Indonesia Power and Distribution Transformers Market (2019-2025) | Size, Industry, Share, Trends, Analysis, Forecast, Companies, Outlook, Growth, Revenue & Value

Market Forecast By Types (Power Transformers and Distribution Transformers), By Power Ratings (Distribution Transformers (Up to 100 KVA, 100.1 KVA- 315 KVA and 315.1 KVA- 5000 KVA), Power Transformers (5.1 MVA- 50 MVA, 50.1 MVA- 160 MVA, 160.1 MVA- 350 MVA and Above 350 MVA)), By Insulation Type (Oil Immersed and Dry Type), By Applications (Power Utilities and Industrial Applications), By Regions (Java-Bali, Sumatra, Kalimantan, Sulawesi, and Papua) and Competitive Landscape

| Product Code: ETC000583 | Publication Date: Feb 2022 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 118 | No. of Figures: 46 | No. of Tables: 4 |

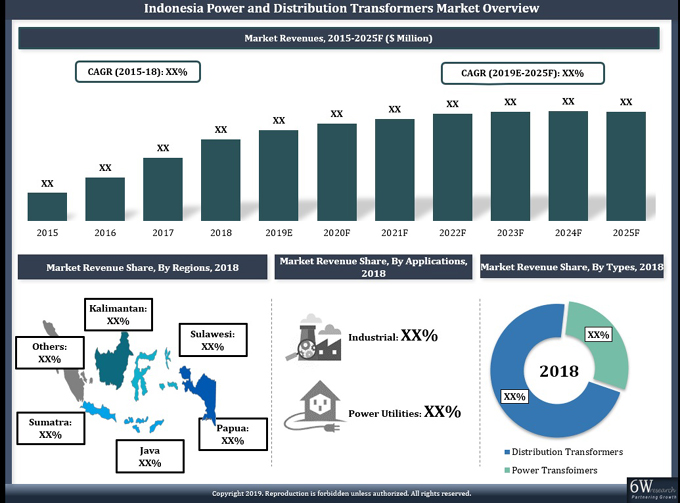

Indonesia Power and Distribution Transformers Market are anticipated to generate sound revenues on account of infrastructure expansion. Indonesia is a densely populated country in the South East Asia region. The establishment of manufacturing industries as well as improving electrification across the country are some of the key drivers which have led to the Indonesia Power and Distribution Transformers Market. In the Western region, which covers Java and Bali, electrification is already 99% or even more, the demand for new transformers is likely to fall in these regions during the forecast period, while the demand would rise in the Eastern part of the country that includes Kalimantan, Sulawesi and Papua due to the development of substations and power plants in these regions.

According to 6Wresearch, Indonesia Power and Distribution Tansformers Market size is projected to grow at a CAGR of 3.1% during 2019-2025. The power and distribution transformers market witnessed substantial growth in 2017 and 2018, as the country was preparing to host a number of international events in 2018 that includes the 2018 Asian Games, 2018 Asian Para Games, international meetings of IMF and World Bank that were attended by the delegates of 179 countries. Thus, the need for a stable electricity supply during these international events created a very strong growth in the power and distribution transformers market in 2017-18.

However, the market is expected to grow at a very slow pace after 2019 and the Indonesia Power and Distribution Transformers Market Share would eventually decline, primarily due to the success of the government initiatives to bring all the households under stable electricity supply by 2024 with the completion of the 35GW program.

Amongst all the applications segments, the power utility sector accounts for the majority of the share in the Indonesia power and distribution transformers market revenues. Indonesian state-owned utility company PLN is planning to improve electrification across 400 remote islands in Indonesia, which would surge the demand for power and distribution transformers market in utility applications. Some of the key players in Indonesia power and distribution transformers market include- PT Bambang Djaja, PT Trafoindo Prima Perkasa, PT CG Power Systems Indonesia, GE Indonesia, PT Siemens Indonesia, and PT Schneider Electric Indonesia.

The Indonesia power and distribution transformers market report thoroughly covers the market by types, cooling system, KVA ratings, applications, and regions. The Indonesia power and distribution transformers market outlook report provides an unbiased and detailed analysis of the ongoing Indonesia power and distribution transformers market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

- Indonesia Power and Distribution Transformers Market Overview

- Indonesia Power and Distribution Transformers Market Outlook.

- Indonesia Power and Distribution Transformers Forecast

- Indonesia Power and Distribution Transformers Market Forecast, Until 2025.

- Historical Data of Indonesia Power and Distribution Transformers Market Revenues and Volume by Types for the Period 2015-2018.

- Indonesia Power and Distribution Transformers Market Size and Indonesia Power and Distribution Transformers Market Forecast of revenues and volume, By Types until 2025.

- Historical Data of Indonesia Power Transformers Market Revenues and Volume for the Period 2015-2018.

- Market Size & Forecast of Indonesia Power Transformers Market Revenues and Volume until 2025.

- Historical Data of Indonesia Distribution Transformers Market Revenues and Volume for the Period 2015-2018.

- Market Size & Forecast of Indonesia Distribution Transformers Market Revenues and Volume until 2025.

- Historical Data of Indonesia Power Transformers Market Revenues and Volume, By Power Rating for the Period 2015-2018.

- Market Size & Forecast of Indonesia Power Transformers Market Revenues and Volume, By Power Rating until 2025.

- Historical Data of Indonesia Distribution Transformers Market Revenues and Volume, By Power Rating for the Period 2015-2018.

- Market Size & Forecast of Indonesia Distribution Transformers Market Revenues and Volume, By Power Rating until 2025.

- Historical Data of Indonesia Power and Distribution Transformers Market Revenues, By Cooling Type for the Period 2015-2018.

- Market Size & Forecast of Indonesia Power and Distribution Market Revenues, By Cooling Type until 2025.

- Historical Data of Indonesia Power and Distribution Transformers Market Revenues, By Applications for the Period 2015-2018.

- Market Size & Forecast of Indonesia Power and Distribution Transformers Market Revenues, By Applications Until 2025.

- Historical Data of Indonesia Power and Distribution Transformers Market Revenues, By Regions for the Period 2015-2018.

- Indonesia Power and Distribution Transformers Market Forecast of Revenues, By Regions Until 2025.

- Indonesia Power and Distribution Transformers Market Trends

- Market Drivers and Restraints.

- Porter’s Five Force Analysis and Market Opportunity Assessment.

- Indonesia Power and Distribution Transformers Market Share, By Players.

- Indonesia Power and Distribution Transformers Market Overview on competitive Benchmarking

- Competitive Landscape

- Company Profiles

- Strategic Recommendations

Markets Covered:

The report provides a detailed analysis of the following market segments:

• By Types:

o Power Transformers

o Distribution Transformers

• By Power Rating:

o Distribution Transformers

? Up to 100 KVA

? 100.1 KVA- 315 KVA

? 315.1 KVA- 5000 KVA

o Power Transformers

? 5.1 MVA- 50 MVA

? 50.1 MVA- 160 MVA

? 160.1 MVA- 350 MVA

? Above 350 MVA

• By Insulation Type:

o Oil Immersed

o Dry type

• By Applications:

o Power Utilities

o Industrial Applications

• By Regions:

o Java-Bali

o Sumatra

o Kalimantan

o Sulawesi

o Papua

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Methodology Adopted and Key Data Points |

| 2.5. Assumptions |

| 3. Indonesia Power and Distribution Transformers Market Overview |

| 3.1. Indonesia Country Indicators |

| 3.2. Indonesia Power and Distribution Transformers Market Revenues and Volume, 2015-2025F ($ million, units) |

| 3.3. Indonesia Power and Distribution Transformers Market Industry Life Cycle, 2019 |

| 3.4. Indonesia Power and Distribution Transformers Market Porter's Five Forces |

| 3.5. Indonesia Power and Distribution Transformers Market Revenue and Volume Share, By Types, 2018 & 2025F |

| 3.6. Indonesia Power Transformers Market Revenue Share, By Power Rating, 2018 & 2025F, |

| 3.7. Indonesia Distribution Transformers Market Revenue Share, By Power Rating, 2018 & 2025F |

| 3.8. Indonesia Power Transformers Market Volume Share, By Power Rating, 2018 & 2025F |

| 3.9. Indonesia Distribution Transformers Market Volume Share, By Power Rating, 2018 & 2025F |

| 3.10. Indonesia Power and Distribution Transformers Market Revenue Share, By Cooling Type, 2018 & 2025F |

| 3.11. Indonesia Power and Distribution Transformers Market Revenue Share, By Applications, 2018 & 2025F |

| 3.12. Indonesia Power and Distribution Transformers Market Revenue Share, By Regions, 2018 & 2025F |

| 4. Indonesia Power and Distribution Transformers Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Indonesia Power and Distribution Transformers Market Trends |

| 6. Indonesia Power Transformers Market Overview |

| 6.1. Indonesia Power Transformers Market Revenues and Volumes, 2015-2025F, ($ Million, Units) |

| 6.1.1. Indonesia Power Transformers Market Revenues and Volumes Share, By Power Rating, 2018 & 2025F |

| 6.2. Indonesia Power Transformers Market Revenues and Volumes, By Power Rating 2015-2025F, ($ million, Units) |

| 7. Indonesia Distribution Transformers Market Overview |

| 7.1. Indonesia Distribution Transformers Market Revenues and Volumes, 2015-2025F, ($ million, Units) |

| 7.1.1. Indonesia Distribution Transformers Revenue and Volume Share, By Power Rating, 2018 & 2025F |

| 7.2. Indonesia Distribution Transformers Market Revenues and Volume, By Power Rating, 2015-2025F, ($ million, Units) |

| 8. Indonesia Power and Distribution Transformers Market Overview, By Cooling System |

| 8.1. Indonesia Liquid Type Power and Distribution Transformers Market Revenues, 2015-2025F, ($ Million) |

| 8.2 Indonesia Dry Type Power and Distribution Transformers Market Revenues, 2015-2025F, ($ Million) |

| 9. Indonesia Power and Distribution Transformers Market Overview, By Applications |

| 9.1. Indonesia Power and Distribution Transformers Market Revenues, By Power Utilities Applications, 2015-2025F, ($ Million) |

| 9.1.1. Indonesia Power Sector Outlook |

| 9.2. Indonesia Power and Distribution Transformers Market Revenues, By Industrial Applications, 2015-2025F, ($ Million) |

| 9.2.1. Indonesia Industrial Sector Outlook |

| 10. Indonesia Power and Distribution Transformers Market Overview, By regions |

| 10.1. Indonesia Power and Distribution Transformers Market Revenues, By Regions, 2015-2025F, ($ Million) |

| 10.2 Indonesia Regional Overview |

| 11. Indonesia Power and Distribution Market Price Trend |

| 11.1. Indonesia Power Transformers Price Trend, By Power Rating, ($ per unit) |

| 11.2. Indonesia Distribution Transformers Price Trend, By Power Rating, ($ per unit) |

| 12. Indonesia Power and Distribution Market, Key Performance indicators |

| 12.1. Indonesia Government Spending Outlook |

| 12.2 Indonesia Construction Industry Outlook |

| 13. Indonesia Power and Distribution Transformers Market Opportunity Assessment |

| 13.1. Indonesia Power and Distribution Transformers Market Opportunity Assessment, By Applications |

| 13.2. Indonesia Power Transformers Market Opportunity Assessment, By Power Rating |

| 13.2. Indonesia Distribution Transformers Market Opportunity Assessment, By Power Rating |

| 14. Competitive Landscape |

| 14.1. Indonesia Power and Distribution Transformers Market Revenue Share, By Company,2018 |

| 14.2. Indonesia Power and Distribution Transformers Competitive Benchmarking, By Power Rating |

| 14.3. Indonesia Power and Distribution Transformers Competitive Benchmarking, By Operating Parameters |

| 15. Company Profiles |

| 15.1. PT CG Power Systems Indonesia |

| 15.2. PT Siemens Indonesia |

| 15.3. PT ABB Sakti Industri |

| 15.4. GE Indonesia |

| 15.5. PT Bambang Djaja |

| 15.6. PT. Schneider Electric Indonesia |

| 15.7. PT Fuji Electric Indonesia |

| 15.8. PT Trafoindo Prima Perkasa |

| 15.9. PT Sintra Sinarindo Elektrik |

| 15.10. PT. XD Sakti Indonesia |

| 16. Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| Figure1. Indonesia Power and Distribution Transformers Market Revenues and Volume, 2015-2025F ($ Million, Units) |

| Figure2. Indonesia Power and Distribution Transformers Market Industry Life Cycle, 2019 |

| Figure3. Indonesia Power and Distribution Transformers Market Revenue Share, By Types, 2018 & 2025F |

| Figure4. Indonesia Power and Distribution Transformers Market Volume Share, By Types, 2018 & 2025F |

| Figure5. Indonesia Power Transformers Market Revenue Share, By Power Rating, 2018 & 2025F |

| Figure6. Indonesia Distribution Transformers Market Revenue Share, By Power Rating, 2018 & 2025F |

| Figure7. Indonesia Power Transformers Market Volume Share, By Power Rating, 2018 & 2025F |

| Figure8. Indonesia Distribution Transformers Market Volume Share, By Power Rating, 2018 & 2025F |

| Figure9. Indonesia Power and Distribution Transformers Market Revenue Share, By Cooling Type, 2018 & 2025F |

| Figure10. Indonesia Power and Distribution Transformers Market Revenue Share, By Applications, 2018 & 2025F |

| Figure11. 0Indonesia Power and Distribution Transformers Market Revenue Share, By Regions, 2018 & 2025F |

| Figure12. Indonesia Construction Side growth, 2015- 2018(%) |

| Figure13. Indonesia Industrial estates, and future goal, 2017 |

| Figure14. Electrification Ratio in Indonesia, 2013-2025, (%) |

| Figure15. Transmission and Distribution Network in Indonesia, 2017-2027, (Thousand Units) |

| Figure16. Indonesia Energy Mix, 2015 & 2025F |

| Figure17. Indonesia Power Transformers Market Revenues and Volume, 2015-2025F ($ Million, Units) |

| Figure18. Indonesia Power Transformers Market Revenue Share, By Power Rating, 2018 & 2025(F) |

| Figure19. Indonesia Power Transformers Market Volume Share, By Power Rating, 2018 & 2025(F) |

| Figure20. Indonesia 5.1 MVA-50 MVA Power Transformers Market Revenues and Volume, 2015-2025F ($ Million, Units) |

| Figure21. Indonesia 50.1 MVA-160 MVA Power Transformers Market Revenues and Volume, 2015-2025F ($ Million, Units) |

| Figure22. Indonesia 160.1 MVA- 350 MVA Power Transformers Market Revenues and Volume, 2015-2025F ($ Million, Units) |

| Figure23. Indonesia Above 350 MVA Power Transformers Market Revenue and Volume, 2015-25F, ($ Million, Units) |

| Figure24. Indonesia Distribution Transformers Market Revenues and Volume, 2015-2025F ($ Million, Units) |

| Figure25. Indonesia Distribution Transformers Market Revenue Share, By Power Rating, 2018 & 2025(F) |

| Figure26. Indonesia Distribution Transformers Market Volume Share, By Power Rating, 2018 & 2025(F) |

| Figure27. Indonesia up to 100 KVA Distribution Transformers Market Revenues and Volume, 2015-2025F ($ Million, Units) |

| Figure28. Indonesia 100 KVA-315 KVA Distribution Transformers Market Revenue and Volume, 2015-25F, ($ Million, Units) |

| Figure29. Indonesia 315.1KVA- 5000 KVA Distribution Transformers Market Revenues and Volume,2015-2025F ($ Million, Units) |

| Figure30. Indonesia Liquid Type Power and Distribution Transformers Market Revenue Share, 2015-2025F ($ Million) |

| Figure31. Indonesia Dry Type Power and Distribution Transformers Market Revenue Share, 2015-2025F ($ Million) |

| Figure32. Indonesia Power and Distribution Transformers Market Revenues, By Power Utilities Application, 2015-2025F($ million) |

| Figure33. Indonesia Power Generation fuel Mix, 2017, (% Share) |

| Figure34. Indonesia Power and Distribution Transformers Market Revenues, By Industrial Application, 2015-2025F($ million) |

| Figure35. Indonesia Power and Distribution Transformers Market Revenues, By Regions, 2015-2025F($ million) |

| Figure36. Indonesia Transmission and Distribution Network, By Regions, 2017 |

| Figure37. Indonesia Power Transformers Price Trend, By Power Rating, 2015-2025F, ($ per unit- ASP) |

| Figure38. Indonesia Distribution Transformers Price Trend, By Power Rating, 2015-2025F, ($ per unit- ASP) |

| Figure39. Indonesia Government Projected Government Expenditure, 2018, (% Share) |

| Figure40. Indonesia Actual Government Spending VS Actual Government Revenues, 2015-2025 (IDR Trillion) |

| Figure41. Indonesia Power and Distribution Transformers Market Opportunity Assessment, By Applications |

| Figure42. Indonesia Power Transformers Market Opportunity Assessment, By Power Rating |

| Figure43. Indonesia Distribution Transformers Market Opportunity Assessment, By Power Rating |

| Figure44. Indonesia Power Transformers Market Revenue Share, By Company, 2018 |

| Figure45. Indonesia Distribution Transformer Market Revenue Share, By Company, 2018 |

| Figure46. Indonesia Distribution Transformers Market Revenue VS Overall Transformers Market Revenues, 2015-2025 |

| List of Tables |

| Table1. Indonesia Upcoming Commercial Projects |

| Table2. Indonesia Upcoming Office Projects |

| Table3. Indonesia Upcoming Residential Projects |

| Table4. Indonesia Upcoming Hotel Projects |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero