scented candles made from eco-friendly materials. As consumer preferences evolve towards more luxurious and sustainable products, the candle market in Bahrain is expected to see continued expansion.

Drivers of the market

The Bahrain candle market is expanding due to increasing consumer demand for decorative and scented candles. Candles are no longer just a source of light but are now seen as essential elements for home décor, relaxation, and aromatherapy. The rising trend of gifting candles, along with the growing popularity of luxury and eco-friendly candles made from natural waxes, is driving the market. Additionally, the influence of tourism and hospitality sectors in Bahrain, where candles are used to enhance ambiance, is further boosting the demand for a variety of candle products.

Challenges of the market

The Bahrain candle market faces challenges primarily due to the relatively small size of the consumer base and the niche nature of the product. While candles are popular for decorative purposes and in religious ceremonies, their usage is limited compared to larger markets. Imported candles from established global brands dominate the market, leaving little room for local producers to compete on price or variety. Furthermore, fluctuations in the cost of raw materials, particularly paraffin wax and fragrances, add to production costs. Additionally, the growing demand for eco-friendly and natural candles requires manufacturers to adapt their production processes, which can increase operational expenses.

Investment opportunities in the Market

The candle market in Bahrain offers investment opportunities driven by the rising demand for candles used in home décor, aromatherapy, and special occasions. Consumers seek high-quality, scented, and aesthetically designed candles. Investors can explore opportunities in producing or distributing premium candles, including eco-friendly, soy-based, or beeswax candles. The gifting and home décor sectors support the growing demand for unique and artisanal candle products.

Government Policy of the market

The candle market in Bahrain is growing, primarily driven by increasing demand for decorative and aromatic candles. Government policies supporting small businesses and the local artisanal industry have positively influenced this market. These policies encourage entrepreneurship in the creative and handicraft sectors, fostering local production and driving demand for a variety of candles, particularly during festivals and cultural events.

Key Highlights of the Report:

- Bahrain Candle Market Outlook

- Market Size of Bahrain Candle Market, 2024

- Forecast of Bahrain Candle Market, 2031

- Historical Data and Forecast of Bahrain Candle Revenues & Volume for the Period 2021 - 2031

- Bahrain Candle Market Trend Evolution

- Bahrain Candle Market Drivers and Challenges

- Bahrain Candle Price Trends

- Bahrain Candle Porter's Five Forces

- Bahrain Candle Industry Life Cycle

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Product Type for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Votive for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Container Candle for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Pillars for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Tapers for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Wax for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Paraffin for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Soy Wax for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Beeswax for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Palm Wax for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Distribution Channel for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Offline for the Period 2021 - 2031

- Historical Data and Forecast of Bahrain Candle Market Revenues & Volume By Online for the Period 2021 - 2031

- Bahrain Candle Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Wax

- Market Opportunity Assessment By Distribution Channel

- Bahrain Candle Top Companies Market Share

- Bahrain Candle Competitive Benchmarking By Technical and Operational Parameters

- Bahrain Candle Company Profiles

- Bahrain Candle Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Bahrain Candle Market Overview |

3.1 Bahrain Country Macro Economic Indicators |

3.2 Bahrain Candle Market Revenues & Volume, 2021 & 2031F |

3.3 Bahrain Candle Market - Industry Life Cycle |

3.4 Bahrain Candle Market - Porter's Five Forces |

3.5 Bahrain Candle Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

3.6 Bahrain Candle Market Revenues & Volume Share, By Wax, 2021 & 2031F |

3.7 Bahrain Candle Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

4 Bahrain Candle Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Bahrain Candle Market Trends |

6 Bahrain Candle Market, By Types |

6.1 Bahrain Candle Market, By Product Type |

6.1.1 Overview and Analysis |

6.1.2 Bahrain Candle Market Revenues & Volume, By Product Type, 2021 - 2031F |

6.1.3 Bahrain Candle Market Revenues & Volume, By Votive, 2021 - 2031F |

6.1.4 Bahrain Candle Market Revenues & Volume, By Container Candle, 2021 - 2031F |

6.1.5 Bahrain Candle Market Revenues & Volume, By Pillars, 2021 - 2031F |

6.1.6 Bahrain Candle Market Revenues & Volume, By Tapers, 2021 - 2031F |

6.1.7 Bahrain Candle Market Revenues & Volume, By Others, 2021 - 2031F |

6.2 Bahrain Candle Market, By Wax |

6.2.1 Overview and Analysis |

6.2.2 Bahrain Candle Market Revenues & Volume, By Paraffin, 2021 - 2031F |

6.2.3 Bahrain Candle Market Revenues & Volume, By Soy Wax, 2021 - 2031F |

6.2.4 Bahrain Candle Market Revenues & Volume, By Beeswax, 2021 - 2031F |

6.2.5 Bahrain Candle Market Revenues & Volume, By Palm Wax, 2021 - 2031F |

6.2.6 Bahrain Candle Market Revenues & Volume, By Others, 2021 - 2031F |

6.3 Bahrain Candle Market, By Distribution Channel |

6.3.1 Overview and Analysis |

6.3.2 Bahrain Candle Market Revenues & Volume, By Offline, 2021 - 2031F |

6.3.3 Bahrain Candle Market Revenues & Volume, By Online, 2021 - 2031F |

7 Bahrain Candle Market Import-Export Trade Statistics |

7.1 Bahrain Candle Market Export to Major Countries |

7.2 Bahrain Candle Market Imports from Major Countries |

8 Bahrain Candle Market Key Performance Indicators |

9 Bahrain Candle Market - Opportunity Assessment |

9.1 Bahrain Candle Market Opportunity Assessment, By Product Type, 2021 & 2031F |

9.2 Bahrain Candle Market Opportunity Assessment, By Wax, 2021 & 2031F |

9.3 Bahrain Candle Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

10 Bahrain Candle Market - Competitive Landscape |

10.1 Bahrain Candle Market Revenue Share, By Companies, 2024 |

10.2 Bahrain Candle Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero