Brazil Air Freshener Market (2025-2031) | Companies, Share, Forecast, Revenue, Industry, Size, Outlook, Analysis, Trends, Value & Growth

Market Forecast By Product Type (Sprays/Aerosols, Electric Air Fresheners, Gels Air Fresheners, Candles Air Fresheners, Other Air Fresheners), By Application (Households, Corporate, Car, Others), By Type of Customers (Individual Customers, Enterprise Customers) And Competitive Landscape

| Product Code: ETC050202 | Publication Date: Jan 2021 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

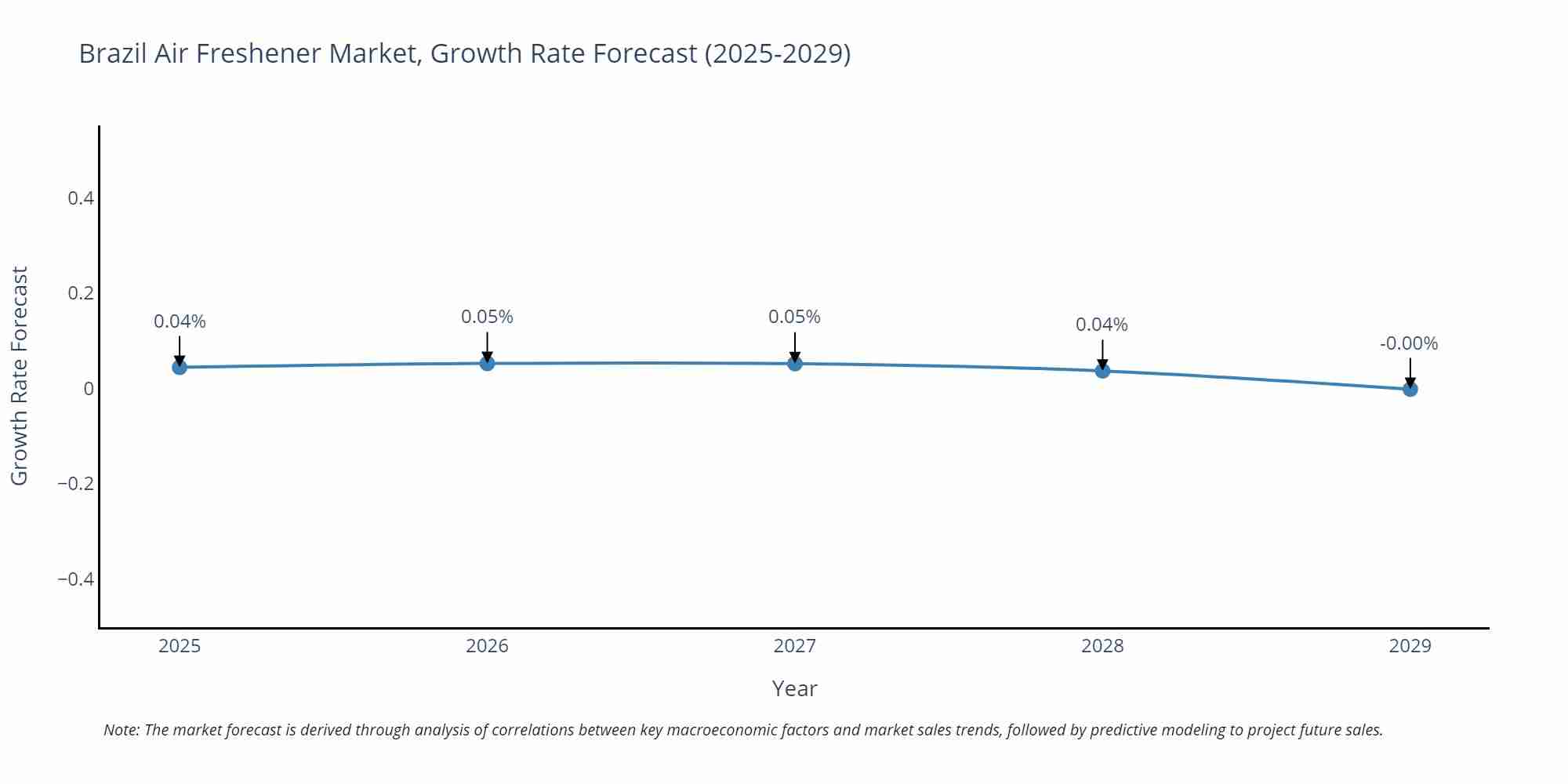

Brazil Air Freshener Market Size Growth Rate

The Brazil Air Freshener Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 0.05% in 2026, following an initial rate of 0.04%, before easing to -0.00% at the end of the period.

Brazil Air Freshener Market Highlights

| Report Name | Brazil Air Freshener Market |

| Forecast period | 2025-2031 |

| CAGR | 13.8% |

| Growing Sector | Household |

Topics Covered in the Brazil Air Freshener Market Report

Brazil Air Freshener Market Report thoroughly covers the market by product type, by Application and by types of customers. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Brazil Air Freshener Market Synopsis

Brazil Air Freshener Market is experiencing steady growth, largely due to a growing consumer preference for pleasant and aromatic indoor environments. The introduction of innovative product formats and environmentally friendly alternatives is widening the market, addressing the varied needs of a diverse consumer base. Additionally, increased urbanization and improved living standards are key drivers of this demand, especially within residential and commercial sectors. To maintain competitiveness, leading market players are concentrating on brand expansion and enhancing product attractiveness through dynamic marketing strategies.

According to 6Wresearch, the Brazil Air Freshener Market is projected to grow at CAGR of 13.8% during the forecast period 2025-2031. This growth projection is underpinned by a multitude of drivers that are shaping the industry's landscape. One of the primary drivers is the increasing consumer inclination towards maintaining pleasant and aromatic indoor environments, attributed to rising urbanization and improvement in household incomes. Additionally, innovations in the air fresheners sector, including the introduction of technologically advanced products such as smart diffusers with mobile connectivity, are enhancing user experience and broadening consumer base. With the growing awareness around environmental issues, there is a significant shift towards naturally sourced and eco-friendly air fresheners, which also provides an impetus for market growth as manufacturers expand their sustainable product lines to align with consumer preferences. Furthermore, the expansion of the e-commerce sector offers consumers increased access and convenience, consequently driving the sales of air fresheners across various online platforms. These elements collectively contribute to a favorable outlook for the air freshener market in Brazil.

Despite these promising trends, the market does face certain challenges that could potentially impede its growth trajectory. Regulatory constraints constitute a significant challenge as companies need to comply with stringent government regulations related to product safety, labeling, and environmental impact, which may increase operational costs and affect profit margins. The necessity to continually innovate and reformulate products to meet these legal standards can be resource-intensive for manufacturers, particularly smaller or local firms with limited capabilities. Additionally, the market is confronted with growing competition, both from multinational giants and emergent local brands, which heightens the need for differentiation and marketing prowess. Price sensitivity among consumers, especially in economically volatile periods, may limit the upscale shift in the market, constraining premium product penetration.

Brazil Air Freshener Market trends

In recent years, the Brazil air freshener market has demonstrated several significant trends. A prominent trend is the increased demand for natural and eco-friendly products, driven by consumers' heightened environmental consciousness. As individuals aim to reduce their ecological impact, brands are responding by broadening their range of biodegradable and sustainable products. Furthermore, there is a growing interest in technologically advanced air fresheners, including smart diffusers that offer mobile app control and customizable fragrance options.

Consumer preference for personalized scents has also encouraged manufacturers to provide customizable fragrance blends. Additionally, the e-commerce channel has become a vital growth driver, offering consumers both convenience and an extensive selection of products. These trends, along with strategic partnerships and strong brand engagements, suggest a promising trajectory of growth and innovation within Brazil's air freshener market.

Investment Opportunities in the Brazil Air Freshener Market

Brazil air freshener market offers significant investment potential, particularly with the shift towards sustainable and technology-driven products. Investors can capitalize on the rising demand for eco-friendly air fresheners, which resonate with the environmentally aware consumer segment, indicating strong growth prospects. Additionally, there is potential in developing smart air fresheners, especially those featuring IoT integration, as consumers increasingly seek technology that enhances convenience.

Establishing a presence in the e-commerce space also presents a strategic advantage, as it serves as a primary sales channel, providing consumers with personalized experiences and a diverse product selection. Forming strategic partnerships or collaborations with local entities or startups can further strengthen market reach and brand visibility. By leveraging these emerging trends and aligning with evolving consumer preferences, investors are well-positioned to benefit from Brazil's dynamic and growing air freshener market.

Leading Players in the Brazil Air Freshener Market

Brazil air freshener market growth is led by several prominent players that exhibit a strong brand presence and a commitment to innovative product offerings. Major multinational corporations such as Procter & Gamble, Reckitt Benckiser, and SC Johnson play pivotal roles, leveraging their vast distribution networks and widely recognized brands, including Febreze, Air Wick, and Glade. These companies continuously innovate by introducing new formats and fragrances that appeal to Brazilian consumers.

Local brands, including Bom Ar and Doctor Z, are also gaining momentum by providing cost-effective, culturally relevant solutions. Many of these companies emphasize eco-friendly practices and sustainable packaging, aligning with the increasing consumer demand for environmentally responsible products. The competitive landscape is further intensified by targeted customer engagement strategies, such as direct marketing and social media campaigns, highlighting the dynamic and competitive nature of Brazil’s air freshener market.

Government Regulations

Government regulations play a pivotal role in shaping the air freshener market in Brazil by ensuring product safety, quality, and environmental responsibility. Regulatory authorities enforce stringent guidelines on the formulation, labeling, and packaging of air fresheners to safeguard both consumer health and the environment. For instance, the National Health Surveillance Agency (ANVISA) requires that air fresheners feature detailed labeling, including ingredient lists and safety instructions.

Additionally, regulations restrict the use of certain chemicals that may pose risks to human health and the environment. To comply, companies are developing alternative, natural ingredients that meet regulatory standards while appealing to environmentally conscious consumers. In response to rigorous packaging requirements, many brands have transitioned to recyclable materials, meeting both regulatory mandates and consumer demand for sustainable products. This regulatory framework not only protects public interests but also encourages innovation and accountability across the industry.

Future Insights of the Brazil Air Freshener Market

The outlook for the Brazil air freshener industry is highly optimistic, with continued growth anticipated through innovation and shifting consumer preferences. As awareness of environmental sustainability increases, the demand for natural and eco-friendly air fresheners is projected to rise significantly. Companies are expected to invest heavily in research and development to deliver advanced products, including smart, app-controlled diffusers and aromatherapy-inspired options that align with wellness trends.

The trend towards fragrance customization will likely expand, offering consumers unique and personalized scent experiences. E-commerce is poised to grow as a key sales channel, offering consumers enhanced convenience and a broader selection. Furthermore, strategic alliances and collaborations among brands, retailers, and technology innovators will be instrumental in capturing market share. These evolving dynamics indicate substantial growth potential, positioning the Brazilian air freshener market as a vibrant arena for future innovation and consumer engagement.

Market Segmentation Analysis

The Report offers a comprehensive study of the subsequent market segments and their leading categories.

Sprays and aerosols to Dominate the Market-By Product type

Among the various category in Brazil air freshener market, sprays and aerosols is expected to lead the market among product type categories. Their popularity can be attributed to their affordability, convenience, and widespread availability, making them a go-to choice for a broad consumer base.

Household segment to Dominate the Market-By Application

Brazil air freshener market share is dominated by household applications, reflecting strong consumer demand for home products. In the Brazil air freshener market, the household application category is projected to lead, driven by strong consumer demand for products that enhance indoor air quality and create pleasant living environments.

Individual customers Dominate the Market-By type of Customers

According to Saurabh, Senior Research Analyst, 6Wresearch, In the Brazil air freshener market, individual customers are expected to lead, as they drive significant demand for home and personal use products. While enterprise customers contribute notably, especially in commercial and hospitality settings, individual customers remain the primary market drivers.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- Brazil Air Freshener Market Outlook

- Market Size of Brazil Air Freshener Market, 2024

- Forecast of Brazil Air Freshener Market, 2031

- Historical Data and Forecast of Brazil Air Freshener Revenues & Volume for the Period 2021-2031

- Brazil Air Freshener Market Trend Evolution

- Brazil Air Freshener Market Drivers and Challenges

- Brazil Air Freshener Price Trends

- Brazil Air Freshener Porter`s Five Forces

- Brazil Air Freshener Industry Life Cycle

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Product Type for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Sprays/Aerosols for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Electric Air Fresheners for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Gels Air Fresheners for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Candles Air Fresheners for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Other Air Fresheners for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Households for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Corporate for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Car for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Type of Customers for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Individual Customers for the Period 2021-2031

- Historical Data and Forecast of Brazil Air Freshener Market Revenues & Volume By Enterprise Customers for the Period 2021-2031

- Brazil Air Freshener Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Type of Customers

- Brazil Air Freshener Top Companies Market Share

- Brazil Air Freshener Competitive Benchmarking By Technical and Operational Parameters

- Brazil Air Freshener Company Profiles

- Brazil Air Freshener Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product Type

- Sprays/Aerosols

- Electric Air Fresheners

- Gels Air Fresheners

- Candles Air Fresheners

- Other Air Fresheners

By Application

- Households

- Corporate

- Car

- Others

By Type of Customers

- Individual Customers

- Enterprise Customers

Brazil Air Freshener Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Brazil Air Freshener Market Overview |

| 3.1 Brazil Country Macro Economic Indicators |

| 3.2 Brazil Air Freshener Market Revenues & Volume, 2021 & 2031F |

| 3.3 Brazil Air Freshener Market - Industry Life Cycle |

| 3.4 Brazil Air Freshener Market - Porter's Five Forces |

| 3.5 Brazil Air Freshener Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.6 Brazil Air Freshener Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 3.7 Brazil Air Freshener Market Revenues & Volume Share, By Type of Customers, 2021 & 2031F |

| 4 Brazil Air Freshener Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Brazil Air Freshener Market Trends |

| 6 Brazil Air Freshener Market, By Types |

| 6.1 Brazil Air Freshener Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Brazil Air Freshener Market Revenues & Volume, By Product Type, 2021-2031F |

| 6.1.3 Brazil Air Freshener Market Revenues & Volume, By Sprays/Aerosols, 2021-2031F |

| 6.1.4 Brazil Air Freshener Market Revenues & Volume, By Electric Air Fresheners, 2021-2031F |

| 6.1.5 Brazil Air Freshener Market Revenues & Volume, By Gels Air Fresheners, 2021-2031F |

| 6.1.6 Brazil Air Freshener Market Revenues & Volume, By Candles Air Fresheners, 2021-2031F |

| 6.1.7 Brazil Air Freshener Market Revenues & Volume, By Other Air Fresheners, 2021-2031F |

| 6.2 Brazil Air Freshener Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Brazil Air Freshener Market Revenues & Volume, By Households, 2021-2031F |

| 6.2.3 Brazil Air Freshener Market Revenues & Volume, By Corporate, 2021-2031F |

| 6.2.4 Brazil Air Freshener Market Revenues & Volume, By Car, 2021-2031F |

| 6.2.5 Brazil Air Freshener Market Revenues & Volume, By Others, 2021-2031F |

| 6.3 Brazil Air Freshener Market, By Type of Customers |

| 6.3.1 Overview and Analysis |

| 6.3.2 Brazil Air Freshener Market Revenues & Volume, By Individual Customers, 2021-2031F |

| 6.3.3 Brazil Air Freshener Market Revenues & Volume, By Enterprise Customers, 2021-2031F |

| 7 Brazil Air Freshener Market Import-Export Trade Statistics |

| 7.1 Brazil Air Freshener Market Export to Major Countries |

| 7.2 Brazil Air Freshener Market Imports from Major Countries |

| 8 Brazil Air Freshener Market Key Performance Indicators |

| 9 Brazil Air Freshener Market - Opportunity Assessment |

| 9.1 Brazil Air Freshener Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.2 Brazil Air Freshener Market Opportunity Assessment, By Application, 2021 & 2031F |

| 9.3 Brazil Air Freshener Market Opportunity Assessment, By Type of Customers, 2021 & 2031F |

| 10 Brazil Air Freshener Market - Competitive Landscape |

| 10.1 Brazil Air Freshener Market Revenue Share, By Companies, 2024 |

| 10.2 Brazil Air Freshener Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero