India Submersible Pumps Market (2017-2023) | Analysis, Size, Revenue, Trends, Growth, Forecast, Industry, Outlook, Value & Segmentation

Market Forecast By Types (Openwell Submersible Pumps and Borewell Submersible Pumps), By Applications (Agriculture, Residential & Commercial and Industrial), By Industry (Construction, Oil & Gas, Water & Sewage, Chemical, Power Utilities, Mining and Others), By Regions (Northern, Western, Eastern and Sothern) and Competitive Landscape

| Product Code: ETC000403 | Publication Date: Aug 2023 | Updated Date: May 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 105 | No. of Figures: 40 | No. of Tables: 7 | |

India Submersible Pumps Market Competition 2023

India Submersible Pumps market currently, in 2023, has witnessed an HHI of 1350, Which has increased slightly as compared to the HHI of 1187 in 2017. The market is moving towards highly competitive. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market.

India Export Potential Assessment For Submersible Pumps Market (Values in USD Thousand)

Latest 2023 Developments of the India Submersible Pumps Market

India Submersible Pumps Market has witnessed the latest developments such as the innovation of advanced technology and enhancement of existing pumps. In addition, the newest technology has led to a surge in the development of hydraulic designs with fully welded impellers that improve its efficiency. Further, installation of ESP systems to increase the pressure levels, deriving energy from high voltage alternating sources and adaptation of modular shaft technology has been driving the market.

India Submersible Pumps Market Synopsis

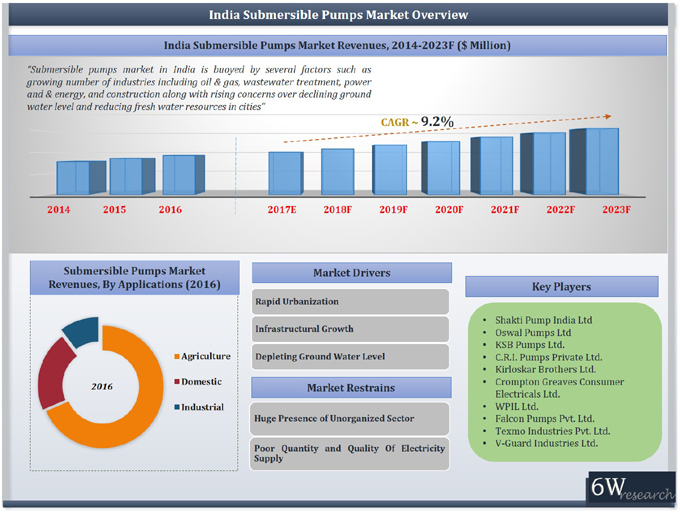

Growing infrastructural development activities, rising urbanization, and rapid industrialization are some of the key growth drivers for the submersible pump market in India. The declining groundwater level coupled with increasing agricultural practices has contributed to the demand for submersible pumps in the country. Growing industrial applications such as mining, power utilities, and oil & gas are likely to complement the India submersible pumps market forecast revenues over the coming years.

According to 6Wresearch, India submersible pumps market size is projected to grow at a CAGR of 9.2% during 2017-23. The open well pumps segment registered the majority of the revenue share in 2016, owing to major adoption in agriculture applications. In the overall submersible pumps market, agriculture applications acquired the majority of India submersible pumps market share followed by residential & commercial, and industrial applications. The agriculture sector in India is projected to witness substantial growth over the coming years, attributed to increasing facilities and investments in agricultural infrastructure such as irrigation facilities, cold storage, and warehousing.

The submersible pumps market is relatively fragmented, owing to the presence of a large number of foreign and domestic players across the country. Moreover, domestic manufacturers are rigorously focusing on expansion through mergers and tie-ups with several international players. Some of the major players in the submersible pumps market in India include Shakti Pumps, Oswal Pumps, KSB Pumps, and C.R.I. Pumps, Kirloskar Brothers, Crompton Greaves, WPIL, Falcon Pumps, Texmo Industries, and V-Guard Industries.

The India submersible pumps market report thoroughly covers the submersible pump market by type, applications, industry, and region. The India submersible pumps market outlook report provides an unbiased and detailed analysis of the ongoing India submersible pumps market trends, opportunities/ high growth areas, and market drivers, which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

India Submersible Pumps Market There are many different types of submersible pumps such as WPIL, V-Guard Industries, Texmo Industries, Falcon Pumps, KSB Pumps, C.R.I. Pumps, Shakti Pumps, Oswal Pumps. The government improving the agriculture of India while investments towards the agriculture sector highly subsidized power supply to farmers such as submersible pumps for agriculture. India submersible pump market is having the attribute of market growth in the agriculture sector and helps with rising water scarcity in India. The government of India also focuses on the improvement of India agriculture by investments in agriculture and boosting investments into the sector. The government of India also provides submersible water pumps for the agriculture sector. In India, the rapid growth of industries and their different activities help in the positive influence of India submersible pumps in the upcoming years. There are different classify and forecast market ways of India submersible pumps market such as regional distribution, type, mode of operation, and end-use.

According to the Size, Share, and Forecast of India Submersible Water Pumps Market, According to the market condition India's Submersible Water pumps are projected to grow more and growth takes place in the billion. The country's agriculture will boost and the chance of growth is more and might be rising the water scarcity. The government wants to improve the agriculture sector for this government investment in the agriculture sector. The government provides highly subsidized equipment to the farmers for the improvement of agriculture in India and an increase in the demand for submersible water pumps in the market. With the rapid increase in industries, the growth rate of submersible water pumps will increase in the upcoming years.

India submersible pumps market is projected to find its true potential growth in the upcoming six years backed by the rising growth of the agriculture sector. The rise in agriculture practices with the growing domestic consumption is likely to proliferate the use of submersible pumps during the irrigation process. On the other hand, some ongoing construction projects in the country like Navi Mumbai International Airport and Megha business district for Mumbai have boosted the deployment of submersible pumps to pump out the excess water and are estimated to upsurge the growth of the India submersible pumps market in the coming timeframe.

Key Highlights of the Report:

• India Submersible Pumps Market Overview

• India Submersible Pumps Market Outlook

• Historical Trends of India Submersible Pumps Market Revenues, 2014 - 2016

• India Submersible Pumps Market Size & India Submersible Pumps Market Forecast of Revenues until, 2023

• Historical Market Volume Trends for India Submersible Pumps Market, 2014 - 2016

• Market Size & Volume Forecast of India Submersible Pumps Market until 2023

• Historical Market Trends and Estimation for India Submersible Pumps Market Revenues, By Openwell, 2014-2023

• Historical Market Trends and Estimation for India Submersible Pumps Market Revenues, By Borewell, 2014-2023

• Historical Market Trends and Estimation for India Submersible Pumps Market, By Application, 2014-2023

• Historical Market Trends and Estimation for India Submersible Pumps Market, By Industry, 2014-2023

• India Submersible Pumps Market Drivers and Restraints

• India Submersible Pumps Market Trends and Opportunity

• Industry Life Cycle & Value Chain Analysis

• India Submersible Pumps Market Share by Players

• India Submersible Pumps Market Overview on Competitive Benchmarking

• Company Profiles

• Key Strategic Pointers

Markets Covered

The India submersible pumps market report provides a detailed analysis of the following market segments:

By Types

- Openwell Submersible Pumps

- Borewell Submersible Pumps

By Applications

- Agriculture

- Residential & Commercial

- Industrial

By Industry

- Construction

- Oil & Gas

- Water & Sewage

- Chemical

- Power Utilities

- Mining

- Others

By Regions

- Northern

- Western

- Eastern

- Southern

India Submersible Pumps Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Submersible Pumps Market Overview |

| 3.1 India Submersible Pumps Market Revenues (2014-2023F) |

| 3.2 India Submersible Pumps Industry Life Cycle |

| 3.3 India Submersible Pumps Market Opportunistic Matrix |

| 3.4 India Submersible Pumps Market Value Chain Analysis |

| 3.5 India Submersible Pumps Market Porter's Five Forces Model |

| 3.6 India Submersible Pumps Market Revenue Share, By Type (2016 & 2023F) |

| 3.7 India Submersible Pumps Market Revenue Share, By Application (2016 & 2023F) |

| 3.8 India Submersible Pumps Market Revenue Share, By Industrial Application |

| 3.9 India Submersible Pumps Market Industrial Cluster |

| 4 India Submersible Pumps Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 India Submersible Pumps Market Trends |

| 5.1 Market trends |

| 6 India Submersible Pumps Market Overview, By Type |

| 6.1 India Openwell Submersible Pumps Market Revenues (2014-2023F) |

| 6.2 India Borewell Submersible Pumps Market Revenue (2014-2023F) |

| 7 India Submersible Pumps Market Overview, By Application |

| 7.1 India Submersible Pumps Market Revenues, By Agriculture Application (2014-2023F) |

| 7.2 India Submersible Pumps Market Revenues, By Residential & Commercial Application (2014-2023F) |

| 7.3 India Submersible Pumps Market Revenues, By Industrial Application (2014-2023F) |

| 8 India Submersible Pumps Market Overview, By Industry |

| 8.1 India Submersible Pumps Market Revenues, By Construction Industry (2014-2023F) |

| 8.2 India Submersible Pumps Market Revenues, By Oil & Gas Industry (2014-2023F) |

| 8.3 India Submersible Pumps Market Revenues, By Chemical Industry (2014-2023F) |

| 8.4 India Submersible Pumps Market Revenues, By Power Utilities Industry (2014-2023F) |

| 8.5 India Submersible Pumps Market Revenues, By Water and Sewage Industry (2014-2023F) |

| 8.6 India Submersible Pumps Market Revenues, By Mining Industry (2014-2023F) |

| 8.7 India Submersible Pumps Market Revenues, By Other Industry (2014-2023F) |

| 9 India Submersible Pumps Market Overview, By Region |

| 9.1 Northern India Submersible Pumps Market Revenues (2014-2023F) |

| 9.2 Southern India Submersible Pumps Market Revenues (2014-2023F) |

| 9.3 Eastern India Submersible Pumps Market Revenues (2014-2023F) |

| 9.4 Western India Submersible Pumps Market Revenues (2014-2023F) |

| 10 Competitive Landscape |

| 10.1 India Submersible Pumps Market Revenue Share, By Players (2016) |

| 10.2 Competitive Benchmarking, By Technology |

| 10.3 Competitive Benchmarking, By Operating Parameter |

| 11 Company Profiles |

| 11.1 Shakti Pump India Ltd |

| 11.2 Oswal Pumps Ltd. |

| 11.3 KSB Pumps Ltd. |

| 11.4 C.R.I. Pumps Private Ltd. |

| 11.5 Kirloskar Brothers Ltd. |

| 11.6 Crompton Greaves Consumer Electricals Ltd |

| 11.7 WPIL Ltd. |

| 11.8 Falcon Pumps Pvt. Ltd. |

| 11.9 Texmo Industries Pvt. Ltd. |

| 11.10 V-Guard Industries Ltd. |

| 12 Recommendations |

| 13 Annexure |

| 14 Disclaimer |

| List of Figures |

| 1 India Submersible Pumps Market Volume, 2014-2023F (Million Units) |

| 2 India Submersible Pumps Market Revenues, 2014-2023F ($ Billion) |

| 3 India Submersible Pumps Industry Life Cycle (2016) |

| 4 Value Chain Analysis of India Submersible Pump Market |

| 5 India Submersible Pumps Market Revenue Share, By Type (2016) |

| 6 India Submersible Pumps Market Revenue Share, By Type (2023F) |

| 7 India's Water Requirement |

| 8 India Submersible Pumps Market Revenue Share, By Application (2016) |

| 9 India Submersible Pumps Market Revenue Share, By Application (2023F) |

| 10 India Submersible Pumps Market Revenue Share, By Industry (2016) |

| 11 India Submersible Pumps Market Revenue Share, By Industry (2023F) |

| 12 India Openwell Submersible Pumps Market Revenues, 2014-2023F ($ Million) |

| 13 India Openwell Submersible Pumps Market Volume, 2014-2023F (Million Units) |

| 14 India Borewell Submersible Pumps Market Revenue, 2014-2023F ($ Million) |

| 15 India Borewell Submersible Pumps Market Volume, 2014-2023F (Million Units) |

| 16 India Submersible Pumps Market Revenues, By Agricultural Application 2014-2023F ($ Million) |

| 17 India Submersible Pumps Market Revenues, By Residential & Commercial Application 2014-2023F ($ Million) |

| 18 India Submersible Pumps Market Revenues, By Industrial Application 2014-2023F ($ Million) |

| 19 India Submersible Pumps Market Revenues, By Construction Industry 2014-2023F ($ Million) |

| 20 Growth In Infrastructure-Related Activities From Apr-Sep 2016 |

| 21 Growth Index of Eight Core Industries |

| 22 Cumulative FDI Inflow Between 2013-2017 ($ Billion) |

| 23 India Submersible Pumps Market Revenues, By Oil & Gas Industry, 2014-2023F ($ Million) |

| 24 Refined Petroleum Products Output, Consumption, And Net Exports, 2014-2016 (MMT) |

| 25 India Submersible Pumps Market Revenues, By Chemical Industry, 2014-2023F ($ Million) |

| 26 India Submersible Pumps Market Revenues, By Power Utilities Industry, 2014-2023F ($ Million) |

| 27 Electricity Production in India, 2010-2016 (Billion Units) |

| 28 India Installed Electricity Generation Capacity, 2010-2016 (Gigawatt) |

| 29 India Submersible Pumps Market Revenues, By Water and Sewage Industry, 2014-2023F ($ Million) |

| 30 India Wastewater Treatment Capital Expenditure, 2013-2018F ($ Billion) |

| 31 India Submersible Pumps Market Revenues, By Mining Industry, 2014-2023F ($ Million) |

| 32 Shares of the Indian Mining Sector in FY 2016 |

| 33 Crude Steel Production in India, 2010-2016 (Million Metric Tones) |

| 34 Coal Production in India, 2010-2016 (Million Tones) |

| 35 India Submersible Pumps Market Revenues, By Other Industry, 2014-2023F ($ Million) |

| 36 North India Submersible Pumps Market Revenues, 2014-2023F ($ Million) |

| 37 South India Submersible Pumps Market Revenues, 2014-2023F ($ Million) |

| 38 East India Submersible Pumps Market Revenues, 2014-2023F ($ Million) |

| 39 West India Submersible Pumps Market Revenues, 2014-2023F ($ Million) |

| 40 India Submersible Pumps Market Revenue Share, By Company (2016) |

| List of Tables |

| 1 Rural Electrification Target and Achievements (2013-2017) |

| 2 Growth in Conventional Energy Generation (2011-2017) |

| 3 Upcoming Government Projects in India |

| 4 Production, Installed Capacity & Growth of Selected Major Chemicals, 2013-2016 (000 ‘MT) |

| 5 All India Demand Forecast of Fertilizer Products, 2013-2017 (000 ‘MT) |

| 6 License and Brands Registered Under BIS and BEE (Jan 2016) |

| 7 Region-wise Potentiality of Submersible Pump in India |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero