India Self Priming Pumps Market (2018-2024) | Size, Share, Growth, Analysis, Forecast, Trends, Value, Outlook & Revenue

Market Forecast By Types (Electric and Diesel), By Head Range (Below 30 m, 30-50 m, 50.1-100 m, 100.1-200 m and Above 200 m), By Horse Power (Below 1 HP, 1-3 HP, 3.1-5 HP, 5.1-7 HP, 7.1-10 HP, 10.1-100 HP and Above 100 HP), By Applications (Residential, Agriculture, Oil & Gas, Commercial, Mining, Industrial and Water & Wastewater), By Regions (Northern, Western, Eastern and Southern) and Competitive Landscape

| Product Code: ETC000503 | Publication Date: Jul 2018 | Updated Date: Jun 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 110 | No. of Figures: 33 | No. of Tables: 30 | |

Latest 2023 Developments of the India Self Priming Pumps Market

India Self Priming Pumps Market developments are floating pump sets which automatically adjust their level according to the water level. Xylem self-priming pumps are designed to pump liquid with dissolved gases and to stay primed even without water in the suction line. KBL launched its SP coupled pump set which offers ultra-premium efficiency with high specific discharge which saves energy consumption. Intelligent pump systems can control and regulate the flow of the fluid can adjust to process changes and also have a tolerant design.

Mergers and Acquisitions

- Integrated Power services acquired Rotek Services on July 30, 2021.

India Self Priming Pumps Market Synopsis

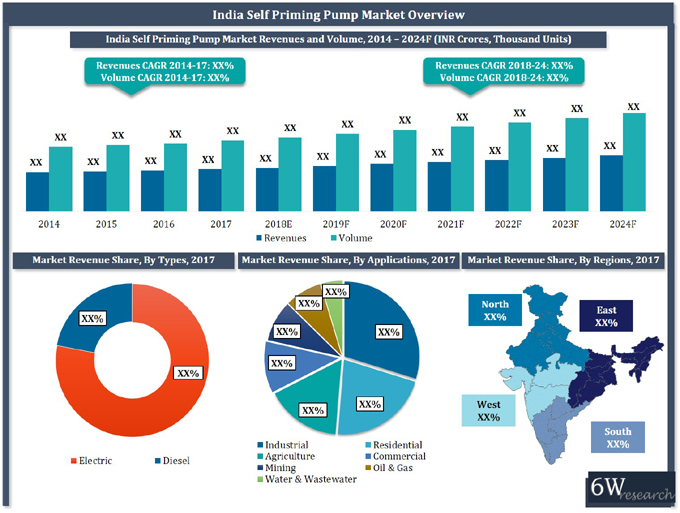

The growing industrial market along with the increasing inflow of investment in the construction and residential sectors are some of the key factors which are driving the market for self-priming pumps in India. In India, self-priming pumps market, the residential application accounted for the highest market revenue share owing to the availability of supporting infrastructure and wide installation.

According to 6Wresearch, India self-priming pump market size is expected to increase at a CAGR of 4.3% during 2018-2024. Indian market registered a modest increase in demand for self-priming pumps during 2014-17, owing to the slowdown in residential construction activities. However, the market is anticipated to bounce back with expected stability in the economy post-2018. The residential and agriculture applications would remain at the forefront and would drive the growth of self-priming pumps in India, however, the industrial application is anticipated to exhibit a higher CAGR during 2018-24.

In India, the Northern region held the largest India self-priming pump market share on the back of increasing infrastructure development activities in the Northern region. The Northern region is expected to lead the India self-priming pump market forecast revenues over the coming years.

In India, the Northern region held the largest India self-priming pump market share on the back of increasing infrastructure development activities in the Northern region. The Northern region is expected to lead the India self-priming pump market forecast revenues over the coming years.

The India self-priming pump market report thoroughly covers the market by self-priming pump types, applications, head range, HP range, and regions. The India self-priming pump market outlook report provides an unbiased and detailed analysis of the India self-priming pump market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align market strategies according to the current and future market dynamics.

India self priming pumps market is anticipated to register sound growth in the coming timeframe on the back of the rising optimistic growth of the mining sector in the country. The rising production of iron and steel due to high domestic use especially in the Commercial and residential industry coupled with the rising export practices as result is estimated to boost the demand for self priming pumps on mining sites to perform various activities such as mineral slurry transfer, and dewatering and is estimated to acts as a catalyst for the growth of the India self pro ing pumps market in the forthcoming years.

Key Highlights of the Report:

• India Self Priming Pump Market Overview

• India Self Priming Pump Market Outlook

• Historical Data of India Self Priming Pump Market Revenues for the Period 2014-2017

• India Self Priming Pump Market Size & India Self Priming Pump Market Forecast of Revenues until 2024

• Historical Data of India Self Priming Pump Market Revenues for the Period 2014-2017, By Types

• Market Size & Forecast of India Self Priming Pumps Market Revenues until 2024, By Types

• Historical Data of India Self Priming Pumps Market Revenues for the Period 2014-2017, By Applications

• Market Size & Forecast of India Self Priming Pumps Market Revenues until 2024, By Applications

• Historical Data of India Self Priming Pumps Market Revenues for the Period 2014-2017, By Regions

• Market Size & Forecast of India Self Priming Pumps Market Revenues until 2024, By Regions

• India Self Priming Pump Market Drivers and Restraints

• India Self Priming Pump Market Trends and Developments

• India Self Priming Pump Market Share, by Players

• India Self Priming Pump Market Overview on Competitive Landscape

• Company Profiles

• Strategic Recommendations

Markets Covered

The India self priming pump market report provides a detailed analysis of the following market segments:

By Types

- Electric

- Diesel

By Head Range

- Below 30 m

- 30-50 m

- 50.1-100 m

- 100.1-200 m

- Above 200 m

By Horse Power

- Below 1 HP

- 1-3 HP

- 3.1-5 HP

- 5.1-7 HP

- 7.1-10 HP

- 10.1-100 HP

- Above 100 HP

By Applications

- Residential

- Agriculture

- Oil & Gas

- Commercial

- Mining

- Industrial

- Water & Wastewater

By Regions

- Northern

- Western

- Eastern

- Southern

India Self Priming Pumps Market (2018-2024): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Global Self Priming Pumps Market Overview |

| 3.1 Global Self Priming Pumps Market Revenues (2014-2024F) |

| 3.2 Global Self Priming Pumps Market Revenue Share, By Regions (2017) |

| 4. India Self Priming Pumps Market Overview |

| 4.1 India Self Priming Pumps Market Revenues and Volume (2014-2024F) |

| 4.2 India Self Priming Pumps Market - Industry Life Cycle |

| 4.3 India Self Priming Pumps Market - Opportunity Matrix |

| 4.4 India Self Priming Pumps Market Value Chain Analysis |

| 4.5 India Self Priming Pumps Market - Porter's Five Forces |

| 4.6 India Self Priming Pumps Market - Rental Business Model in Mining and Water & Wastewater Application |

| 4.7 India Self Priming Pumps Market Revenue Share, By Types (2017 & 2024F) |

| 4.8 India Self Priming Pumps Market Revenue Share, By Applications (2017 & 2024F) |

| 4.9 India Self Priming Pumps Market Revenue Share, By HP (2017 & 2024F) |

| 4.10 India Self Priming Pumps Market Revenue Share, By Head Range (2017 & 2024F) |

| 4.11 India Self Priming Pumps Market Revenue Share, By Regions (2017 & 2024F) |

| 5. India Self Priming Pumps Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraints |

| 6. India Self Priming Pumps Market Trends |

| 7. India Self Priming Pump Market Overview, By Types |

| 7.1 India Electric Self Priming Pump Market Revenues and Volume (2014-2024F) |

| 7.2 India Diesel Self Priming Pump Market Revenues and Volume (2014-2024F) |

| 8. India Self Priming Pump Market Overview, By Applications |

| 8.1 India Self Priming Pump Market - By Residential Application (2014-2024F) |

| 8.1.1 India Residential Application Self Priming Pump Market Revenues and Volume - By HP (2014-2024F) |

| 8.1.2 India Residential Application Self Priming Pump Market Revenues and Volume - |

| By Head Range (2014-2024F) |

| 8.2 India Self Priming Pump Market - By Agriculture Application (2014-2024F) |

| 8.2.1 India Agriculture Application Self Priming Pump Market Revenues and Volume - By HP (2014-2024F) |

| 8.2.2 India Agriculture Application Self Priming Pump Market Revenues and Volume - |

| By Head Range (2014-2024F) |

| 8.3 India Self Priming Pump Market - By Water & Wastewater Application (2014-2024F) |

| 8.3.1 India Water & Wastewater Application Self Priming Pump Market Revenues and Volume - |

| By HP (2014-2024F) |

| 8.3.2 India Water & Wastewater Application Self Priming Pump Market Revenues and Volume - |

| By Head Range (2014-2024F) |

| 8.4 India Self Priming Pump Market - By Mining Application (2014-2024F) |

| 8.4.1 India Mining Application Self Priming Pump Market Revenues and Volume - By HP (2014-2024F) |

| 8.4.2 India Mining Application Self Priming Pump Market Revenues and Volume - |

| By Head Range (2014-2024F) |

| 8.5 India Self Priming Pump Market - By Commercial Application (2014-2024F) |

| 8.5.1 India Commercial Application Self Priming Pump Market Revenues and Volume - By HP (2014-2024F) |

| 8.5.2 India Commercial Application Self Priming Pump Market Revenues and Volume - |

| By Head Range (2014-2024F) |

| 8.6 India Self Priming Pump Market - By Oil & Gas Application (2014-2024F) |

| 8.6.1 India Oil & Gas Application Self Priming Pump Market Revenues and Volume - By HP (2014-2024F) |

| 8.6.2 India Oil & Gas Application Self Priming Pump Market Revenues and Volume |

| By Head Range (2014-2024F) |

| 8.7 India Self Priming Pump Market - By Industrial Application (2014-2024F) |

| 8.7.1 India Industrial Application Self Priming Pump Market Revenues and Volume - By HP (2014-2024F) |

| 8.7.2 India Industrial Application Self Priming Pump Market Revenues and Volume - |

| By Head Range (2014-2024F) |

| 9. India Self Priming Pumps Market Overview, By Regions |

| 9.1 India Self Priming Pumps Market Revenues, By Regions (2014-2024F) |

| 9.2 India Self Priming Pumps Market Volume, By Regions (2014-2024F) |

| 10. India Self Priming Pumps Market Opportunity Assessment, By Types & Applications |

| 10.1 India Self Priming Pumps Market Opportunity Assessment, By Types |

| 10.2 India Self Priming Pumps Market Opportunity Assessment, By Applications |

| 11. India Self Priming Pumps Market Ecosystem |

| 12. India Self Priming Pumps Market Competitive Landscape |

| 12.1 India Self Priming Pumps Market, By Players' Revenue (2017) |

| 12.2 India Self Priming Pumps Market, By Operating Parameters (2017) |

| 13. Company Profiles |

| 13.1 Kirloskar Brothers Limited |

| 13.2 Havells India Ltd. |

| 13.3 C.R.I. Pumps Private Limited |

| 13.4 Flowmore Pumps |

| 13.5 Crompton Greaves Consumer Electricals Ltd. |

| 13.6 V-GUARD INDUSTRIES LTD. |

| 13.7 Grundfos Pumps India Private Ltd. |

| 13.8 Texmo Industries |

| 13.9 KSB Pumps Ltd. |

| 13.10 Xylem Water Solutions India Pvt. Ltd. |

| 14. Key Strategic Pointers |

| 15. Disclaimer |

| List of Figures |

| 1. Global Self Priming Pump Market Revenues, 2014 - 2024F (INR Crores) |

| 2. Global Self Priming Pump Market Revenue Share, By Regions (2017) |

| 3. India Self Priming Pump Market Revenues and Volume, 2014 - 2024F (INR Crores, Thousand Units) |

| 4. India Self Priming Pump Market Overview - Industry Life Cycle |

| 5. India Self Priming Pump Market Opportunity Matrix, By Applications (2024F) |

| 6. India Self Priming Pumps Market Revenue Share, By Types, 2017 & 2024FF |

| 7. India Self Priming Pumps Market Revenue Share, By Applications, 2017 & 2024FF |

| 8. India Self Priming Pumps Market Revenue Share, By HP, 2017 & 2024FF |

| 9. India Self Priming Pumps Market Revenue Share, By Head Range, 2017 & 2024FF |

| 10. India Self Priming Pumps Market Revenue Share, By Regions, 2017 & 2024FF |

| 11. Number of Agricultural Workers in India (% of Total Workers) |

| 12. Growth in Indian Farm Machinery Exports, 2011-2016 ($ Million) |

| 13. India Solar Water Pumping System Market Volume, 2014-2022F (Thousand Units) |

| 14. India Electric Self Priming Pump Market Revenues, 2014 - 2024F (INR Crore, Thousand Units) |

| 15. India Diesel Self Priming Pump Market Revenues, 2014 - 2024F (INR Crore, Thousand Units) |

| 16. India Self Priming Pump Market Volume Share, By Types (2017 & 2024F) |

| 17. India Self Priming Pump Market Revenues & Volume, By Residential Application, |

| 2014 - 2024F (INR Crore, Thousand Units) |

| 18. India Self Priming Pump Market Revenues & Volume, By Agriculture Application, |

| 2014 - 2024F (INR Crore, Thousand Units) |

| 19. India Self Priming Pump Market Revenues & Volume, By Water & Wastewater Application, |

| 2014 - 2024F (INR Crore, Thousand Units) |

| 20. India Self Priming Pump Market Revenues & Volume, By Mining Application, |

| 2014 - 2024F (INR Crore, Thousand Units) |

| 21. India Copper Production, 2011-18E (Lakh Tons) |

| 22. India Zinc Production, 2012-17 (Lakh Tons) |

| 23. India Aluminium/Bauxite Production, 2012-17 (Lakh Tons) |

| 24. India Coal Production, 2012-17 (Million Tons) |

| 25. India Iron Production, 2012-17 (Lakh Tons) |

| 26. India Self Priming Pump Market Revenues & Volume, By Commercial Application, |

| 2014 - 2024F (INR Crore, Thousand Units) |

| 27. India Self Priming Pump Market Revenues & Volume, By Oil & Gas Application, |

| 2014 - 2024F (INR Crore, Thousand Units) |

| 28. India Self Priming Pump Market Revenues & Volume, By Industrial Application, |

| 2014 - 2024F (INR Crore, Thousand Units |

| 29. India Self Priming Pump Market Revenues, By Regions, 2014 - 2024F (INR Crore) |

| 30. India Self Priming Pump Market Volume, By Regions, 2014 - 2024F (Thousand units) |

| 31. India Self Priming Pump Market Opportunity Assessment, By Types (2024F) |

| 32. India Self Priming Pump Market Opportunity Assessment, By Applications (2024F) |

| 33. India Self Priming Market Revenues, By Company, 2017 |

| List of Tables |

| 1. Status of Village Electrification as on 28.12.2015 |

| 2. Road Map for Village Electrification Under DDUGJY, 2016 to 2018 |

| 3. Central Finance Assistance (CFA) pattern for Off-Grid Solar PV Pumps (Rs per HP) |

| 4. India Residential Application Self Priming Pump Market Revenues, By Horse Power, 2014 - 2024F (INR Crore) |

| 5. India Residential Application Self Priming Pump Market Volume, By Horse Power, 2014 - 2024 (Thousand Units) |

| 6. India Residential Application Self Priming Pump Market Revenues, By Head Range, 2014 - 2024F (INR Crore) |

| 7. India Residential Application Self Priming Pump Market Volume, By Head Range, 2014 - 2024 (Thousand Units) |

| 8. India Agriculture Application Self Priming Pump Market Revenues, By Horse Power, 2014 - 2024F (INR Crore) |

| 9. India Agriculture Application Self Priming Pump Market Volume, By Horse Power, 2014 - 2024 (Thousand Units) |

| 10. India Agriculture Application Self Priming Pump Market Revenues, By Head Range, 2014 - 2024F (INR Crore) |

| 11. India Agriculture Application Self Priming Pump Market Volume, By Head Range, 2014 - 2024 (Thousand Units) |

| 12. India Water & Wastewater Application Self Priming Pump Market Revenues, |

| By Horse Power, 2014 - 2024F (INR Crore) |

| 13. India Water & Wastewater Application Self Priming Pump Market Volume, |

| By Horse Power, 2014 - 2024 (Thousand Units) |

| 14. India Water & Wastewater Application Self Priming Pump Market Revenues, |

| By Head Range, 2014 - 2024F (INR Crore) |

| 15. India Water & Wastewater Application Self Priming Pump Market Volume, |

| By Head Range, 2014 - 2024 (Thousand Units) |

| 16. India Mining Application Self Priming Pump Market Revenues, By Horse Power, 2014 - 2024F (INR Crore) |

| 17. India Mining Application Self Priming Pump Market Volume, By Horse Power, 2014 - 2024 (Thousand Units) |

| 18. India Mining Application Self Priming Pump Market Revenues, By Head Range, 2014 - 2024F (INR Crore) |

| 19. India Mining Application Self Priming Pump Market Volume, By Head Range, 2014 - 2024 (Thousand Units) |

| 20. India Commercial Application Self Priming Pump Market Revenues, By Horse Power, 2014 - 2024F (INR Crore) |

| 21. India Commercial Application Self Priming Pump Market Volume, By Horse Power, 2014 - 2024 (Thousand Units) |

| 22. India Commercial Application Self Priming Pump Market Revenues, By Head Range, 2014 - 2024F (INR Crore) |

| 23. India Commercial Application Self Priming Pump Market Volume, By Head Range, 2014 - 2024 (Thousand Units) |

| 24. India Oil & Gas Application Self Priming Pump Market Revenues, By Horse Power, 2014 - 2024F (INR Crore) |

| 25. India Oil & Gas Application Self Priming Pump Market Volume, By Horse Power, 2014 - 2024 (Thousand Units) |

| 26. India Oil & Gas Application Self Priming Pump Market Revenues, By Head Range, 2014 - 2024F (INR Crore) |

| 27. India Oil & Gas Application Self Priming Pump Market Volume, By Head Range, 2014 - 2024 (Thousand Units) |

| 28. India Industrial Application Self Priming Pump Market Revenues, By Horse Power, 2014 - 2024F (INR Crore) |

| 29. India Industrial Application Self Priming Pump Market Volume, By Horse Power, 2014 - 2024 (Thousand Units) |

| 30. India Industrial Application Self Priming Pump Market Revenues, By Head Range, 2014 - 2024F (INR Crore) |

| 31. India Industrial Application Self Priming Pump Market Volume, By Head Range, 2014 - 2024 (Thousand Units) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero