Kenya Crane Market (2025-2031) | Share, Outlook, Companies, Growth, Value, Industry, Size, Revenue, Trends, Forecast & Analysis

Market Forecast By Types (Mobile Crane, Fixed Crane, Marine and Offshore Crane), By Applications (Industrial Applications, Marine and offshore, Mining and Excavation, Construction) and Competitive Landscape

| Product Code: ETC002262 | Publication Date: Apr 2020 | Updated Date: Dec 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

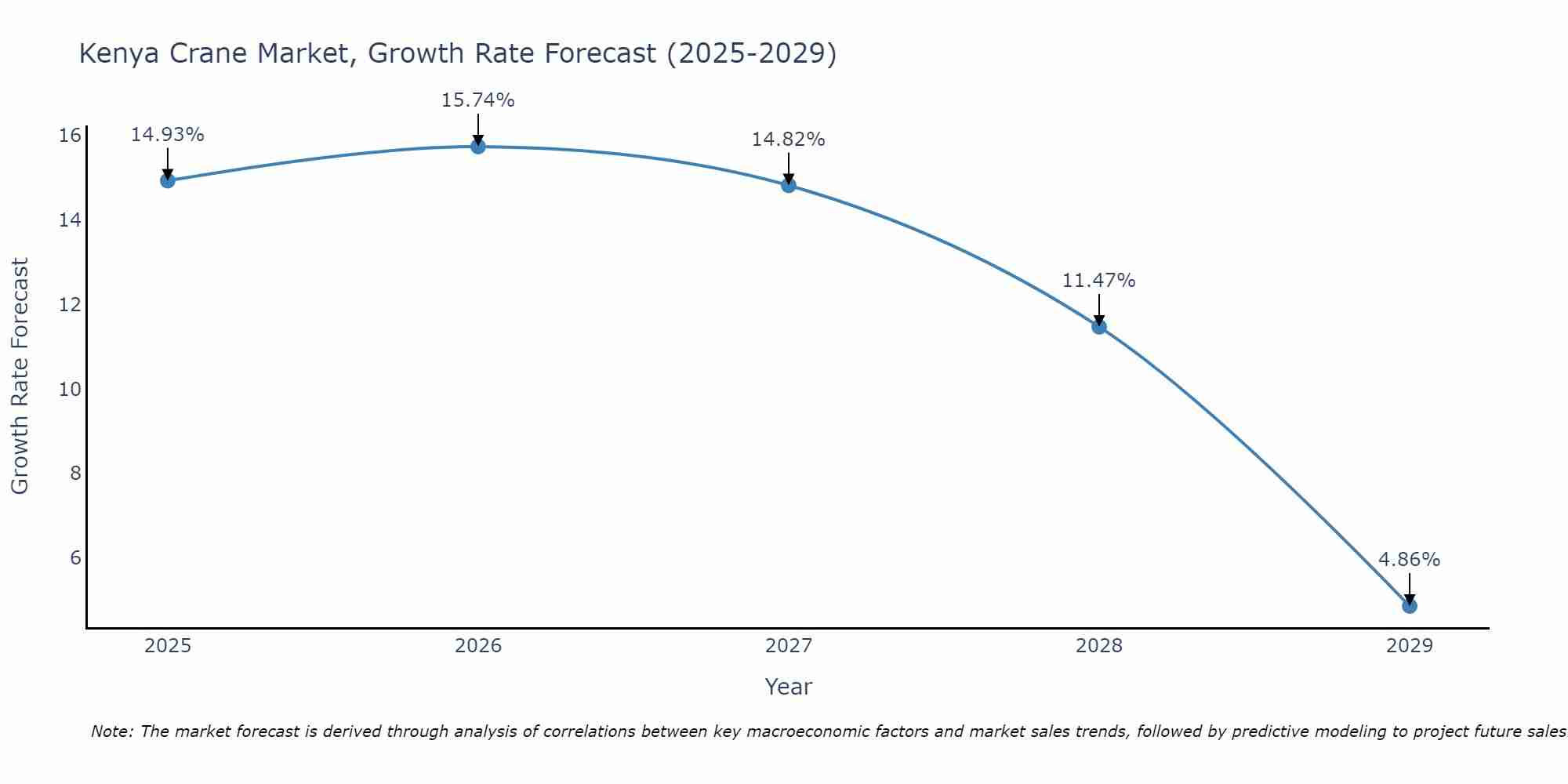

Kenya Crane Market Size Growth Rate

The Kenya Crane Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 14.93% in 2025, climbs to a high of 15.74% in 2026, and moderates to 4.86% by 2029.

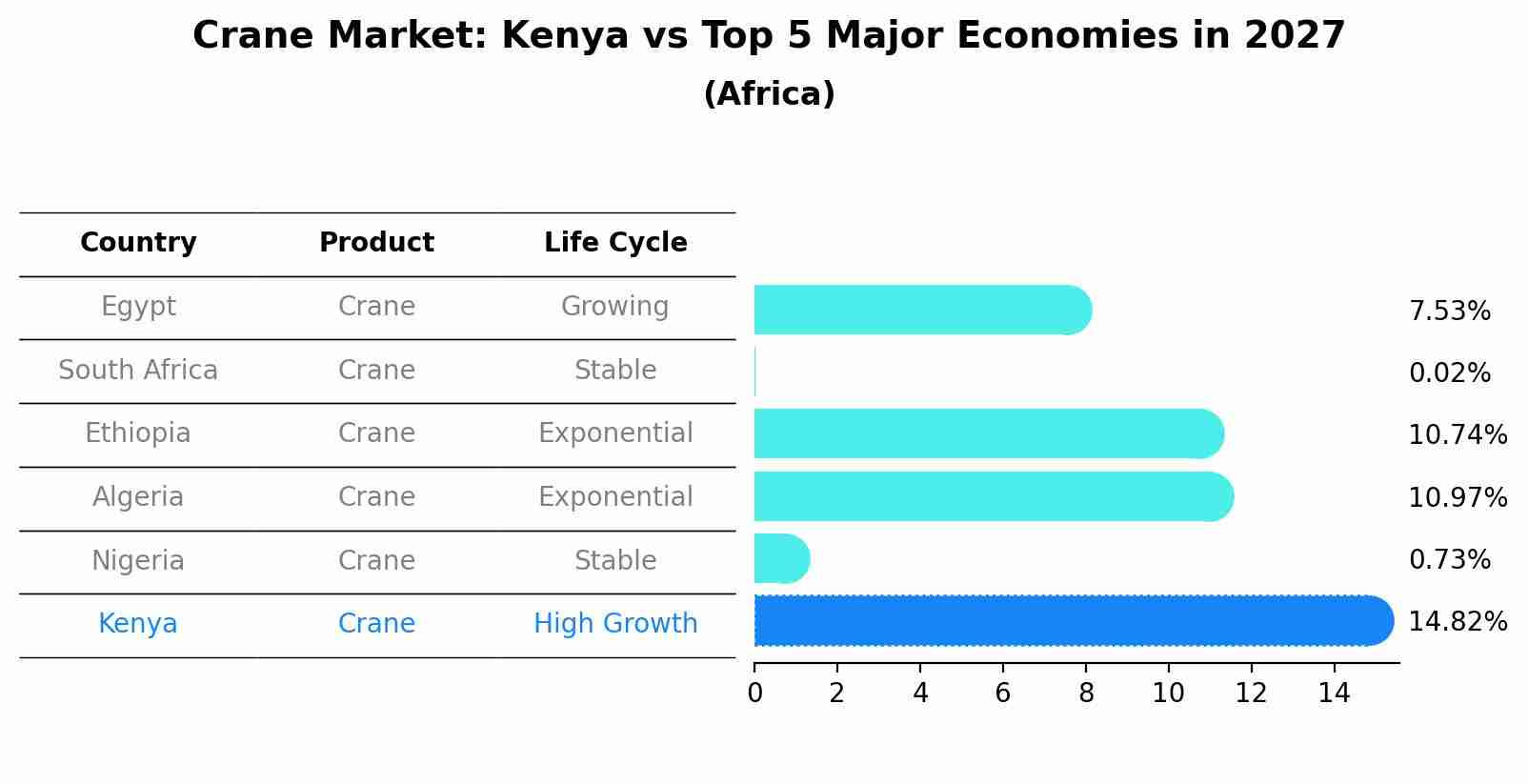

Crane Market: Kenya vs Top 5 Major Economies in 2027 (Africa)

In the Africa region, the Crane market in Kenya is projected to expand at a high growth rate of 14.82% by 2027. The largest economy is Egypt, followed by South Africa, Ethiopia, Algeria and Nigeria.

Kenya Crane Market Highlights

| Report Name | Kenya Crane Market |

| Forecast period | 2025-2031 |

| CAGR | 4.8% |

| Growing Sector | Construction sector |

Topics Covered in the Kenya Crane Market Report

The Kenya Crane Market report thoroughly covers the market by Types, and by Applications . The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would assist stakeholders to devise and align their market strategies according to the current and future market dynamics.

Kenya Crane Market Synopsis

The crane market in Kenya is set to experience significant expansion, fueled by robust industrialization, infrastructure projects, and the burgeoning marine and offshore sectors. This growth surge is underpinned by substantial investments across critical industries such as construction, mining, and industrial applications. Government prioritization of infrastructure development further accelerates market expansion, with both public and private sectors playing pivotal roles in driving heightened demand. Cranes are indispensable for executing diverse operations with efficiency, effectively meeting escalating sectoral needs.

According to 6Wresearch, the Kenya Crane Market size is expected to grow at a significant CAGR OF 4.8% during the forecast period of 2025-2031. The Crane market in Kenya is undergoing rapid growth, driven by significant infrastructural developments and expansions in industry. Government investments in infrastructure projects and the surge in real estate and housing initiatives are major drivers of this expansion. There is a notable increase in demand for various crane types, such as mobile, fixed, and marine and offshore cranes, making them more accessible across sectors. This trend reflects a shift towards more efficient operational strategies and heightened safety standards.

Despite the impressive growth of the crane market in Kenya, several challenges could potentially hinder its progress. One significant issue includes the availability and affordability of raw materials essential for manufacturing cranes. This surge in production demands has led to supply shortages and price escalations, which manufacturers must navigate to maintain production levels and pricing stability.

Kenya Crane Industry Leading Players

In Kenya's Crane industry, several leading players contribute to its dynamic growth and competitive landscape. Companies include Spenomatic Group, with its diverse range of crane solutions including mobile, tower, and crawler cranes, play a pivotal role. Firms such as Sterling Crane, known for their expertise in heavy lifting and specialized crane services across Kenya's construction and infrastructure sectors, also stand out. Other key players like Apex Steel, offering integrated steel solutions and crane services, and Sai Raj, specializing in crane rental services for various industrial applications, further enrich the market. These companies not only provide essential equipment but also contribute to the sector's innovation and safety standards. Their ability to adapt to the evolving demands of Kenya's expanding infrastructure and real estate sectors underscores their influence in

Crane Market in Kenya Government Regulations

In Kenya, the Crane market is regulated by several government policies aimed at ensuring safety, efficiency, and compliance with international standards. The government mandates stringent licensing requirements for crane operators and owners, emphasizing qualifications and certifications to operate these heavy equipment safely. Regulatory bodies enforce guidelines on the importation, installation, and operation of cranes to guarantee adherence to local safety codes and environmental standards. Additionally, there are periodic inspections and maintenance requirements for cranes to ensure their continued safe operation. Government regulations also focus on promoting transparency in procurement processes for public infrastructure projects, which often involve the use of cranes. These regulations aim to foster a competitive market while prioritizing safety and sustainability in the crane industry, thereby supporting Kenya's infrastructural development goals.

Future Insights of the Market

The Crane market in Kenya appears poised for continued growth and evolution. With ongoing infrastructural developments and industrial expansions bolstered by government investments, the market is expected to expand further. The rise in real estate projects and housing schemes will likely sustain demand for various crane types, including mobile, fixed, and specialized marine and offshore cranes. Efficiency improvements and heightened safety standards will remain crucial, driving innovation in crane technologies and operational practices. As Kenya's economy diversifies and expands, the crane market is anticipated to play a pivotal role in supporting construction, manufacturing, and infrastructure projects across the country. Additionally, advancements in automation and digitalization within the crane industry could further enhance productivity and safety, catering to the growing needs of a developing economy. Overall, the future outlook for Kenya's crane market appears promising, with opportunities for growth driven by ongoing investments and strategic developments in key sectors.

Market Segmentation by Type

According to Ravi Bhandari, Research Head, 6Wresearch, mobile crane segment is showing particularly strong growth. This is primarily due to its versatility and ability to operate in diverse environments, including construction sites and infrastructure projects across urban and remote areas. Mobile cranes offer flexibility in handling various loads and navigating challenging terrains, which is crucial in Kenya dynamic construction and development landscape.

Market Segmentation by Applications

Among the applications of cranes in Kenya, the construction sector stands out as experiencing the most significant growth. The boom in real estate projects, infrastructure developments, and housing schemes fueled by government investments is driving robust demand for cranes. Construction activities across urban and rural areas require various types of cranes for tasks ranging from heavy lifting to precise positioning of materials and equipment.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Kenya Crane Market Overview

- Kenya Crane Market Outlook

- Kenya Crane Market Forecast

- Historical Data of Kenya Crane Market Revenues and Volumes for the Period 2021-2031.

- Market Size & Forecast of Kenya Crane Market Revenues and Volumes, Until 2031.

- Historical Data of Kenya Crane Market Revenues and Volumes, by Types, for the Period 2021-2031.

- Market Size & Forecast of Kenya Crane Market Revenues and Volumes, by Types, Until 2031.

- Historical Data of Kenya Crane Market Revenues and Volumes, by Applications, for the Period 2021-2031

- Market Size & Forecast of Kenya Crane Market Revenues and Volumes, by Applications, Until 2031

- Historical Data of Kenya Crane Market Revenues and Volumes, by Regions, for the Period 2021-2031

- Market Size & Forecast of Kenya Crane Market Revenues and Volumes, by Regions, Until 2031

- Market Drivers and Restraints

- Kenya Crane Market Trends and Industry Life Cycle

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- Kenya Crane Market Share, By Countries

- Kenya Crane Market Share, By Companies

- Kenya Crane Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The report offers a comprehensive study of the subsequent market segments

By Types

- Mobile Crane

- Fixed Crane

- Marine and Offshore Crane

By Applications

- Industrial Applications

- Marine and Offshore

- Mining and Excavation

- Construction

Kenya Crane Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Kenya Crane Market Overview |

| 3.1 Kenya Crane Market Revenues and Volume, 2021-2031F |

| 3.2 Kenya Crane Market Revenue Share, By Types, 2021 & 2031F |

| 3.3 Kenya Crane Market Revenue Share, By Applications, 2021 & 2031F |

| 3.4 Kenya Crane Market Revenue Share, By Regions, 2021 & 2031F |

| 3.5 Kenya Crane Market - Industry Life Cycle |

| 3.6 Kenya Crane Market - Porter’s Five Forces |

| 4. Kenya Crane Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Kenya Crane Market Trends |

| 6. Kenya Cranes Market - Distribution Channel Analysis |

| 7. Kenya Cranes Market - Price Trend Analysis |

| 8. Kenya Crane Market Overview, by Types |

| 8.1 Kenya Mobile Cranes Market Revenues and Volume, 2021-2031F |

| 8.2 Kenya Fixed Cranes Market Revenues and Volume, 2021-2031F |

| 8.3 Kenya Marine & Offshore Cranes Market Revenues and Volume, 2021-2031F |

| 9. Kenya Crane Market Overview, by Applications |

| 9.1 Kenya Crane Market Revenue and Volumes, By Industrial, 2021-2031F |

| 9.2 Kenya Crane Market Revenue and Volumes, By Construction, 2021-2031F |

| 9.3 Kenya Crane Market Revenue and Volumes, By Mining & Excavation, 2021-2031F |

| 9.4 Kenya Crane Market Revenue and Volumes, By Marine & Offshore, 2021-2031F |

| 9.5 Kenya Crane Market Revenue and Volumes, By Others, 2021-2031F |

| 10. Kenya Cranes Market Overview, By Regions |

| 10.1 Kenya Cranes Market Revenues, By Northern Region (2021-2031) |

| 10.2 Kenya Cranes Market Revenues, By Southern Region (2021-2031) |

| 10.3 Kenya Cranes Market Revenues, By Eastern Region (2021-2031) |

| 10.4 Kenya Cranes Market Revenues, By Western Region (2021-2031) |

| 11. Kenya Cranes Market - Government Initiatives / Regulations |

| 12. Kenya Cranes Market - Key Performance Indicators |

| 13. Kenya Cranes Market Opportunity Assessment |

| 13.1 Kenya Cranes Market Opportunity Assessment, By Types (2031F) |

| 13.2 Kenya Cranes Market Opportunity Assessment, By Applications (2031F) |

| 14. Kenya Cranes Market Competitive Landscape |

| 14.1 Kenya Cranes Market, By Players’ Revenue Share (2024) |

| 14.2 Kenya Cranes Market, By Players’ Competitive Benchmarking, By Operating Parameters |

| 15. Company Profiles |

| 16. Key Strategic Pointers |

| 17. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero