United States (US) Motor Graders Market Outlook (2023-2029) | Industry, Revenue, Size, Trends, Analysis, Value, COVID-19 IMPACT, Growth, Forecast, Companies & Share

Market Forecast By Type (Rigid Frame Motor Grader, Articulated Frame Motor Grader), By Capacity (Small Motor Graders (80 - 150 HP), Medium Motor Graders (150 - 300 HP), Large Motor Graders (Above 300 HP)), By Application (Construction, Mining, Others) And Competitive Landscape

| Product Code: ETC099080 | Publication Date: Jun 2021 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

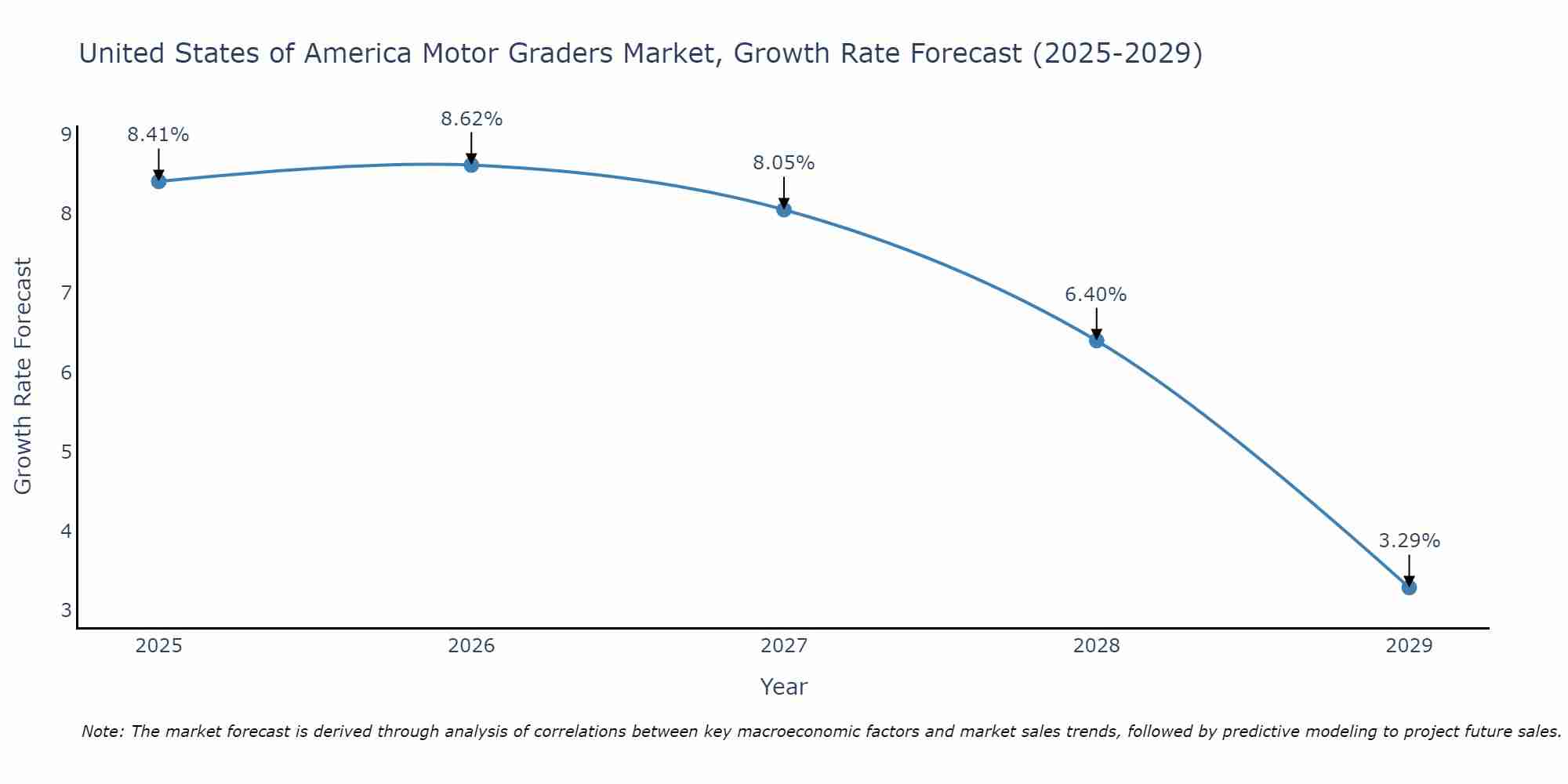

United States of America Motor Graders Market Size Growth Rate

The United States of America Motor Graders Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 8.62% in 2026, following an initial rate of 8.41%, before easing to 3.29% at the end of the period.

USA Motor Graders Market | Country-Wise Share and Competition Analysis

In the year 2021, Brazil was the largest exporter in terms of value, followed by China. It has registered a growth of 39.44% over the previous year. While China registered a decline of -33.94% as compared to the previous year. In the year 2017, Brazil was the largest exporter followed by Japan. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, the USA has a Herfindahl index of 6634 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 6063 which signifies high concentration in the market.

![USA Motor Graders Market | Country-Wise Share and Competition Analysis]() USA Motor Graders Market - Export Market Opportunities

USA Motor Graders Market - Export Market Opportunities![USA Motor Graders Market - Export Market Opportunities]() Topics Covered in the United States (US) Motor Graders Market

Topics Covered in the United States (US) Motor Graders Market

United States (US) Motor Graders Market report thoroughly covers the market by types, by capacity, and by applications. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

United States (US) Motor Graders Market Synopsis

The United States Motor Graders Market is a key sector in the US construction industry. Many contractors have been investing heavily in new equipment due to rising demand for efficient and cost-effective construction solutions. Several leading players dominate the United States (US) Motor Graders Market Share. The US motor graders market looks promising with several factors contributing towards its continued growth. However, challenges such as high costs associated with purchasing and maintaining these heavy-duty machines might hinder their adoption among small-scale contractors in some regions of the country.

According to 6Wresearch, the United States (US) Motor Graders Market is projected to grow at a rapid pace during the forecast period 2023-2029. The United States (US) motor graders market has been witnessing steady growth in recent years. There are several factors driving the United States Motor Graders Market Growth including increasing government spending on infrastructure development and rising demand for advanced motor graders with high technological capabilities. Moreover, the growing trend of urbanization and industrialization is also driving the demand for efficient construction equipment like motor graders. This has significantly contributed to the overall growth of the US motor grader market. However, the high initial cost associated with these machines remains a major challenge for many operators looking to invest in them. Additionally, there is intense competition among key players in the industry that poses significant challenges to new entrants.

COVID-19 Influence on the United States (US) Motor Graders Market

The COVID-19 pandemic has impacted various industries worldwide, including the United States (US) motor graders market. The closure of construction sites and a slowdown in infrastructure projects due to lockdown measures resulted in a significant decline in demand for new motor graders. However, with governments lifting restrictions and resumption of construction activities across the US, there is a growing demand for efficient and advanced grading equipment. The need to fast-track infrastructure development as part of economic recovery plans will further boost demand for motor

Leading players in the United States (US) Motor Graders Market

The United States (US) Motor Graders Market has a highly competitive landscape with several key players competing for market share. Some of the major companies operating in this market include;

- Caterpillar Inc.

- John Deere

- Komatsu Ltd.

- Hitachi Construction Machinery Co. Ltd.

- Volvo Group.

The Future of the United States (US) Motor Graders Market

The future of the United States Motor Graders Industry is positive owing to the increase in construction activities across the country and growing demand for better infrastructure. In general, motor graders are expected to play a crucial role in shaping America's roads, highways, and other transportation networks. The major key players will need to focus on innovation and technological advancements to stay ahead of their competitors.

Market Analysis by Applications

According to Bhavya, Senior Research Analyst, 6Wresearch, the construction sector is a significant application area for motor graders in the market, and motor graders are extensively used in construction projects. They are employed for leveling and shaping the ground to create a smooth surface for subsequent construction activities.

Key attractiveness of the report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022.

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- United States (US) Motor Graders Market Outlook

- Market Size of United States (US) Motor Graders Market, 2020

- Forecast of United States (US) Motor Graders Market, 2027

- Historical Data and Forecast of United States (US) Motor Graders Revenues & Volume for the Period 2018 - 2027

- United States (US) Motor Graders Market Trend Evolution

- United States (US) Motor Graders Market Drivers and Challenges

- United States (US) Motor Graders Price Trends

- United States (US) Motor Graders Porter's Five Forces

- United States (US) Motor Graders Industry Life Cycle

- Historical Data and Forecast of United States (US) Motor Graders Market Revenues & Volume By Type for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Motor Graders Market Revenues & Volume By Rigid Frame Motor Grader for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Motor Graders Market Revenues & Volume By Articulated Frame Motor Grader for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Motor Graders Market Revenues & Volume By Capacity for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Motor Graders Market Revenues & Volume By Small Motor Graders (80 - 150 HP) for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Motor Graders Market Revenues & Volume By Medium Motor Graders (150 - 300 HP) for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Motor Graders Market Revenues & Volume By Large Motor Graders (Above 300 HP) for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Motor Graders Market Revenues & Volume By Application for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Motor Graders Market Revenues & Volume By Construction for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Motor Graders Market Revenues & Volume By Mining for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Motor Graders Market Revenues & Volume By Others for the Period 2018 - 2027

- United States (US) Motor Graders Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Capacity

- Market Opportunity Assessment By Application

- United States (US) Motor Graders Top Companies Market Share

- United States (US) Motor Graders Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Motor Graders Company Profiles

- United States (US) Motor Graders Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Rigid Frame Motor Graders

- Articulated Frame Motor Graders

By Capacity

- Small Motor Graders (80- 150 HP)

- Medium Motor Graders (150- 300 HP)

- Large Motor Graders (Above 300 HP)

By Application

- Construction

- Mining

- Others

United States (US) Motor Graders Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 United States (US) Motor Graders Market Overview |

| 3.1 United States (US) Motor Graders Market Revenues & Volume, 2019 - 2029F |

| 3.2 United States (US) Motor Graders Market - Industry Life Cycle |

| 3.3 United States (US) Motor Graders Market - Porter's Five Forces |

| 3.4 United States (US) Motor Graders Market Revenues & Volume Share, By Type, 2022 & 2029F |

| 3.5 United States (US) Motor Graders Market Revenues & Volume Share, By Capacity, 2022 & 2029F |

| 3.6 United States (US) Motor Graders Market Revenues & Volume Share, By Application, 2022 & 2029F |

| 4 United States (US) Motor Graders Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 United States (US) Motor Graders Market Trends |

| 6 United States (US) Motor Graders Market Segmentation |

| 6.1 United States (US) Motor Graders Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 United States (US) Motor Graders Market Revenues & Volume, By Type, 2019 - 2029F |

| 6.1.3 United States (US) Motor Graders Market Revenues & Volume, By Rigid Frame Motor Grader, 2019 - 2029F |

| 6.1.4 United States (US) Motor Graders Market Revenues & Volume, By Articulated Frame Motor Grader, 2019 - 2029F |

| 6.2 United States (US) Motor Graders Market, By Capacity |

| 6.2.1 Overview and Analysis |

| 6.2.2 United States (US) Motor Graders Market Revenues & Volume, By Small Motor Graders (80 - 150 HP), 2019 - 2029F |

| 6.2.3 United States (US) Motor Graders Market Revenues & Volume, By Medium Motor Graders (150 - 300 HP), 2019 - 2029F |

| 6.2.4 United States (US) Motor Graders Market Revenues & Volume, By Large Motor Graders (Above 300 HP), 2019 - 2029F |

| 6.3 United States (US) Motor Graders Market, By Application |

| 6.3.1 Overview and Analysis |

| 6.3.2 United States (US) Motor Graders Market Revenues & Volume, By Construction, 2019 - 2029F |

| 6.3.3 United States (US) Motor Graders Market Revenues & Volume, By Mining, 2019 - 2029F |

| 6.3.4 United States (US) Motor Graders Market Revenues & Volume, By Others, 2019 - 2029F |

| 7 United States (US) Motor Graders Market Import-Export Trade Statistics |

| 7.1 United States (US) Motor Graders Market Export to Major Countries |

| 7.2 United States (US) Motor Graders Market Imports from Major Countries |

| 8 United States (US) Motor Graders Market Key Performance Indicators |

| 9 United States (US) Motor Graders Market - Opportunity Assessment |

| 9.1 United States (US) Motor Graders Market Opportunity Assessment, By Type, 2022 & 2029F |

| 9.2 United States (US) Motor Graders Market Opportunity Assessment, By Capacity, 2022 & 2029F |

| 9.3 United States (US) Motor Graders Market Opportunity Assessment, By Application, 2022 & 2029F |

| 10 United States (US) Motor Graders Market - Competitive Landscape |

| 10.1 United States (US) Motor Graders Market Revenue Share, By Companies, 2022 |

| 10.2 United States (US) Motor Graders Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero