South Korea Technical Ceramics Market (2022-2028) | Size, Share, Forecast, Revenue, Analysis, Growth, Trends, Industry, Outlook & COVID-19 IMPACT

Market Forecast By Material Type (Oxide ceramics, Non-oxide ceramics), By Product Type (Monolithic ceramics, Ceramic matrix composites, Ceramic coatings, Others), By End-Use Industry (Electronics & semiconductor, Automotive, Energy & power, Industrial, Medical, Military & defense, Others) And Competitive Landscape

| Product Code: ETC045783 | Publication Date: Sep 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 67 | No. of Figures: 21 | No. of Tables: 4 | |

South Korea Technical Ceramics Market report thoroughly covers the market Material Types, Product Types and End-Use Industry The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

South Korea Technical Ceramics Market Synopsis

South Korea Technical Ceramics market is expected to grow moderately during the forecast period, owing to government initiatives such as the $37 billion Green New Deal, which aims to boost green infrastructure and promote green energy to achieve South Korea's Net Zero emission target by 2050. Such initiatives are boosting industries such as automotive, electrical and semiconductor, military and defense, healthcare, and others, which will directly influence the South Korean technical ceramics market in terms of demand generation. In 2020, the outbreak of coronavirus hampered the growth of the South Korean technical ceramics market, and demand for technical ceramics plummeted because of a government-imposed nationwide lockdown, as well as disruption in the global supply chain, which resulted in the halt of operations of the electrical & semiconductor industry, which is a prominent end use industry. In terms of market capitalization electrical & semiconductor industry accounted for $130 bn.

According to 6Wresearch, South Korea Technical Ceramics Market size is projected to grow at CAGR of 6.4% during 2022-2028. Accredited to a robust automotive sector in South Korea, as well as a growing military & defense sector and a rallying healthcare sector because of COVID-19, would boost demand for technical ceramics in the forecast years. The medical equipment market would provide opportunities to use technical ceramics in the medical segment, which would boost demand for technical ceramics in the country during the forecast period.

Market by End-Use Industry Analysis

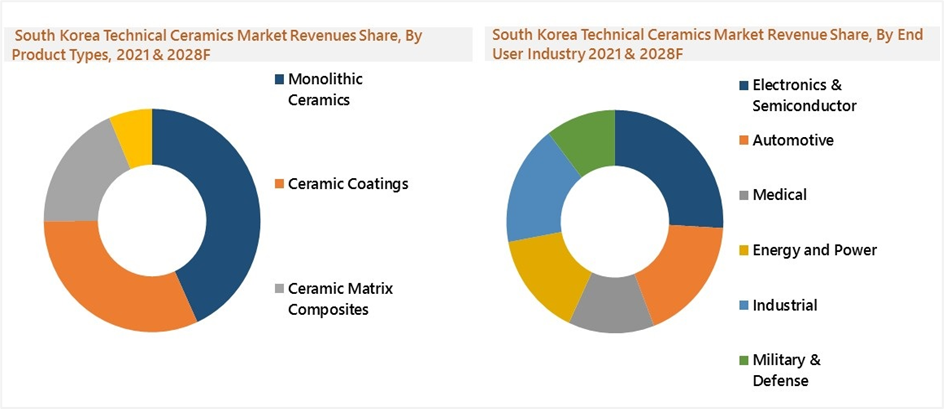

In terms of the end-use industry, the electronics and semiconductor segment accounted for 25.9% of market revenue in 2021 and leads the market. The results are extrapolations of the market capitalization of electronics and semiconductor companies compared to other industries. The electrical and semiconductor industry in South Korea is projected to experience increased demand due to the transformation expected in the communication sector due to the arrival of 5G technology and increased demand for Internet of Things (IoT) devices, where technical ceramics are used in their manufacturing.

Market by Product Types, Analysis

In the South Korean Technical Ceramics Market, monolithic ceramics are the most popular type of product, accounting for more than 43.15% of the market revenues in 2021. Monolithic ceramics are durable and can withstand high temperatures, which makes them a popular choice in many South Korean industries.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2021

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- South Korea Technical Ceramics Market Outlook

- Market Size of South Korea Technical Ceramics Market, 2023

- Forecast of South Korea Technical Ceramics Market, 2030

- Historical Data and Forecast of South Korea Technical Ceramics Revenues & Volume for the Period 2020-2030

- South Korea Technical Ceramics Market Trend Evolution

- South Korea Technical Ceramics Market Drivers and Challenges

- South Korea Technical Ceramics Price Trends

- South Korea Technical Ceramics Porter's Five Forces

- South Korea Technical Ceramics Industry Life Cycle

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Material Type for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Oxide ceramics for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Non-oxide ceramics for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Product Type for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Monolithic ceramics for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Ceramic matrix composites for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Ceramic coatings for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Others for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By End-Use Industry for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Electronics & semiconductor for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Automotive for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Energy & power for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Industrial for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Medical for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Military & defense for the Period 2020-2030

- Historical Data and Forecast of South Korea Technical Ceramics Market Revenues & Volume By Others for the Period 2020-2030

- South Korea Technical Ceramics Import Export Trade Statistics

- Market Opportunity Assessment By Material Type

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By End-Use Industry

- South Korea Technical Ceramics Top Companies Market Share

- South Korea Technical Ceramics Competitive Benchmarking By Technical and Operational Parameters

- South Korea Technical Ceramics Company Profiles

- South Korea Technical Ceramics Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Material Type

- Oxide ceramics

- Non-oxide ceramics

By Product Type

- Monolithic ceramics

- Ceramic matrix composites

- Ceramic coatings

- Others

By End-Use Industry

- Electronics & semiconductor

- Automotive

- Energy & power

- Industrial

- Medical

- Military & defense

- Others

South Korea Technical Ceramics Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of The Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. South Korea Technical Ceramics Market Overview |

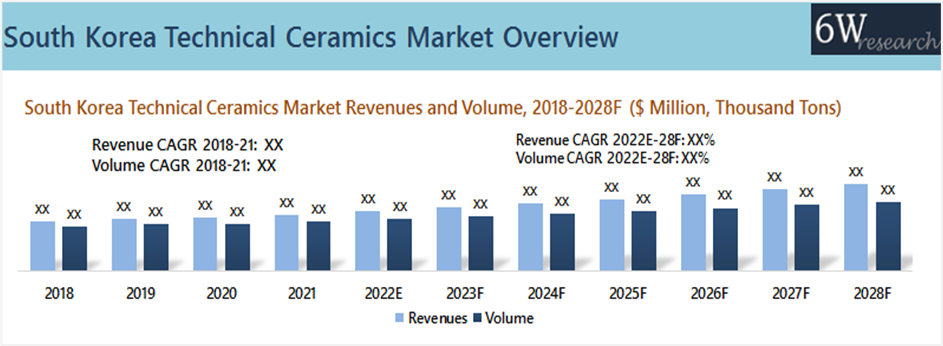

| 3.1. South Korea Technical Ceramics Market Revenues & Volume, 2018-2028F |

| 3.2. South Korea Technical Ceramics Market - Industry Life Cycle, 2021 |

| 3.3. South Korea Technical Ceramics Market - Porter’s Five Forces |

| 3.4. South Korea Technical Ceramics Market Revenue Share & Volume Share, By Material Types, 2021 & 2028F |

| 3.5. South Korea Technical Ceramics Market Revenue Share, By Product Types, 2021 & 2028F |

| 3.6. South Korea Technical Ceramics Market Revenue Share, By End Use Industry, 2021 & 2028F |

| 3.7. South Korea Technical Ceramics Market COVID-19 Impact Analysis |

| 4. South Korea Technical Ceramics Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing demand for technical ceramics in the electronics industry due to their high thermal and electrical insulation properties. |

| 4.2.2 Growing adoption of technical ceramics in the automotive sector for applications like sensors, engine components, and exhaust systems. |

| 4.2.3 Government initiatives promoting the use of technical ceramics in various industries to enhance product performance and durability. |

| 4.3. Market Restraints |

| 4.3.1 High initial investment required for manufacturing technical ceramics leading to higher product costs. |

| 4.3.2 Limited availability of skilled labor for the production and processing of technical ceramics. |

| 4.3.3 Fluctuating raw material prices impacting the overall production cost of technical ceramics. |

| 5. South Korea Technical Ceramics Market Trends and Evolution |

| 6. South Korea Technical Ceramics Market, By Material Types |

| 6.1. South Korea Technical Ceramics Market Revenues and Volume, By Material Types 2018–2028F |

| 6.1.1. South Korea Technical Ceramics Market Revenues and Volume, Oxide Ceramics, 2018–2028F |

| 6.1.2. South Korea Technical Ceramics Market Revenues and Volume, Non-Oxide Ceramics, 2018–2028F |

| 7. South Korea Technical Ceramics Market, By Product Types |

| 7.1. South Korea Technical Ceramics Market Revenues, By Product Types, 2018-2028F |

| 7.1.1. South Korea Technical Ceramics Market Revenues, By Monolithic Ceramics, 2018-2028F |

| 7.1.2. South Korea Technical Ceramics Market Revenues, By Ceramic Coatings, 2018-2028F |

| 7.1.3. South Korea Technical Ceramics Market Revenues, By Ceramic Matrix Composites, 2018-2028F |

| 7.1.4. South Korea Technical Ceramics Market Revenues, By Others, 2018-2028F |

| 8. South Korea Technical Ceramics Market Overview, By End Use Industry |

| 8.1. South Korea Technical Ceramics Market Revenues, By End Use Industry, 2018-2028F |

| 8.1.1. South Korea Technical Ceramics Market Revenues, By Electronics & Semiconductor, 2018-2028F |

| 8.1.2. South Korea Technical Ceramics Market Revenues, By Automotive, 2018-2028F |

| 8.1.3. South Korea Technical Ceramics Market Revenues, By Medical, 2018-2028F |

| 8.1.4. South Korea Technical Ceramics Market Revenues, By Energy & Power, 2018-2028F |

| 8.1.5. South Korea Technical Ceramics Market Revenues, By Industrial, 2018-2028F |

| 8.1.6. South Korea Technical Ceramics Market Revenues, By Military & Defense, 2018-2028F |

| 9. South Korea Technical Ceramics Market – Key Performance Indicators |

| 10. South Korea Technical Ceramics Market Opportunity Assessment |

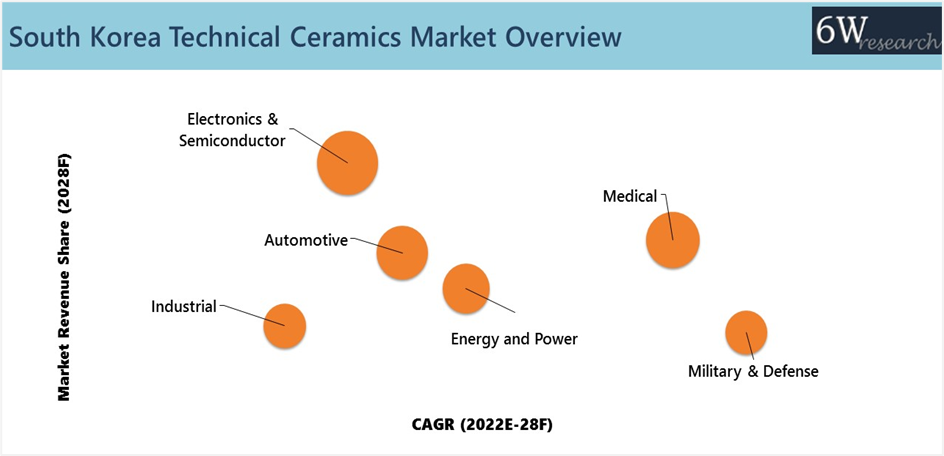

| 10.1. South Korea Technical Ceramics Market Opportunity Assessment, By Product Types, 2028F |

| 10.2. South Korea Technical Ceramics Market Opportunity Assessment, By End Use Industry, 2028F |

| 11. South Korea Technical Ceramics Market Competitive Landscape |

| 11.1. South Korea Technical Ceramics Market, By Company Ranking, 2021 |

| 11.2. South Korea Technical Ceramics Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1. Sungjo Fine Ceramics Co.Ltd. |

| 12.2. KYOCERA AVX Components Seoul Ltd. |

| 12.3. Union Materials Corporation |

| 12.4. Looktech Co. Ltd. |

| 12.5. Dongkuk R&S. Co., Ltd. |

| 12.6. CeramTec GmbH |

| 12.7. CoorsTek Inc. |

| 12.8. Morgan Advanced Materials Plc. |

| 12.9. Korea NTK Ceramics Co., Ltd. |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List Of Figures |

| 1. South Korea Technical Ceramics Market Revenues and Volume, 2018-2028F ($ Million, Thousand Tons) |

| 2. South Korea Technical Ceramics Market Revenue Share, By Material Types, 2021 & 2028 ($ Million) |

| 3. South Korea Technical Ceramics Market Volume Share, By Material Types 2021 & 2028F (Thousand Tons) |

| 4 South Korea Technical Ceramics Market Revenues Share, By Product Types, 2021 & 2028F |

| 5. South Korea Technical Ceramics Market Revenue Share, By End User Industry 2021 & 2028F |

| 6. South Korea Domestic Automotive Sales Volume, 2019-2020 (Thousand Units) |

| 7. South Korean Exports of Semiconductors, 2019- 2020 ($ Hundred Million) |

| 8. South Korea Military Expenditure, 2015– 2020 & 2025F ($ Million) |

| 9. South Korea Military Equipment Export Value, 2021 vs 2022E ($ Billion) |

| 10. Medical Device Market, South Korea, 2017– 2019 & 2025F ($ Million) |

| 11. Health Expenditure Per Capita, South Korea, 2017– 2019 & 2025F (In $) |

| 12. South Korea Value of Semiconductor Production, 2017- 2019 ($ Billion) |

| 13. South Korean Exports of Semiconductors, 2018- 2020 ($ Hundred Million) |

| 14. South Korea Share in Global Semiconductor Market, 2018-2020 (in %) |

| 15. South Korea Domestic Automotive Sales Volume, 2021 (Thousand Units) |

| 16. South Korea Energy Production, 2018-2020, (In TJ) |

| 17. Electricity Generation By Source, 2018 |

| 18. South Korea Total CO2 emission, 2018-2020, (In Mt) |

| 19. South Korea Technical Ceramics Market Opportunity Assessment, By Product Types, 2028F |

| 20. South Korea Technical Ceramics Market Opportunity Assessment, By End Use Industry, 2028F |

| 21. South Korea Technical Ceramics Market Revenue Ranking, By Company, 2021 |

| List Of Tables |

| 1. South Korea Technical Ceramics Market Revenues, By Material Types, 2018–2028F ($ Million) |

| 2. South Korea Technical Ceramics Market Volume, By Material Types, 2018–2028F (Thousand Tonnes) |

| 3. South Korea Technical Ceramics Market Revenues, By Product Types, 2018–2028F ($ Million) |

| 4. South Korea Technical Ceramics Market Revenues, By End-Use Industry, 2018–2028F ($ Million) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero