Brazil Technical Ceramics Market (2025-2031) | Trends, Value, Industry, Companies, Growth, Outlook, Revenue, Analysis, Forecast, Share & Size

Market Forecast By Material Type (Oxide ceramics, Non-oxide ceramics), By Product Type (Monolithic ceramics, Ceramic matrix composites, Ceramic coatings, Others), By End-Use Industry (Electronics & semiconductor, Automotive, Energy & power, Industrial, Medical, Military & defense, Others) And Competitive Landscape

| Product Code: ETC045762 | Publication Date: Jan 2021 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

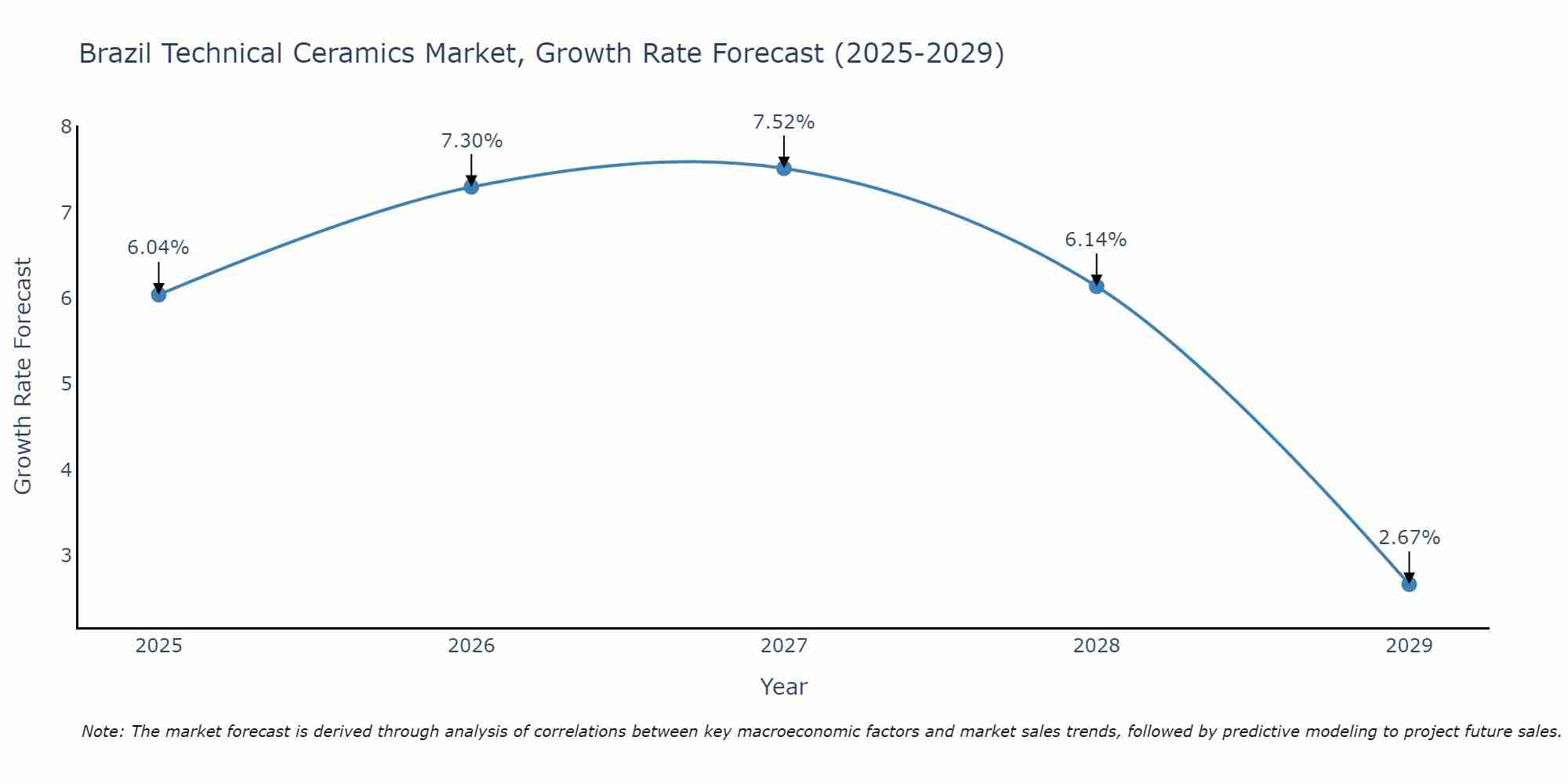

Brazil Technical Ceramics Market Size Growth Rate

The Brazil Technical Ceramics Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 6.04% in 2025, climbs to a high of 7.52% in 2027, and moderates to 2.67% by 2029.

Brazil Technical Ceramics Market Highlights

| Report Name | Brazil Technical Ceramics Market |

| Forecast period | 2025-2031 |

| CAGR | 6.5% |

| Growing Sector | Electronics |

Topics Covered in the Brazil Technical Ceramics Market Report

Brazil Technical Ceramics Market report thoroughly covers the market by material type, by product type and by end-use industry. The Brazil Technical Ceramics Market report provides an unbiased and detailed analysis of the ongoing Brazil Technical Ceramics Market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Brazil Technical Ceramics Market Synopsis

Brazil Technical Ceramics Market has experienced significant success and is expected to continue growing in the future. The market is experiencing strong growth, driven by demand from industries like electronics, aerospace, and automotive. Key players are focusing on product innovations and collaborations to stay competitive. Advanced ceramics, including alumina ceramics and zirconia ceramics, are dominating the market due to their superior properties like high thermal resistance and electrical insulation. The market is also witnessing increasing applications in medical devices and renewable energy sectors, promising further expansion.

According to 6Wresearch, the Brazil Technical Ceramics Market size is expected to grow at a significant CAGR of 6.5% during the forecast period 2025-2031. One major driver of the Brazil Technical Ceramics Market is the growing demand from the electronics industry. With the increasing adoption of electronic devices such as smartphones, tablets, and wearables, there is a significant need for technical ceramics in components like capacitors, substrates, and insulators. Technical ceramics offer superior electrical properties, thermal stability, and mechanical strength, making them essential for ensuring the reliability and performance of electronic devices. Additionally, the rise of emerging technologies such as 5G networks, Internet of Things (IoT) devices, and electric vehicles (EVs) further amplifies the demand for technical ceramics in Brazil. The country’s focus on infrastructure development and renewable energy initiatives also contributes to the market growth, as technical ceramics play a crucial role in components for solar panels, wind turbines, and energy storage systems. Overall, the electronics sector expansion and technological advancements are major drivers driving the Brazil Technical Ceramics Market forward.

However, one major obstacle facing the Technical Ceramics Market in Brazil is intense competition from other materials like metals and plastics, which can offer comparable properties at lower costs. This presents a threat to the market growth, especially in price-sensitive industries. Additionally, fluctuations in raw material prices and supply chain disruptions can impact manufacturing costs and product availability. Ensuring consistent quality standards and meeting evolving regulatory requirements also present challenges for market players operating in Brazil technical ceramics sector.

Brazil Technical Ceramics Industry: Leading Players

Some leading players in the Brazil Technical Ceramics industry include Saint-Gobain Ceramic Materials, Morgan Advanced Materials, Kyocera Corporation, CoorsTek Inc., and CeramTec GmbH. These companies are known for their extensive product portfolios, technological expertise, and global presence. They focus on product innovations, strategic partnerships, and expansions to strengthen their market position. Additionally, they provide to diverse industries such as electronics, automotive, aerospace, healthcare, and energy, offering a wide range of technical ceramic products like alumina ceramics, zirconia ceramics, silicon nitride ceramics, and others. Their strong R&D capabilities and customer-centric approach contribute to their leadership in the market.

Technical Ceramics Market in Brazil: Government Regulations

Government regulations play a significant role in the Brazil Technical Ceramics Market, ensuring product quality, safety, and environmental sustainability. Regulatory bodies such as the National Health Surveillance Agency (ANVISA) and the National Institute of Metrology, Quality, and Technology (INMETRO) set standards for technical ceramic products used in healthcare and industrial applications. Environmental regulations, governed by agencies like the Brazil Institute of Environment and Renewable Natural Resources (IBAMA), oversee waste management and emissions control in ceramic manufacturing processes. Additionally, import and export regulations, tariffs, and trade agreements influence market dynamics for technical ceramics in Brazil. Adhering to these regulations is essential for market players to maintain compliance, ensure market access, and build trust with customers and stakeholders, contributing to the sustainable Brazil Technical Ceramics Market Growth.

Future Insights of the Market

The Brazil Technical Ceramics Market has been experiencing significant growth over the past few years. The future of the market looks promising with anticipated growth driven by several factors. These include increasing applications in emerging technologies like 5G networks, electric vehicles (EVs), and renewable energy systems. The market is likely to witness continued demand from the electronics, automotive, aerospace, and healthcare sectors due to technical ceramics superior properties. Moreover, advancements in material science and manufacturing technologies are expected to lead to the development of innovative ceramic products with enhanced performance characteristics. Strategic collaborations, investments in R&D, and a focus on sustainability are also anticipated to shape the market's evolution, creating opportunities for market players to capitalize on the growing demand for technical ceramics in Brazil.

Market Segmentation by Material Type

According to Ravi Bhandari, Head of Research, 6Wresearch, Non-Oxide Ceramics are anticipated to witness significant growth in the industry. Comprising materials such as silicon carbide (SiC) and boron nitride (BN), these ceramics are valued for their exceptional thermal conductivity, chemical stability, and mechanical strength at high temperatures. The increasing demand for materials that can perform under extreme conditions is driving the growth of the Non-Oxide Ceramics segment, particularly in applications like aerospace, defense, and energy.

Market Segmentation by Product Type

On the basis of product type, Ceramic Matrix Composites (CMCs) are expected to witness the highest growth rate. This can be attributed to their superior properties, such as high fracture toughness and thermal shock resistance, which are essential for applications in extreme conditions. Ceramic Coatings and other segments also contribute to the market diversity, offering solutions for surface protection and enhancement in various applications, including biomedical devices and industrial machinery. The ongoing research and development in the field of technical ceramics promise innovative materials with enhanced capabilities, driving the market growth further.

Market Segmentation by End-Use Industry

On the basis of end-use industry, the Electronics & Semiconductor sector is poised to dominate the Brazil technical ceramics market. Driven by Brazil growing demand for advanced electronic devices and components, this segment utilizes the exceptional properties of technical ceramics, such as high thermal stability and electrical insulation. The adoption of 5G technology and the expansion of consumer electronics are additional catalysts driving this segment growth.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Brazil Technical Ceramics Market Outlook

- Market Size of Brazil Technical Ceramics Market, 2024

- Forecast of Brazil Technical Ceramics Market, 2031

- Historical Data and Forecast of Brazil Technical Ceramics Revenues & Volume for the Period 2021-2031

- Brazil Technical Ceramics Market Trend Evolution

- Brazil Technical Ceramics Market Drivers and Challenges

- Brazil Technical Ceramics Price Trends

- Brazil Technical Ceramics Porter's Five Forces

- Brazil Technical Ceramics Industry Life Cycle

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Material Type for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Oxide ceramics for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Non-oxide ceramics for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Product Type for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Monolithic ceramics for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Ceramic matrix composites for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Ceramic coatings for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By End-Use Industry for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Electronics & semiconductor for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Automotive for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Energy & power for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Industrial for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Medical for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Military & defense for the Period 2021-2031

- Historical Data and Forecast of Brazil Technical Ceramics Market Revenues & Volume By Others for the Period 2021-2031

- Brazil Technical Ceramics Import Export Trade Statistics

- Market Opportunity Assessment By Material Type

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By End-Use Industry

- Brazil Technical Ceramics Top Companies Market Share

- Brazil Technical Ceramics Competitive Benchmarking By Technical and Operational Parameters

- Brazil Technical Ceramics Company Profiles

- Brazil Technical Ceramics Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Material Type

- Oxide ceramics

- Non-oxide ceramics

By Product Type

- Monolithic ceramics

- Ceramic matrix composites

- Ceramic coatings

- Others

By End-Use Industry

- Electronics & semiconductor

- Automotive

- Energy & power

- Industrial

- Medical

- Military & defense

- Others

Brazil Technical Ceramics Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Brazil Technical Ceramics Market Overview |

| 3.1 Brazil Country Macro Economic Indicators |

| 3.2 Brazil Technical Ceramics Market Revenues & Volume, 2021 & 2031F |

| 3.3 Brazil Technical Ceramics Market - Industry Life Cycle |

| 3.4 Brazil Technical Ceramics Market - Porter's Five Forces |

| 3.5 Brazil Technical Ceramics Market Revenues & Volume Share, By Material Type, 2021 & 2031F |

| 3.6 Brazil Technical Ceramics Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.7 Brazil Technical Ceramics Market Revenues & Volume Share, By End-Use Industry, 2021 & 2031F |

| 4 Brazil Technical Ceramics Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Brazil Technical Ceramics Market Trends |

| 6 Brazil Technical Ceramics Market, By Types |

| 6.1 Brazil Technical Ceramics Market, By Material Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Brazil Technical Ceramics Market Revenues & Volume, By Material Type, 2021 - 2031F |

| 6.1.3 Brazil Technical Ceramics Market Revenues & Volume, By Oxide ceramics, 2021 - 2031F |

| 6.1.4 Brazil Technical Ceramics Market Revenues & Volume, By Non-oxide ceramics, 2021 - 2031F |

| 6.2 Brazil Technical Ceramics Market, By Product Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 Brazil Technical Ceramics Market Revenues & Volume, By Monolithic ceramics, 2021 - 2031F |

| 6.2.3 Brazil Technical Ceramics Market Revenues & Volume, By Ceramic matrix composites, 2021 - 2031F |

| 6.2.4 Brazil Technical Ceramics Market Revenues & Volume, By Ceramic coatings, 2021 - 2031F |

| 6.2.5 Brazil Technical Ceramics Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.3 Brazil Technical Ceramics Market, By End-Use Industry |

| 6.3.1 Overview and Analysis |

| 6.3.2 Brazil Technical Ceramics Market Revenues & Volume, By Electronics & semiconductor, 2021 - 2031F |

| 6.3.3 Brazil Technical Ceramics Market Revenues & Volume, By Automotive, 2021 - 2031F |

| 6.3.4 Brazil Technical Ceramics Market Revenues & Volume, By Energy & power, 2021 - 2031F |

| 6.3.5 Brazil Technical Ceramics Market Revenues & Volume, By Industrial, 2021 - 2031F |

| 6.3.6 Brazil Technical Ceramics Market Revenues & Volume, By Medical, 2021 - 2031F |

| 6.3.7 Brazil Technical Ceramics Market Revenues & Volume, By Military & defense, 2021 - 2031F |

| 7 Brazil Technical Ceramics Market Import-Export Trade Statistics |

| 7.1 Brazil Technical Ceramics Market Export to Major Countries |

| 7.2 Brazil Technical Ceramics Market Imports from Major Countries |

| 8 Brazil Technical Ceramics Market Key Performance Indicators |

| 9 Brazil Technical Ceramics Market - Opportunity Assessment |

| 9.1 Brazil Technical Ceramics Market Opportunity Assessment, By Material Type, 2021 & 2031F |

| 9.2 Brazil Technical Ceramics Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.3 Brazil Technical Ceramics Market Opportunity Assessment, By End-Use Industry, 2021 & 2031F |

| 10 Brazil Technical Ceramics Market - Competitive Landscape |

| 10.1 Brazil Technical Ceramics Market Revenue Share, By Companies, 2024 |

| 10.2 Brazil Technical Ceramics Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero