India Power Tools Market (2020-2030) | Outlook, Revenue, Forecast, Share, Analysis, Size, Industry, Companies, Value, Growth & Trends

Market Forecast By Technology (Electric Power Tools (Corded Power Tools, Cordless Power Tools), Pneumatic Power Tools), By Tool Types (Metal Power Tools (Grinder, Cutter, Driller), Concrete Power Tools (Demolition Hammer, Rotatory Hammer), Wood Power Tools (Saws, Router, Planer), Other Power Tools (Sand Polisher, Shears & Nibbers, Painting Tools), By Verticals (Industrial, Commercial, Transportation, Others (Defense, DIY Customers, etc.)), By Market Type (Organized Market, Unorganized Market), By Regions (Eastern, Western, Northern, Southern) and competitive landscape

| Product Code: ETC003134 | Publication Date: Aug 2023 | Updated Date: Sep 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 118 | No. of Figures: 38 | No. of Tables: 12 | |

India Power Tools Market Competition 2023

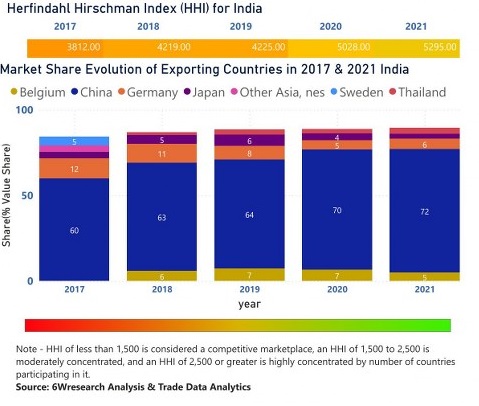

India Power Tools market currently, in 2023, has witnessed an HHI of 4880, Which has decreased slightly as compared to the HHI of 4894 in 2017. The market is moving towards concentrated. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

India Export Potential Assessment For Power Tools Market (Values in USD Thousand)

India Power Tools Market | Country-Wise Share and Competition Analysis

In the year 2021, China was the largest exporter in terms of value, followed by Germany. It has registered a growth of 51.42% over the previous year. While Germany registered a growth of 66% as compared to the previous year. In the year 2017, China was the largest exporter followed by Germany. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, India had a Herfindahl index of 3812 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 5295 which signifies high concentration in the market.

India Power Tools Market - Export Market Opportunities

Latest 2023 Developments of India Power Tools Market

The India power tools market has been attaining steady growth, and the growth of this market is driven by factors like urbanization, increasing do-it-yourself (DIY) activities, and infrastructure development. Technological advancements are also supporting the market growth. There are continued innovations in power tools technology in the country, which help in the market progress. The do-it-yourself urfe has been also attaining growth in India, which is leading to a rise in demand for power tools among hobbyists and homeowners.

Manufacturers in the market are anticipated to continue prioritizing safety features as well as ergonomic designs in order to enhance user experience and decrease the risk of accidents. There is a high demand for cordless power tools, especially in segments such as drills, impact drivers, as well as screwdrivers, which will to continue rise attributed to the convenience and portability they offer. Government-led initiatives such as "Make in India" and increased investments in infrastructure projects also drive the demand for power tools in the country. There is a rising interest in energy-efficient and eco-friendly power tools, with a rising focus on sustainability.

Topics Covered in India Power Tools Market

The India power tools market report thoroughly covers the India power tools market by technology, tool types, verticals, and regions. The India power tools market outlook report provides an unbiased and detailed analysis of the India power tools market trends, opportunities/ high growth areas, and market drivers which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

India Power Tools Market Synopsis

India Power Tools Market is anticipated to witness notable growth during the forecast period. A rapid shift in consumer preference from hand tools to power tools on account of several factors such as better durability, precision, performance, and convenience has resulted in significant demand for power tools in recent years. The majority of the demand for power tools in the Indian market could be witnessed in verticals such as construction, industrial, and transportation. Although international brands namely Bosch, Stanley, and Makita emerged as the key players in the market, the Chinese power tools are being highly preferred by price-sensitive consumers across the small-scale industries, residential sector, and DIY consumer segment. The market has seen a halt owing to the massive outbreak of COVID-19 which resulted in nationwide lockdowns to combat the spread of the virus and has led to a decline in the overall market growth.

According to 6Wresearch, India Power Tools Market size is projected to grow at a CAGR of 8.4% during 2020-2030. The power tools market size in India is projected to gain traction in the forthcoming years on the back of increasing product acceptance across all major verticals including construction and residential sectors. Additionally, an increase in the number of middle-class families and the youth population has accelerated the adoption of electric vehicles in the country and is likely to widen the product demand during the maintenance of automobiles. In line with this, the power tools speed up the repetitive process of tightening and loosening nuts and bolts is estimated to leave a positive impact on the market demand and would benefit the growth of the India power tools market in the upcoming six years.

Market Analysis by Technology

In terms of technology type, electric power tools have emerged as a major market shareholder in the India power tools market in 2020, owing to their comparatively lesser price, maintenance, and convenience to handle in comparison to pneumatic power tools. As technological advancements and innovations are taking place in power tools, the revenues and revenue share of cordless electric power tools is expected to increase further in the years to come.

The power Tools Market in India is projected to gain traction in the upcoming six years backed by the rising potential growth of the automotive sector in the years to come. The increase in the adoption of electric vehicles in the country due to cease the carbon emission rate coupled with the increase in passenger vehicles where three-wheeler is increasing at a rapid pace and is leading to increasing the manufacturing of vehicles and is estimated to proliferate the use of power tools and is expected to boost the optimistic growth of to power tools in the country in the forthcoming years.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2020.

- Base Year: 2020

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- India Power Tools Market Overview

- India Power Tools Market Outlook

- India Power Tools Market Forecast

- Historical data of India Power Tools Market Revenues for the Period 2016-2020

- India Power Tools Market Size and India Power Tools Market Forecast of Revenues, until 2030

- Historical data and Forecast of India Power Tools Market Revenues, By Tool Types, for the Period 2020-2030

- Historical Data and Forecast of India Power Tools Market Revenues, By Technology, for the Period 2020-2030

- Historical Data and Forecast of India Power Tools Market Revenues, By Verticals, for the Period 2020-2030

- Historical Data and Forecast of India Power Tools Market Revenues, By Regions, for the Period 2020-2030

- Historical Data and Forecast of India Power Tools Market Revenues, By Market Types, for the Period 2020-2030

- Market Drivers and Restraints

- India Power Tools Market Trends

- Industry Life Cycle and Value Chain Analysis & Ecosystem

- Porter’s Five Forces Analysis

- India Power Tools Market Share, By Companies

- India Power Tools Market Opportunity Assessment

- India Power Tools Market Overview by Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

-

By Technology

- Corded Power Tools

- Cordless Power Tools

- Electric Power Tools

- Pneumatic Power Tools

-

By Tool Types

- Grinder

- Cutter

- Driller

- Demolition Hammer

- Rotatory Hammer

- Saws

- Router

- Planer

- Sand Polisher

- Shears & Nibblers

- Painting Tools

- Metal Power Tools

- Concrete Power Tools

- Wood Power Tools

- Other Power Tools

By Verticals

- Industrial

- Commercial

- Transportation

- Others (Defense, DIY Customers, etc.)

By Regions

- Eastern

- Western

- Northern

- Southern

India Power Tools Market: FAQs

| TABLE OF CONTENTS |

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. India Power Tools Market Overview |

| 3.1 India Power Tools Market Revenues & Volume, 2016-2026F |

| 3.2 India Power Tools Market Revenue Share, By Technology, 2019 & 2026F |

| 3.3 India Power Tools Market Revenue Share, By Tool Types, 2019 & 2026F |

| 3.4 India Power Tools Market Revenue Share, By Verticals 2019 & 2026F |

| 3.5 India Power Tools Market Revenue Share, By Regions, 2019 & 2026F |

| 3.6 India Power Tools Market Revenue Share, By Market Type, 2019 & 2026F |

| 3.7 India Power Tools Market- Industry Life Cycle |

| 3.8 India Power Tools Market- Porter’s Five Forces |

| 3.9 India Power Tools Market- Value Chain Analysis & Ecosystem |

| 4. India Power Tools Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. India Power Tools Market Trends & Evolution |

| 6. India Power Tools Market Price Trend Analysis |

| 7. India Power Tools Market Overview, By Market Type |

| 7.1 India Power Tools Market Revenue Share, By Market Type, 2019 & 2026F |

| 7.1.1 India Organized Power Tools Market Revenues, 2016-2026F |

| 7.1.2 India Unorganized Power Tools Market Revenues, 2016-2026F |

| 8. India Power Tools Market Overview, By Technology |

| 8.1 India Electric Power Tools Market Revenues, 2016-2026F |

| 8.1.1 India Corded Power Tools Market Revenues, 2016-2026F |

| 8.1.2 India Cordless Power Tools Market Revenues, 2016-2026F |

| 8.2 India Pneumatic Power Tools Market Revenues, 2016-2026F |

| 9. India Metal Power Tools Market Overview |

| 9.1 India Metal Power Tools Market Revenues & Volume, 2016-2026F |

| 9.2 India Metal Power Tools Market Revenue Share, By Types, 2019 & 2026F |

| 9.2.1 India Metal Power Tools Market Revenues, By Types, 2016-2026F |

| 9.3 India Metal Power Tools Market Revenue Share, By Applications, 2019 & 2026F |

| 9.3.1 India Metal Manufacturing Power Tools Market Revenues, 2016-2026F |

| 9.3.2 India Metal Fabrication Power Tools Market Revenues, 2016-2026F |

| 9.3.3 India Other Metal Power Tools Market Revenues, 2016-2026F |

| 10. India Concrete Power Tools Market Overview |

| 10.1 India Concrete Power Tools Market Revenues & Volume, 2016-2026F |

| 10.2 India Concrete Power Tools Market Revenue Share, By Types, 2019 & 2026F |

| 10.2.1 India Concrete Power Tools Market Revenues, By Types, 2016-2026F |

| 10.3 India Concrete Power Tools Market Revenue Share, By Applications, 2019 & 2026F |

| 10.3.1 India Concrete Drilling Power Tools Market Revenues, 2016-2026F |

| 10.3.2 India Concrete Grinding Power Tools Market Revenues, 2016-2026F |

| 10.3.3 India Other Concrete Power Tools Market Revenues, 2016-2026F |

| 11. India Wood Power Tools Market Overview |

| 11.1 India Wood Power Tools Market Revenues & Volume, 2016-2026F |

| 11.2 India Wood Power Tools Market Revenue Share, By Types, 2019 & 2026F |

| 11.2.1 India Wood Power Tools Market Revenues, By Types, 2016-2026F |

| 11.3 India Wood Power Tools Market Revenue Share, By Applications, 2019 & 2026F |

| 11.3.1 India Wood Cutting Power Tools Market Revenues, 2016-2026F |

| 11.3.2 India Wood Drilling Power Tools Market Revenues, 2016-2026F |

| 11.3.3 India Other Wood Power Tools Market Revenues, 2016-2026F |

| 12. India Other Power Tools Market Overview |

| 12.1 India Other Power Tools Market Revenues & Volume, 2016-2026F |

| 13. India Power Tools Market Overview, By Verticals |

| 13.1 India Construction Power Tools Market Revenues, 2016-2026F |

| 13.2 India Industrial Power Tools Market Revenues, 2016-2026F |

| 13.3 India Transportation Power Tools Market Revenues, 2016-2026F |

| 13.3.1 India Transportation Power Tools Market Revenue Share, By Types 2019 & 2026F |

| 13.3.1.1 India Transportation Power Tools Market Revenues, By Automotive Application, 2016-2026F |

| 13.3.1.2 India Transportation Power Tools Market Revenues, By Aerospace Application, 2016-2026F |

| 13.3.1.3 India Transportation Power Tools Market Revenues, By Marine Application, 2016-2026F |

| 13.3.1.4 India Transportation Power Tools Market Revenues, By Others Applications, 2016-2026F |

| 13.4 India Other Power Tools Market Revenues, 2016-2026F |

| 14. India Power Tools Market Overview, By Regions |

| 14.1 India Power Tools Market Revenues, By Western Region, 2016-2026F |

| 14.2 India Power Tools Market Revenues, By Eastern Region, 2016-2026F |

| 14.3 India Power Tools Market Revenues, By Southern Region, 2016-2026F |

| 14.4 India Power Tools Market Revenues, By Northern Region, 2016-2026F |

| 15. India Power Tools Market- Industry Regulations |

| 16. India Power Tools Market- Key Performance Indicators |

| 16.1 India Real Estate Sector Outlook |

| 16.2 India Residential Sector Outlook |

| 16.3 India Industrial Sector Outlook |

| 16.4 India Education Sector Outlook |

| 16.5 India Healthcare Sector Outlook |

| 17. India Power Tools Market - Opportunity Assessment |

| 17.1 India Power Tools Market Opportunity Assessment, By Technology, 2026F |

| 17.2 India Power Tools Market Opportunity Assessment, By Tool Types, 2026F |

| 17.3 India Power Tools Market Opportunity Assessment, By Verticals, 2026F |

| 17.4 India Power Tools Market Opportunity Assessment, By Regions, 2026F |

| 18. India Power Tools Market – Competitive Landscape |

| 18.1 India Power Tools Market Revenue Share, By Companies, 2019 |

| 18.2 India Power Tools Market Competitive Benchmarking, By Technology |

| 18.3 India Power Tools Market Competitive Benchmarking, By Operating Parameters |

| 19. Company Profiles |

| 19.1 Bosch Ltd. |

| 19.2 Stanley Black & Decker India Pvt. Ltd. |

| 19.3 Makita Power Tools India Pvt. Ltd. |

| 19.4 Hikoki India Pvt. Ltd. |

| 19.5 Hilti India Pvt. Ltd. |

| 19.6 Kulkarni Power Tools Ltd. (KPT) |

| 19.7 FEIN Power Tools India Pvt. Ltd. |

| 19.8 Atlas Copco (India) Ltd. |

| 19.9 Snap-on Inc. |

| 19.10 Dongcheng Power Tools |

| 20. Key Strategic Recommendation |

| 21. Disclaimer |

| LIST OF FIGURES |

| 1. India Power Tools Market Revenues & Volume, 2016-2026F (INR Crore, ‘0000 Units) |

| 2. India Power Tools Market Revenue Share, By Technology, 2019 & 2026F |

| 3. India Power Tools Market Revenue Share, By Tool Types, 2019 & 2026F |

| 4. India Power Tools Market Revenue Share, By Verticals, 2019 & 2026F |

| 5. India Power Tools Market Revenue Share, By Regions, 2019 & 2026F |

| 6. India Power Tools Market Revenue Share, By Market Type, 2019 & 2026F |

| 7. Price Trend of Power Tools in India, 2016-2026F (INR Rs per unit) |

| 8. India Power Tools Market Revenue Share, By Market Type, 2019 & 2026F |

| 9. India Organized Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 10. India Unorganized Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 11. India Electric Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 12. India Corded Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 13. India Cordless Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 14. India Pneumatic Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 15. India Metal Power Tools Market Revenues & Volume, 2016-2026F (INR Crore, ‘0000 Units) |

| 16. India Metal Power Tools Market Revenue Share, By Types, 2019 & 2026F |

| 17. India Metal Power Tools Market Revenue Share, By Applications, 2019 & 2026F |

| 18. India Concrete Power Tools Market Revenues & Volume, 2016-2026F (INR Crore, ‘0000 Units) |

| 19. India Concrete Power Tools Market Revenue Share, By Types, 2019 & 2026F |

| 20. India Concrete Power Tools Market Revenue Share, By Applications, 2019 & 2026F |

| 21. India Wood Power Tools Market Revenues & Volume, 2016-2026F (INR Crore, ‘0000 Units) |

| 22. India Wood Power Tools Market Revenue Share, By Types, 2019 & 2026F |

| 23. India Wood Power Tools Market Revenue Share, By Applications, 2019 & 2026F |

| 24. India Other Power Tools Market Revenues & Volume, 2016-2026F (INR Crore, ‘0000 Units) |

| 25. India Construction Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 26. India Industrial Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 27. India Transportation Vertical Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 28. India Transportation Power Tools Market Revenue Share, By Types, 2019 & 2026F |

| 29. India Other Verticals Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 30. Eastern India Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 31. Western India Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 32. Northern India Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 33. Southern India Power Tools Market Revenues, 2016-2026F (INR Crore) |

| 34. India Power Tools Market Opportunity Assessment, By Technology, 2026F |

| 35. India Power Tools Market Opportunity Assessment, By Tool Types, 2026F |

| 36. India Power Tools Market Opportunity Assessment, By Verticals, 2026F |

| 37. India Power Tools Market Opportunity Assessment, By Regions, 2026F |

| 38. India Power Tools Market Revenue Share, By Companies, 2019 |

| LIST OF TABLES |

| 1. India Automobile Domestic Sales Trend, 2015-2019 |

| 2. India Automobile Production Trend, 2015-2019 |

| 3. List of Construction Project details under the Government/ Private ownership as of Feb 2020 (Contd.) |

| 4. India Metal Power Tools Market Revenues, By Types, 2016-2026F (INR Crore) |

| 5. India Metal Power Tools Market Revenues, By Applications, 2016-2026F (INR Crore) |

| 6. India Concrete Power Tools Market Revenues, By Types, 2016-2026F (INR Crore) |

| 7. India Concrete Power Tools Market Revenues, By Applications, 2016-2026F (INR Crore) |

| 8. India Wood Power Tools Market Revenues, By Types, 2016-2026F (INR Crore) |

| 9. India Wood Power Tools Market Revenues, By Applications, 2016-2026F (INR Crore) |

| 10. India Transportation Power Tools Market Revenues, By Types, 2016-2026F (INR Crore) |

| 11. Upcoming High-Rise Building Across Key Cities in India (As of Feb 2020) |

| 12. Upcoming Residential Projects in Key Cities in India |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero