Brazil Motor Graders Market (2025-2031) | Outlook, Revenue, Share, Companies, Size, Forecast, Analysis, Trends, Value, Industry & Growth

Market Forecast By Type (Rigid Frame Motor Grader, Articulated Frame Motor Grader), By Capacity (Small Motor Graders (80 - 150 HP), Medium Motor Graders (150 - 300 HP), Large Motor Graders (Above 300 HP)), By Application (Construction, Mining, Others) And Competitive Landscape

| Product Code: ETC099081 | Publication Date: Jun 2021 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

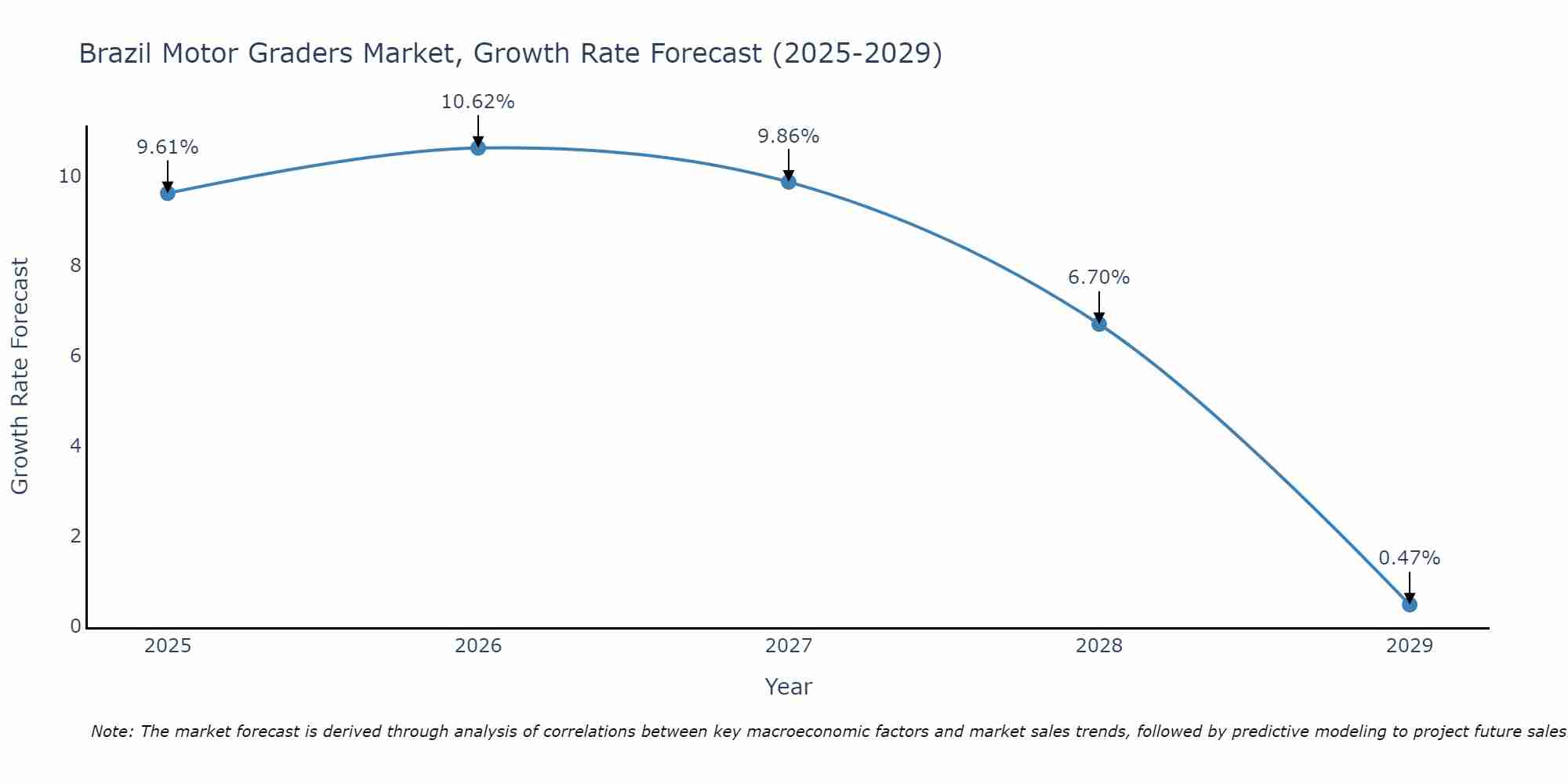

Brazil Motor Graders Market Size Growth Rate

The Brazil Motor Graders Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 10.62% in 2026, following an initial rate of 9.61%, before easing to 0.47% at the end of the period.

Brazil Motor Graders Market Highlights

| Report Name | Brazil Motor Graders Market |

| Forecast period | 2025-2031 |

| CAGR | 5.6% |

| Growing Sector | Construction |

Topics Covered in the Brazil Motor Graders Market Report

The Brazil Motor Graders Market report thoroughly covers the market by types, by capacity, and by applications. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Brazil Motor Graders Market Synopsis

The Brazil motor graders market is expanding steadily due to rising infrastructure investments and rising demand from the mining and construction sectors. Product innovation is being driven by technological developments, such as improved precision and multipurpose capabilities. A move toward adaptable equipment that serves a variety of purposes benefits the market. The market's growth and potential are further supported by the increasing use of mid-sized graders and an emphasis on operational effectiveness.

According to 6Wresearch, the Brazil Motor Graders Market is anticipated to grow at a CAGR of 5.6% during the forecast period 2025-2031. The Brazil Motor Graders market growth is driven by increased demand for earthmoving equipment in the mining and construction sectors as well as strong investments in infrastructure projects. The demand for effective grading solutions to assist large-scale projects has expanded due to the growth of urbanization and industry. Technological developments are essential because they improve machine accuracy, adaptability, and fuel economy. A crucial sector within the equipment industry, the market's growth trajectory has also been further cemented by the growing use of mid-sized, multipurpose graders.

The Brazil Motor Graders Market has many challenges to face in spite of its expansion. Infrastructure budgets may be constrained by shifting fiscal policies and economic concerns, which will have an immediate effect on grader demand. For smaller companies and contractors, the high expense of purchasing and maintaining motor graders is a barrier. Alternative earthmoving equipment, such bulldozers and skid-steer loaders, which are frequently chosen for their affordability and adaptability in smaller-scale projects, also compete with the market. Resolving these obstacles is essential for long-term market growth.

Brazil Motor Graders Market Trends

There are notable trends influencing the trajectory of the Brazil motor graders market. Adoption of cutting-edge technology, like automation and GPS-based precise systems, is increasing operational accuracy and efficiency, which is attracting buyers. The demand for mid-sized, multifunctional graders that are adaptable to a variety of mining and construction jobs is rising. Furthermore, there is a growing market emphasis on sustainability, particularly on eco-friendly and fuel-efficient machinery. These trends are affecting consumer choices, changing the nature of the market, and making sure the sector is in line with contemporary needs.

Investment Opportunities in the Brazil Motor Graders Market

Brazil motor graders market offers attractive investment prospects due to the country's massive infrastructure initiatives and rising need for sophisticated, multifunctional graders. Innovation in technology, such as automation and GPS integration, provides a crucial avenue for leveraging changing consumer demands. Government programs to improve transportation systems and private sector involvement in major mining and construction projects lay the groundwork for long-term growth. Investors can take advantage of new trends to enter a market that is ready for long-term growth and profitability as a result of the move toward environmentally friendly, fuel-efficient machinery.

Leading Players in the Brazil Motor Graders Market

Caterpillar, Komatsu, Volvo Construction Equipment, and John Deere are some of the major companies that control the Brazil motor graders market and have a big impact on its growth. These world-leading businesses are renowned for their wide range of products, inventive technologies, and robust market presence. Volvo and John Deere prioritize fuel-efficient, environmental solutions, while Caterpillar and Komatsu are notable for their sophisticated equipment and dependability. By means of consistent innovation and strong distribution systems, these businesses are essential in satisfying a wide range of client demands and propelling sector expansion.

Government Regulations in the Brazil Motor Graders Market

The National Policy on Solid Waste (PNRS) and the National Environmental Policy (PNMA) are two examples of government rules that significantly influence the Brazilian motor grader market. These regulations promote the use of environmentally friendly methods, placing a strong emphasis on waste management and the production of machines. They encourage businesses to develop and produce environmentally friendly technology by imposing more stringent emissions and material handling regulations. Adherence to these laws not only guarantees conformity with legal structures but also strengthens the market's emphasis on sustainable expansion and operational effectiveness.

Future Insights of the Brazil Motor Graders Market

The market for motor graders in Brazil is expected to grow steadily because to the continuous improvement of infrastructure and the increasing use of cutting-edge technologies. It is anticipated that government spending on major initiatives like mining and road construction will increase market demand. GPS systems and other automation and precision technologies will boost productivity and spur equipment innovation. Furthermore, the industry's future will be significantly shaped by the transition to fuel-efficient, environmentally friendly machinery. Stakeholders have a great chance to profit from these trends and the market's encouraging trajectory.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories

Articulated Frame Motor Graders are anticipated to dominate the Market – By Type

According to Ashutosh, Senior Research Analyst at 6Wresearch, Rigid frame motor graders and articulated frame motor graders are the two segments of the Brazilian motor grader market. Articulated Frame Motor Graders are anticipated to outperform the others because of their exceptional agility and versatility. These graders are ideal for large-scale mining and construction operations because they perform well in rough terrain.

Medium motor graders are expected to dominate the Market – By Capacity

Large motor graders (above 300 HP), medium motor graders (between 150 and 300 HP), and small motor graders (between 80 and 150 HP) make up the market. Medium motor graders are expected to dominate the market because they have a power-to-portability ratio that makes them suitable for medium-sized infrastructure and construction projects.

Construction will dominate the Market – By Application

Construction, mining, and others are the additional application-based market categories. According to projections, the construction category will dominate due to continued infrastructure development, including urbanization projects and road construction. This market segment continues to be crucial due to its steady demand.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Brazil Motor Graders Market Outlook

- Market Size of Brazil Motor Graders Market, 2024

- Forecast of Brazil Motor Graders Market, 2031

- Historical Data and Forecast of Brazil Motor Graders Revenues & Volume for the Period 2021 - 2031

- Brazil Motor Graders Market Trend Evolution

- Brazil Motor Graders Market Drivers and Challenges

- Brazil Motor Graders Price Trends

- Brazil Motor Graders Porter's Five Forces

- Brazil Motor Graders Industry Life Cycle

- Historical Data and Forecast of Brazil Motor Graders Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Motor Graders Market Revenues & Volume By Rigid Frame Motor Grader for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Motor Graders Market Revenues & Volume By Articulated Frame Motor Grader for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Motor Graders Market Revenues & Volume By Capacity for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Motor Graders Market Revenues & Volume By Small Motor Graders (80 - 150 HP) for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Motor Graders Market Revenues & Volume By Medium Motor Graders (150 - 300 HP) for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Motor Graders Market Revenues & Volume By Large Motor Graders (Above 300 HP) for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Motor Graders Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Motor Graders Market Revenues & Volume By Construction for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Motor Graders Market Revenues & Volume By Mining for the Period 2021 - 2031

- Historical Data and Forecast of Brazil Motor Graders Market Revenues & Volume By Others for the Period 2021 - 2031

- Brazil Motor Graders Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Capacity

- Market Opportunity Assessment By Application

- Brazil Motor Graders Top Companies Market Share

- Brazil Motor Graders Competitive Benchmarking By Technical and Operational Parameters

- Brazil Motor Graders Company Profiles

- Brazil Motor Graders Key Strategic Recommendations

Market Segmentation

Brazil Motor Graders Market report covers a detailed analysis of the following market segments

By Type

- Rigid Frame Motor Graders

- Articulated Frame Motor Graders

By Capacity

- Small Motor Graders (80 - 150 HP)

- Medium Motor Graders (150 - 300 HP)

- Large Motor Graders (Above 300 HP)

By Application

- Construction

- Mining

- Others

Brazil Motor Graders Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Brazil Motor Graders Market Overview |

| 3.1 Brazil Motor Graders Market Revenues & Volume, 2021 - 2031F |

| 3.2 Brazil Motor Graders Market - Industry Life Cycle |

| 3.3 Brazil Motor Graders Market - Porter's Five Forces |

| 3.4 Brazil Motor Graders Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.5 Brazil Motor Graders Market Revenues & Volume Share, By Capacity, 2021 & 2031F |

| 3.6 Brazil Motor Graders Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 Brazil Motor Graders Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Brazil Motor Graders Market Trends |

| 6 Brazil Motor Graders Market Segmentation |

| 6.1 Brazil Motor Graders Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Brazil Motor Graders Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 Brazil Motor Graders Market Revenues & Volume, By Rigid Frame Motor Grader, 2021 - 2031F |

| 6.1.4 Brazil Motor Graders Market Revenues & Volume, By Articulated Frame Motor Grader, 2021 - 2031F |

| 6.2 Brazil Motor Graders Market, By Capacity |

| 6.2.1 Overview and Analysis |

| 6.2.2 Brazil Motor Graders Market Revenues & Volume, By Small Motor Graders (80 - 150 HP), 2021 - 2031F |

| 6.2.3 Brazil Motor Graders Market Revenues & Volume, By Medium Motor Graders (150 - 300 HP), 2021 - 2031F |

| 6.2.4 Brazil Motor Graders Market Revenues & Volume, By Large Motor Graders (Above 300 HP), 2021 - 2031F |

| 6.3 Brazil Motor Graders Market, By Application |

| 6.3.1 Overview and Analysis |

| 6.3.2 Brazil Motor Graders Market Revenues & Volume, By Construction, 2021 - 2031F |

| 6.3.3 Brazil Motor Graders Market Revenues & Volume, By Mining, 2021 - 2031F |

| 6.3.4 Brazil Motor Graders Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 Brazil Motor Graders Market Import-Export Trade Statistics |

| 7.1 Brazil Motor Graders Market Export to Major Countries |

| 7.2 Brazil Motor Graders Market Imports from Major Countries |

| 8 Brazil Motor Graders Market Key Performance Indicators |

| 9 Brazil Motor Graders Market - Opportunity Assessment |

| 9.1 Brazil Motor Graders Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Brazil Motor Graders Market Opportunity Assessment, By Capacity, 2021 & 2031F |

| 9.3 Brazil Motor Graders Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 Brazil Motor Graders Market - Competitive Landscape |

| 10.1 Brazil Motor Graders Market Revenue Share, By Companies, 2024 |

| 10.2 Brazil Motor Graders Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero