Nigeria Crane Market (2025-2031) | Industry, Companies, Growth, Revenue, Outlook, Analysis, Trends, Forecast, Share, Size & Value

Market Forecast By Types (Mobile Crane, Fixed Crane, Marine and Offshore Crane), By Applications (Industrial Applications, Marine and offshore, Mining and Excavation, Construction) and Competitive Landscape

| Product Code: ETC002264 | Publication Date: Apr 2020 | Updated Date: Dec 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

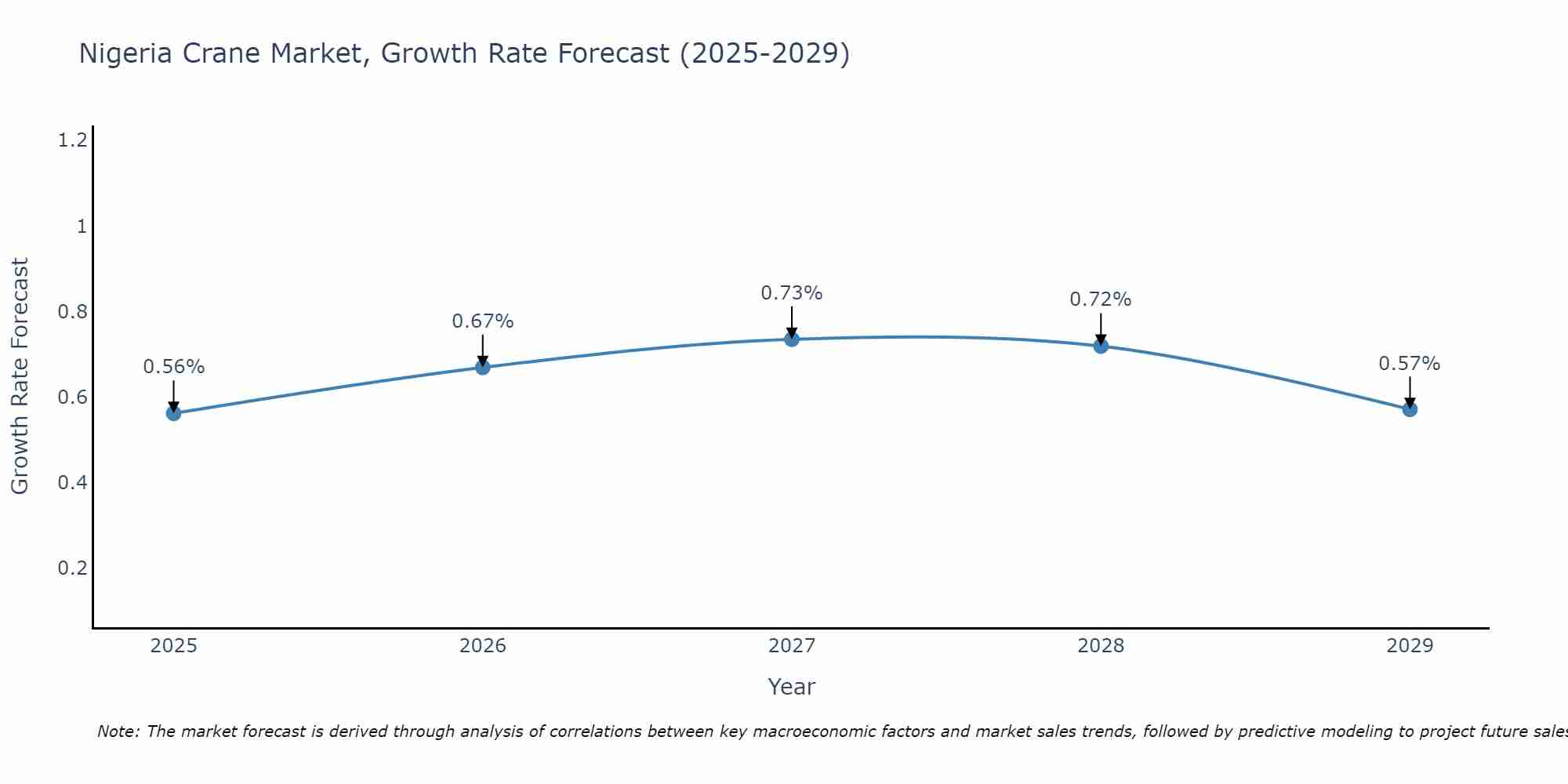

Nigeria Crane Market Size Growth Rate

The Nigeria Crane Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 0.73% in 2027, following an initial rate of 0.56%, before easing to 0.57% at the end of the period.

Nigeria Crane Market Highlights

| Report Name | Nigeria Crane Market |

| Forecast period | 2025-2031 |

| CAGR | 4.8% |

| Growing Sector | Construction industry |

Topics Covered in the Nigeria Crane Market Report

The Nigeria Crane Market report thoroughly covers the market by Types, and by Applications.The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would assist stakeholders to devise and align their market strategies according to the current and future market dynamics.

Nigeria Crane Market Synopsis

The crane market in Nigeria is experiencing significant growth, driven by rapid infrastructural development and industrialization. This surge in demand is bolstered by substantial investments in key sectors like industry, marine and offshore operations, mining, excavation, and construction. Both public and private sectors are ramping up their development efforts, creating a heightened need for various types of cranes. Nigeria emphasis on infrastructure expansion further fuels this market, with industrial applications and large-scale construction projects playing pivotal roles in driving demand. Cranes are indispensable for handling heavy lifting tasks across diverse environments, making them crucial assets in Nigeria's expanding economy.

According to 6Wresearch, the Nigeria Crane Market size is expected to grow at a significant CAGR OF 4.8% during the forecast period of 2025-2031. The crane market in Nigeria is currently undergoing significant growth, driven by ambitious national development initiatives. Government policies emphasizing infrastructure expansion, paired with advancements in crane technology, play pivotal roles in this expansion. There's a heightened recognition of the value of sophisticated lifting solutions across diverse sectors. This encompasses robust demand for mobile, fixed, marine, and offshore cranes alike. The market benefits from increasing awareness and adoption of modern crane designs that enhance efficiency and safety. These trends collectively foster a dynamic environment where stakeholders are increasingly investing in innovative crane solutions to meet Nigeria's evolving industrial and infrastructural needs.

Despite the impressive growth of the crane market in Nigeria, several challenges could hinder its progress. One critical issue is the availability and affordability of raw materials essential for manufacturing cranes. The surge in demand has led to increased demand for these materials, causing supply shortages and price escalations, which manufacturers must navigate to maintain production levels and pricing stability. Another potential factor influencing the market is the evolving consumer preference for modern and efficient cranes.

Nigeria Crane Industry Leading Players

In Nigeria's crane industry, several leading players are shaping the landscape with their expertise and advanced offerings. Companies include Julius Berger Nigeria Plc stand out for their extensive experience in construction and infrastructure projects, deploying a range of crane types to meet diverse lifting requirements. CFAO Equipment Nigeria Ltd. contributes significantly with its comprehensive portfolio of heavy equipment, including various crane models suitable for different applications. Sarens Nigeria Ltd. brings global expertise in heavy lifting and engineered transport solutions, supporting major projects across Nigeria with their specialized crane fleet. These players, along with others like Sifax Group and Mantrac Nigeria Ltd., play crucial roles in advancing the crane industry by providing cutting-edge technologies and reliable services that support Nigeria's growing infrastructure development and industrial sectors.

Crane Market in Nigeria Government Regulations

In Nigeria, the crane market is influenced significantly by government regulations aimed at fostering safe and efficient infrastructure development. These regulations set standards for crane operations, emphasizing safety protocols, certification requirements for crane operators, and adherence to international quality and safety standards. Government initiatives also focus on enhancing regulatory frameworks to ensure compliance with environmental and operational safety guidelines. Licensing and registration processes for crane equipment and operators are rigorously enforced to maintain operational integrity and mitigate risks. Moreover, ongoing policy reforms seek to streamline procedures for importing and deploying cranes, facilitating smoother market entry and operational efficiency. By promoting a regulatory environment that prioritizes safety, quality, and efficiency, Nigerian authorities aim to support sustainable growth in the crane sector while safeguarding public safety and infrastructure integrity across construction, industrial, and offshore applications.

Future Insights of the Market

The crane market in Nigeria is poised for continued growth and evolution. As the country intensifies its focus on infrastructure development and industrial expansion, demand for cranes is expected to rise steadily. Technological advancements will play a crucial role, with innovations in crane design enhancing efficiency, safety features, and operational capabilities. There's also a growing emphasis on environmentally friendly and energy-efficient crane solutions. Additionally, the market is likely to witness increased integration of digital technologies such as IoT (Internet of Things) for remote monitoring and predictive maintenance, further optimizing crane performance and reducing downtime. With ongoing government support for infrastructure projects and industrial growth initiatives, the crane market in Nigeria presents substantial opportunities for manufacturers, suppliers, and service providers aiming to capitalize on the country's development trajectory.

Market Segmentation By Types

According to Ravi Bhandari, Research Head, 6Wresearch, mobile crane segment is experiencing the most significant growth in Nigeria. This growth can be attributed to its versatility and suitability for diverse construction and infrastructure projects across the country. Mobile cranes offer flexibility in terms of mobility and can be quickly deployed to various job sites, which aligns well with Nigeria's dynamic and geographically dispersed development landscape.

Market Segmentation By Applications

Among the various applications of cranes in Nigeria, the construction sector stands out as experiencing the most rapid growth. The surge in construction activities driven by infrastructure development projects across the country fuels significant demand for cranes. These cranes are essential for lifting heavy materials, facilitating high-rise construction, and supporting various building phases.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Nigeria Crane Market Overview

- Nigeria Crane Market Outlook

- Nigeria Crane Market Forecast

- Historical Data of Nigeria Crane Market Revenues and Volumes for the Period 2021-2031.

- Market Size & Forecast of Nigeria Crane Market Revenues and Volumes, Until 2026.

- Historical Data of Nigeria Crane Market Revenues and Volumes, by Types, for the Period 2021-2031.

- Market Size & Forecast of Nigeria Crane Market Revenues and Volumes, by Types, Until 2026.

- Historical Data of Nigeria Crane Market Revenues and Volumes, by Applications, for the Period 2021-2031

- Market Size & Forecast of Nigeria Crane Market Revenues and Volumes, by Applications, Until 2026

- Historical Data of Nigeria Crane Market Revenues and Volumes, by Regions, for the Period 2021-2031

- Market Size & Forecast of Nigeria Crane Market Revenues and Volumes, by Regions, Until 2026

- Market Drivers and Restraints

- Nigeria Crane Market Trends and Industry Life Cycle

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- Nigeria Crane Market Share, By Countries

- Nigeria Crane Market Share, By Companies

- Nigeria Crane Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The report offers a comprehensive study of the subsequent market segments

By Types

- Mobile Crane

- Fixed Crane

- Marine And Offshore Crane

By Applications

- Industrial Applications

- Marine And Offshore

- Mining And Excavation

- Construction

Nigeria Crane Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Nigeria Crane Market Overview |

| 3.1 Nigeria Crane Market Revenues and Volume, 2021-2031F |

| 3.2 Nigeria Crane Market Revenue Share, By Types, 2021 & 2031F |

| 3.3 Nigeria Crane Market Revenue Share, By Applications, 2021 & 2031F |

| 3.4 Nigeria Crane Market Revenue Share, By Regions, 2021 & 2031F |

| 3.5 Nigeria Crane Market - Industry Life Cycle |

| 3.6 Nigeria Crane Market - Porter’s Five Forces |

| 4. Nigeria Crane Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Nigeria Crane Market Trends |

| 6. Nigeria Cranes Market - Distribution Channel Analysis |

| 7. Nigeria Cranes Market - Price Trend Analysis |

| 8. Nigeria Crane Market Overview, by Types |

| 8.1 Nigeria Mobile Cranes Market Revenues and Volume, 2021-2031F |

| 8.2 Nigeria Fixed Cranes Market Revenues and Volume, 2021-2031F |

| 8.3 Nigeria Marine & Offshore Cranes Market Revenues and Volume, 2021-2031F |

| 9. Nigeria Crane Market Overview, by Applications |

| 9.1 Nigeria Crane Market Revenue and Volumes, By Industrial, 2021-2031F |

| 9.2 Nigeria Crane Market Revenue and Volumes, By Construction, 2021-2031F |

| 9.3 Nigeria Crane Market Revenue and Volumes, By Mining & Excavation, 2021-2031F |

| 9.4 Nigeria Crane Market Revenue and Volumes, By Marine & Offshore, 2021-2031F |

| 9.5 Nigeria Crane Market Revenue and Volumes, By Others, 2021-2031F |

| 10. Nigeria Cranes Market Overview, By Regions |

| 10.1 Nigeria Cranes Market Revenues, By Northern Region (2021-2031) |

| 10.2 Nigeria Cranes Market Revenues, By Southern Region (2021-2031) |

| 10.3 Nigeria Cranes Market Revenues, By Eastern Region (2021-2031) |

| 10.4 Nigeria Cranes Market Revenues, By Western Region (2021-2031) |

| 11. Nigeria Cranes Market - Government Initiatives / Regulations |

| 12. Nigeria Cranes Market - Key Performance Indicators |

| 13. Nigeria Cranes Market Opportunity Assessment |

| 13.1 Nigeria Cranes Market Opportunity Assessment, By Types (2031F) |

| 13.2 Nigeria Cranes Market Opportunity Assessment, By Applications (2031F) |

| 14. Nigeria Cranes Market Competitive Landscape |

| 14.1 Nigeria Cranes Market, By Players’ Revenue Share (2024) |

| 14.2 Nigeria Cranes Market, By Players’ Competitive Benchmarking, By Operating Parameters |

| 15. Company Profiles |

| 16. Key Strategic Pointers |

| 17. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero